Time Claims to Maximize Social Security Benefits

Social Security benefits have long been a critical part of Americans’ retirement income plans.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Social Security benefits have long been a critical part of Americans’ retirement income plans. After all, the monthly benefits provide a stream of income that is adjusted for inflation annually and can’t be outlived. And now, with the decline of pensions and increasing life spans, Social Security is playing a larger role in shoring up retirees’ nest eggs. “Social Security payments are one of the biggest assets that most people have,” says Dan Keady, chief financial planning strategist at TIAA.

How you handle that income “has an important impact on an overall plan,” Keady says. For baby boomers, “using a more intelligent Social Security strategy can increase income over their lifetimes.” Some critical moves: Know your full retirement age, coordinate the timing of benefit claims with your spouse, and weigh the advantages of delaying your Social Security benefits.

As more baby boomers become eligible for benefits, some claiming strategies are disappearing, the full retirement age is increasing and the threat of future benefit cuts looms—but the rules for claiming retirement benefits have also become a little simpler. Under a 2015 law, for example, people born on or after January 2, 1954, are presumed to be applying for the highest benefit for which they qualify—whether it’s their own benefit or a spousal benefit—no matter what their age is when they claim. The law also phases out a strategy known as “restricting an application for spousal benefits,” which could boost a couple’s total payout by tens of thousands of dollars—but a small group of boomers still have a shot at using it.

These key moves can help you maximize your lifetime benefits—and help your nest egg go the distance.

Know Your Full Retirement Age

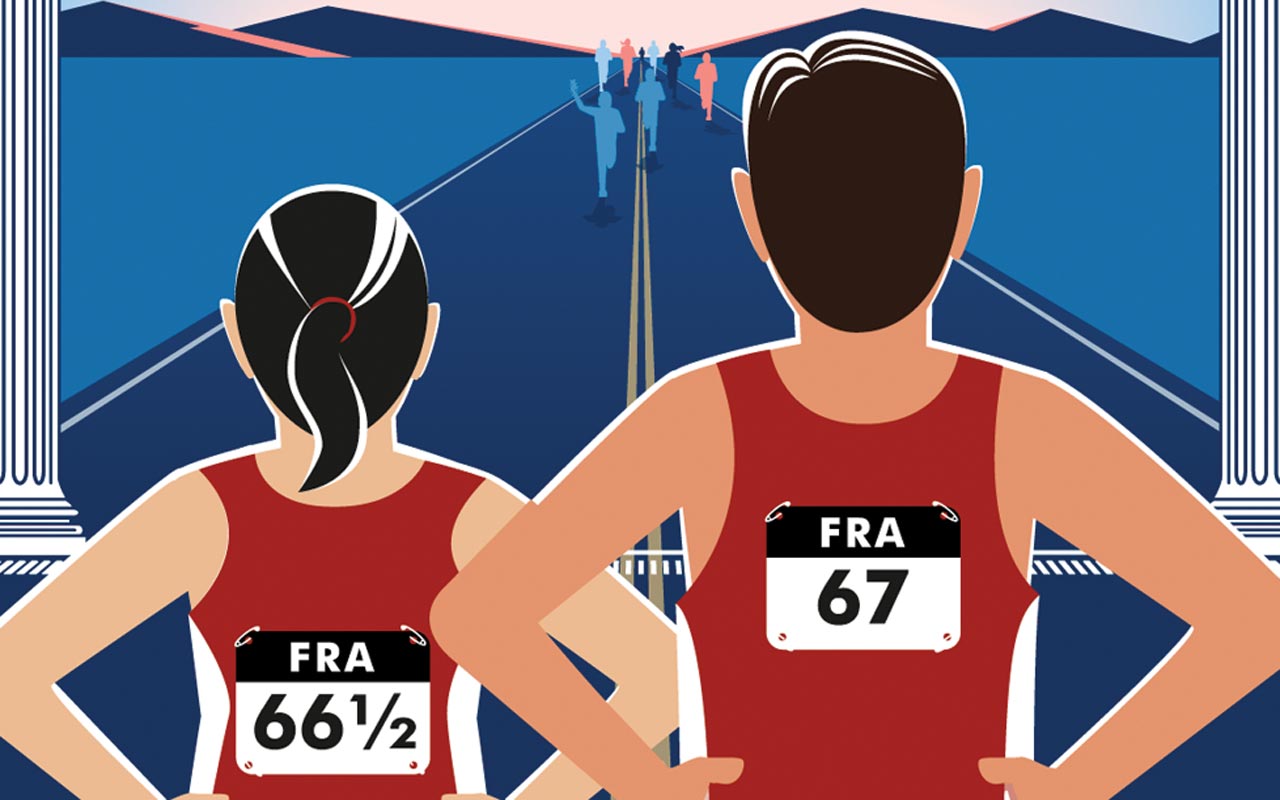

Full retirement age, which is determined by your birth year, is on a gradual march upward from age 66 to age 67. For instance, a boomer who turns 62 in 2019 has a full retirement age of 66 and six months. But someone who turns 62 in 2021 has a full retirement age of 66 and 10 months. Benefits increase monthly by a small percentage from age 62 to your full retirement age, so if you mistakenly claim at age 66 when your full retirement age is really 66½, the haircut won’t be massive—but it could be permanent, trimming your benefits for a lifetime.

