IRS Watchdog: Three Problems the IRS Must Address in 2025

The tax season is over, but new changes to the IRS can pose risks to your taxpayer experience.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The IRS has gone through unprecedented changes this year, and some developments orchestrated by the Trump administration have aggravated existing challenges.

The National Taxpayer Advocate, Erin Collins, released her fiscal year 2026 Objectives Report to Congress. While the government watchdog noted that the 2025 filing season was successful, there are several problem areas the agency has struggled to address.

These include refund delays for victims of identity theft, a lack of transparency on the agency's modernization strategy, and workforce challenges. Some of these problems are just the tip of the iceberg, but they can impact your experience as a taxpayer — with some folks already facing doubt as to how to address their taxpayer questions.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Here’s more of what you need to know about what to expect when tax season rolls around.

IRS Taxpayer Advocate Report cites several issues

While the 2025 tax season is over, a shrinking workforce and a lack of stable leadership in the IRS this year are starting to show cracks in the foundation of the agency. Research projects and modernization efforts are being suspended, and some folks are still waiting on refund delays.

These challenges can potentially worsen if the GOP keeps in promise to sunset programs like IRS Direct File, reduce allocated funding, and continue to cut down the workforce.

“As a recently retired IRS employee (took the Deferred Resignation Program) and an incredible 35-year career, it saddens me to see our agency suffer the personnel loss of hard-working and knowledgeable people,” wrote Martiza Flores-Travanti on LinkedIn, explaining that she’s had more friends and acquaintances unable to resolve issues with the IRS.

“I’m afraid we will all be receiving the ‘phone from a friend’ calls,” Flores-Travanti added. “The services to everyday Americans is diminishing. AI can’t do it all!”

IRS workforce challenges

The IRS started the year with a headcount of over 102,000 federal employees, and six months into 2025, that figure has dropped to just 75,702.

The changes to the agency came almost as soon as President Donald Trump was sworn into office, and created Elon Musk’s led Department of Government Efficiency (DOGE). The tech billionaire’s external government entity was tasked with dismantling federal agencies and other spending.

As reported by Kiplinger, the layoffs at the IRS impacted nearly every division. By the end of the 2025 tax season, more than 25% of the agency’s workforce had been cut down via layoffs, buyouts, or attrition.

Not to mention, this year, the IRS has been operating without consistent leadership.

- The agency had five commissioners or acting commissioners during the first four months of the year.

- Many of its most experienced leaders chose to leave the agency voluntarily.

- This left the agency with fewer frontline employees and managers with less experience to carry out the tax season.

- Trump’s controversial pick for Commissioner was just recently confirmed well past the 2025 tax season and had previously advocated for abolishing the IRS.

Former Internal Revenue Service workers leave their office after being laid off in downtown Denver, Colorado on Thursday, February 20, 2025. The IRS began laying off roughly 6,000 employees in the middle of tax season as the Trump administration via the Department of Government Efficiency (DOGE) works to downsize the federal workforce.

Taxpayer Services lost 1,836 during Trump’s first deferred resignation offer, and another 4,896 in its second resignation offer. A total of 829 cut ties with the IRS through a voluntary early retirement or voluntary separation incentive program.

The areas impacted, like Taxpayer Services, are responsible for processing tax returns, answering taxpayer phone calls, and more.

Already, the lack of IRS employees has caused important projects to be suspended. The agency sent a notice on July 1 that its Joint Statistical Research Program (JSRP) is on hold due to “unforeseen circumstances.” That division was designed to support research projects and use tax microdata to address tax administration research questions.

“Due to current staffing limitations, Statistics of Income (SOI) is unable to provide the necessary support for new projects,” the memo said.

The Trump administration plans a 20% reduction in appropriated IRS funding next year, which would amount to an overall 37% reduction in funding after counting the decrease in supplemental funding from the Inflation Reduction Act (IRA).

For now, all federal hiring efforts have been paused by the Trump administration. The Taxpayer Advocate recommends lifting the hiring freeze and providing a direct hire authority so Taxpayer Services can hire “essential filing season employees” this summer, and onboard them in time for the 2026 filing season.

