How a Mouse Ate My Car

Our world is full of wonderful furry creatures. They just need to stay the heck away from our vehicles already.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

I love animals: We have two cats and two dogs—and sometimes more when we foster animals for rescue organizations. I also love cars. These two passions cohabit my personality just fine, but a recent event reminded me that in the real world, vehicles and animals don’t get along so well—and that the consequences of their interactions can be pricey.

No, I didn’t hit a deer, thankfully. That’s the usual story when it comes to critter woes, especially in fall—mating season. The deer can get a bit distracted, you know. State Farm has studied deer-car collisions for 15 years, and its latest study puts the national average cost per claim at $4,179. Ouch! The insurance giant also calculates the likelihood of hitting Bambi on a state-by-state basis. Live in West Virginia? You had a 1 in 43 chance of hitting a deer in 2017. In Hawaii, it was only 1 in 6,823. (Deer in Hawaii? Yes, they were introduced.)

Hitting a deer with your car may damage the vehicle but is unlikely to injure you. But swerving to miss a deer or a dog or any other animal and instead colliding with a guardrail, tree or—the worst—another car is an entirely different story. If an animal does appear out of nowhere in front of you, brake as hard as you safely can, but don’t swerve, say safety experts. It pains me to say this, but just hit the darn thing if you can’t stop in time.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The rodent exclusion. Beyond your safety, there’s also a pocketbook issue for that guidance. If your car is damaged by collision with an animal, that’s a claim on your comprehensive coverage, which is meant to cover things that can’t be blamed on your driving (such as fire, falling trees and theft). But if you damage your car while avoiding an animal, it would count against your collision insurance. Collision claims are much more likely to lead to higher insurance rates than comprehensive claims. If you damaged property or hurt someone else in the process, that would trigger your liability insurance, and now things can really get ugly.

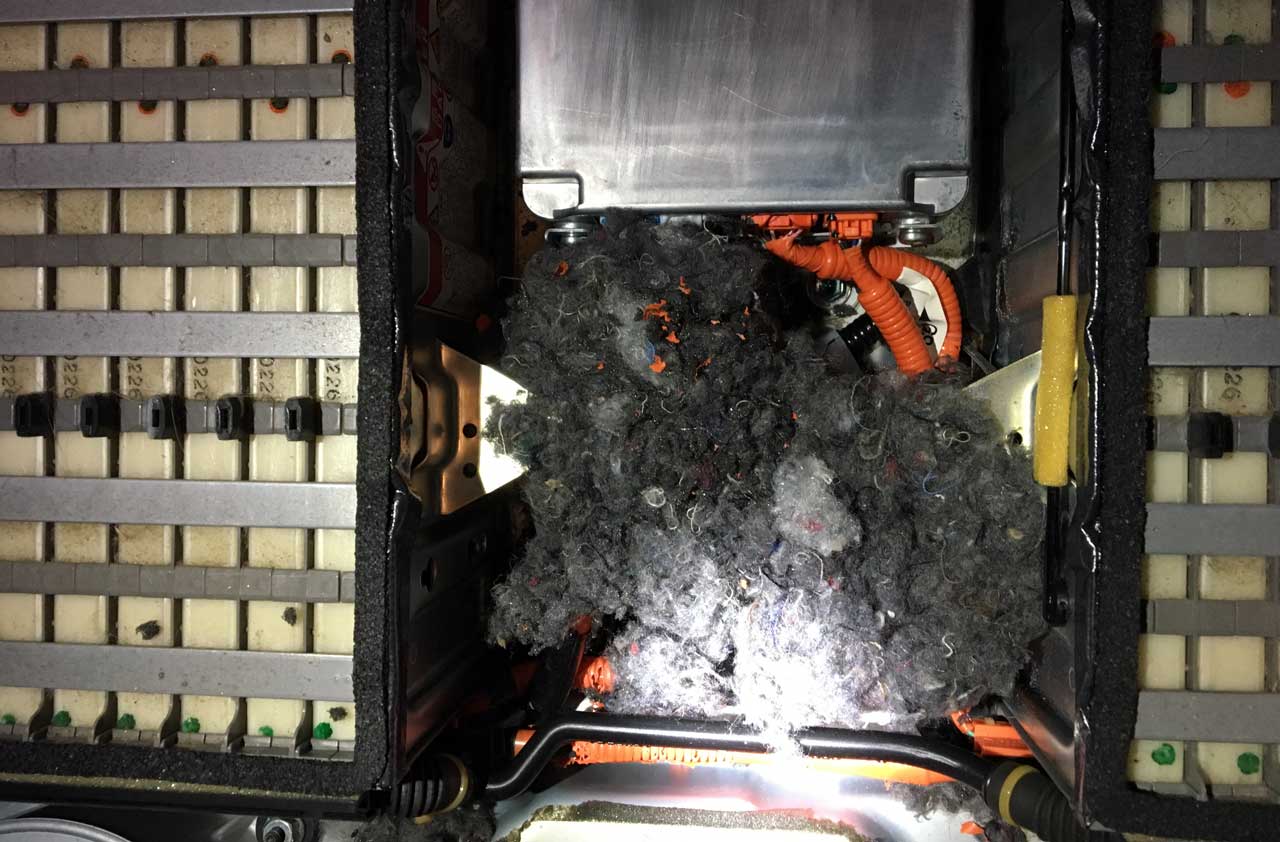

My wildlife woe—which wasn’t covered by insurance and cost me about $6,000—was caused by a much, much smaller animal that would not have made so much as a thump had I run over it. A mouse (or some other tiny creature with big, nasty, pointy teeth) chewed on the wires in the hybrid battery pack of my wife’s Toyota Highlander.