The rising full retirement age for Social Security means that people who claim early face a bigger benefit reduction. For those with a FRA of 66, claiming at 62 permanently reduced benefits by 25%—but for those with a FRA of 67, the reduction is 30%. A higher full retirement age also reduces the bonus for people who delay claiming until age 70. Those with a FRA of 66 can earn up to 32% extra—or 8% a year in delayed retirement credits up to age 70—while those with a FRA of 67 can earn up to 24% extra. Pin down your precise FRA to understand exactly how your benefit will be affected by claiming at different ages.

But those numbers don’t tell the whole story. Christine Russell, senior manager of retirement and annuities for TD Ameritrade, notes another advantage of delaying benefits: “All the cost-of-living adjustments are calculated on that higher amount. You get the benefit of compounding.”

FRA also matters if you are still working when you claim. Retiring and taking Social Security benefits are two separate decisions, and you can do one without doing the other. But if you apply for benefits before your full retirement age while still working, your benefits will be subject to the earnings test.

Early claimers will temporarily forfeit $1 of benefits for every $2 of earnings above $17,640 in 2019. In the year you hit full retirement age, the threshold is higher—in 2019, you’d temporarily forfeit $1 of benefits for every $3 of earnings above $46,920.

But in the month you turn full retirement age—poof!—the earnings test goes away. If you plan to keep working later in life, it’s typically a good idea to wait until full retirement age or later to claim benefits. (If you do forfeit any benefits to the earnings test, your benefit will be adjusted upward at your full retirement age to replace the missing benefits over time.)

QUIZ: Do You Know the Best Social Security Claiming Strategies?

Coordination for Couples

If you’re married, carefully time your claim with your spouse’s claim to maximize the total benefits. The highest benefit is the one that will last the lifetime of the last spouse to die, so boosting that benefit is key. “It’s very common for one spouse of a married couple to live to their nineties,” says Russell.

- For dual-earner couples, ideally the higher earner should wait to claim until age 70, while the lower earner could claim a benefit earlier, perhaps even at age 62, to bring some income into the household. At the death of the first spouse, the lower benefit will drop off, and the survivor gets 100% of the highest benefit, including any delayed retirement credits that were earned.

Dual earners should doublecheck if they fall in the narrowing group of boomers who can still make use of the “restricting an application to spousal benefits” strategy. To qualify, you must be born before January 2, 1954. You also need to file the restricted application for spousal benefits only once you hit your full retirement age, and your spouse must claim his or her benefit so that you can get a spousal benefit. If you and your spouse can time your claims to make use of this strategy, the higher earner can bring in additional income from the spousal benefit to add to the lower earner’s benefit. At age 70, the higher earner switches to a boosted benefit that’s earned delayed retirement credits worth 8% a year, and the lower earner switches to a spousal benefit if it’s higher than his or her benefit.

An age gap between spouses can affect a couple’s claiming strategy. The claiming decision typically hinges on the life expectancy of the second spouse to die, says Neil Krishnaswamy, a certified financial planner at Exencial Wealth Advisors. For instance, a higher earner who is 10 years older than his spouse should typically delay his benefit, because it will last the lifetime of the lower earner who has the longer life expectancy. For a higher earner with a lower life expectancy, “it can be counterintuitive to say to wait, but there’s a reason to do it,” he says, and that’s to account for joint life expectancy.

In a one-earner household, holding off until age 70 can be a tougher decision because the non-earning spouse can’t claim a spousal benefit until the earner claims a benefit. The spousal benefit is worth up to 50% of the worker’s full retirement age benefit. Carefully consider life expectancies when deciding when to claim. If one spouse lives into his or her nineties, delaying benefits could still make sense in the long run.

Strategies for Singles

“For single people, it’s fairly straightforward,” says Russell. If you never married, the main claiming considerations are your life expectancy and whether you can afford to delay benefits. If your family has a history of longevity and you have a sizable nest egg, delaying until 70 makes sense. If your health, or the health of your nest egg, isn’t great, you might consider claiming at full retirement age or sooner. After all, no survivor will qualify for a benefit off your record. “For singles, it really comes down to how long you think you will live,” says Sarah Caine, a certified financial planner with Agili, a financial planning and investment management firm.

