Hallmark Price Increase Due to Tariffs: What You Need to Know

Even some companies with U.S.-based manufacturing are impacted by the Trump administration’s trade dispute.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Tariffs are causing turmoil for your favorite low-cost Chinese-based e-commerce vendors like Temu and Shein. Other affected players include TikTok Shop and Amazon, which feature many Chinese sellers.

But to the surprise of many, even companies like Hallmark, which manufactures many of its products in the U.S., are raising prices due to tariffs.

Hallmark, known for its seasonal greeting cards, gift wrap, and other goods, says it produces 75% of its products in its Kansas-based manufacturing facilities. However, if you plan to get an ornament for your loved one this year, you may be out of luck.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Suppliers in Sri Lanka, Thailand, and China make Hallmark ornaments.

So, will your favorite ornaments and gifts cost more this year? Read on to learn more.

Hallmark prices going up?

“Some categories, like ornaments, are disproportionately impacted by the current economic climate,” Hallmark’s Keepsake Ornament Club wrote in a statement, indicating that they raised prices on May 2, 2025.

“If you have already submitted your Wish List in store, the new pricing will be reflected at pickup and you may adjust your order at that time,” the company added.

Some customers have expressed their frustration on social media platforms like TikTok, while other supporters of President Trump are calling to “boycott Hallmark” due to supposed “price-gauging.”

“Hallmark doesn’t think Kansas is in the United States, apparently,” wrote one user on X. “Boycott them!”

The price hike comes as the Trump administration rolled back the so-called “de minimis” exemption in May, which allowed products sourced from China and Hong Kong under the price point of $800 to enter the U.S. duty-free.

Other countries are subject to a baseline 10% tariff while reciprocal tariffs, which can run as high as 50%, are currently paused until August 1.

As economists warned, companies are now passing along tariffs to consumers like you.

Here's how online vendors are responding to new tariffs, and how it may impact your shopping.

De minimis exemption tariff: What is it?

The Trump administration's elimination of the de minimis exemption on low-value goods means U.S. consumers must pay duties to import items from the Republic of China and Hong Kong, which were previously tax-free.

The measure impacts the price of small items like socks, jewelry, and clothes, just to name some examples.

How much can you expect to pay with this new wave of tariffs? It depends.

- U.S. consumers can expect to pay more for items shipped from China and Hong Kong, as well as any additional shipping costs or taxes.

- Goods shipped via the U.S. Postal Service (USPS) will be subject to a higher tariff or a flat fee of $100 per postal item.

- This surcharge was set to increase to $200 per postal item on June 1, 2025, according to the White House fact sheet.

Companies are already responding to tariff hikes, with some passing the import charges to consumers. Here’s what you can expect.

