Government Watchdog Warns More IRS Layoffs to Come

Over 11,400 IRS employees took the Trump-instructed buyout or were terminated. What does it mean for your taxes going forward?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The 2025 tax season has wrapped up, and the IRS is set to experience another gutting of its workforce this week — or is it?

As many as 5,000 IRS employees reportedly accepted the Trump administration’s “fork-in-the-road” deferred resignation offer, initially provided earlier this year. Most of those workers were told to work until May 15, because the agency characterized their work as “essential” to the 2025 tax season.

Now, some Treasury Department and IRS employees are reportedly being told they must work through June 30, and can go on administrative leave starting July 1. This could include call representatives and employees who are still processing tax returns.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The timeline for the layoffs, orchestrated by the Trump administration’s efforts to downsize the federal government, caused problems for taxpayers across the country. Multiple tax preparers told Kiplinger that their communication with revenue officers was becoming a black hole.

“We suspect that this means that those revenue officers are no longer with the IRS, and we have to wait for a new one — from the already reduced pool of revenue officers to be assigned,” said Logan Allec, CPA and founder of Choice Tax Relief.

Here’s a snapshot of what the IRS layoffs looked like this tax season, and what it could mean for you going forward.

Nearly 5,000 IRS employees resigned

The disruptions at the IRS began nearly as soon as President Donald Trump began his second term in January, when federal employees were surprised with a controversial “fork-in-the-road” deferred resignation offer.

The offer would grant federal employees full pay and benefits through September 30 in exchange for their resignation. As reported by Kiplinger, IRS employees deemed critical to the tax season could accept the offer but were told to work through May 15, one month after the April 15 tax deadline.

An analysis by the Treasury Inspector General for Tax Administration (TIGTA) revealed that:

- A total of 4,128 employees accepted and were approved for the deferred resignation program (DRP).

- As of March, an additional 552 applications were eligible and pending approval.

- Nearly half (47%) of approved applicants were older than 55.

Overall, more than half of the employees who accepted the DRP were placed on administrative leave.

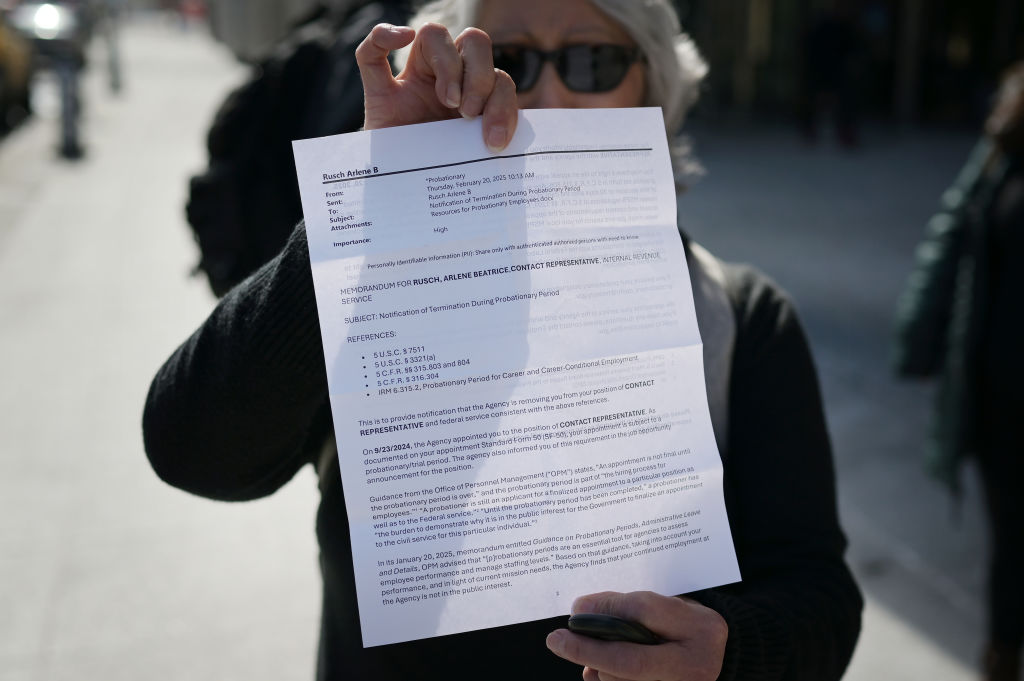

IRS layoffs 2025: Probationary employees targeted

Former Internal Revenue Service workers leave their office after being laid off in downtown Denver, Colorado on Thursday, February 20, 2025.

