7 Ways PPP Loans Just Got Better

The Paycheck Protection Program Flexibility Act makes a number of changes to the popular small-business loan program. See how your business might benefit from the improvements.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

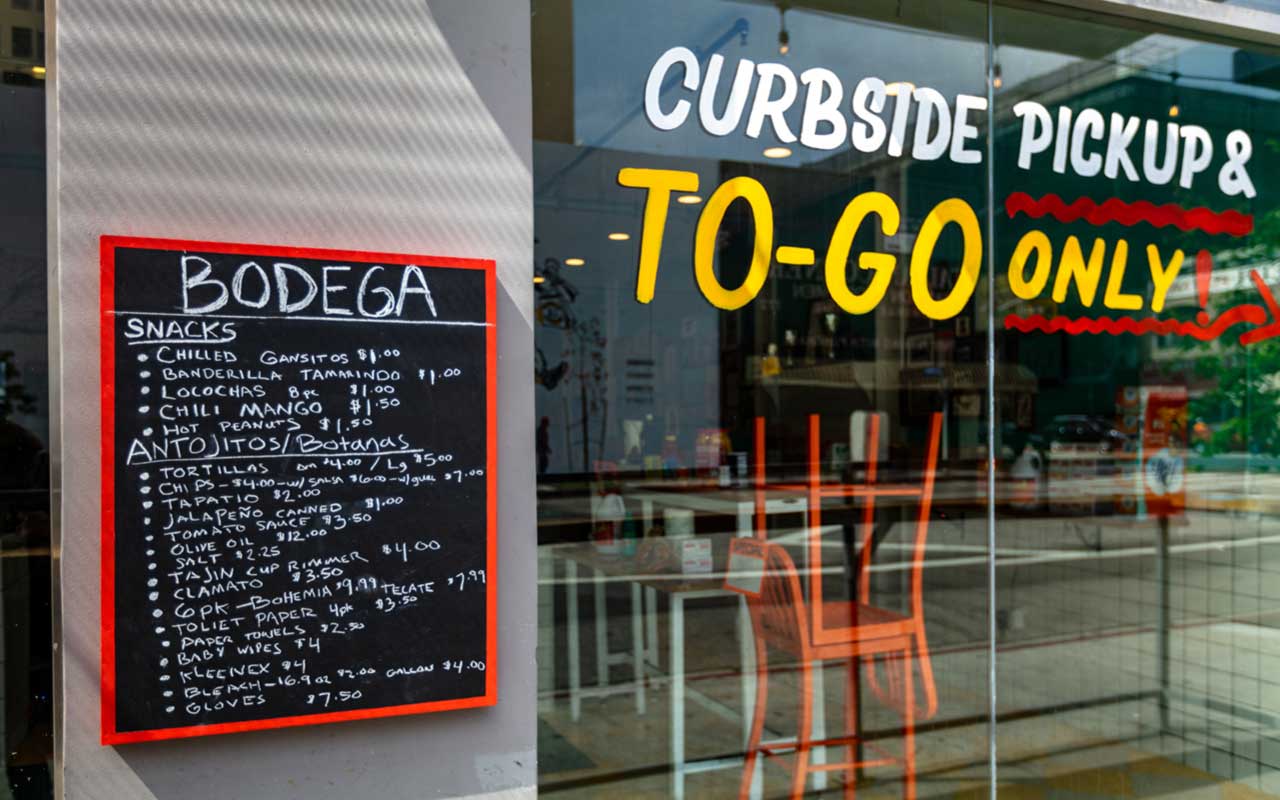

The CARES Act, which was signed into law on March 27, 2020, provided much-needed economic relief to businesses and employees affected by the COVID-19 pandemic. One of the CARES Act's key components was the Paycheck Protection Program (PPP), which offers forgivable loans to small businesses so that they can make their payrolls during the pandemic. However, the CARES Act included a number of restrictions that have hampered the effectiveness of the program.

But now there's some good news for small business owners: President Trump signed the Paycheck Protection Program Flexibility Act (PPPFA), which gives borrowers additional time and flexibility to use PPP loan proceeds. The legislation zipped through Congress with bipartisan support, and there's high hopes that the PPPFA will provide an additional boost for small businesses trying to claw their way out of the pandemic-induced economic crisis.

We've listed 7 of the most significant changes from the PPPFA. Read on to see how your business might benefit from the improvements.

Loan Maturity Date

Under the CARES Act and Small Business Administration regulations, the term of any unforgiven portion of a PPP loan is two years from origination. The PPPFA extends the maturity of PPP loans from two years to five years. The extended repayment period applies only to PPP loans made after June 5, 2020, but lenders and borrowers can renegotiate the maturity of any previously existing PPP loan.

