Why to Buy Emerging Markets Now

Now, when developing markets are flat on their backs, is the time for contrarian investors to look closely at them.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Thank goodness for emerging nations such as China, India and Brazil. By continuing to grow briskly, they kept the recession of 2007–09 and its immediate aftermath from turning into a global calamity. Now, however, emerging economies are slipping. In India, for example, inflation is higher than in any other large country, yields on ten-year government bonds have jumped to nearly 10%, the rupee has lost two-fifths of its value, and growth in gross domestic product has dropped from about 9% to half that. China’s growth rate is down by one-fourth, and Brazilian economists estimate that their nation’s GDP will increase by a puny 2.9% in 2013.

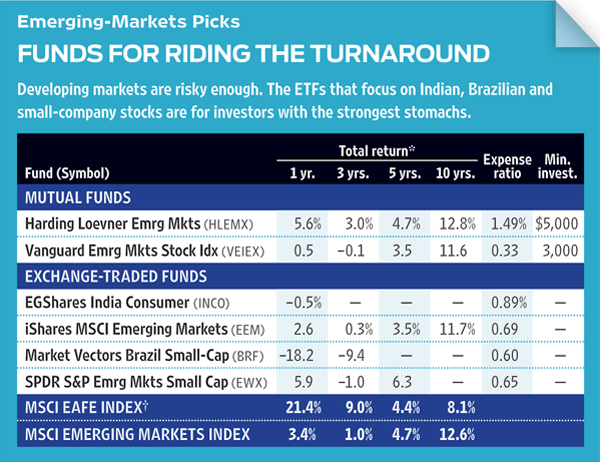

*Total returns through September 6; three-, five- and ten-year returns are annualized. Returns for ETFs are based on share prices. Source: Morningstar.

Among mutual funds, I like Vanguard Emerging Markets Stock Index (VEIEX), which tracks the FTSE Emerging index, and Harding Loevner Emerging Markets (HLEMX), an actively managed fund that has done a bit better over the long run. (The Harding Loevner fund is a member of the Kiplinger 25.) I slightly prefer the Vanguard fund because its annual expense ratio of 0.33% is less than one-fourth that of the Harding offering. The broad exposure to the global economy of the large-company stocks in such funds tends to dampen volatility, and they do own loads of stocks in real emerging markets, such as China, India and Brazil.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

If you can absorb more risk, focus, in these dark days, on India. One of my favorite ETFs is EGShares India Consumer (INCO), linked to the Indxx India Consumer index. It holds firms that sell to the huge domestic market, including Zee Entertainment, a film- and TV-production firm; and United Breweries, India’s largest beer purveyor.

Another way to get the most out of emerging markets is to invest in the stocks of small companies, which tend to have more of a local focus. Consider SPDR S&P Emerging Markets Small Cap (EWX), an ETF with an expense ratio of 0.65% and holdings such as China Everbright International, a developer of environmental projects, and Kroton Educacional, the third-largest for-profit education firm in Brazil.

Market Vectors Brazil Small-Cap (BRF) is an ETF whose top holding is another chain of post-secondary private schools, Brazil’s Anhanguera Educacional Participacoes. It also owns Qualicorp, which offers insurance to unions and trade associations, and Marfrig Alimentos, a meat processor that is expanding to China.

I would stay away from individual stocks of small companies and emerging-markets bonds. Bonds, too, have been clobbered in 2013, but although risks are lower than for stocks, they are still too high for the potential rewards.

You can’t time emerging markets any better than you can time domestic ones, but there’s no doubt that it’s better to buy when investors are heading for the exits. And that’s just what they’re doing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

QUIZ: Are You Ready To Retire At 55?

QUIZ: Are You Ready To Retire At 55?Quiz Are you in a good position to retire at 55? Find out with this quick quiz.

-

10 Decluttering Books That Can Help You Downsize Without Regret

10 Decluttering Books That Can Help You Downsize Without RegretFrom managing a lifetime of belongings to navigating family dynamics, these expert-backed books offer practical guidance for anyone preparing to downsize.

-

New Ways to Keep Online Accounts Safe

New Ways to Keep Online Accounts SafeAs cybercrime evolves, the strategies you use to protect yourself need to evolve, too.

-

White House Probes Tracking Tech That Monitors Workers’ Productivity: Kiplinger Economic Forecasts

White House Probes Tracking Tech That Monitors Workers’ Productivity: Kiplinger Economic ForecastsEconomic Forecasts White House probes tracking tech that monitors workers’ productivity: Kiplinger Economic Forecasts

-

Investing in Emerging Markets Still Holds Promise

Investing in Emerging Markets Still Holds PromiseEmerging markets have been hit hard in recent years, but investors should consider their long runway for potential growth.

-

5 Big Tech Stocks That Are Bargains Now

5 Big Tech Stocks That Are Bargains Nowtech stocks Few corners of Wall Street have been spared from this year's selloff, creating a buying opportunity in some of the most sought-after tech stocks.

-

Stocks: Winners and Losers from the Strong Dollar

Stocks: Winners and Losers from the Strong DollarForeign Stocks & Emerging Markets The greenback’s rise may hurt companies with a global footprint, but benefit those that depend on imports.

-

How to Invest for a Recession

How to Invest for a Recessioninvesting During a recession, dividends are especially important because they give you a cushion even if the stock price falls.

-

5 Exciting Emerging Markets Funds to Buy

5 Exciting Emerging Markets Funds to BuyForeign Stocks & Emerging Markets Emerging markets funds haven't been immune to global inflationary pressures. But now might be the time to strike on these high-risk, high-reward products.

-

10 Stocks to Buy When They're Down

10 Stocks to Buy When They're Downstocks When the market drops sharply, it creates an opportunity to buy quality stocks at a bargain.

-

How Many Stocks Should You Have in Your Portfolio?

How Many Stocks Should You Have in Your Portfolio?stocks It’s been a volatile year for equities. One of the best ways for investors to smooth the ride is with a diverse selection of stocks and stock funds. But diversification can have its own perils.