Hallmark announces price increases in 2025

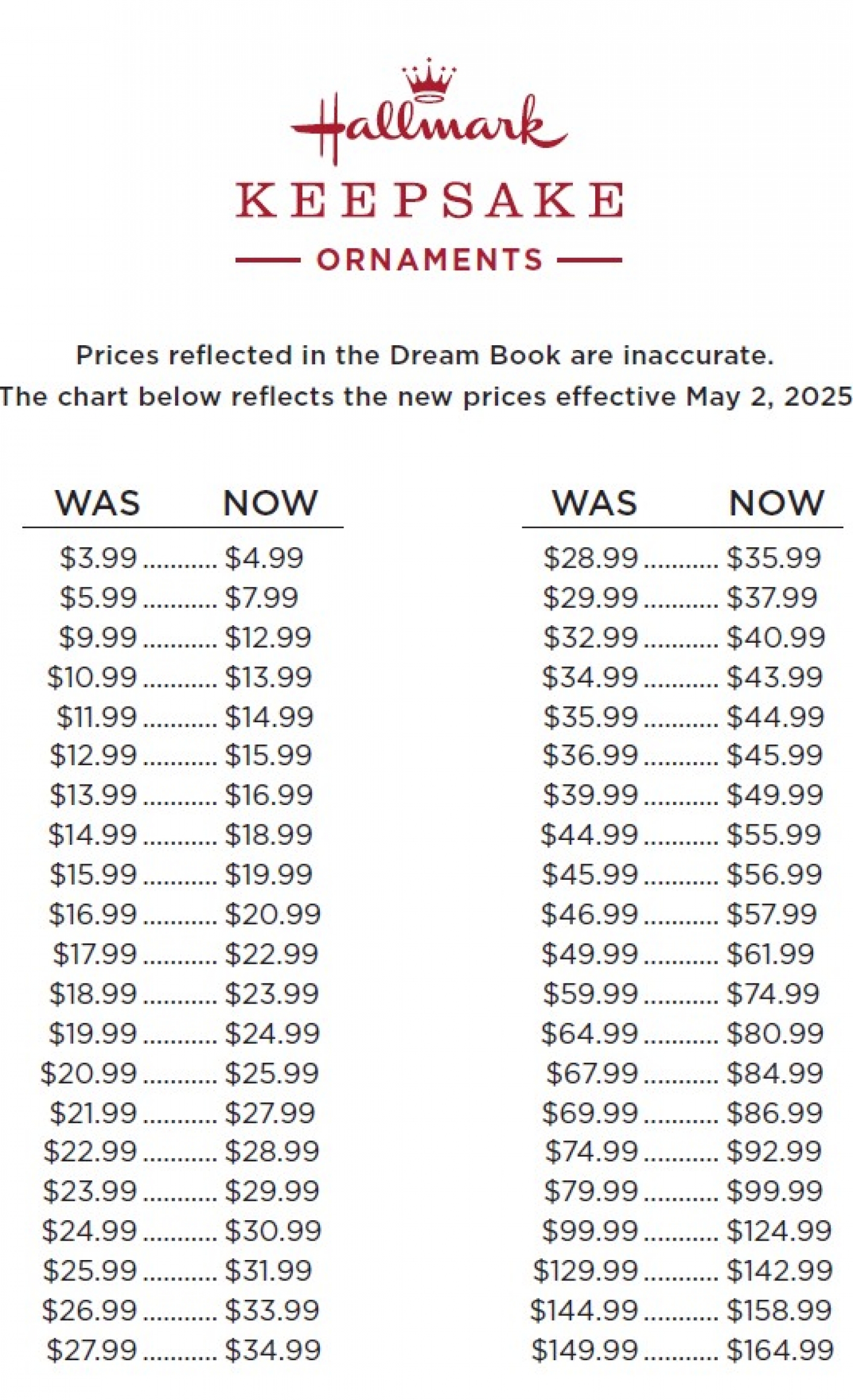

A digital flyer from Hallmark Keepsake Ornaments shows new prices for products sold in the 2025 Dream Book, effective May 2, 2025.

Hallmark, a family favorite for some, with products designed to celebrate major holidays and milestones, is upping its prices in response to Trump’s tariffs.

Hallmark listed its 2025 Dream Book online, with collector items you can add to a Wish List to purchase items.

- For example, consider Disneyland’s 70th Anniversary Musical ornament valued at $61.99. Before tariffs, the ornament would have cost you $49.99. That’s a price hike of roughly 25%.

- A fan of Star Wars? The Mandalorian Grogu ornament will set you back $24.99, instead of $19.99, due to tariffs. The popular Jedi is manufactured in Thailand.

The company mailed out its print 2025 Dream Book before Trump’s tariffs on Chinese goods kicked in. So buyers may be surprised to see price hikes across the board.

- Disney’s Winnie the Pooh Baby’s First Christmas 2025 Ornament was valued at $19.99, and is now $24.99. The product is made in Thailand.

- Grandbaby’s First Christmas Swan 2025 Porcelain Ornament was priced at $24.99, and is now $30.99. The item is manufactured in China.

- Mom’s Love Shines Metal Ornament was listed at $17.99 before tariffs, and is now $22.99. The collector’s item is made in China.

“As we look toward the holiday season, we’ve made the necessary decision to adjust pricing on select imported products from our gift and ornament collections that are impacted by the current economic climate,” Hallmark said in a statement.

While products imported from Thailand and Sri Lanka are currently subject to a 10% baseline tariff. Once Trump’s reciprocal tariffs kick in, those will increase to 36% and 44%, respectively.

Shein price increase for tariffs

As you may have expected, online retail giants like Shein are passing along tariff increases to consumers.

Shein announced that it began adjusting prices on April 25 to reflect the new import charges.

As a consumer, you won’t know exactly how much you are paying in tariff shipping costs. Shein says that tariffs and import fees are included in the price you pay at checkout.

However, customers have noticed a price increase across all categories.

- Earlier this year, home and kitchen goods saw an increase of 30%, while women’s clothing increased by 8%. According to the Daily Beast, some items saw prices skyrocket.

- A bestselling set of 10 kitchen towels saw its price increase by 377%, according to CNET and Bloomberg. The set rose from $1.28 to $6.10.

Temu shipping from local warehouses

Chinese e-commerce platforms like Temu, Shein, and AliExpress will be impacted by tariffs.

