Six Steps to Appeal Your Property Tax Bill

As home values increase nationwide, property taxes are also on the rise.

Gabriella Cruz-Martínez

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As summer rolls in, many homeowners have seen their property values shoot up. If you're envisioning big proceeds when you sell your house, rising home prices are a cause for celebration.

However, you might not feel like popping the Champagne when you get your property tax bill. As home prices climb, property taxes follow. Your tax bill is determined by multiplying your home’s assessed value by the local tax rate.

Homeowners will see higher taxes as localities reassess property values, although the pain should ease as price appreciation slows. Keep in mind that local tax rates affect your bill, too. If your municipality lowers rates to provide relief or stay within required levels, your bill could fall or show only a modest increase.

But if your property taxes have increased significantly, you might have grounds for an appeal, particularly if the increase seems out of line with overall appreciation in your area.

Property taxes are an important responsibility when it comes to owning a home or considering where you want to live if you’re in the market to purchase a property. It’s best to go in knowing your rights as a homeowner.

Here are six steps to get you started if you plan to appeal your property tax bill.

Step 1: Know your deadlines

Schedules vary, but local governments commonly send assessment notices to homeowners in the first few months of the year.

As soon as you get yours — or even before — check the deadline for challenging the value. You might have just a few weeks. Be sure you know how your locality assesses property.

Some set the tax assessment at a percentage of market value, 80%, for example, so don’t feel smug if you get an $80,000 assessment on a home you think is worth at least $100,000. Everyone in your jurisdiction should get the same treatment.

Depending on how frequently your community reassesses home values, you might not see a sizable increase in your tax bill right away.

- Some areas refresh values annually, while others do so every other year or every few years.

- If you're selling your home, individual properties are reassessed when they change ownership.

Step 2: Check if you qualify for property tax breaks

When you get your property tax bill, check it for your tax rate, assessment figures and payment schedule, and make sure that all the reductions you’re entitled to are itemized.

Some states allow anyone who owns and lives in a primary home to shield a portion of its value from taxation. You might be eligible for credits based on your income or status as a senior citizen, veteran or a person with a disability.

In Florida, for example, all homeowners are eligible for a homestead exemption of up to $50,000; those 65 and older who meet certain income limits can claim an additional $50,000.

As reported by Kiplinger, some lawmakers in the Sunshine State have also considered eliminating property taxes altogether.

Other tax breaks come in the form of freezes or deferrals.

Rebates and other property tax breaks aren’t automatic: you usually have to apply for them and show proof of eligibility.

Contact your state’s department of taxation or visit its website to see which breaks are available to you.

