Kip 25: Our Favorite Mutual Funds, 2014

We add four new names to the roster of our favorite no-load mutual funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

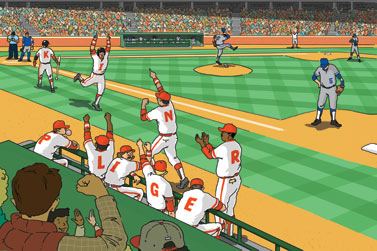

No baseball team, not even the winner of the World Series, rests on its laurels. So it is with the Kiplinger 25, the list of our favorite no-load mutual funds. Most of our picks outpaced their respective benchmarks over the past year, the third year in a row we can make that claim. But we want to make the Kip 25 even better and, just as important, bench any problematic funds before their performance starts to slip. So, as any good general manager would do, we’ve brought in a few new players.

Illustration by Dave Urban

Hunting for opportunity

John Roth, manager of Fidelity New Millennium (FMILX), can invest in companies of any size that present opportunity. He’s well suited for the job. Since he joined the Boston-based fund giant in 1999, Roth has managed several sector funds: Select Chemicals, Utilities, Consumer Discretionary and Multimedia. He’s analyzed old firms and new ones; companies that experience boom-and-bust cycles and companies that deliver steady results; stocks that are out of favor and stocks that are highfliers. The experience has turned him into a versatile, and good, stock picker. Since Roth became manager of New Millennium in mid 2006, the fund has returned 10.1% annualized, an average of 2.7 percentage points per year better than Standard & Poor’s 500-stock index.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Roth divides potential investments into four buckets: emerging growers (such as green darling Tesla Motors), consistent growers (oil-services giant Schlumberger), economy-sensitive stocks on the rebound (mortgage insurer Radian) and what Roth calls “oddballs”—out-of-favor companies with underappreciated assets (Nokia, for its intellectual property).

Roth approaches each type of company differently. When he looks at high-quality growth stocks, for instance, he seeks companies with high profit margins and returns on capital, among other things. With a bank, Roth focuses on the quality of the institution’s loans. “I like to look at each firm individually and use the appropriate metrics,” he says.

With $3 billion in assets—97% less than sibling Fidelity Contrafund, which New Millennium is replacing in the Kip 25—every holding matters, even the smaller companies, says Roth. Most of the fund’s 184 holdings have market values of more than $10 billion, but 15 have market values of less than $1 billion. Roth looks for opportunities (he calls them disconnects) to pile into a stock. “On days when people are panicking, I step up and buy,” he says. Roth loaded up on Tesla when the company experienced a string of battery-related problems in the fourth quarter of 2013 and the stock tanked. Disconnects exist for selling, too. After surviving the Internet bubble and the 2008 financial crisis, among other bad market spells, Roth likes to keep tabs on “where cash is flowing and where it is getting out of whack,” he says. To that end, he recently trimmed his holdings in small and midsize biotech firms, a sector that has jumped 68% in value over the past year. “Expectations are high,” he says. “You don’t want to stick around in that situation.”

New Millennium’s annual expense ratio is a modest 0.87%. That’s well below the average of 1.44% for actively managed, diversified domestic stock funds that have a minimum investment of less than $50,000.

Investing like owners

Davenport & Co. is a Richmond, Va., money-management firm that has been around since 1863. “We like to say we’re older than Thanksgiving,” says George Smith, who manages Davenport Equity Opportunities (DEOPX) with Chris Pearson.

Smith and Pearson don’t see themselves as growth investors or value investors. “We go wherever we see money-making opportunities,” says Smith. He and Pearson like growing firms with solid balance sheets, such as American Tower, which owns wireless-communications towers. “Space in those towers is in demand,” says Smith. “You don’t have to worry about who has the hottest phone or the best service plan.”

