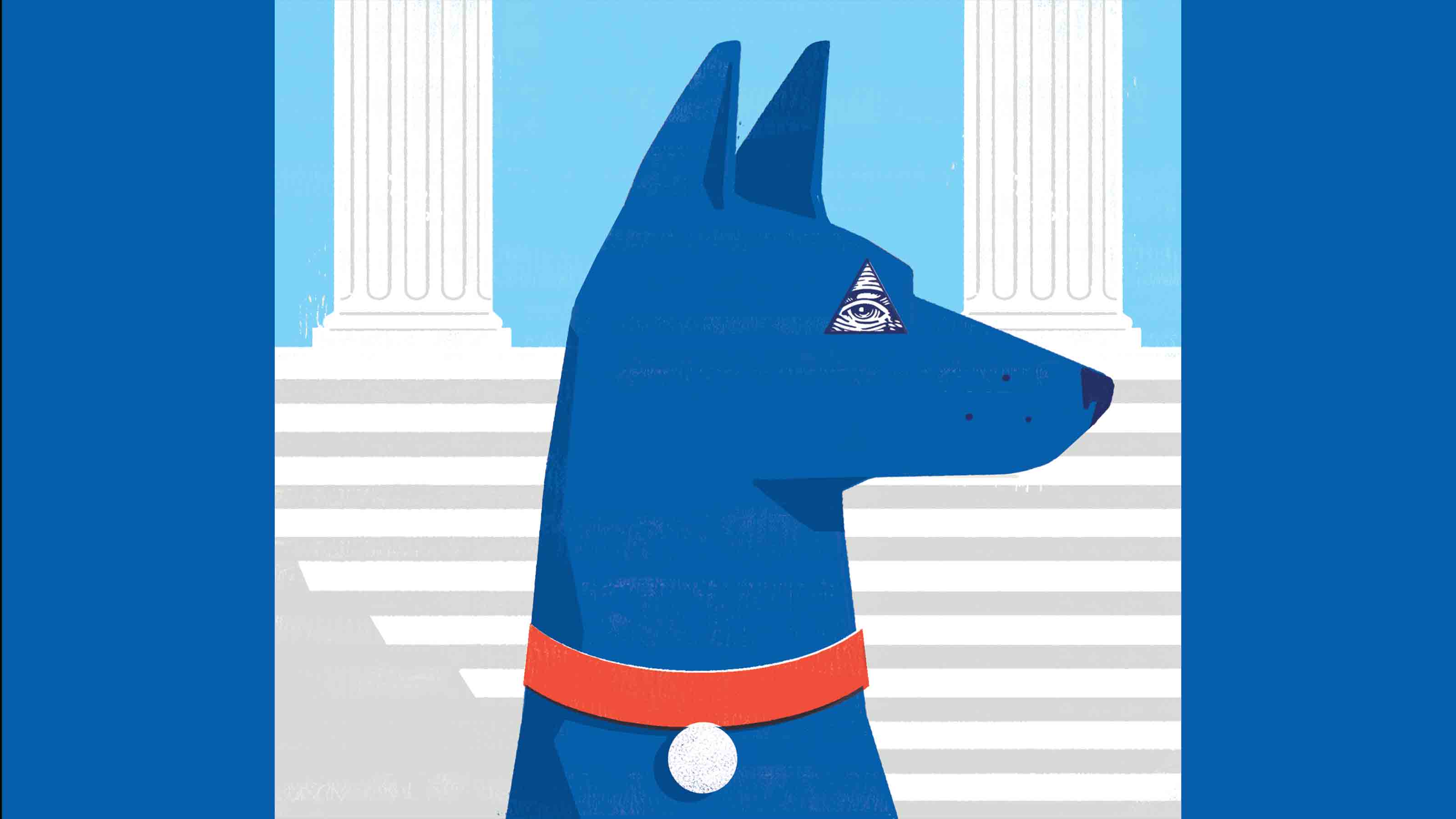

Investors Will Make Big Banks Safer

The cloud hanging over bank stocks this year has a silver lining.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

There's been a heap of bad news lately for shareholders and executives of the nation's largest banks, but it will be good news in the long run, significantly improving the safety and soundness of the U.S. financial system.

Four years since the onset of the financial crisis, market forces are exposing vulnerabilities that remain in the U.S. financial system and imposing major improvements. In some cases, the market is doing so more effectively than regulators or the Dodd-Frank Act, enacted by Congress after the crisis to make banks safer.

Despite strong earnings in 2011, major banks started out the year with low share values. Many were worth less than their assets, which is unusual for healthy companies. The threat of a Greek debt default and a broader European financial crisis was certainly a factor, but not the primary one. Low share prices also afflicted banks with minor exposure in Europe, and prices haven't rebounded since recent progress in the euro zone lifted European bank stocks.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Then in April, news broke of JPMorgan Chase's London trading losses -- as much as $7 billion at last estimate. Because JPMorgan was widely considered the best managed and most risk averse of the large banks, its losses fed doubts about the safety of other banks, depressing their shares even more.

