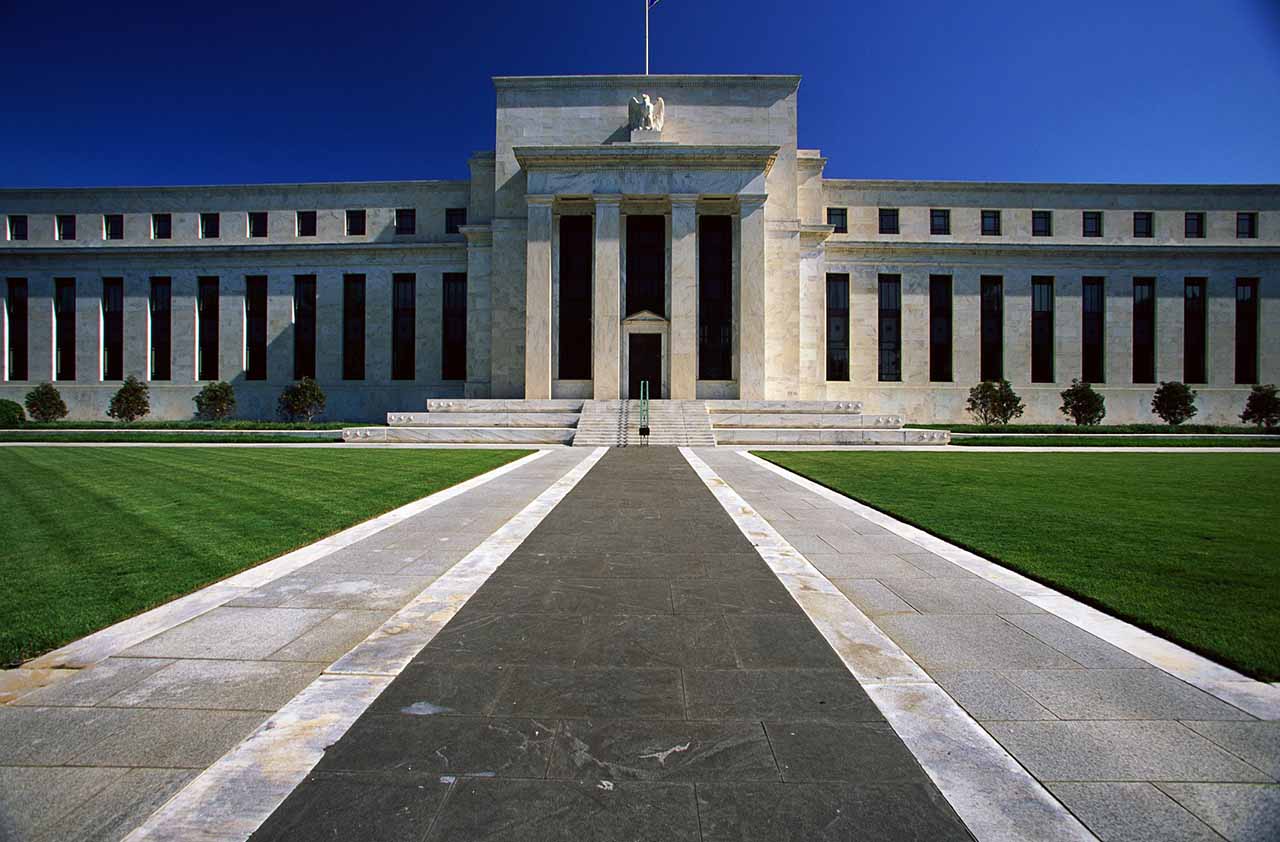

The Fed Is Buying ETFs. Now What?

The Federal Reserve's plan to hoover up $750 billion in bond funds could have some serious long-term consquences.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It's official. The Federal Reserve is now buying bond exchange-traded funds (ETFs).

Specifically, as part of the stimulus effort to counteract the effects of the coronavirus lockdowns, the Treasury gave the Fed $75 billion, which the Fed will in turn leverage 10-to-1 to buy $750 billion in corporate debt. Some of that figure will be in the form of corporate bond ETFs and even junk bond funds.

In a lot of ways, this is no big deal; it's essentially just the next logical progression of the Fed's traditional open-market operations.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But in a few critical ways, this really is a major policy shift – one that potentially makes a major weakness in the bond ETF space even more dangerous.

Why Is the Fed Buying ETFs?

The Fed has bought and sold trillions of dollars of Treasury and agency debt over the years, yet they've never dabbled in ETFs.

So, why now?

The answer here is pretty simple. The Fed essentially has the same issue that other passive indexers do. They're looking to get exposure to the corporate bond market as a whole, but not necessarily to any single company. The Fed isn't a bond fund manager. Nor does it have the interest or the inclination to research the credit worthiness of individual bond issuers.

Furthermore, there's a political element. The Fed needs to maintain its image of neutrality and can't be seen as favoring individual companies. The last thing Fed Chair Jerome Powell needs is to face a congressional firing squad over his decision to buy – or not buy – the bonds of a controversial or politically incorrect company.

Buying passive bond index ETFs – and having BlackRock (BLK) manage the endeavor – extricates the Fed from that situation.

Why Is This Bad?

The Fed's ostensible reason for buying corporate bonds was to improve liquidity in the bond market. During the March rout, the credit markets seized up. Liquidity disappeared, and bond prices dropped like a rock.

By jumping into corporate bonds, the Fed is looking to keep the market orderly and functioning. That sounds great, but here's the problem: By purchasing the bond ETFs rather than the bonds themselves, the Fed actually makes an existing problem worse.

"Bond ETFs create a false sense of liquidity," says Mario Randholm of Randholm & Co., a money manager with clients in Europe and South America. "The ETFs themselves are extremely liquid and even trade on the NYSE and other major exchanges. But the bonds they own are not. Liquidity in the ETF is not the same thing as (liquidity in the underlying bonds)."

Exchange-traded funds are an attractive vehicle because you can create and destroy shares as demand warrants. When there is more demand for an ETF than current inventory can support, large institutional investors create new shares by buying up the underlying holdings and bundling them into new creation units. When demand for the ETF falls, the institutional investors can break apart shares of the ETFs and sell the underlying holdings.

How is the Fed going to unwind three quarters of a trillion dollars in corporate bonds? How could they unload these bond ETFs without crushing bond prices?

No one knows, and that's exactly the problem. The Fed is about to become the largest lender to corporate America, and unwinding this might be impossible.

What Does This Mean for Stocks?

In the capital markets, a rising tide lifts all boats. By hoovering up hundreds of billions of dollars in bonds, the Fed is essentially freeing up capital that will have nowhere else to go but to the stock market.

This isn't news, of course. The Fed's interventions and the promises of more interventions are the primary reason that the stock market has been on fire since late March.

It remains to be seen how far this trend goes. The Fed's interventions were a major driver of the 2009-20 bull market. Some would argue they were the biggest driver, in fact.

And as a general rule, it's a bad idea to fight the Fed. It has a bigger wallet than you.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

Why the Next Fed Chair Decision May Be the Most Consequential in Decades

Why the Next Fed Chair Decision May Be the Most Consequential in DecadesKevin Warsh, Trump's Federal Reserve chair nominee, faces a delicate balancing act, both political and economic.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.