As more experienced IRS employees accepted Trump’s deferred resignation offer, newer federal workers were placed on the chopping block.

The Office of Personnel Management (OPM) sent a memorandum asking federal agencies to identify probationary employees in January. These workers were defined as those who had served “less than one year in a competitive service appointment, or less than two years in an excepted service appointment.”

Specifically, the memo said that probationary employees could be terminated “without triggering Merit Systems Protection Board appeal rights.”

In response to executive orders, the IRS Human Capital Office created an initial list of probationary employees to be let go. Employees deemed essential to the tax filing season from the Taxpayer Services, Taxpayer Advocate, and Information Technology departments were exempt from this list.

As many as 7,315 probationary employees received termination notices on February 20, according to the analysis. These workers were temporarily reinstated in March as part of ongoing court challenges, only to be fired again. The legal battle continues.

According to TIGTA, most of the 7,315 probationary employees who received termination notices had less than one year of experience with the IRS.

- 6,669 employees had been at the IRS for 1 year or less.

- 615 employees had between 1 and 5 years of service at the agency.

- 31 employees had worked at the IRS for more than 5 years.

Notably, probationary employees who received termination notices were under the age of 40. A total of 549 of those let go were under 25 years old, while 3,466 were between 25 to 39 years old.

Thousands forced to leave the IRS

Arlen Rusch, a former Internal Revenue Service worker, shows the termination notice and leaves her office after being laid off in downtown Denver, Colorado on Thursday, February 20, 2025.

As of February, the IRS had a headcount of 103,000 federal employees. The Trump-orchestrated reductions to the workforce shrank this figure by 11%, according to TIGTA.

Overall, 11,433 of the tax agency's employees were terminated because of their probationary status or were approved to accept the deferred resignation.

A deeper dive into job titles showed which employees were most affected by IRS layoffs, for instance:

- As many as 3,623 (or 31%) of revenue agents either received termination notices or accepted the DRP.

- Some 2,599 IRS contact representatives, who help taxpayers with tax-related issues, also left the agency.

- A total of 1,614 (or 10%) of tax examiners separated from the IRS.

