10 Things Social Security Recipients Need to Know About Their Second Stimulus Check

It's a bit more difficult for Social Security recipients to learn the ins and outs of second-round stimulus checks, since there are a few special rules that only apply to them.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Trying to track down answers to all your second stimulus check questions can make anyone's head spin. This is especially true for Social Security recipients, because there are several special rules that only apply to them.

But don't worry — we've got you covered. We combed through the law and related guidance on second-round stimulus checks and pulled out the 10 important things Social Security recipients should know about their second stimulus check. Hopefully, we'll answer all your questions, point you in the right direction for more information, and provide a little advice for moving forward.

The IRS is Working with the Social Security Administration

For most people, the IRS gets the information it needs to process and send a second stimulus check from their 2019 tax return. The tax agency can also use information it collected from online tools it released last year to help deliver first-round stimulus checks. But for people receiving Social Security retirement benefits, there's another source of information at the IRS's disposal.

For retirees who didn't file a 2019 tax return, the IRS will get the information it needs from the Social Security Administration. In addition, the IRS will also get information from other government departments or agencies for non-filers who receive Supplemental Security Income (SSI), survivor or disability benefits (SSDI), Railroad Retirement benefits and certain veterans benefits.

While the IRS was also able to get information from the Social Security Administration to process first-round stimulus checks, the process should go more smoothly this time around. As you may recall, there was a point back in April when we weren't sure if Social Security recipients who didn't file a 2018 or 2019 tax return would automatically get a first-round stimulus check. They ultimately did, but not without some confusion at the start of the process. Those issues should not crop up for second-round stimulus checks going out now.

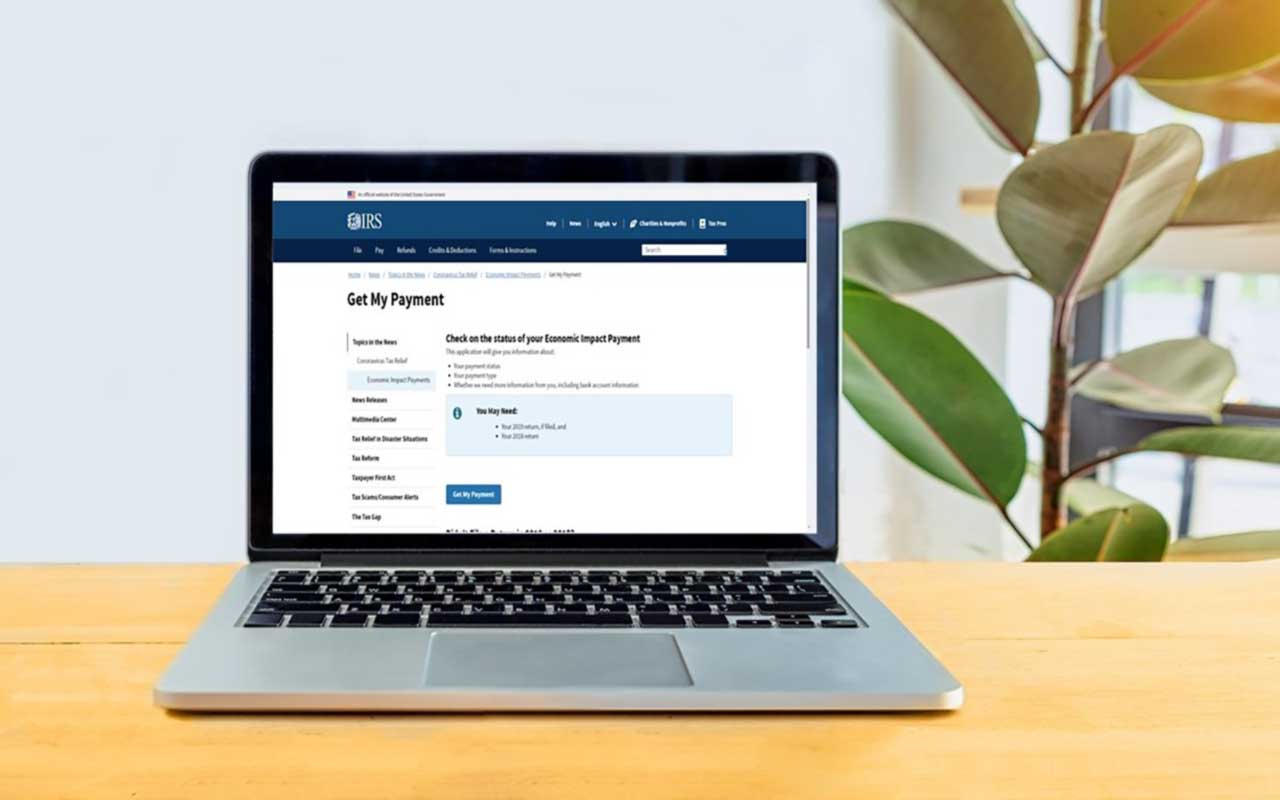

You Can Track the Status of Your Stimulus Check

The IRS updated a popular online tool that will let you:

- Check the status of your first or second stimulus check (the tool will show the status of your most recent payment);

- Confirm your payment type (paper check or direct deposit); and

- Get a projected direct deposit or paper check delivery date (or find out if a payment hasn't been scheduled).

