7 Great Socially Responsible Mutual Funds

You don’t have to sacrifice returns to do good with your investments.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Combining the desire to make money with the impulse to do good is a concept that is catching on. Although such socially responsible investing has been around for decades, the amount of money invested according to ethical and social principles has grown substantially in recent years.

Assets invested using SRI strategies totaled nearly $7 trillion in 2014, a 76% jump in just two years, according to the Forum for Sustainable and Responsible Investment. One out of every six dollars managed professionally in the U.S. today is invested using an SRI strategy. Much of that money comes from institutions, primarily pension funds, foundations and college endowments. But mutual funds that invest in a range of SRI strategies are flourishing; 45 new funds opened over the past five years. All told, 181 U.S. mutual funds and 39 exchange-traded funds practice SRI in one form or another. Assets in Vanguard FTSE Social Index, the biggest SRI index fund, have quadrupled since 2011. “We have seen much more interest in the past five years than in the previous 10,” says Christine Franquin, who ran the fund until December.

And expect more to come. One-third of millennials—the generation of Americans born between the early 1980s and the early 2000s—consider socially responsible factors when they invest, according to a 2013 survey by U.S. Trust, Bank of America Private Wealth Management. “Socially responsible investing is going to continue to grow and be in demand as the next generation of investors takes over,” says Stephen Liberatore, comanager of TIAA-CREF Social Choice Bond. Over the next few years, more employer-sponsored retirement plans may offer SRI funds.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The first SRI fund opened in 1952, way before terms such as green and sustainability were used the way they are today. More came along in the 1970s and ’80s. Back then, strategies centered on what couldn’t be in the fund: typically, firms with significant revenues from alcohol, gambling or tobacco, and later weapons and utilities that relied on nuclear power. Faith-based funds—-Christian and Islamic—-also sprouted, tacking on other kinds of businesses to avoid.

But SRI has evolved from a philosophy that focuses on exclusion to one that seeks to reward companies for good citizenship, as defined by practitioners of what’s known as ESG. The acronym stands for environmental, social and governance. Among other things, companies with high ESG scores are mindful of their environmental impact; treat employees, customers and suppliers well; and have policies that align the interests of management and shareholders. According to ESG advocates, companies that stand out in these areas will be more successful over the long haul than companies that don’t. Such businesses tend to cluster in certain sectors, so funds that incorporate ESG criteria in their securities selection process tend to have above-average exposure to health and technology and below-average holdings in the industrial, materials and utility sectors.

The knock on all social investing strategies has been that if you invest in line with your ethics, faith or culture, you sacrifice some return. Morningstar analyst David Kathman says maybe not. “There is no evidence that shows ESG or socially responsible investing helps or hurts performance,” he says. “Over the long term, it probably evens out.”

We took a look at one popular area of the mutual fund marketplace: funds that focus on large-capitalization stocks. Over the past 10 years through mid December, the average diversified, actively managed large-cap SRI fund returned 6.2% annualized. Compare that with an average of 6.5% annualized for the average actively managed non-SRI fund, excluding index funds. The non-SRI funds get the nod, but not by much. Neither group, it’s worth noting, beat the 6.9% annualized 10-year return for Standard & Poor’s 500-stock index.

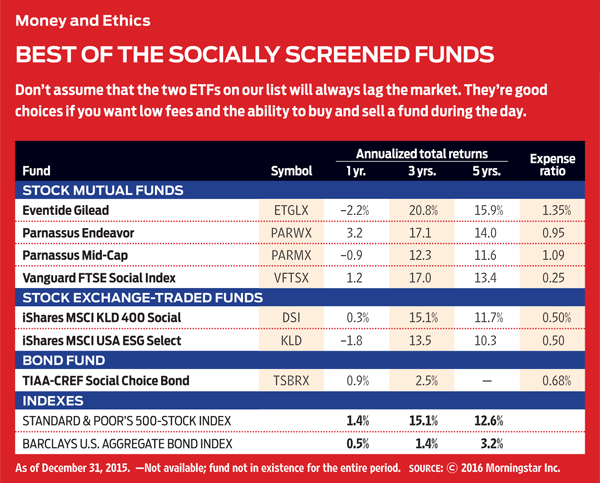

Still, for those who want to invest with a conscience, we found seven solid ethics-based funds. Three are actively managed, one is an index mutual fund, two are ETFs, and the last is a faith-based fund. Returns are as of December 31.