Identity theft remains a weakness

The last problem you want to deal with as a taxpayer is having your identity stolen. What’s worse: getting that issue resolved will take years.

The IRS has promised over the past 18 months that it’s been working to resolve the Identity Theft Victim Assistance (IDTVA) cases, but the backlogs continue to this day. The agency handles two types of identity theft cases.

- Potentially fraudulent. These are cases that the IRS processing filter flags as a risk. Taxpayers whose returns were incorrectly flagged must authenticate their identity to receive their refunds. The process can take several months to be resolved.

- Stolen identity. These cases involve an individual stealing a taxpayer’s identity and Social Security number to file a tax return.

By the end of the 2025 filing season, the IRS had about 387,000 second-category cases in inventory, according to the NTA. These cases take an average of 20 months to resolve.

Some of the delays are also linked to a lack of personnel handling IDTVA cases. As reported by Kiplinger, the agency has been known to siphon employees from various departments to help Taxpayer Services during the filing season. This year was no different.

The IRS planned on siphoning identity theft personnel to assist Taxpayer Services in answering phone calls. Now, as both departments' workforce has been cut further, there’s no telling how Trump’s downsizing of the agency will impact pending IDTVA cases.

“Apart from the time and frustration these delays cause, victims entitled to refunds are waiting nearly two years to receive them,” wrote Collins. “We found these delays disproportionately affect vulnerable populations dependent on their refunds to meet basic living expenses.”

IRS modernization plan?

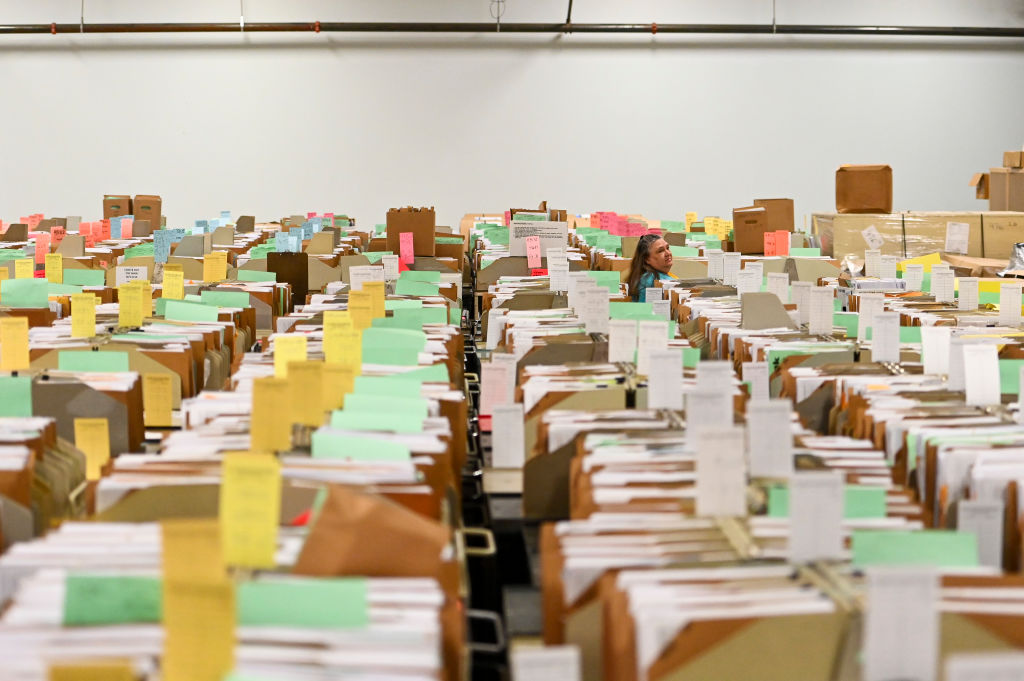

An IRS employee walks through tax documents in the staging warehouse at a Internal Revenue Service facility in Ogden, Utah.

The IRS has relied on an outdated technology system for decades, with some “legacy” equipment dating back more than 25 years.