The managers are not required to invest in companies of any particular size, either, though they lean toward stocks with midsize market values. The fund’s 30 stocks have an average market capitalization of $8.3 billion. Benchmarks are up for grabs, too. In fact, Pearson and Smith want to beat them all, from the S&P 500, which is oriented toward large companies, to the Russell 2000 index (small firms) and the Russell Midcap index. Over the past three years, their fund, which launched in late 2010, earned 19% annualized and topped all three indexes by an average of nearly three percentage points per year.

Because the fund holds a trim number of stocks, the managers get to know the companies well. “We have a heavy emphasis on research, and we get to thinking like true owners of a business rather than traders who own 100 or 200 stocks,” says Smith. He and Pearson award extra points to companies whose executives own big chunks of the businesses. Founders (or their descendants) still run many of the firms in the fund, including credit card powerhouse Capital One Financial and packaged-food giant J.M. Smucker. “People who own their own business think differently than people who are investors,” says Smith. “We tend to own those stocks for a long time.”

Davenport, with $173 million in assets, replaces $48 billion Fidelity Low-Priced Stock in the Kip 25. Despite its small size, Davenport charges a reasonable 1.01% per year for expenses.

[page break]

Diversifying abroad

You won’t find the managers of Cambiar International Equity (CAMIX) making judgments about which country or region is most attractive. “We’re all stock pickers at heart,” says the fund’s lead manager, Jennifer Dunne.

She and her colleagues search for large, well-known companies (typically industry leaders with little debt) that have fallen on hard times but are poised for growth in profits, revenues or cash flow. “Every high-quality company disappoints at some time,” says Dunne. “When one hits a hiccup, when we see depressed valuations, we buy.” Of course, that happens only if the stock has met a couple of well-defined parameters: It has to trade at a significant discount to its average historical price-earnings ratio, and it has to offer a potential return of 50% over one to two years.

The team, which consists of Dunne, five other managers and four analysts, is “benchmark agnostic,” says Dunne. As such, she and her teammates don’t care if the fund, which holds 45 stocks, looks little like its bogey, the MSCI EAFE index. At last report, for instance, 32% of the fund’s assets were in Japanese stocks, about one-third more than in the EAFE index.

Although the managers focus on individual stocks, they don’t ignore the big picture. For example, International Equity owns just two emerging-markets stocks: Taiwan Semiconductor Manufacturing and América Móvil, a Mexican telecommunications firm. A host of external issues, including political unrest in Ukraine and Venezuela, have kept the managers from investing more in the developing world. But in the end, says Dunne, “every stock has its own story and specific growth factors that make it a worthy holding.” (Read more on emerging markets.)

Because each analyst and manager on the investment team specializes in a specific sector, the fund tends to stay diversified among many industries. Recently, the fund has invested in KPN, a Dutch telecom firm; BAE Systems, a U.K.–based aerospace company; and Otsuka Holdings, a conglomerate in Japan.

Cambiar holds $223 million in assets—a rounding error compared with the $50 billion in the fund it replaces, Harbor International. Cambiar charges 1.23% annually for fees, compared with 1.53% for the average actively managed, diversified foreign stock fund with a minimum investment of less than $50,000.

Aiming for singles

Fidelity Total Bond (FTBFX) “is not a shoot-the-lights-out kind of fund,” says lead manager Ford O’Neil. Its goal is to beat the bond market, as represented by the Barclays U.S. Aggregate Bond index, by at least one percentage point every year. That may not seem like much, but in the world of bonds, one point a year is monumental. Since O’Neil started managing the fund in late 2004, it has returned 5.2% annualized, topping 80% of its peers (intermediate-term taxable bond funds) and beating the Barclays index by an average of 0.5 percentage point per year. The fund yields 2.7%.

Total Bond is not just a core fixed-income fund. Sure, it holds a chunk of Treasuries and investment-grade corporate bonds (76% of the fund’s assets). But O’Neil and co-managers Matthew Conti and Jeffrey Moore can invest 20% of the fund’s assets in debt rated below investment grade. These days, about 14% of the $13 billion fund’s assets are in leveraged loans, commercial mortgage-backed securities, corporate junk bonds and emerging-markets debt.

