Should Congress Dictate How Colleges Spend Their Endowments?

Charitable institutions with endowments—whether colleges, museums or hospitals—have a legal and moral obligation to honor the wishes of past donors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Q. I think that both public and private colleges have a moral obligation to make themselves more affordable without burdening their students with heavy loans. Now I see that some members of Congress want to force colleges to spend more of their endowments on financial aid. Your thoughts, please.

A. I agree with you that colleges should address the twin issues of high tuition and student loan burdens—not just as a matter of fairness, but for the sake of a stronger economy and the civic good of an educated citizenry. They should cut their operating costs by reducing administrative overhead; trim campus amenities that aren’t essential to learning, such as lavish recreational, dining and athletic facilities; and even eliminate less-distinguished or underenrolled academic departments.

I think schools should allocate a large portion of those savings to more financial aid for low- and middle-income students—in the form of grants, not loans. And colleges should motivate their donors to earmark more gifts for that purpose. Fortunately, all of these trends are now under way in higher education, which recognizes that it has an ethical and public-relations problem.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

I do not support attempts by the government to legislate how colleges use their endowments—for example, by forcing them to boost the annual withdrawal and spend it on financial aid. Many colleges saw their endowments shrink in the bear market of 2007–09, so they’re properly wary of boosting the annual drawdown beyond a prudent 5% or so. Besides, charitable institutions with endowments—whether colleges, museums or hospitals—have a legal and moral obligation to honor the wishes of past donors. They can’t divert the annual income from gifts given for one purpose to another purpose, however worthy, without donor consent.

Other ill-advised proposals include changing the tax code to give donors of restricted endowment gifts (say, earmarked for the teaching of biology or art history) a smaller charitable tax deduction than donors would receive if they made gifts to unrestricted endowments or to scholarship funds. Using the tax code to play favorites (a longtime habit of Congress) is a bad idea anytime.

