Parnassus: Investing With a Conscience

Few fund operators have combined principles and performance with as much success as Parnassus.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The sweeping view from the offices of Parnassus Investments, in the heart of San Francisco’s bustling financial district, could easily grace the pages of a coffee-table book. The San Francisco Bay panorama encompasses the historic Ferry Building terminal, with its imposing clock tower, and the stately suspension towers of the Bay Bridge, stretching across steel-blue water to Yerba Buena Island and on to Oakland.

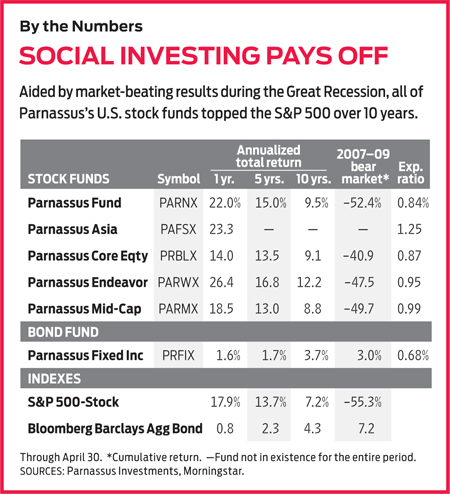

The dazzling view is fitting for a mutual fund company that has dazzled investors with its returns while investing with a social conscience. Few fund operators have combined principles and performance with as much success as Parnassus, and its brand is resonating with investors. Assets have soared to $23.5 billion, up from just $1.5 billion in 2008. But continued success depends on delivering solid returns, even as a management transition looms.

The bar is high. Parnassus Core Equity (symbol PRBLX), with the lion’s share of assets at more than $15 billion, beat its peers in nine of 10 calendar years through 2016 and did so with less volatility. Through April 30, Parnassus Endeavor (PARWX), which focuses on, among other things, corporate workplace policies, was the third-best large-company mutual fund over the past 10 years, number five over five years and number 11 over three years. Parnassus Mid-Cap (PARMX) is a member of the Kiplinger 25, the list of our favorite no-load funds.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Uncertain bet. Parnassus’s success is rooted in humble beginnings, dating back to the early days of an investing movement that now claims $1 out of every $5 under professional management in the U.S. The firm began as an experiment by Jerry Dodson, a Harvard MBA who, working out of his Bay Area home, launched Parnassus Fund (PARNX) in 1984. “The premise under which I founded the company was that if you bought companies that were socially responsible and that were undervalued, you would have excellent returns,” says Dodson, 73. “But I was not confident—there was no evidence to prove that was correct.”

Dodson struggled to reach a break-even point, then estimated to require $30 million in assets. After the 1990 bear market, “there was a question in my mind whether Parnassus was a viable entity—I was starting to run out of money,” says Dodson. But in 1991, Parnassus Fund soared 53%, crushing Standard & Poor’s 500-stock index by 22 percentage points. By 1992, assets were up to $100 million, and by 1995, the company had two more funds and an office in a swanky skyscraper with a view of the Bay.

Parnassus will soon begin a new chapter, with Dodson slated to step down as CEO in 2018 and, at some point, as comanager of Parnassus Fund. He will continue to run Endeavor and will serve as a consultant to Ben Allen, who is a portfolio manager, Parnassus’s current president and the person who will step into the CEO role at the employee-owned firm. “One of Dodson’s strengths is his ability to develop strong teams, which should ensure Parnassus’s continued success,” says Morningstar analyst Wiley Green.

Most of Parnassus’s key employees wear more than one hat—portfolio managers are analysts, too—and share a common stock-picking philosophy. Not surprisingly, many of the funds’ top holdings overlap. Still, the process is easy to understand but tough to execute, says Green. So, with Endeavor in particular, manager succession remains a question mark.

Nine portfolio managers run six funds under the Parnassus umbrella. Parnassus Asia (PAFSX), which debuted in 2013, invests in companies of all sizes in both developed and emerging countries in the region. Parnassus Fixed Income (PRFIX), a taxable, intermediate-term bond fund, is the lone disappointment in the lineup. Its returns lagged those of the Bloomberg Barclays U.S. Aggregate Bond index in seven of 10 calendar years through 2016, although the fund squeaked past its benchmark in the first four months of 2017.

What they avoid. All of the funds shun securities of companies that manufacture weapons. They also bar firms that make alcohol or tobacco products, are involved in gambling or nuclear power, or conduct business in the Sudan. Parnassus Fund and Endeavor also screen out businesses involved with fossil fuels.

But Parnassus’s focus on environmental, social and corporate-governance policies (or ESG, in the vernacular of sustainable investing) is more than a simple process of elimination. The initial exclusionary screens rule out less than 10% of the market. “Where we add real value is in how we use our ESG sensitivity after we’ve done the exclusionary screens,” says Allen, who comanages Core Equity.

Companies are assessed on five core ESG principles, the importance of which vary from industry to industry. Environmental impact might be the paramount consideration for industrial companies, but corporate-governance policies, including compensation practices and the caliber and composition of the board of directors, might be more important for financial firms. Having an innovative, employee-friendly workplace, a third barometer, is crucial for attracting talent and fostering productivity in the tech industry, but it is increasingly important more broadly, says Allen. Finally, Parnassus also seeks to measure companies on engagement within their communities and on how they treat their customers.