Deadline to Use Loan Proceeds

Under the CARES Act, PPP loans don't have to be repaid to the extent the borrowed money is used to cover the first eight weeks of the business's payroll costs, rent, utilities, and mortgage interest. However, current PPP borrowers can now choose to extend the eight-week period to 24 weeks, or they can keep the original eight-week period. New PPP borrowers will automatically have a 24-week period, but the use period can't extend beyond December 31, 2020.

Forgivable Uses of Loan Proceeds

Originally, PPP borrowers had to use at least 75% of loan proceeds for payroll costs. Borrowers who failed to satisfy this requirement had their loan forgiveness amount reduced. However, under the PPPFA, the 75% threshold is now reduced to 60%. As a result, borrowers can now use up to 40% of PPP loan proceeds for nonpayroll costs, such as rent, utility and mortgage-interest payments.

Rehiring Workers

The amount of a PPP loan that is forgiven is generally reduced if the borrower cuts back on the number of "full-time equivalent" (FTE) employees during the eight-week or 24-week coverage period. However, this rule doesn't apply for a significant decrease in employment and/or wage levels between February 15 and April 26, 2020, if the number of workers and wage levels are restored by June 30, 2020. The new law extends this deadline from June 30 to December 31, 2020.

Inability to Rehire Workers or Return to Full Operation

The PPPFA also adds a new exception to the loan forgiveness reduction rules. Now, the amount of a PPP loan that is forgiven won't be reduced due to the borrower's failure to restore FTE levels by December 31, 2020, if, in good faith, the business can document an inability to:

- Rehire people who were employees on February 15, 2020, and hire similarly qualified employees for unfilled positions by Decmber 31, 2020; or

- Return to its pre-February 15, 2020, level of business activity because it's complying with COVID-19 regulations or guidance issued by the Department of Health and Human Services, Centers for Disease Control and Prevention, or Occupational Safety and Health Administration between March 1 and December 1, 2020.

These exemptions are important for businesses that are unable to return to full operation because of restrictions on customer capacity or similar reopening restrictions.

Loan Deferral Period

The CARES Act allows borrowers to defer payment of PPP loan amounts for six months from disbursement of the loan. The PPPFA extends the deferral period until the date that the amount of loan forgiveness is determined. If the borrower doesn't apply for loan forgiveness, the business must begin making payments 10 months after the last day of the eight- or 24-week loan use period.

Payroll Tax Deferral

The CARES Act permits a business to delay payment of employer payroll taxes through December 31, 2020 (payments are due over the following two years). However, the CARES Act did not permit PPP borrowers to take advantage of this benefit. The new law removes this restriction, so any PPP borrower can now delay payment of its payroll taxes like other businesses.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rodrigo Sermeño covers the financial services, housing, small business, and cryptocurrency industries for The Kiplinger Letter. Before joining Kiplinger in 2014, he worked for several think tanks and non-profit organizations in Washington, D.C., including the New America Foundation, the Streit Council, and the Arca Foundation. Rodrigo graduated from George Mason University with a bachelor's degree in international affairs. He also holds a master's in public policy from George Mason University's Schar School of Policy and Government.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

32 Ways to Make Money in 2025

32 Ways to Make Money in 2025business Check out these cool side hustles to earn bonus bucks this year.

-

12 IRS Audit Red Flags for the Self-Employed

12 IRS Audit Red Flags for the Self-Employedtaxes If you are self-employed, minimize the odds of an IRS audit by avoiding these audit triggers.

-

Business Cost Outlooks for 2022: Eight Key Sectors

Business Cost Outlooks for 2022: Eight Key SectorsEconomic Forecasts What’s in store for all sorts of business costs in 2022?

-

Open Enrollment Brings New Employee Perks (for a Price)

Open Enrollment Brings New Employee Perks (for a Price)Employee Benefits The pandemic and an increasingly diverse workforce have led to more benefits options for workers.

-

I Sold My Business … Now What?

I Sold My Business … Now What?small business The rich cash infusion that comes from selling a business can create a liquidity conundrum that's a challenge to manage.

-

COVID Sparked a Surge of Generosity

COVID Sparked a Surge of GenerosityCoronavirus and Your Money One big focus among donors: charities that address food insecurity.

-

Tough Times for a Family Business

Tough Times for a Family BusinessBusiness Costs & Regulation His dry-cleaning operation was rocked by the pandemic, but he is staying optimistic.

-

Our "K-Shaped," Uneven Economic Recovery

Our "K-Shaped," Uneven Economic RecoveryEconomic Forecasts Confidence is key to the recovery, but the sentiment depends on consumers’ financial circumstances.