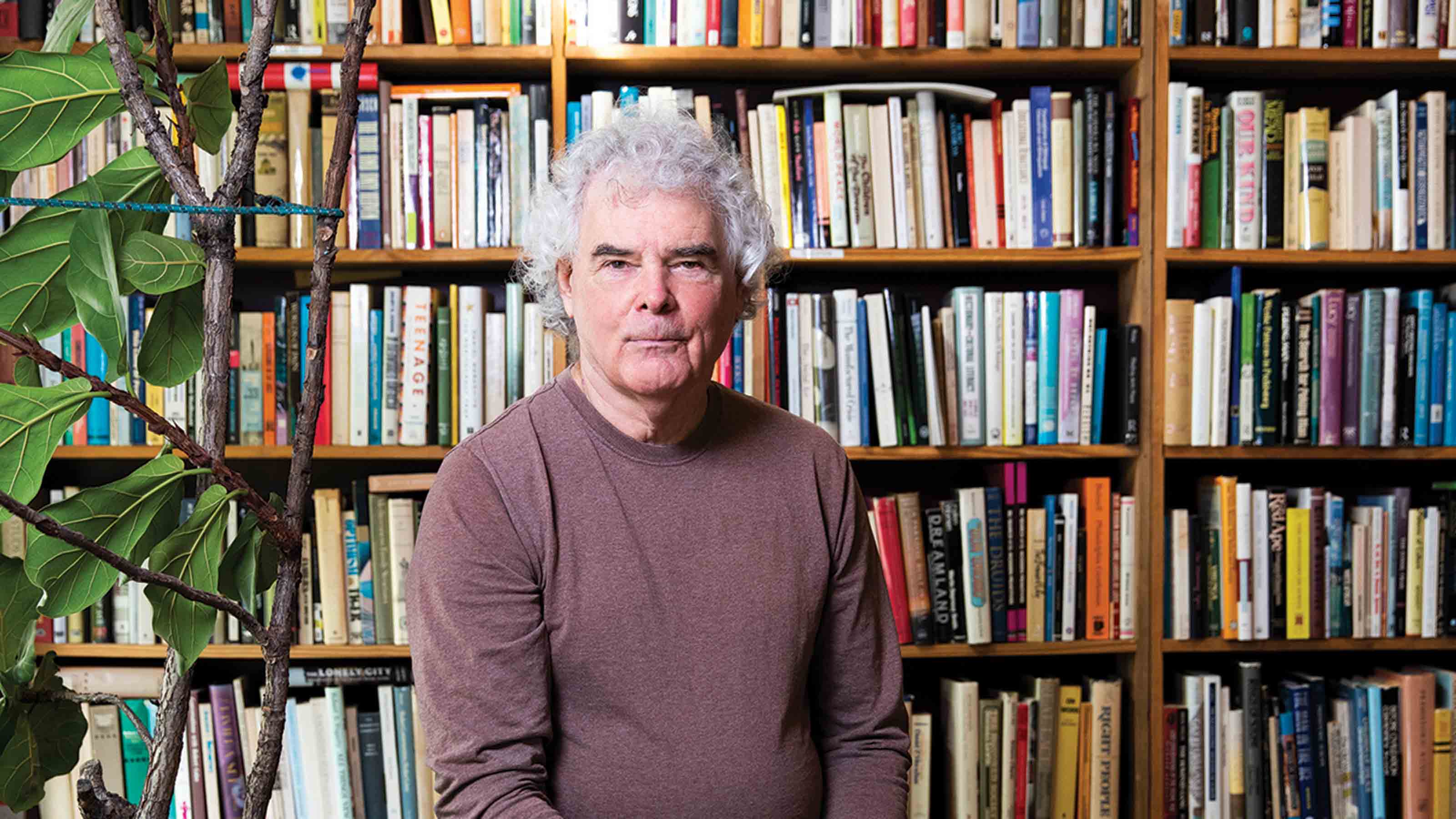

Have a money-and-ethics question you’d like answered in this column? Write to editor in chief Knight Kiplinger at ethics@kiplinger.com.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Knight came to Kiplinger in 1983, after 13 years in daily newspaper journalism, the last six as Washington bureau chief of the Ottaway Newspapers division of Dow Jones. A frequent speaker before business audiences, he has appeared on NPR, CNN, Fox and CNBC, among other networks. Knight contributes to the weekly Kiplinger Letter.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

What Will Happen With Health Costs in 2023

What Will Happen With Health Costs in 2023Business Costs & Regulation Higher drug costs are likely to accelerate health insurance premium increases.

-

New Platforms for a Comedy Couple

New Platforms for a Comedy CoupleCoronavirus and Your Money COVID forced them to expand their stand-up repertoire to YouTube and podcasts.

-

This Vet is on the Frontlines of the Pandemic Pet Problem

This Vet is on the Frontlines of the Pandemic Pet ProblemCoronavirus and Your Money Lisa Gretebeck used telemedicine and other creative ways to handle a surge of new cat and dog patients.

-

Tying the Knot Post-Pandemic

Tying the Knot Post-PandemicBusiness Costs & Regulation This wedding planner is gearing up for a full fall season amid continuing concerns about safety.

-

Fintech: The Bank Disrupters

Fintech: The Bank DisruptersFinancial Planning Fintechs offer mostly free accounts with tantalizing yields and slick features, but don’t expect much hand-holding.

-

Biden Puts New Cops on the Money Beat

Biden Puts New Cops on the Money BeatBusiness Costs & Regulation President Biden has nominated well-known watchdogs to head agencies that regulate the financial sector.

-

A New Chapter for This Bookstore

A New Chapter for This BookstoreCoronavirus and Your Money Katrina and COVID haven’t deterred the owner of a used bookstore from catering to his clientele.

-

From Music to Merchandise

From Music to MerchandiseMaking Your Money Last This rapper has pivoted from putting on live shows to selling T-shirts and tote bags.