Step 3: Set the record straight

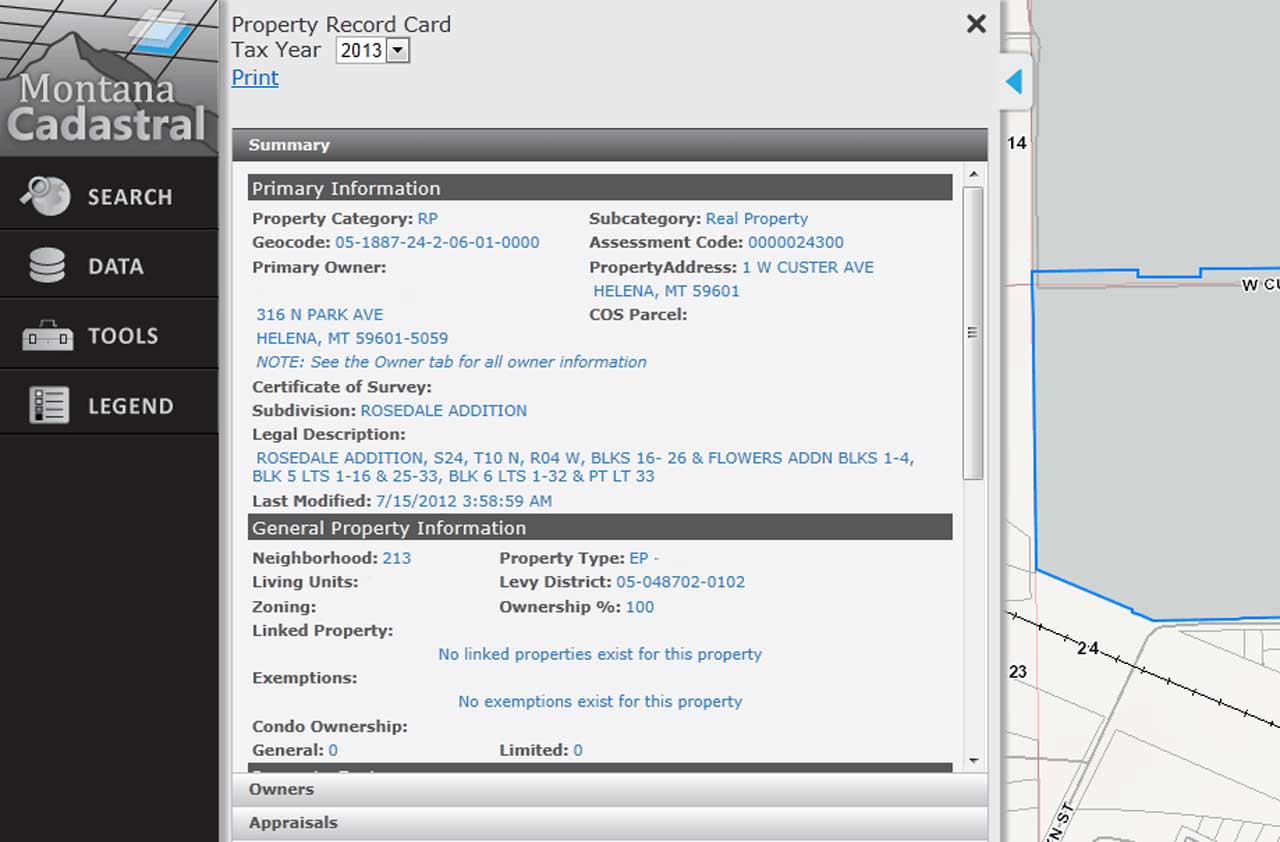

Check your property’s record card. You can often verify it on your locality’s website, although in some jurisdictions, you might have to go to the assessor’s office to view property cards or request the information by e-mail or fax.

This record is the official description of your house, and if you see an outright error — say, four bedrooms and three-and-a-half bathrooms for your two-bedroom bungalow, for example, the assessor might fix the problem on the spot, reduce the assessed value, and your tax bill. That will save you the trouble of a formal appeal.

Step 4: Compare with your neighbors

One way to check if your property taxes are fair is by comparing your property with similar ones in your neighborhood.

Pull up property cards of several homes of similar age and square footage and with the same number of bedrooms and bathrooms to see how their assessments line up with yours.

Keep in mind, if you’ve remodeled your property, that can add to your property taxes, especially if it significantly increases your home’s market value. That can include adding a pool, deck, even a new fence in your yard.

Search in your area for recent sale prices of homes similar to yours on a website such as Zillow or Realtor.com. Any sales in the past few months might have taken place after your assessor’s latest property evaluation.

Step 5: Build your case

If you find that your assessed value is considerably higher than several similar homes, you might have grounds for an appeal.

You can also appeal your case if the sale prices of nearby homes suggest that your property’s value is lower than estimated.

You should also ask yourself if there are problems with your property that can impact its value or make it less attractive; these could include damage to its condition due to aging. Maybe your house has a leaky basement or lousy grading that doesn’t allow you to have a garden.

The assessment should be based on the market value of your home; if your place has issues that would turn off buyers, now’s the time to own up to them.

Step 6: Consider a professional appraisal

If you don’t have time to handle things yourself, hire a professional to do the legwork for you.

A professional appraiser can provide the strongest evidence of your property’s worth.

If your community allows outside appraisals — and you're willing to spend at least $250 — find an appraiser with national certification, such as through the Appraisal Institute or the American Society of Appraisers.

However, don’t fall for solicitations from law firms or other services saying they'll assist you in return for a high percentage of the savings on your bill.

Bottom line

If you need added incentive to bring a skeptical eye to your real estate appraisal, remember this: A successful appeal can be a gift that keeps on giving year after year.

Related

- Property Tax Explained: What Homeowners Need to Know

- Tax Deductions and Credits for Homeowners and Homebuyers

- Property Tax Cap: Does Your State Have One?

- The Original Property Tax Hack: Avoiding The ‘Window Tax’

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Lisa has been the editor of Kiplinger Personal Finance since June 2023. Previously, she spent more than a decade reporting and writing for the magazine on a variety of topics, including credit, banking and retirement. She has shared her expertise as a guest on the Today Show, CNN, Fox, NPR, Cheddar and many other media outlets around the nation. Lisa graduated from Ball State University and received the school’s “Graduate of the Last Decade” award in 2014. A military spouse, she has moved around the U.S. and currently lives in the Philadelphia area with her husband and two sons.

- Gabriella Cruz-MartínezTax Writer

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Avoid a Tax Surprise After Your 2026 Super Bowl Bets: A New IRS Rule to Know

Avoid a Tax Surprise After Your 2026 Super Bowl Bets: A New IRS Rule to KnowTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Oregon Tax Kicker in 2026: What's Your Refund?

Oregon Tax Kicker in 2026: What's Your Refund?State Tax The Oregon kicker for 2025 state income taxes is coming. Here's how to calculate your credit and the eligibility rules.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.

-

Tax Season 2026 Is Here: 8 Big Changes to Know Before You File

Tax Season 2026 Is Here: 8 Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.

-

Do You Pay Property Taxes in Tennessee? What You Need to Know in 2026

Do You Pay Property Taxes in Tennessee? What You Need to Know in 2026Property Taxes State lawmakers are moving to ban state property taxes, but can they stop the local rate spike? Here's how 2026 could lower your Tennessee property tax bill.