The tool is called the "Get May Payment" portal, and it can be found at irs.gov/coronavirus/get-my-payment. Social Security recipients can use the portal to track the status of their payment, even if they didn't file a tax return. However, Social Security recipients can't use the portal to provide bank account information if they didn't file a 2019 tax return. The IRS will get that information, if it is available, from the Social Security Administration.

For more information on the "Get My Payment" tool, see Where's My Stimulus Check? Use the IRS's "Get My Payment" Portal to Get an Answer.

There are Various Ways to Receive Your Second Stimulus Check

If you filed a 2019 tax return and the IRS has your bank account information, you'll receive your second stimulus payment by direct deposit. That's the fastest and easiest way for both you and the IRS.

If you didn't file a 2019 tax return, you'll automatically receive your second stimulus check by direct deposit, debit card or paper check — whichever way you normally receive your Social Security benefits. For example, if your benefits are currently deposited to a Direct Express card, your second stimulus check will also be deposited to that card. If your benefits are currently deposited directly into your bank account, your second stimulus check will be deposited to that account. If you didn't file a 2019 tax return, you'll be able to use the "Get My Payment" tool to check the status of your payment, but you won't be able to use it to provide your bank account information.

You Might Not Get All Your Money Right Now if You Have Dependent Children

Social Security recipients who have (or care for) dependent children 16 years old or younger might not get all the money they're entitled to in their second stimulus check. If you didn't file a 2019 return, and you didn't send the IRS information about the children by November 21 (for first-round stimulus check purposes), you probably won't get an extra $600 per child added to your second stimulus check. (The information for first-round stimulus checks had to be provided online using the IRS's "Non-Filers: Enter Your Payment Info Here" tool.)

For non-filers who didn't provide the IRS with the necessary information by the November 21 deadline, your second stimulus payment will be for the standard $600 amount. However, you'll be able to claim the additional $600-per-child amount as a "recovery rebate" tax credit when you file your 2020 tax return. So, you'll still get paid, but you'll just have to wait a while to claim it.

You Won't Receive a Second Stimulus Check If You're Listed as a Dependent on Someone's Tax Return

As with the first round of stimulus payments under the CARES Act, not everyone is entitled to a second stimulus check. For instance, if you can be claimed as a dependent on someone else's tax return, then you're not eligible for a stimulus check payment. So, you live with one of your adult children who cares for you, then you won't get a check if your child can claim you as a dependent on his or her tax return. (That's the case even if your children don't actually claim you as a dependent on their return.)

Stimulus Checks Won't Increase the Tax on Social Security Benefits

Uncle Sam can tax up to 85% of your Social Security benefits. To calculate the federal tax on your benefits, you first need to determine your "base income" (often referred to as your "provisional income"). Your base income is equal to the combined total of (1) 50% of your Social Security benefits, (2) your tax-exempt interest, and (3) your adjusted gross income (not including the student loan interest deduction or the tuition and fees deduction).

If you're single, none of your Social Security benefits are taxed if your base income is less than $25,000. If you're married and filing a joint return, the threshold is $32,000. If a single filer's base income is between $25,000 and $34,000, then up to 50% of his or her Social Security benefits may be taxable. The 50% rate is applied to joint filers with a base income from $32,000 to $44,000. Finally, if your base income is more than $34,000 on a single return, or $44,000 on a joint return, up to 85% of your benefits may be taxable.

Any additional taxable income will increase your adjusted gross income, which then increases your base income for Social Security tax purposes. If your base income goes up enough to move you from the 0% to the 50% bracket, or from the 50% to the 85% bracket, then you're looking at a tax increase.

The good news is that your second stimulus check is not taxable income. As a result, it will not increase your AGI, or your base income – and, therefore, it won't increase the tax on your Social Security benefits, either.

Stimulus Checks Won't Affect Eligibility for Government Benefits

Many Social Security recipients are also receiving other government benefits. Eligibility for these additional benefits is often based on your income. However, your second stimulus check will not affect your income for purposes of determining eligibility for federal government assistance or benefit programs.

For example, second-round stimulus payments do not count as income, and are excluded from resources for 12 months, for purposes of qualifying for benefits under the following federal programs that support many Social Security recipients:

- Supplemental Security Income (SSI);

- Medicaid;

- Supplemental Nutrition Assistance Program (SNAP); and

- HUD housing assistance.

Second Stimulus Payments Will Be Sent to Representative Payees

If you have a representative payee, the IRS will send your second stimulus check to the payee using the same method the payee normally receives your monthly benefit (direct deposit, Direct Express, or paper check). But don't forget �� the payment belongs to you.