Mickey (or Minnie) isn’t solely to blame; I am as well, for having let a water leak into the passenger compartment—where the battery is located—go unrepaired. During an exceptionally heavy rain, water met gnawed cables, and the car’s hybrid system took deep umbrage. Unfortunately (I guess), the short didn’t cause a fire, because that might have been covered by insurance. In our case, we had no coverage because of my insurance carrier’s “rodent exclusion.” (My wife: “Can we tell them it was raccoons?”)

Not all policies have this limitation to their comprehensive coverage, says Penny Gusner, consumer analyst for Insurance.com. If you think you’re at risk for varmint invasion, it pays to check because the coverages and rules vary from company to company and state to state.

Quiz: Does Car Insurance Cover That?

How can you do your own rodent exclusion—that is, keep rodents out of your car? Keeping the interior clean is one of the anti-vermin tips recommended by rodent-control company Victor Pest (you might know them from their iconic snap traps). We definitely failed to do that with the Highlander, which carried my kids during the Cheerios-and-Chex-Mix phase of their lives. Another tip is to let your cat roam the garage where the car is parked—if you have a cat. Victor Pest also sells scented products it claims mice will avoid.

Rodents don’t always head for the interior of your car. Air intakes for both the passenger compartment and the engine can be another vector. I’ve seen people improvise barriers made out of metal hardware cloth for the engine air intake. If you try that, make sure it doesn’t get plugged with leaves or other debris that could reduce airflow.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

In his former role as Senior Online Editor, David edited and wrote a wide range of content for Kiplinger.com. With more than 20 years of experience with Kiplinger, David worked on numerous Kiplinger publications, including The Kiplinger Letter and Kiplinger’s Personal Finance magazine. He co-hosted Your Money's Worth, Kiplinger's podcast and helped develop the Economic Forecasts feature.

-

$3,000 Checks for Most Households? Lawmakers' New Billionaire Tax Plan Unveiled

$3,000 Checks for Most Households? Lawmakers' New Billionaire Tax Plan UnveiledWealth Taxes Two prominent lawmakers are proposing to 'tax the rich' and send some proceeds to taxpayers. Could it be a sign of things to come?

-

Florida Wants to Eliminate Property Taxes. Here’s Who Would Really Pay Instead

Florida Wants to Eliminate Property Taxes. Here’s Who Would Really Pay InsteadState Taxes A new proposal could significantly reduce property taxes for many Florida homeowners. Here’s how the plan would recalibrate the state’s tax structure and shift who ultimately pays the price.

-

Why AI Superiority is Measured in Gigawatts

Why AI Superiority is Measured in GigawattsThe Kiplinger Letter The artificial intelligence arms race hinges on unprecedented demands for computing power and electricity. Could anything change that?

-

Getting a Used Car Deal in a Tight Market

Getting a Used Car Deal in a Tight MarketBuying & Leasing a Car Cars are scarce and prices have gone up. Use these strategies to find the best values.

-

Get Your Car on the Cheap

Get Your Car on the CheapBuying & Leasing a Car Want to spend less on transportation? Step 1 is a car that’s used, but not used up.

-

How to Save on a Used Car

How to Save on a Used Carused cars Tips and techniques that can help you save money when shopping for a used car.

-

How to Buy a Car (for Less!) During COVID-19

How to Buy a Car (for Less!) During COVID-19Buying & Leasing a Car Safety first, but don’t rule out the old-school approach of just picking up the phone and calling your local dealer.

-

Protecting Your Car During COVID-19

Protecting Your Car During COVID-19Buying & Leasing a Car Lack of exercise won’t make your car flabby, but problems with the battery, the fuel and even malevolent wildlife are a real possibility.

-

How to Clean and Maintain Your Car in the Coronavirus Era

How to Clean and Maintain Your Car in the Coronavirus EraBuying & Leasing a Car First things first: Let’s disinfect that small, enclosed space.

-

Should You Buy Your Next Car New or Used?

Should You Buy Your Next Car New or Used?Buying & Leasing a Car There are cases when it’s better to buy new than used. Look for low-priced cars with high resale value.

-

Minivans: What’s Not to Like?

Minivans: What’s Not to Like?Buying & Leasing a Car The minivan has been unfairly displaced by the three-row SUV as the family hauler of choice.