This Will Make You Rethink Your Dividend Investing Strategy

Despite the popularity of using dividend yields to choose stocks for their retirement portfolios, there's a better indicator that investors should be looking at.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

In the current interest rate environment, individual investors are understandably on the hunt for income. Naturally, many of them turn to dividend investing to generate a steady stream of income, especially in retirement.

However, the problem is that the way most people approach dividend investing is to fall into the yield trap. A stock that pays an above-average yield seems attractive and presumably solves the income problem. But does it?

Focusing on stocks that pay the highest current dividend yield is akin to telling a teenager to drop out of school to work flipping burgers so they can earn an income at that point in time. Wouldn’t they be better off INVESTING in their FUTURE so their income has the greatest potential to grow?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The fact is that dividend-paying companies produce three, not two forms of return: stock price appreciation, current dividend yield, and something else far more valuable but often overlooked: the possibility of future dividend growth.

Current yields are tempting and could produce income streams in the short-term, but it’s not sustainable.

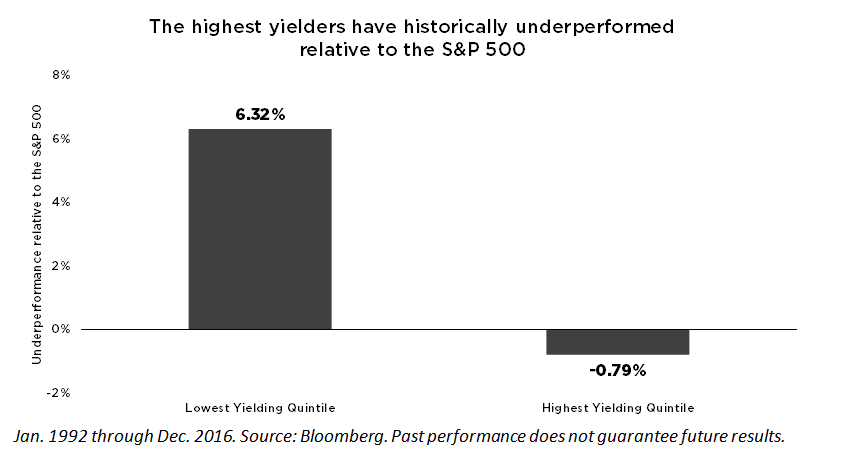

This is not an opinion, but rather a proven fact. To wit, my colleagues and I at Reality Shares looked at Bloomberg data, between 1992 and 2016 and found, on average, the companies with the highest dividend yields historically underperformed the broad equity market on a total return basis. Conversely, companies with the lowest dividend yields historically outperformed the broad equity market.

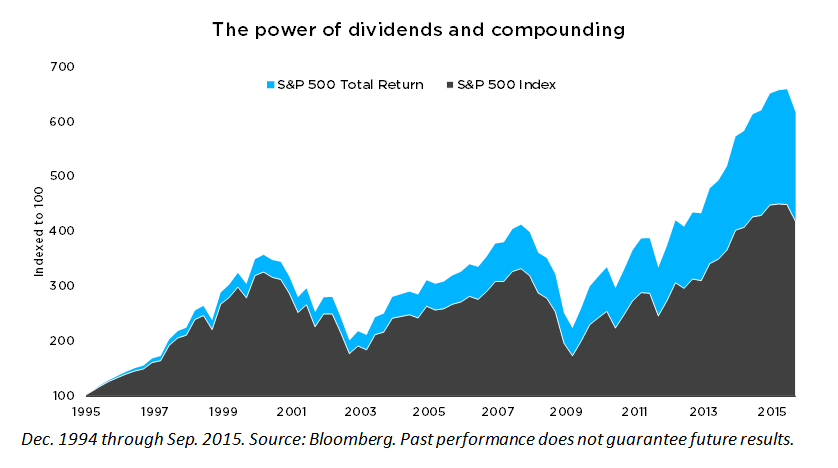

Certainly, this data is not meant to discourage you from dividend investing, but rather, it should make you rethink your dividend investing strategy. As the following chart shows, nearly 40% of the total return of the S&P 500 can be attributed to reinvested dividends and the power of compounding.

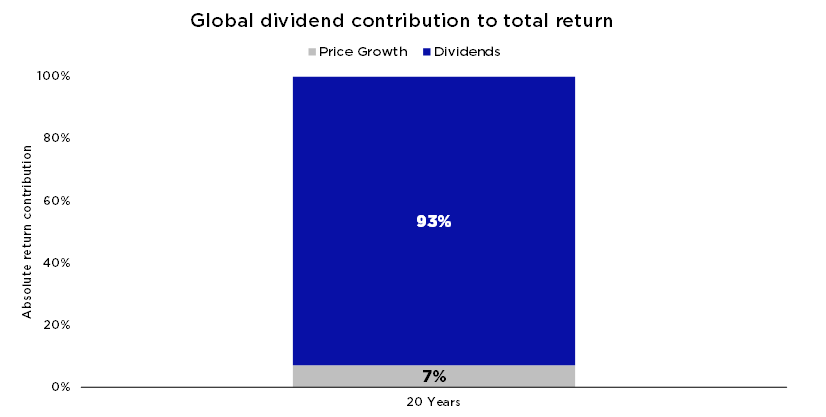

This is not just a domestic phenomenon. MSCI research found dividends were the largest contributor to global equity returns, accounting for 93% of total return over the 20-year period from December 1994 through September 2015.