[page break]

Actively managed funds

Parnassus Endeavor and Parnassus Mid-Cap

When Parnassus was founded in 1984, socially responsible investing was in its adolescence. But founder Jerome Dodson believed that stocks of companies that fit the SRI bill—those that weren’t involved in alcohol, gambling, tobacco or the like and were mindful of the environment and their employees—would beat the market.

Today, Parnassus managers combine modern-day ESG assessments, which are used to create an approved list of firms from which to cull prospective investments, with thorough company analysis to build their portfolios. Each of the firm’s five stock funds is relatively compact, with 30 to 40 holdings, below-average turnover and a below-average expense ratio. But the final proof is in the performance. Endeavor (PARWX) and Mid-Cap (PARMX) sport 10-year records that rank among the top 5% of their respective peer groups.

Endeavor, a large-company growth fund, is what Parnassus sees as its “super” ESG offering. In addition to excluding the usual suspects, Dodson, who runs the fund, also eliminates firms involved with fossil fuels. Plus, Endeavor gives extra credit to companies with excellent working environments, believing that contented employees contribute to corporate success. The fund has been more volatile than the broad market over the past five years, thanks primarily to an average allocation to tech stocks of 52% over the period (tech currently accounts for 21% of the S&P 500). The reward: Endeavor has returned an average of 14.0% per year over the past five years, compared with 12.6% annualized for the S&P 500.

At Parnassus Mid-Cap, a member of the Kiplinger 25, lead manager Matthew Gershuny and comanager Lori Keith search for companies with good growth prospects. They like companies that they believe behave ethically, but their screens aren’t as strict as Dodson’s at Endeavor. Fossil-fuel businesses, for instance, are acceptable. Mid-Cap’s 8.8% annualized 10-year return beats the Russell Mid Cap index by an average of 0.8 percentage point per year.

TIAA-CREF Social Choice Bond Fund

Can a bond fund perform well and help the world? As far as performance goes, the answer is yes: Since the fund (TSBRX) launched in 2012, it has returned 2.7% annualized, beating Barclays U.S. Aggregate Bond index by an average of 1.2 percentage points per year. Like the index, the fund focuses on medium-maturity bonds.

Comanagers Liberatore and Joseph Higgins divide the fund into two parts. They have about 70% of the fund’s assets (currently $589 million) in bonds issued by U.S. firms that win the best ESG ratings from financial data provider MSCI. MSCI’s complex methodology includes dozens of factors and results in ratings that range from triple-A (the best) to triple-C (the worst) for ESG factors. Berkshire Hathaway and Intel, for instance, have passed muster.

The managers reserve the remaining 30% of assets for so-called impact investing. Liberatore and Higgins buy bonds for a project or a company (for-profit or nonprofit) that is generating what they see as a measurable and positive impact. Take Topaz Solar Farm in California. The managers invested in debt issued by the farm, which is owned by a Berkshire Hathaway subsidiary. It powers 160,000 homes, which has the same effect in reducing carbon dioxide as taking 73,000 cars off the road, says Liberatore. “We want to directly tie our investors’ principles with the investment holdings,” he says. The fund charges a below-average expense ratio of 0.68% and currently yields 2.5%.

[page break]

Index funds

Vanguard FTSE Social Index

This fund tracks an index that puts companies through the ubiquitous alcohol, tobacco and pornography screens. It also eliminates companies involved in nuclear power and firms that derive a significant amount of revenues from sales to the military. But companies must pass a few other hurdles as well. For starters, they must show diversity in the workplace (at least one woman must be on the board of directors, and the company must have an equal-opportunity policy in place). And any whiff of human rights violations or negative environmental impact is cause for rejection. The result is a portfolio that currently consists of 405 mostly large-capitalization stocks. The top three holdings are Apple, Alphabet and Microsoft. (The three biggest holdings in the S&P 500 are Apple, Microsoft and ExxonMobil.)

FTSE Social Index (VFTSX) has lagged the broad market since its 2000 inception. But it has done better in recent years, thanks to a hefty stake in health care and technology stocks. Over the past five years, the fund’s 13.4% annualized return has beaten the S&P 500’s results by an average of 0.8 percentage point per year. The fund charges 0.25% per year to cover expenses.

Pickings are slim among exchange-traded funds. Plenty of ETFs home in on specific ESG factors—clean water or workplace equality, for example. But only two are diversified: iShares MSCI USA ESG Select ETF (KLD) and iShares MSCI KLD 400 Social ETF (DSI). ESG Select holds 105 companies that win the highest scores in the MSCI ESG ratings. MSCI KLD 400 tracks one of the oldest socially responsible benchmarks, the MSCI KLD 400 Social Index (formerly known as the Domini 400 Social Index), which launched in 1990. The index includes about 400 companies, all of which carry an MSCI ESG rating of double-B or better. Over the past five years, both funds have lagged the S&P 500’s 12.6% annualized return. But we’re recommending them because they offer an opportunity for people to invest with their conscience at a low annual cost. Both charge annual fees of 0.50%.