You can still order some products online tariff-free, while supplies last.

If you’re shopping from Temu, you’ll see that certain top-rated or best-selling products now have a “local” banner next to the item.

That means the product is in a local warehouse and doesn’t require import charges. In other words, you’ll be able to avoid tariff charges while supplies last.

- This garden camping hammock will cost you $6.75. The listing indicates that there are “no import charges for all local warehouse items and no extra charges upon delivery.”

- A full-sized inflatable pool was recently listed for $50.03 as a Mother’s Day deal. However, there’s a warning that the product is almost sold out at local warehouses.

“All sales in the U.S. are now handled by locally based sellers, with orders fulfilled from within the country,” a Temu spokesperson said in a statement to the press. “Temu has been actively recruiting U.S. sellers to join the platform.”

Some U.S.-based customers may view Temu’s new online shopping model as slim pickings. Temu announced the business halted its shipments of Chinese-made goods to customers in the U.S. following Trump’s latest tariff move.

Amazon won’t disclose import charges

Items sold on Amazon Haul may be subject price adjustments due to tariffs.

Will your online shopping on Amazon’s Haul e-commerce site be pricier? If it is, chances are you won’t be able to know how tariffs are impacting your purchase.

An unnamed source told Punchbowl News that Amazon would consider listing import charges on certain products for customers using Haul, the retail giant’s low-cost Temu and Shein competitor.

The report came out days before Trump rolled back the de minimis exemption.

After the Trump administration condemned Amazon’s supposed idea, citing it as a “hostile and political act,” the retail giant’s spokesperson, Tim Doyle, issued a follow-up statement reported by The Washington Post denying Amazon’s plans to display import charges caused by tariffs.

“The team that runs our ultra-low-cost Amazon Haul store considered the idea of listing import charges on certain products,” said Doyle. “This was never approved and is not going to happen.” Jeff Bezos owns The Washington Post.

You’ll still find some deals on Amazon Haul, but chances are that prices have changed a bit to factor in the new import duties.

Tariffs and your wallet

As reported by Kiplinger, businesses are passing along tariff costs to consumers. These taxes may be incorporated into the price of your purchase or disclosed as a separate import charge on your receipt.

Tariffs may impact the cost of everyday goods like clothes, toys, and furniture. They are also impacting small business owners, who may source some products from countries that were slammed with tariffs. Already, some vendors on popular e-commerce sites like Etsy are crying for help as sales have taken a hit due to new import charges.

Stay tuned to find out how new tariffs can impact your business and shopping experience this year.

Related Content

- How Tariffs Work and What They Mean For You in 2025

- What’s Happening With Trump’s Tariffs? New Rates and Trade Talks

- Ten States With the Lowest Sales Taxes

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Gabriella Cruz-Martínez is a finance journalist with 8 years of experience covering consumer debt, economic policy, and tax.

Gabriella’s work has also appeared in Yahoo Finance, Money Magazine, The Hyde Park Herald, and the Journal Gazette & Times-Courier.

As a reporter and journalist, she enjoys writing stories that empower people from diverse backgrounds about their finances, no matter their stage in life.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Ask the Editor, February 13: More Questions on IRAs

Ask the Editor, February 13: More Questions on IRAsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on IRAs

-

Ask the Editor, February 6: Questions on Federal Income Tax Deductions

Ask the Editor, February 6: Questions on Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax Season

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax SeasonTax Law A new Trump lawsuit and warnings from a tax-industry watchdog point to an IRS under strain, just as millions of taxpayers begin filing their 2025 returns.

-

Ask the Editor, January 30: Questions on Social Security Benefits Taxation

Ask the Editor, January 30: Questions on Social Security Benefits TaxationAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on the taxation of Social Security benefits

-

Ask the Tax Editor, January 23: Questions on Residential Rental Property

Ask the Tax Editor, January 23: Questions on Residential Rental PropertyAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on reporting income and loss from residential rental property.

-

Trump Reshapes Foreign Policy

Trump Reshapes Foreign PolicyThe Kiplinger Letter The President starts the new year by putting allies and adversaries on notice.

-

Congress Set for Busy Winter

Congress Set for Busy WinterThe Kiplinger Letter The Letter editors review the bills Congress will decide on this year. The government funding bill is paramount, but other issues vie for lawmakers’ attention.

-

Ask the Editor, January 16: Tips for Filing Your Form 1040

Ask the Editor, January 16: Tips for Filing Your Form 1040Ask the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on preparing and filing your 2025 Form 1040.