IRS in Turmoil: GOP Budget Cuts and Staff Shake-Ups Threaten Taxpayer Services

Republican lawmakers advance a controversial budget bill that would gut IRS funding further, risking your 2026 tax filing season.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A spending bill is moving forward among Republicans in the U.S. House of Representatives that could significantly cut IRS funding, jeopardizing your taxpayer experience during the 2026 filing season.

The proposed measure, which is now moving to a House vote, would reduce the IRS budget by billions of dollars. In particular, key funding for Taxpayer Services, which is responsible for processing tax returns, answering taxpayer questions, and delivering tax refunds and correspondence, is at risk of being gutted further.

The IRS enforcement budget would also be dealt another blow by the GOP fiscal funding proposal. The result could mean fewer staff and automation tools would be available to enforce taxpayer compliance, audits, and the prevention of taxpayer fraud next year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“No phones are going to be answered, no people are going to be at the offices to help people as they come in, and of course, Direct File has been eliminated as well,” said Rep. Steny H. Hoyer (D-Md.). “Under this administration, you’re certainly on your own if you’re a federal worker.”

Let’s dive into the GOP’s budget proposal for the IRS and what it means for you.

2026 GOP Budget Proposal for the IRS: Key Points

House Republicans seek to reduce IRS funding to $9.5 billion next year, representing a 23% decrease from its current spending.

Opponents of the funding cut argue that the proposed measure could seriously impact taxpayer services during the upcoming tax season and reduce revenue for the agency.

- House lawmakers also rejected the Treasury Department’s request for $852 million for Taxpayer Services.

- That funding was intended for the IRS to hire call center representatives to maintain its current level of phone service and implement automation tools for taxpayers.

The request sought to reverse some of the Trump administration’s major staffing cuts, which have already caused strain to taxpayers seeking customer service this year.

Here’s what proposed $2.8 billion in IRS funding cuts could mean for taxpayers next year.

Risk of fewer audits and taxpayer compliance

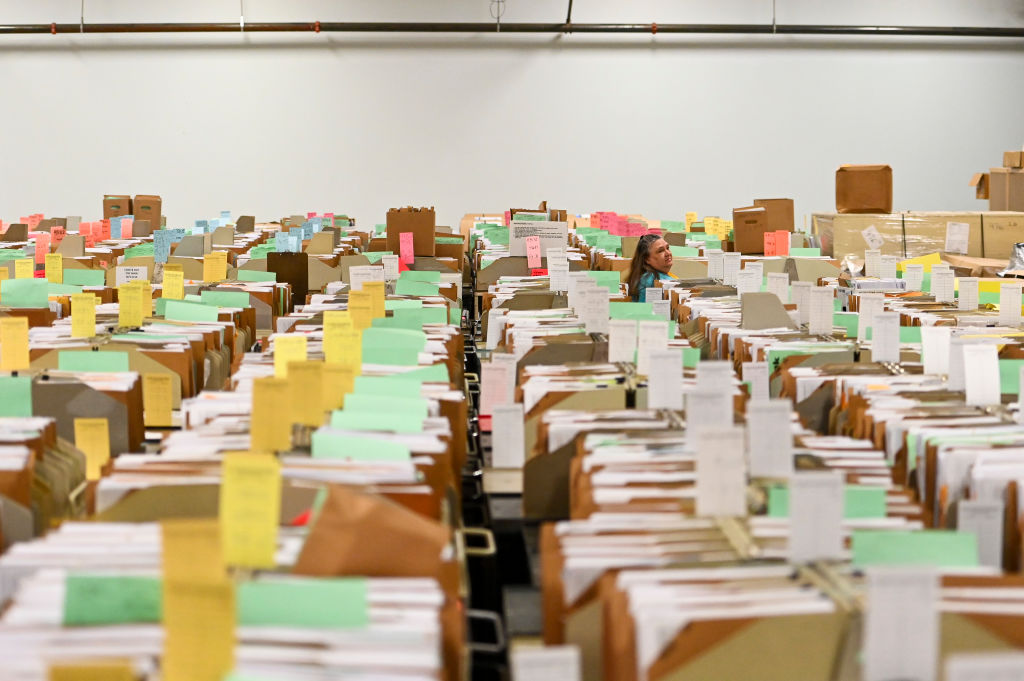

An IRS employee walks through tax documents in the staging warehouse at an Internal Revenue Service facility in Ogden, Utah. Opponents of funding cuts to the IRS argue that staffing shortages may lead to processing delays and fewer audits. (Photo by Alex Goodlett for The Washington Post via Getty Images)

The IRS suggests that every $1 invested in enforcement yields $7 in revenue, but House Republicans' proposed funding cuts could erode some of that funding stream.

- House Republicans' proposed 2026 fiscal budget includes a more than $2.4 billion, or 45% cut below the current IRS enforcement budget.

- This funding is allocated for IRS departments responsible for conducting financial crime investigations, including tax fraud, audits, and enforcing taxpayer compliance.

“When enforcement funding is cut, taxpayers potentially lose an important service provided by the IRS: the chance to gain clarity and, in some cases, certainty about what the tax code means for them before they file a tax return riddled with unintentional errors,” wrote Janet Holtzblatt, senior fellow at the Urban-Brookings Tax Policy Center.

