Fidelity Select Health Care Portfolio Has a Promising Prognosis

This fund seeks a healthy balance between risk and return.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

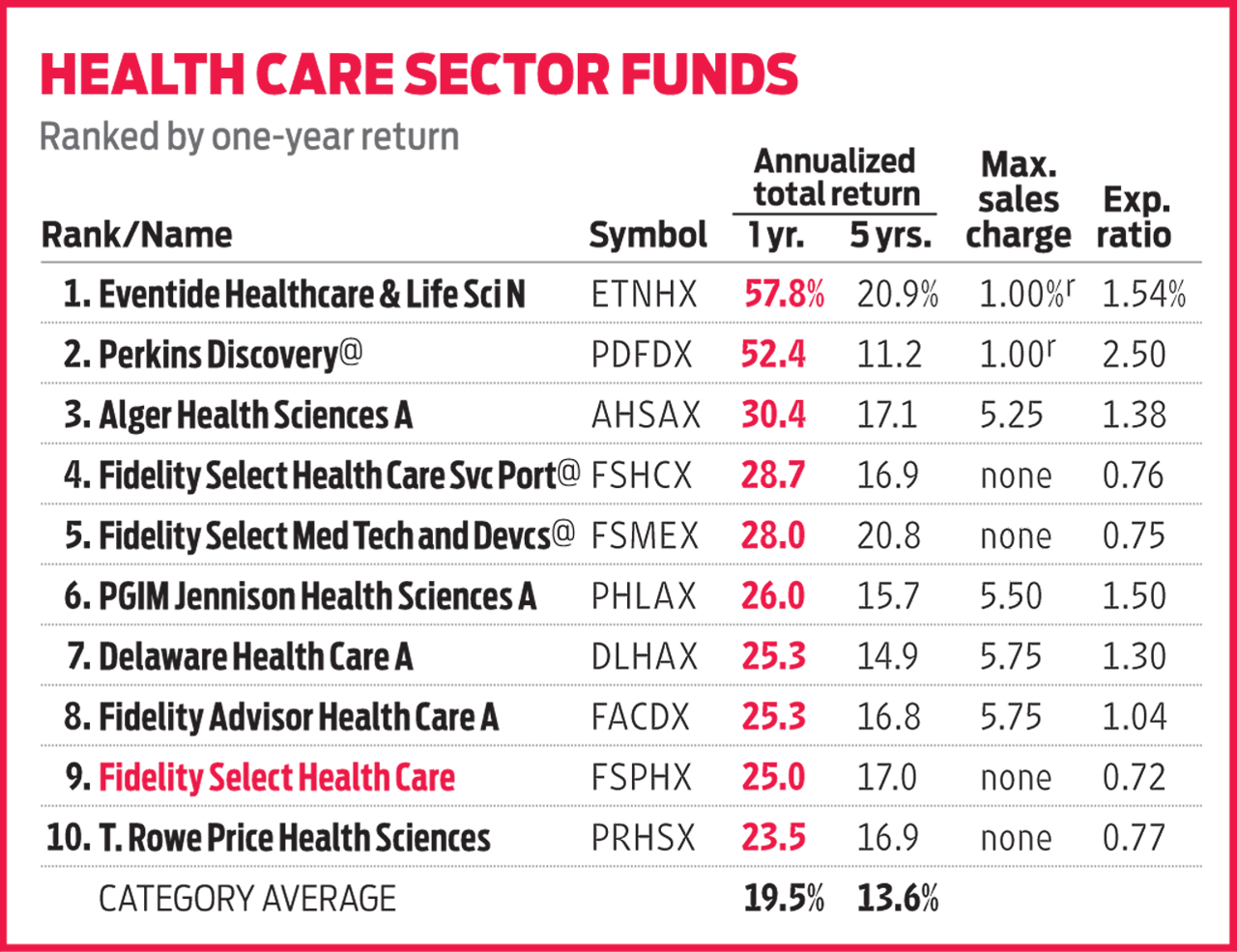

Health care stocks have climbed steadily over the past decade, even accounting for a pause in 2016, when the sector got entangled in election-year issues. There are reasons to expect the robust returns will continue. Spending on health care around the world is rising, thanks to an aging population in need of specialized care in advanced nations, and a growing middle class in emerging countries seeking better care. What's more, health care spending doesn't wither in the face of rising inflation or interest rates, says Eddie Yoon, manager of Fidelity Select Health Care Portfolio (FSPHX). "Demand is constant," he says.

Yoon typically holds 90 to 100 stocks in Select Health Care, balancing outsize positions in well-established firms with tiny bets in small biotechnology companies that have yet to make their mark. The fund's top holdings, such as insurer and care provider UnitedHealth Group (UNH), are fortress-like stocks that are growing steadily and are run by managers who spend cash wisely. They give the fund stability, says Yoon. The fund's smallest holdings each account for 0.4% or less of assets. These stocks tend to be volatile but have the potential to rise five to 10 times in price, he adds. One holding, biotech firm AC Immune (ACIU), is currently testing treatments for Alzheimer's.

Yoon picks stocks a company at a time. He focuses on free cash flow—the cash that's left over after paying necessary expenses to maintain a business. Price matters. Yoon buys when shares trade at bargain levels based on his forecast of free cash flow per share over the next three to five years.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Select Health Care Portfolio is diversified, but Yoon tilts the fund toward specific areas of the sector that he finds attractive. Shares in health care equipment firms and biotech companies together currently make up 56% of the fund's assets. And he doesn't own stock in Merck or Pfizer these days because he says the big pharmaceutical manufacturers are vulnerable to potential changes in drug-pricing regulations. "Every stock we own is purposeful, and the size in which we own it is purposeful," Yoon says. Since he took over almost 10 years ago, the fund has returned an annualized 17.5%, which beats the MSCI US IMI/Health Care 25-50 index.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into UnitedHealth Group Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UnitedHealth Group Stock 20 Years Ago, Here's What You'd Have TodayUNH stock was a massive market beater for ages — until it wasn't.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Stock Market Today: Stocks Keep Climbing on Interest-Rate Optimism

Stock Market Today: Stocks Keep Climbing on Interest-Rate OptimismInvestors continued to cheer Thursday's inflation update, with the Nasdaq and S&P 500 scoring their best week in months.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.