O’Neil and his teammates get help from Fidelity’s strong bench of bond pickers. For example, Jonathan Kelly handles the emerging-markets investments in Fidelity Total Bond fund. And Eric Mollenhauer, manager of Fidelity Floating Rate High Income, runs a separate portfolio of floating-rate bank loans for Total Bond.

O’Neil expects muted annual returns of 1% to 4% over the next several years. But he’s ready to pounce when opportunities arise. “There are interesting challenges around the world,” he says. “That could lead us to some bouts of volatility, and it will lead to buying opportunities.”

Total Bond charges annual expenses of 0.45%. That’s a tad less than the fees of Harbor Bond, the fund it replaces, and much less than the 1.17% charged by the average actively managed taxable bond fund with a minimum of less than $50,000. The Fidelity fund is twice as big as Harbor Bond. But Harbor is managed by Pimco in the same way that Pimco runs its Total Return fund, which holds a staggering $237 billion.

[page break]

What does “no-load” really mean?

The Kiplinger 25 contains only no-load mutual funds. Technically, a fund is considered no-load if it does not charge a commission, either up front or on the back end, that winds up in the pockets of a broker. Redemption fees, which typically come into play if you sell shares within a month or two of purchasing them and proceeds of which go to the fund itself, are fine. So are 12b-1 marketing fees, as long as they don’t exceed 0.25% per year.

Things get more complicated if you invest in a no-load fund through a discount broker. If you buy shares through such a firm, make sure the fund is part of its no-transaction-fee network. Otherwise, you’ll end up paying a hefty price. For example, Schwab charges $76 to buy shares in funds that are not in its NTF program, called OneSource; Fidelity charges either $49.99 or $75, depending on the fund. Neither firm charges when you sell a fund. But at E*Trade, it costs $19.99 to buy and the same amount to sell shares in a fund that is not in the firm’s NTF program.

Some members of the Kip 25 don’t show up in many NTF programs (among them the Dodge & Cox and Vanguard funds). If you want to avoid transaction fees, you may have to buy them directly from their sponsors.

What’s in and what’s out

We think long and hard before we make changes to the Kiplinger 25. However, a few funds on the list had grown too large or had posted disappointing results. So we set out to find replacements that we thought could do better.

Harbor International, for instance, had lagged its benchmark, the MSCI EAFE index, which tracks foreign stocks in developed countries, by an average of nearly a percentage point per year since portfolio manager Hakan Castegren died in October 2010. We have found a worthy replacement in Cambiar International Equity.

A humongous asset base has tripped up many great funds. The poster child for asset-bloat disease is Fidelity Magellan, and we worried that two siblings, Fidelity Contrafund and Fidelity Low-Priced Stock, were on a similar path. We continue to have the highest regard for their managers: Contra’s Will Danoff, and Joel Tillinghast, who controls some 90% of Low-Priced’s assets. But Contra, with $114 billion in its coffers, and Low-Priced, with $48 billion, have gotten too big for comfort. Frankly, it’s painful to say goodbye to these wonderful funds. But we are. We’ve replaced Contra with the much smaller Fidelity New Millennium ($3.2 billion in assets). And we’ve swapped Low-Priced Stock for Davenport Equity.

Harbor Bond, which focuses on medium-maturity, investment-grade debt, has compiled a terrific long-term record under legendary Pimco manager Bill Gross. But some ill-timed moves in recent years, coupled with turmoil at Pimco, gave us pause. We’ve traded Harbor for Fidelity Total Bond.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

The Kiplinger 25: Our Favorite No-Load Mutual Funds

The Kiplinger 25: Our Favorite No-Load Mutual FundsThe Kiplinger 25 The Kiplinger 25 is a list of our top no-load mutual funds that have proven capable of weathering any storm.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.