Part of the services in the enforcement budget include guidance to taxpayers, like rulings and regulations. Businesses and high-income individuals often use these services, added Holtzblatt, and they aren’t cheap.

For example, a private letter ruling (the response when a taxpayer formally asks the IRS to explain a complicated tax provision that applies to their particular situation), can cost at a minimum $3,450.

The GOP’s proposed smaller enforcement budget could lead to a decrease in taxpayer services and an increase in undetected tax fraud and audit errors, warned Democratic opponents of the bill. As Kiplinger reported, for taxpayers, that means less access to customer service and a higher risk of accruing penalties.

Overall, the IRS warns that a budget cut of that magnitude will result in the agency losing billions in long-term revenue over the next couple of years.

Republicans reject funding for IRS hiring

After laying off thousands of employees from the IRS, the Trump administration sought to reverse some of the damage by asking for nearly $853 million (31% funding increase) to boost hiring at Taxpayer Services. The request was rejected by House Republicans.

The Taxpayer Services division is responsible for processing tax returns, answering telephone calls, processing taxpayer correspondence, and staffing Taxpayer Assistance Centers.

An IRS budget document warned that without the $853 million investment, the level of service provided to telephone callers would “plummet” to 16% next year, down from 87% in 2025.

“At this level of service, most taxpayers would be unable to reach the IRS by phone or receive answers to questions related to tax compliance,” the IRS noted. “Taxpayers that do get through would face long wait times.”

Former Internal Revenue Service workers leave their office after being laid off in downtown Denver, Colorado on Thursday, February 20, 2025.

The lack of staff could also impact other critical taxpayer service channels, including paper correspondence and in-person assistance.

“As the name implies, [Taxpayer Services] is responsible for the heaviest lift of serving taxpayers,” Erin Collins, National Taxpayer Advocate, wrote in a report to Congress, before recommending the Trump administration lift the hiring freeze and provide the division with direct hire authority to hire essential filing-season employees for 2026.

“It is critical the IRS hire them by the end of summer so it can onboard them, provide them with adequate training, and ensure they are prepared to assist taxpayers when the 2026 filing season begins in January,” the IRS government watchdog added.

The summer is over, and the IRS is reportedly planning on allowing some employees who accepted incentives to leave the agency to return to their jobs. However, the 2026 IRS budget's outcome could impact the agency's ability to fill staffing shortages before the next filing season.

Will GOP lawmakers cut IRS funding?

According to TaxNotes (paywall), it is “highly unlikely” that the 2026 Financial Services and General Government (FSGG) bill will be enacted by September 30, the end of the fiscal year.

This is primarily because the Senate has passed its version of the bill on time only once in the last two decades. Furthermore, the current White House request for a 20% reduction in the IRS's annual budget is unprecedented, as no previous administration has sought more than a 2% cut in the past century.

As noted, the GOP proposed budget calls to cut IRS funding by $2.8 billion next year, or 23% below the current 2025 fiscal year budget.

The impact on taxpayers nationwide would be devastating, warned the National Treasury Employees Union (NTEU).

“These drastic cuts, if enacted, would turn back the clock and undo all of the progress the agency has made in recent years, resulting in backlogs, slower refunds, more uncollected taxes, and fewer tax cheats caught,” NTEU National President Doreen Greenwald said in a statement.

“This bill is not going to see the light of day in the United States Senate,” said Rep. Hoyer.

Related

- IRS Layoffs Spark Delays, Doubt This Tax Season

- Trump IRS Commissioner Billy Long Out: What’s Next for the Tax Agency?

- No New IRS Agents? What Trump’s Federal Hiring Freeze, Firings Mean for Your Taxes

- No More IRS Paper Checks: What to Know After the September 30 Deadline

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Gabriella Cruz-Martínez is a finance journalist with 8 years of experience covering consumer debt, economic policy, and tax.

Gabriella’s work has also appeared in Yahoo Finance, Money Magazine, The Hyde Park Herald, and the Journal Gazette & Times-Courier.

As a reporter and journalist, she enjoys writing stories that empower people from diverse backgrounds about their finances, no matter their stage in life.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

How to Open Your Kid's $1,000 Trump Account

How to Open Your Kid's $1,000 Trump AccountTax Breaks Filing income taxes in 2026? You won't want to miss Form 4547 to claim a $1,000 Trump Account for your child.

-

In Arkansas and Illinois, Groceries Just Got Cheaper, But Not By Much

In Arkansas and Illinois, Groceries Just Got Cheaper, But Not By MuchFood Prices Arkansas and Illinois are the most recent states to repeal sales tax on groceries. Will it really help shoppers with their food bills?

-

7 Bad Tax Habits to Kick Right Now

7 Bad Tax Habits to Kick Right NowTax Tips Ditch these seven common habits to sidestep IRS red flags for a smoother, faster 2026 income tax filing.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

New Gambling Tax Rule Impacts Super Bowl 2026 Bets

New Gambling Tax Rule Impacts Super Bowl 2026 BetsTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax Season

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax SeasonTax Law A new Trump lawsuit and warnings from a tax-industry watchdog point to an IRS under strain, just as millions of taxpayers begin filing their 2025 returns.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.