The Dow 30: Which Stocks to Buy, Hold or Sell

For all its quirks, the Dow Jones industrial average remains one of the most influential market gauges in the world.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

For all its quirks, the Dow Jones industrial average remains one of the most influential market gauges in the world.

The Dow still makes headlines when it hits new highs, and additions to and deletions from the blue-chip index are watched with interest for what they show about the shifting composition of the U.S. economy.

In this slide show, you’ll find our rating (buy, hold or sell) on each of the 30 stocks in the Dow. Only two stocks warrant a sell rating, reflecting our view that the global economy will continue to grow, albeit modestly. And the holds greatly outnumber the buys because share prices have advanced so sharply over the past four years.

Stock prices and other data are as of June 28.

3M

- Symbol: MMM52-Week High: $113.2552-Week Low: $85.34Annual Sales (billion): $29.9Five-Year Projected Earnings Growth: 9.0% annuallyOur Judgment: Buy

The maker of Scotch tape, sealants for airplanes, orthodontic appliances and much more is a fabulous company that’s feeling the pinch of a slow economy. Company officials recently lowered their forecast for 2013 profits. But 3M’s record of innovation, its diversified product base and its excellent prospects abroad signal a bright future. Even better, 3M has raised its quarterly dividend each year for the past 55 years.

Chevron

- Symbol: CVX52-Week High: $127.4052-Week Low: $100.66Annual Sales (billion): $241.9Five-Year Projected Earnings Growth: 1.8% annuallyOur Judgment: Buy

By investing heavily in exploration in recent years, the second-largest U.S. energy company has set itself up for years of solid growth. In 2012, for example, the company replaced the equivalent of every 100 barrels of oil and gas it extracted with the equivalent of 112 barrels of new proven reserves. Chevron is also increasing its exposure to liquid natural gas, with big projects in Australia and Canada in the works. The firm has boosted its dividend at an annual pace of 9% over the past five years.

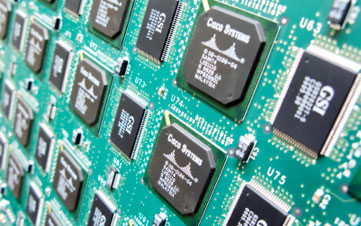

Cisco Systems

- Symbol: CSCO52-Week High: $24.9852-Week Low: $14.96Annual Sales (billion): $46.1Five-Year Projected Earnings Growth: 9.0% annuallyOur Judgment: Buy

Cisco is the dominant player in routers, switches and other networking equipment. The company is seeking to maintain and sharpen its competitive edge in those areas by shedding lagging business lines and making acquisitions. But it is also expanding into faster-growing software and services, all the while maintaining its enviable profit margins.

General Electric

- Symbol: GE52-Week High: $24.4552-Week Low: $19.36Annual Sales (billion): $147.4Five-Year Projected Earnings Growth: 10.9% annuallyOur Judgment: Buy

GE has rediscovered its mojo. GE Capital, the finance unit that caused major headaches during the 2008 financial crisis, is smaller and healthier than it was a few years ago. The company’s core industrial businesses have sales backlogs large enough to last for years. And management is increasingly focused on returning cash to shareholders.

IBM

- Symbol: IBM52-Week High: $215.9052-Week Low: $181.85Annual Sales (billion): $104.5Five-Year Projected Earnings Growth: 9.7% annuallyOur Judgment: Buy

Big Blue is suffering a temporary slump. The tech giant posted abysmal results in the first quarter, with its hardware and services units showing sluggish sales. But the company is working to sell off its least-profitable units and is in the middle of a vast cost-cutting effort. Once IBM rights the ship, its stock should deliver stellar gains.

Microsoft

- Symbol: MSFT52-Week High: $35.7852-Week Low: $26.26Annual Sales (billion): $73.7Five-Year Projected Earnings Growth: 8.7% annuallyOur Judgment: Buy

Investors who focus on how badly Microsoft is lagging Apple and Samsung in the mobile-phone wars are looking at Microsoft all wrong. The company is entrenched in the corporate world, where sales of its operating systems and applications software throw off steady streams of cash. The stock is plenty cheap, and Microsoft has raised its dividend at a 21% annual clip over the past three years.