For some companies, “it’s obvious that the extent to which the company is considered an ethical corporate citizen matters to the brand,” says Allen. VF Corp. (VFC, $55), a clothing manufacturer whose brands include The North Face and Timberland, is a good example. Parnassus owned close to 3% of VF’s outstanding shares at the end of 2016. (Unless otherwise indicated, share prices and returns are as of April 30.)

For other companies, the socially responsible equation is more nuanced. Although Parnassus trimmed its stake in Wells Fargo (WFC, $54) early this year, the firm at last report held shares of the banking giant in three funds, including a 4% position in Core Equity. The bank continues to deal with the scandal resulting from news last September that millions of accounts were opened without customers’ knowledge or permission. “Believe me, we heard a lot about it from our shareholders, some of whom were not happy that we continue to own Wells Fargo,” says Allen. “But from our point of view, the board has acted responsibly and held the management team accountable.” He notes that Wells’s board replaced the CEO, who resigned; ousted several other top managers; and reduced, withheld and, in some instances, “clawed back” bonuses and other compensation.

Shortly after Tim Sloan took over as the bank’s CEO last October, Parnassus managers walked over to Wells’s nearby headquarters to meet with him and advocate for the values of their firm and its shareholders. “That’s how we do it,” says Allen, who says he coaches his daughter’s softball team (and basketball and soccer teams) with a similar philosophy. Throw the bat once and you get a warning; do it twice and you’re out of the game. Says Allen: “Mistakes are okay, so long as you don’t make the same one over and over again. Wells Fargo has absolutely learned from its mistake.” The question is whether investors will be so forgiving. Since news of the scandal broke, Wells shares have risen 8%, compared with 25% for SPDR S&P Bank ETF (KBE, $43), which tracks an index of bank stocks.

In the end, though, Parnassus’s secret sauce has as much to do with evaluating stocks in terms of standard financial, business and share-price criteria as it does with social considerations. Analysts and managers start by looking for companies with a competitive advantage, or “moat”—the wider, the better. Next comes relevancy: Are the company’s products or services becoming more relevant to customers’ daily lives? The third pillar is management, including how executives allocate the company’s capital. Says Allen: “We own companies that don’t pay dividends and companies that pay very high dividends. We have companies that engage in a lot of mergers and acquisitions and some that don’t. We evaluate where we think companies have the best opportunities, then make sure that matches up with what management is doing.”

The key to the process is estimating the value of a company using standard measures, such as share price in relation to earnings, sales and other yardsticks. A stock is a buy only if it is trading for at least one-third less than Parnassus’s estimate of the company’s true value. That gives the funds more of a value bent than other growth-oriented funds. “Being able to buy when the stock is out of favor is probably more important to our performance than ESG,” says Dodson. When Parnassus pulls the buy trigger, it usually does so with a high degree of conviction. Its stock funds own relatively few firms—Mid-Cap has the most, with 41—and holding periods typically last several years.

Minimizing pain. A disciplined, value-oriented approach has served the funds well in down markets. In 2008, for example, when the S&P 500 plunged 37%, Core Equity lost just 23%; Endeavor lost 30%, and Parnassus Fund, 34%. Mid-Cap fell 29%, far less than the 41% drop in the Russell Midcap index.

Eight years into a bull market, however, the managers say bargains are hard to find. “Endeavor Fund has only 30 stocks,” says Dodson. “I’d much rather have 40 or 45.” Mid-Cap comanager Matt Gershuny agrees. “There aren’t a helluva lot of places for us to park money safely in this environment.”

Still, even these discriminating managers see pockets of opportunity. Some health care stocks are attractive, including Gilead Sciences (GILD, $69), a battered biotech that is a top holding in four of the five stock funds. The stock has fallen more than 45% over the past two years because a shrinking pool of new hepatitis C patients is hurting sales of Gilead’s blockbuster drugs. Investors have overreacted, says Allen, given the outlook for the company’s hep C and HIV franchises. “We think Gilead is a contrarian idea that will pay off,” he says. Within Mid-Cap’s outsize stake in industrial firms, Fortive Corp. (FTV, $63) has a technology twist, says comanager Lori Keith. Spun off from Danaher Corp. in 2016, Fortive provides monitoring, testing and other equipment crucial to internet-connected industrial processes. Another Mid-Cap favorite: Motorola Solutions (MSI, $86), which provides radio handsets for firefighters and police officers.

Parnassus managers are patient. The firm first bought shares in Whole Foods Market (WFM, $36) in 2014, after the stock had sunk from $65 a share to the mid $30s due to concerns about increased competition in the natural foods segment. After the purchase, the stock mostly languished. But since late March, the shares have surged 29%, helped in part by the disclosure that an activist investor had amassed a nearly 9% stake in Whole Foods and reports that Amazon.com (AMZN, $925) had mulled a bid for the grocer last year.

Dodson is philosophical about the game of waiting for stocks to make good—or not. “There’s always uncertainty in the market, and you have to live with that,” he says. He is less on the fence about prospects for the company he founded 32 years ago: “I never dreamed we’d be at $23 billion in assets; I never dreamed we’d be at $1 billion. But if we keep putting up good returns and ESG investing keeps being accepted by the public, then I would imagine that we’d continue to grow. I certainly hope so.”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.