Faith-based fund

Eventide Gilead

This Christian-based fund has a lot of flexibility. It can invest in any size company in the U.S. or abroad, but it sticks with businesses that “value life at every stage,” says Colin Delaney, an Eventide analyst who refers to the fund’s approach as “biblically responsible investing.” That boils down to avoiding the usual suspects of alcohol, tobacco and pornography, as well as businesses that make money from abortion. But instead of starting with a universe of acceptable companies to invest in, Gilead comanager Finny Kuruvilla, a medical doctor with a PhD in chemistry and chemical biology, does the reverse. He identifies the best prospects, what Delaney calls “the leaders, the disrupters, the innovators,” in industries with superior long-term growth prospects and then determines whether they run afoul of the fund’s faith-based objectives. Kuruvilla also looks for “businesses that are trying to create value,” says Delaney, by focusing on positive ESG characteristics, such as customer satisfaction.

Since Gilead’s (ETGLX) launch in 2008, the fund has returned 14.9% annualized, which beats the S&P 500 by an average of 6.0 percentage points per year. Gilead has been 20% more volatile than the S&P 500, due in part to high weightings in tech stocks (26% of the fund’s assets) and health care firms (17%, mostly biotechnology stocks).

The language of social investing

What’s in a name? A lot, as it turns out, when it comes to ethical investing. Here’s a glossary to help you keep the lingo straight.

Socially responsible investing. Traditional SRI funds excluded companies that made money from alcohol, tobacco or gambling. Over time, some funds adopted more no-no’s, barring firms involved with military weapons, nuclear power and, lately, fossil fuels, among other things.

Environmental, social and governance, or ESG, investing. In recent years, many socially conscious investors came to believe that companies that practice good citizenship would outperform those that didn’t. Firms with high ESG scores are good stewards of the environment; treat employees, customers and suppliers fairly; and have policies that align the interests of executives with those of shareholders.

Impact investing. These investors want to see not only good returns but also measurable social benefits. For example, TIAA-CREF Social Choice Bond holds a bond that helped a group provide vaccinations to 44 million children. Those vaccinations will help prevent as many as 6 million deaths, says comanager Stephen Liberatore.

Religious underpinnings. Some funds follow the tenets of a religion. Eventide and Timothy Plan funds follow Christian precepts but are not tied to any one denomination. You can also find funds for Catholics (Ave Maria and Epiphany FFV, for instance), Mennonites (Praxis) and Presbyterians (New Covenant). Islamic funds, such as Amana Funds, cannot invest in firms that are involved in alcohol or pork products. And because Islam bars charging or receiving interest, these funds may not own financial stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Best Mutual Funds to Invest In for 2026

Best Mutual Funds to Invest In for 2026The best mutual funds will capitalize on new trends expected to emerge in the new year, all while offering low costs and solid management.

-

Smart Ways to Invest Your Money This Year

Smart Ways to Invest Your Money This YearFollowing a red-hot run for the equities market, folks are looking for smart ways to invest this year. Stocks, bonds and CDs all have something to offer in 2024.

-

Vanguard's New International Fund Targets Dividend Growth

Vanguard's New International Fund Targets Dividend GrowthInvestors may be skittish about buying international stocks, but this new Vanguard fund that targets stable dividend growers could ease their minds.

-

Best 401(k) Investments: Where to Invest

Best 401(k) Investments: Where to InvestKnowing where to find the best 401(k) investments to put your money can be difficult. Here, we rank 10 of the largest retirement funds.

-

7 Best Stocks to Gift Your Grandchildren

7 Best Stocks to Gift Your GrandchildrenThe best stocks to give your grandchildren have certain qualities in common. Here, we let you know what those are.

-

How to Find the Best 401(k) Investments

How to Find the Best 401(k) InvestmentsMany folks are likely wondering how to find the best 401(k) investments after signing up for their company's retirement plan. Here's where to get started.

-

How to Master Index Investing

How to Master Index InvestingIndex investing allows market participants the ability to build their ideal portfolios using baskets of stocks and bonds. Here's how it works.

-

The Best Vanguard ETFs to Buy

The Best Vanguard ETFs to BuyThe best Vanguard ETFs all feature rock-bottom fees, large asset bases and long trading histories. Here are a few of our favorites.