Pfizer

- Symbol: PFE52-Week High: $31.1552-Week Low: $22.00Annual Sales (billion): $59.0Five-Year Projected Earnings Growth: 2.7% annuallyOur Judgment: Buy

The world’s largest drug maker has been smarting ever since losing patent protection on the hit cholesterol drug Lipitor in 2011. But with several potential new blockbuster drugs on their way to market, plenty of cash to keep its massive research-and-development machine ticking, and a stock that’s far from overpriced, these shares look appealing.

Travelers

- Symbol: TRV52-Week High: $89.0052-Week Low: $60.62Annual Sales (billion): $25.7Five-Year Projected Earnings Growth: 7.7% annuallyOur Judgment: Buy

The seller of business, home, auto and other insurance tends to err on the side of conservatism when it comes to underwriting policies and investing its spare cash. That’s been a boon in recent years and has helped fuel Travelers’ strong stock-price gains compared with its peers. Although low interest rates pose a challenge, Travelers has been able to cope by raising premiums.

United Technologies

- Symbol: UTX52-Week High: $98.1852-Week Low: $70.95Annual Sales (billion): $57.7Five-Year Projected Earnings Growth: 13.5% annuallyOur Judgment: Buy

The maker of elevators, escalators, refrigerators, helicopters, aircraft engines and more is generating large amounts of cash, which it’s using to buy back shares and pay down debt. Although any future cuts to U.S. defense spending could hurt results, strong sales to emerging markets should help keep growth on track.

UnitedHealth Group

- Symbol: UNH52-Week High: $66.3652-Week Low: $50.32Annual Sales (billion): $110.60Five-Year Projected Earnings Growth: 11.0% annuallyOur Judgment: Buy

It isn’t easy for new competitors to put together a network of health providers, so UnitedHealth, the nation’s largest health insurer, holds formidable advantages. Health care reform has been a mixed bag for business, bringing in new patients while increasing regulation. But the company’s number-one position and the stock’s attractive valuation tip the scales here.

American Express

- Symbol: AXP52-Week High: $78.6152-Week Low: $53.02Annual Sales (billion): $33.80Five-Year Projected Earnings Growth: 12.1% annuallyOur Judgment: Hold

The credit card giant is a great company in a fine industry. Credit card companies have strong competitive advantages (it’s not easy for newcomers to set up a network). And Amex’s cardholders tend to be affluent, to spend a lot and to pay their bills on time. But with the shares up 30% this year (results are through June 28) and consumer spending sluggish, this isn’t the time to load up.

AT&T

- Symbol: T52-Week High: $39.0052-Week Low: $32.71Annual Sales (billion): $127.4Five-Year Projected Earnings Growth: 6.3% annuallyOur Judgment: Hold

Competing fiercely with Verizon Wireless, AT&T has seen its results suffer in recent years because of the subsidies it offers to iPhone buyers. Dwindling use of landline phones is another headache. But AT&T throws off plenty of cash to support its hefty dividend, so there’s no reason for investors to sell.

Bank of America

- Symbol: BAC52-Week High: $13.9952-Week Low: $6.90Annual Sales (billion): $100.1Five-Year Projected Earnings Growth: 23.4% annuallyOur Judgment: Hold

BofA has made big strides in cleaning up its problem loans and settling lawsuits with investors who bought bum mortgages from it. But its stock has soared 66% just in the past year, putting it close to the $14 price target mentioned in our story 4 Big-Bank Stocks Worth a Buy. However, with loan and legal woes ongoing, demand for new loans still tepid, and management trying to wrestle a bloated cost structure into submission, investors should sit tight for now.

Boeing

- Symbol: BA52-Week High: $104.1552-Week Low: $69.03Annual Sales (billion): $81.70Five-Year Projected Earnings Growth: 13.9% annuallyOur Judgment: Hold

Investors breathed a sigh of relief when Boeing announced that regulators had approved its fix for faulty batteries on the company’s new 787 Dreamliner planes, which had been grounded for four months. But the Dreamliners haven’t been the only things taking off; the stock has climbed more than 36% this year, making these shares rich.