By law, the entire payment can only be used for your benefit. If a representative payee uses your second stimulus check for the benefit of another person, he or she is subject to a $5,000 civil penalty and could have to pay back up twice the amount of money used for the other person. That's in addition to any other penalties possible under the law.

The Social Security Administration (SSA) does not have authority to investigate or determine whether a stimulus payment has been misused. However, if the SSA receives an allegation that a payment was not used on behalf of the beneficiary, it can decide to investigate for possible misuse of the beneficiary's Social Security benefit payments. The SSA can also decide that the representative payee is no longer suitable and appoint a new payee.

You Could Receive a Second Stimulus Check for a Deceased Spouse

Anyone who died before 2020 is not eligible to receive a second stimulus check. This is specifically stated in the new law that authorizes second-round payments. However, that presumably means that anyone who died in 2020 is eligible for a payment. So, Social Security recipients and other people who had a spouse die in 2020 could receive a $600 second-round stimulus check for their deceased loved one (either as a separate payment or as a combined payment of $1,200).

The IRS hasn't confirmed yet that people died in 2020 are indeed eligible for a second stimulus check. As a result, if you receive a second-round payment for a deceased person, you might want to hold on the money until we know for sure if the IRS is going to ask for it back (as they did with first-round stimulus checks). In other words, don't spend it right away.

[Note: The IRS sent over 1 million first-round stimulus checks to deceased people. However, the IRS is now allowed access to the Social Security Administration's "death master file" for second-round payments. This should cut down on the number of stimulus checks sent to people who died before 2020.]

You Might Be Able to Invest Your Stimulus Check in an IRA

If you're still working, you may be able to put your second stimulus check money in an IRA and save it for later. Anyone over 50 can contribute up to $7,000 in one or more IRAs in 2021. You must, however, have earnings from work to contribute to an IRA, and you can't put more into the account than you earned. (Your stimulus payment doesn't count as earned income.)

If you didn't hit the $7,000 limit last year, it's not too late to contribute to an IRA for the 2020 tax year. The deadline for 2020 contributions is April 15, 2021. The 2020 contribution limit for people over 50 was also $7,000 — so you can't contribute more if you already put in that much.

By the way, starting last year, the SECURE Act repealed the old rule that prohibited contributions to a traditional IRA by taxpayers age 70½ and older. So, you can continue to put away money in a traditional IRA if you work into your 70s and beyond. (There were never age-based restrictions on contributions to a Roth IRA.)

Stay on Top of Stimulus-Check Developments

Follow Kiplinger for the latest news and insights on federal stimulus payments (and other important personal-finance matters). Stay with us on:

- email. Sign up free for our daily Kiplinger Today e-newsletter.

- social media. Follow us on Instagram, Twitter and Facebook.

- podcasts. Subscribe free to our weekly Your Money's Worth podcast. Apple | Google Podcasts | Spotify | Overcast

See some of our other coverage of the second stimulus check:

- Is Your Second Stimulus Check Taxable?

- Second Stimulus Check Update: Senate Kills $2,000 Payments

- When Will Your Second Stimulus Check Arrive? It May Already Be On Its Way

- Who's Not Getting a Second Stimulus Check (Not Everyone is Eligible!)

- How Your Second Stimulus Check Will Differ from the First One

- Will College Students Get a Second Stimulus Check? (Hint: It Depends!)

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rocky Mengle was a Senior Tax Editor for Kiplinger from October 2018 to January 2023 with more than 20 years of experience covering federal and state tax developments. Before coming to Kiplinger, Rocky worked for Wolters Kluwer Tax & Accounting, and Kleinrock Publishing, where he provided breaking news and guidance for CPAs, tax attorneys, and other tax professionals. He has also been quoted as an expert by USA Today, Forbes, U.S. News & World Report, Reuters, Accounting Today, and other media outlets. Rocky holds a law degree from the University of Connecticut and a B.A. in History from Salisbury University.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.

-

A Free Tax Filing Option Has Disappeared for 2026: Here's What That Means for You

A Free Tax Filing Option Has Disappeared for 2026: Here's What That Means for YouTax Filing Tax season officially opens on January 26. But you'll have one less way to submit your tax return for free. Here's what you need to know.

-

When Do W-2s Arrive? 2026 Deadline and 'Big Beautiful Bill' Changes

When Do W-2s Arrive? 2026 Deadline and 'Big Beautiful Bill' ChangesTax Deadlines Mark your calendar: Feb 2 is the big W-2 release date. Here’s the delivery scoop and what the Trump tax changes might mean for your taxes.

-

Are You Afraid of an IRS Audit? 8 Ways to Beat Tax Audit Anxiety

Are You Afraid of an IRS Audit? 8 Ways to Beat Tax Audit AnxietyTax Season Tax audit anxiety is like a wild beast. Here’s how you can help tame it.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?