Dec. 1994 through Sep. 2015. Source: MSCI. Past performance does not guarantee future results.

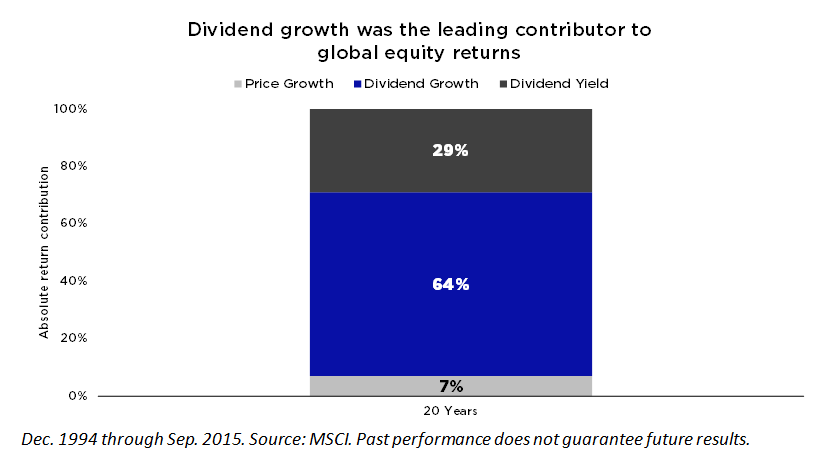

If you break it down further, dividend yield accounted for only 29% of total return, whereas the growth of dividends represented nearly 65% of the performance over 20 years.

Go for the Dividend Growth

While the allure of a high-yielding stock can be attractive, investors need to remain disciplined and should instead focus on the stocks that are committed to growing dividends. Not only has the dividend growth component contributed significantly to historical total returns, but further research from Ned Davis confirms dividend growers and initiators have historically outperformed all other categories of stocks (over a span of 40+ years).

So, what is going on here? Remember what Albert Einstein said about the power of compounding: “Compound interest is the eighth wonder of the world. He who understands it earns it . . . he who doesn't . . . pays it. Compound interest is the most powerful force in the universe.” This is the key to unlocking the magic.

But here’s what even the most ardent dividend growth investors get wrong ...

In This Case, Size Really Does Matter

The magnitude of dividend growth actually matters even more so than whether or not a stock grows its dividend. Even among all the brilliant dividend-focused investors, most people miss this. Instead of simply being satisfied with companies that grow dividends, investors should be asking how much they grow dividends.

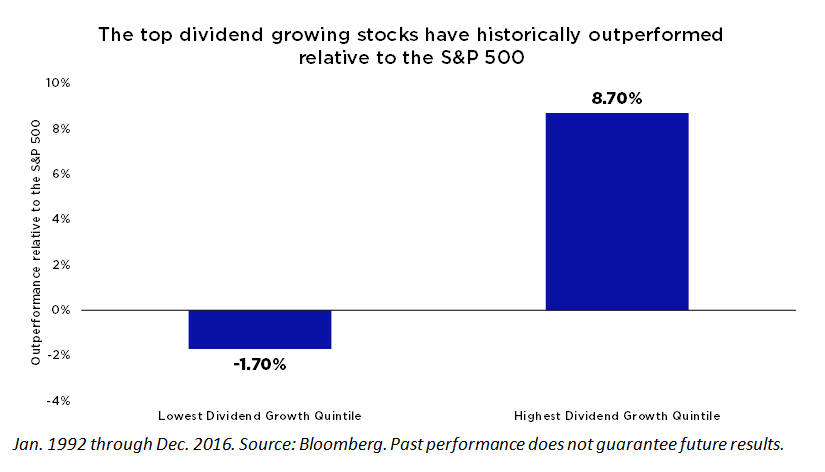

Companies that grew their dividends the most historically outperformed the broad equity market, and those companies with little to no dividend growth actually underperformed the broad equity market (on a total return basis). The following chart illustrates how the stocks with the highest dividend growth rates have historically outperformed the S&P 500 by nearly 9%, and it emphasizes the relevance of the level of dividend growth.

Remember that investing, for the most part, is all about the long term. Therefore, don’t worry about the low current income, and instead focus on companies that have the highest potential to grow their dividends in the future.

Dividend growth investing has historically offered investors an opportunity to outperform the market with lower volatility. Despite the popularity of dividend yield, dividend growth has been a better indicator of outperformance relative to the broad equity market, and the magnitude of dividend growth should be considered as part of a dividend investment strategy.

After running the dividend analysis numbers, here are the companies we believe are poised to raised their dividends the most (according to in-house research and our proprietary methodology, DIVCON):

Click here to find out how you can identify the leading dividend growth stocks for your portfolio.

Visit www.realityshares.com for important disclosures.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Eric Ervin founded Reality Shares, a firm known for ETF industry innovation. He led the launch of investment analytics tools, including Blockchain Score™, a blockchain company evaluation system; DIVCON®, a dividend health analysis system; and the Guard Indicator, a directional market indicator. These tools were designed to help investors access innovative investment strategies as well as provide alternative dividend investment solutions to manage risk.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.