Caterpillar

- Symbol: CAT52-Week High: $99.7052-Week Low: $78.25Annual Sales (billion): $65.90Five-Year Projected Earnings Growth: 14.0% annuallyOur Judgment: Hold

As the world’s largest maker of construction and mining equipment, Caterpillar is a terrific company in an industry that’s closely tied to economic cycles. The firm’s CEO has said the global mining industry is close to a bottom, which would be a positive for Caterpillar. But we think continued economic weakness, plus an inventory backlog among the company’s dealers, merit a patient approach here.

Coca-Cola

- Symbol: KO52-Week High: $43.4352-Week Low: $35.58Annual Sales (billion): $48.00Five-Year Projected Earnings Growth: 8.3% annuallyOur Judgment: Hold

Although health-conscious Americans and other developed-market consumers are drinking fewer sugary sodas, rising living standards in emerging nations leave consumers there with more money to spend on wants rather than needs. The world’s largest beverage company has boosted its dividend in each of the past 50 years, but the stock is on the pricey side.

DuPont

- Symbol: DD52-Week High: $57.2552-Week Low: $41.67Annual Sales (billion): $34.80Five-Year Projected Earnings Growth: 7.3% annuallyOur Judgment: Hold

Once predominantly a chemical company, DuPont has become increasingly dependent on its agriculture business, which sells seeds and pesticides, to drive growth in recent years. But DuPont lags rival Monsanto in agriculture, and sales could continue to be sluggish in its core chemicals business for some time. A fine dividend, however, makes DuPont a hold.

ExxonMobil

- Symbol: XOM52-Week High: $93.6752-Week Low: $82.83Annual Sales (billion): $482.30Five-Year Projected Earnings Growth: 2.1% annuallyOur Judgment: Hold

As more of the world’s easy-to-exploit energy resources are exhausted, Exxon’s main challenges are to make new discoveries and bring them online fast enough to replace depleted reserves. Fortunately, Exxon has unrivaled resources for exploration and acquisitions, with plenty of cash left over to buy back shares and fund its dividend.

Home Depot

- Symbol: HD52-Week High: $81.5652-Week Low: $49.77Annual Sales (billion): $74.80Five-Year Projected Earnings Growth: 14.6% annuallyOur Judgment: Hold

The largest home-improvement retailer, Home Depot has benefited in recent years from an overhaul in how it stocks and prices the merchandise on its shelves. But the shares, which tend to move in sync with the housing market, have already rallied sharply in anticipation of continued improvement in real estate prices.

Intel

- Symbol: INTC52-Week High: $26.9052-Week Low: $19.23Annual Sales (billion): $53.30Five-Year Projected Earnings Growth: 11.0% annuallyOur Judgment: Hold

The Silicon Valley icon is playing catch-up to rival ARM when it comes to producing semiconductors that power smart phones and tablets. But Intel has a massive research-and-development budget with which to address these woes. Moreover, all those mobile devices must connect to servers to deliver Web sites, videos and other content, and Intel dominates the server-processor market. Its dividend is well supported by profits. Investors should hold on.

JPMorgan Chase

- Symbol: JPM52-Week High: $55.9052-Week Low: $33.10Annual Sales (billion): $93.60Five-Year Projected Earnings Growth: 6.5% annuallyOur Judgment: Hold

Some of the bank’s woes are self-inflicted, such as last year’s embarrassing $6 billion trading loss. But many, such as weak loan demand, low interest rates and too-close-for-comfort regulatory scrutiny, are simply common to banking. JPMorgan is in great shape financially and is the best of the big banks.

Johnson & Johnson

- Symbol: JNJ52-Week High: $89.9952-Week Low: $66.85Annual Sales (billion): $67.20Five-Year Projected Earnings Growth: 6.3% annuallyOur Judgment: Hold

The maker of drugs, medical devices and consumer products has faced a string of product recalls and lawsuits in recent years. Yet J&J’s future remains bright, thanks to its excellent drug portfolio, deep pockets and diversified product base. However, after surging 28% in the past year, the stock is tough to get excited about.