But the biggest and broadest piece of bad news was last month's downgrading of the creditworthiness of five of the six largest U.S. banks by Moody's Investors Service. Moody's effectively declared that although the risks were still small, the odds had risen that the banks would become insolvent and default on their debts. The downgrade will cost these banks billions of dollars in higher borrowing costs and lower profits as they are forced to hold more reserves.

Many bank experts have interpreted these developments as evidence that Dodd-Frank hasn't made the system safe enough. They're right. JPMorgan's trading scandal showed that even the best-run banks can fall prey to recklessness and greed, and that regulators are often too slow to prevent it. The Moody’s downgrades demonstrated that legal mandates for banks to curb risk-taking haven't prevented an increase in profit-seeking risk in the past year or so.

Still "too big to fail"

The biggest failure of Dodd-Frank, one that top U.S. officials refuse to acknowledge, lies at the heart of the low valuations for major banks: They are still "TBTF" -- too big to fail. The law was supposed to transform the financial system from a house of cards into one where the failure of a single bank wouldn't threaten the entire system. That hasn't happened, and the insolvency of any of the big banks would still risk another crisis.

Some stock-pickers argue that the discounting of bank stocks indicates banks are still inflating the value of their assets. But such legerdemain is highly unlikely under the "stress test" audits that regulators instituted after the financial crisis. The low prices do reflect the very real risks and future costs of banks that are TBTF.

Although federal regulators might have addressed this by making the largest banks smaller, emergency action during the financial crisis did the opposite. Instead of nationalizing failing banks, as governments often do in financial crises, regulators forced the sale of the healthy assets of failing banks to Citigroup, Bank of America and other majors, leaving the giants larger and more dominant than ever. Two former Federal Reserve chairmen, Paul Volcker and Alan Greenspan, have said that breaking up the big banks might be the only way to safeguard the system. But free market ideology among Republicans and political timidity among Democrats mean that breakups have never been a serious option.

Another approach to TBTF would be to curb risk-taking by requiring banks to hold more assets -- enough to withstand a crisis. And, in fact, U.S. regulators, in agreement with the governments of other nations, determined that capital reserve requirements should more than triple for the world's largest banks, a change to be phased in over the next seven years.

Will it be enough? The banks claim that the higher reserve requirements are way too high and will constrain their lending without improving safety. Daniel Tarullo, the Federal Reserve official focused on capital requirements, has said that even higher reserves are needed to make banks truly safe, but he appears to have been overruled by other U.S. officials. Tarullo points approvingly to Switzerland, where the economy is heavily dependent on banking and is imposing capital requirements about twice as high as those that major U.S. banks will need to meet.

A market ruling

Investors seem to be saying they agree: More reserves will be needed -- certainly sooner than 2019, and possibly more than the increase now planned. Because increased reserves down the road will dilute future share prices, the stock is worth less today than seems justified by the banks' healthy profits. This message was evident when JPMorgan Chase's stock recovered from the sharp decline after announcement of its losses, when CEO Jamie Dimon promised to raise reserves faster than required by regulators. Profitable smaller banks generally aren't facing this "TBTF discount" because their failure doesn't threaten the financial system.

Of course, such market discipline has failed before, notably in the risk-be-damned days before 2008, when investors were cheering on Lehman Brothers, Bear Stearns and other banks later consumed in the financial crisis. But once-burned investors seem to be acting differently now. They're having a real impact on risk-taking and management of major banks and will continue to impose reform when they think it's needed. That's the way markets are supposed to work. When they do, they can be a more effective and swifter protector of the common good than Uncle Sam.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

What Will Happen With Health Costs in 2023

What Will Happen With Health Costs in 2023Business Costs & Regulation Higher drug costs are likely to accelerate health insurance premium increases.

-

Airbnb Host Tells What It's Like

Airbnb Host Tells What It's LikeBusiness Costs & Regulation This Denver pharmacist began booking her ski condo a few months after the pandemic hit.

-

Tough Times for a Family Business

Tough Times for a Family BusinessBusiness Costs & Regulation His dry-cleaning operation was rocked by the pandemic, but he is staying optimistic.

-

IRS Gives Truckers a Tax Break in Response to the Colonial Pipeline Shutdown

IRS Gives Truckers a Tax Break in Response to the Colonial Pipeline ShutdownTax Breaks The tax penalty for using dyed diesel fuel for highway use is temporarily suspended.

-

Reliving a Harlem Renaissance

Reliving a Harlem RenaissanceBusiness Costs & Regulation After a tough winter, two sisters look forward to reviving their restaurant’s business.

-

Add a VPN to Surf the Internet Safely

Add a VPN to Surf the Internet SafelyTechnology To help you fight identity theft, consider adding a VPN.

-

Biden Puts New Cops on the Money Beat

Biden Puts New Cops on the Money BeatBusiness Costs & Regulation President Biden has nominated well-known watchdogs to head agencies that regulate the financial sector.

-

Stephanie Creary: Making the Case for Diversity on Corporate Boards

Stephanie Creary: Making the Case for Diversity on Corporate BoardsBusiness Costs & Regulation Adding underrepresented voices can improve a company’s bottom line.