It’s not a new problem area by any means, and the IRS has acknowledged it has to modernize its systems. However, recent budgetary challenges and a shift in priorities, driven by Elon Musk’s Department of Government Efficiency (DOGE), have led to the suspension of some ongoing modernizing initiatives.

Before DOGE made a splash at the IRS, the agency had made notable strides to update its systems, enhancing online account features, increasing cybersecurity protocols, and launching new online tools like IRS Free File (which is now on the GOP chopping block)..

Musk’s DOGE, in partnership with the Treasury Department, believes that the IRS can effectively automate much of the agency’s work currently performed by employees. However, using AI to substitute employees has raised some concerns.

For instance, there’s no telling how AI can ensure fair compliance, provide quality service, and safeguard taxpayer privacy, according to the Taxpayer Advocate. So far, the IRS has no clear plan on how it will modernize its systems — another pain point for future taxpayer experience.

“Without such transparency, there is a real risk these initiatives could stall or deviate from their intended outcomes,” wrote the NTA.

What’s been long overdue is the digitization of paper. The IRS continues to buckle under the strain of paper returns, even during the 2025 tax season.

- The agency estimates that it would receive roughly 43 million paper tax returns and 19 million paper information returns in 2025.

- It also sends nearly 170 million paper notices to individual taxpayers and receives millions of mailed responses.

- For some taxpayers, any delays can lead to slower refunds.

While the IRS launched its Paperless Processing Initiative in 2023, the agency failed to meet its goal of digitally processing all paper-filed returns by the 2025 filing season.

“I often remarked that paper is the IRS’s kryptonite, and the IRS is buried in it,” wrote Collins, before adding that paper continues to be a vulnerability that “continues to hinder the agency’s effectiveness.”

Bottom line for the IRS

The IRS has undergone significant changes this year that can impact you as a taxpayer.

The 2025 tax season was “the smoothest yet,” as most taxpayers received their refunds without significant delays. As of April, the agency received over 140 million individual income tax returns and processed 138.1 million individual returns. Additionally, some 86 million refunds had been delivered, with an average refund of $2,942.

Still, nearly 3.4 million returns had been suspended due to errors, potential identity theft, or other issues. These delays add to other backlogs that still linger from past tax filing seasons:

- Some Employee Retention Credit (ERC) claims have remained pending since the pandemic.

- Identity theft cases can take up to two years to be resolved.

- Republican lawmakers want to eliminate IRS Direct File, a free filing service that relieves processing burdens for the agency's employees.

Here’s the latest on IRS changes:

- IRS Layoffs Spark Delays, Doubt This Tax Season

- IRS Shakeup: What Trump’s Commissioner Pick Could Mean for Your Taxes

- Trump Plans to Terminate IRS Direct File program

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Gabriella Cruz-Martínez is a finance journalist with 8 years of experience covering consumer debt, economic policy, and tax.

Gabriella’s work has also appeared in Yahoo Finance, Money Magazine, The Hyde Park Herald, and the Journal Gazette & Times-Courier.

As a reporter and journalist, she enjoys writing stories that empower people from diverse backgrounds about their finances, no matter their stage in life.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

How to Open Your Kid's $1,000 Trump Account

How to Open Your Kid's $1,000 Trump AccountTax Breaks Filing income taxes in 2026? You won't want to miss Form 4547 to claim a $1,000 Trump Account for your child.

-

7 Bad Tax Habits to Kick Right Now

7 Bad Tax Habits to Kick Right NowTax Tips Ditch these seven common habits to sidestep IRS red flags for a smoother, faster 2026 income tax filing.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax Season

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax SeasonTax Law A new Trump lawsuit and warnings from a tax-industry watchdog point to an IRS under strain, just as millions of taxpayers begin filing their 2025 returns.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Oregon Tax Kicker in 2026: What's Your Refund?

Oregon Tax Kicker in 2026: What's Your Refund?State Tax The Oregon kicker for 2025 state income taxes is coming. Here's how to calculate your credit and the eligibility rules.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.