McDonald’s

- Symbol: MCD52-Week High: $103.7052-Week Low: $83.31Annual Sales (billion): $27.60Five-Year Projected Earnings Growth: 8.6% annuallyOur Judgment: Hold

On one hand, first-quarter sales at restaurants open for at least a year declined in all three of McDonald’s geographic segments (the U.S., Europe and the rest of the world). And McDonald’s shares trade for an above-market price-earnings ratio of 17. On the other hand, the world’s largest restaurant chain (by sales) has boosted its dividend in each of the past 37 years.

Merck

- Symbol: MRK52-Week High: $50.1652-Week Low: $40.02Annual Sales (billion): $47.30Five-Year Projected Earnings Growth: 3.0% annuallyOur Judgment: Hold

The drug giant is having a tough year, as it is still absorbing the impact of the loss of patent protection last year for its asthma drug, Singulair. The company’s pipeline of new drugs isn’t as promising as that of rival Pfizer. But Merck’s shares are worth holding onto for income and for their turnaround potential.

Procter & Gamble

- Symbol: PG52-Week High: $82.5452-Week Low: $60.78Annual Sales (billion): $83.70Five-Year Projected Earnings Growth: 7.7% annuallyOur Judgment: Hold

The maker of Crest toothpaste, Tide detergent, Gillette razors and other household products lost market share in recent years as strapped consumers shifted to cheaper brands. Sales in emerging nations haven’t been strong enough to pick up the slack. But this steady Eddie has raised its payout in each of the past 57 years.

Verizon

- Symbol: VZ52-Week High: $54.3152-Week Low: $40.51Annual Sales (billion): $115.80Five-Year Projected Earnings Growth: 10.5% annuallyOur Judgment: Hold

Verizon Wireless, the nation’s largest provider of mobile-phone service, has been steadily winning market share in recent years (Verizon owns 55% of Verizon Wireless). And its investments in building high-speed, high-capacity fiber-optic lines (called FiOS) to homes and businesses should pay off for years to come. Verizon is a great company, but its shares are pricey.

Wal-Mart Stores

- Symbol: WMT52-Week High: $79.9652-Week Low: $67.37Annual Sales (billion): $469.20Five-Year Projected Earnings Growth: 9.3% annuallyOur Judgment: Hold

The world’s largest retailer, Wal-Mart Stores is a great company in a highly competitive industry. The firm is cutting prices in the U.S. in a bid to take market share from other discounters, and it plans to open about 500 Neighborhood Market grocery stores over the next four years. But Wal-Mart is struggling to succeed outside the U.S.

Walt Disney

- Symbol: DIS52-Week High: $67.8952-Week Low: $46.53Annual Sales (billion): $42.3Five-Year Projected Earnings Growth: 12.4% annuallyOur Judgment: Hold

The entertainment giant is on a roll. In the January–March quarter, sales and profits were up in every one of its segments—with more visitors to its theme parks, more viewers for its blockbuster movies, and higher results for its TV channels—compared with the same period in 2012. But with the stock up almost 40% over the past year, buying now would be buying high.

Alcoa

- Symbol: AA52-Week High: $9.9352-Week Low: $7.71Annual Sales (billion): $23.70Five-Year Projected Earnings Growth: 6.5% annuallyOur Judgment: Sell

Shares of the largest U.S. aluminum producer have shed 83% from their all-time high of $47 in 2007, tracking a broader decline in aluminum prices. Although a big jump in economic activity could breathe some life into this stock, we think it’s unlikely the economy will jump as much as needed. Moody’s recently lowered Alcoa’s credit rating to junk status in anticipation of continued weak aluminum prices.

Hewlett-Packard

- Symbol: HPQ52-Week High: $25.8752-Week Low: $11.35Annual Sales (billion): $120.4Five-Year Projected Earnings Growth: 0.0% annuallyOur Judgment: Sell

Some investors worry that computer and printer maker HP could fall victim to the “death of the personal computer,” as consumers embrace mobile devices. They may be right, as management has yet to demonstrate that it has a strategy for avoiding such a fate. Missteps recently caused a $9 billion loss on a bad acquisition. And after gaining 74% this year, the stock isn’t cheap.

More from Kiplinger

OPENING SHOT: Why I Love the Dow

STOCK WATCH: Read All Stock Watch Columns

12 Stocks to Get Dividends Every Month

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.