If you are single now but were once married, you may have more options. What “makes it more complex is that you are integrating spousal and survivor benefits into the mix,” says Krishnaswamy. If you are divorced, you might qualify for a spousal benefit off an ex-spouse’s record. You must have been married for at least 10 years and be single now, and both you and your ex must be eligible for a Social Security benefit. If you’ve been divorced at least two years, it doesn’t matter whether your ex has started his own benefits. And Caine notes that if you were born before January 2, 1954, you can restrict your application to the spousal benefit on your ex’s record and let your own benefit earn delayed retirement credits until age 70.

Widows and widowers can qualify for a survivor benefit starting at age 60 (50 if disabled), and surviving spouses who haven’t yet claimed a benefit can mix and match the survivor benefit with their own benefit. A survivor benefit is worth up to 100% of the deceased worker’s benefit, including delayed retirement credits. And the 2015 law that is phasing out the ability to restrict an application to spousal benefits only does not apply to widows and widowers. Surviving spouses can restrict their applications to make use of both their own benefit and the survivor benefit. For instance, a widow could file a restricted application for a reduced survivor benefit at age 60 and let her own benefit grow until age 70. Or she could claim her own reduced benefit at age 62 and switch to the maximum survivor benefit at her full retirement age. Note that widows and widowers who remarry after age 60 can continue to receive their survivor benefits.

QUIZ: True or False? Test Yourself on Social Security Basics

Weigh Benefits for Family

A worker’s earnings record may provide a Social Security benefit for some of his family members, too. In addition to a spouse age 62 or older, children under the age of 18 can each get a benefit worth up to 50% of the worker’s benefit. If the worker’s spouse is younger than 62 but caring for a child under age 16, the spouse can get a spousal benefit, too. The total amount that a family can claim on one earner’s record is capped at about 150% to 180% of the worker’s benefit.

The kicker: To claim benefits for family, the worker has to claim his own benefit. If you have family members who can qualify for benefits on your earnings record, carefully weigh how the timing of your claim will affect their benefits and vice versa. Let’s say you are 66, have a 12-year-old child and qualify for a $2,000 full retirement age benefit now. You could delay four years to bring in a lifetime monthly benefit of $2,640 at age 70, at which time your child would qualify for two years of half your full retirement age benefit, totaling about $24,000. Or you could claim a $2,000 monthly lifetime benefit at 66, which would also provide $1,000 a month for your child for six years until she turns 18, for a total of $72,000.

Consider a Do-Over

What if you’ve already claimed benefits, but you’re not happy with your decision? In the not too distant past, if you made a mistake in claiming benefits, you could fix it—even years later. But now, the chances for a do-over are limited. This makes it all the more important to correctly time your initial claim, but it’s also critical to know the rules for a do-over so you don’t miss your second shot if you need it.

First, you can withdraw your application for benefits within the first 12 months of applying. You will have to repay any benefits received from your earnings record, but you can then later reapply fresh. You only get one chance to withdraw. So if you first claimed at age 63, but then changed your mind about taking a reduced benefit, you could withdraw within 12 months and reapply at your full retirement age to get your full benefit or anytime up to age 70 to get a boosted benefit.

Second, if you miss the window to withdraw your application but claimed early for a reduced benefit, you can pump up that benefit by suspending it at your full retirement age. You forego income while the benefit is suspended, but your benefit will grow 8% a year with delayed retirement credits until age 70. That can help boost a reduced benefit back up to nearly what it would have been if you had filed at full retirement age. If your monthly $2,000 full benefit at age 66 was cut to $1,500 by claiming at 62, suspending your benefit from your FRA of 66 to age 70 would bring it back up to $1,980 a month for the rest of your life.

Check Up on Social Security's Health

If you’re concerned about potential future benefit cuts, you could factor that into your claiming calculations. The Social Security trustees’ report released in April estimates a 23% cut in retirement benefits in 2034—meaning a full benefit of $2,000 would be sliced to $1,540. Congress has been kicking the “fix Social Security” can down the road for years, and suddenly 2034 doesn’t seem so far away. While many experts say any fixes that might depress benefits would most likely affect younger generations, preretirees who want to plan for the worst-case scenario could run one set of numbers with full benefits for a lifetime and another set that includes benefit cuts. If those reduced numbers don’t look so good to you, consider how you might fill that income gap and start dialing up your Congressional representatives to demand action.

No one has a crystal ball, so you have to make the best planning decisions you can with the rules that currently exist. “You want to maximize whatever benefit you can get,” says Krishnaswamy. He says he wouldn’t advise near retirees to change their strategies, and he notes that those with a longer time horizon could scale down their assumption of benefits in their planning. Many policy changes beyond benefit cuts could affect Social Security, Russell notes, adding, “focus on the things you can control.”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

12 Great Places to Retire in the Midwest

12 Great Places to Retire in the MidwestPlaces to live Here are our retirement picks in the 12 midwestern states.

-

15 Cheapest Small Towns to Live In

15 Cheapest Small Towns to Live InThe cheapest small towns might not be for everyone, but their charms can make them the best places to live for plenty of folks.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.