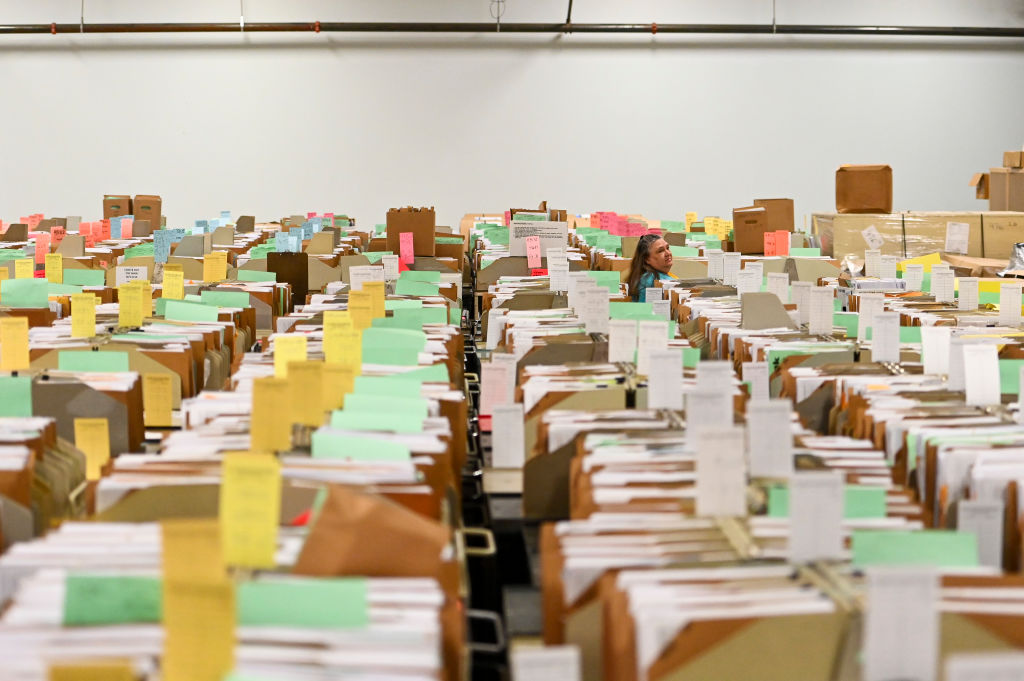

More layoffs are on the horizon

An IRS employee walks through tax documents in the staging warehouse at a Internal Revenue Service facility in Ogden, Utah.

The IRS is offering three voluntary separation programs, including the Treasury Deferred Resignation Program (TDRP), which “will mirror the benefits of the first DRP offering.”

The agency extended the Trump-instructed TDRP to all employees in April. According to the IRS, over 23,000 employees applied for the program, and 13,124 were approved as of April 22, 2025.

TIGTA also noted that the IRS announced in April that it had begun implementing a reduction-in-force (RIF) that would result in “staffing cuts across multiple offices and job categories.” These reductions would target the Office of Civil Rights and Compliance, which was formerly known as the Office of Equity, Diversity & Inclusion.

An internal IRS memo said that 5% of this office had left through the deferred resignation program and attrition, and that an additional 75% of the office would be “reduced through a RIF.” That same month, the IRS announced that it had initiated a RIF for the Taxpayer Experience Office and the Office of Equity, Diversity & Inclusion in Taxpayer Services.

TIGTA noted that it would periodically update its report on IRS reductions to the workforce and operational areas that are impacted by the cuts.

What’s next for the IRS

Before the disruptions in the IRS workforce began, the agency had over 100,000 employees — a staffing milestone not seen in 30 years.

Nearly half of the IRS workforce belongs to Taxpayer Services, which is tasked with processing tax returns and handling the high volume of calls during tax season, among other duties.

The IRS is known for having an “all hands on deck” approach to tax season, often siphoning employees from departments to Taxpayer Services to meet tax filing deadlines. The recent wave of layoffs sparked concerns over the future of the agency and whether taxpayers will be given a fair experience.

Trump has suggested abolishing the IRS and replacing the agency with a tariff-led revenue system administered by a so-called External Revenue Service. To date, the Senate has yet to confirm President Trump’s choice for commissioner, and it remains unclear when the hearing will be scheduled. Additionally, the IRS has lost several members of its leadership.

Stay tuned for more updates on how the IRS layoffs can impact you next tax season.

Related Content

- IRS Layoffs Spark Delays, Doubt This Tax Season

- Trump Wants You Out of the IRS, But You’ll Have to Wait Until May

- House GOP Bill Aims to Abolish the IRS and Rewrite the Tax Code

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Gabriella Cruz-Martínez is a finance journalist with 8 years of experience covering consumer debt, economic policy, and tax.

Gabriella’s work has also appeared in Yahoo Finance, Money Magazine, The Hyde Park Herald, and the Journal Gazette & Times-Courier.

As a reporter and journalist, she enjoys writing stories that empower people from diverse backgrounds about their finances, no matter their stage in life.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

How to Open Your Kid's $1,000 Trump Account

How to Open Your Kid's $1,000 Trump AccountTax Breaks Filing income taxes in 2026? You won't want to miss Form 4547 to claim a $1,000 Trump Account for your child.

-

7 Bad Tax Habits to Kick Right Now

7 Bad Tax Habits to Kick Right NowTax Tips Ditch these seven common habits to sidestep IRS red flags for a smoother, faster 2026 income tax filing.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax Season

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax SeasonTax Law A new Trump lawsuit and warnings from a tax-industry watchdog point to an IRS under strain, just as millions of taxpayers begin filing their 2025 returns.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.

-

A Free Tax Filing Option Has Disappeared for 2026: Here's What That Means for You

A Free Tax Filing Option Has Disappeared for 2026: Here's What That Means for YouTax Filing Tax season officially opens on January 26. But you'll have one less way to submit your tax return for free. Here's what you need to know.