A Kiplinger-Alliance for Lifetime Income Poll: Americans & Retirement Security

The majority of respondents in our poll would welcome more guaranteed income.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

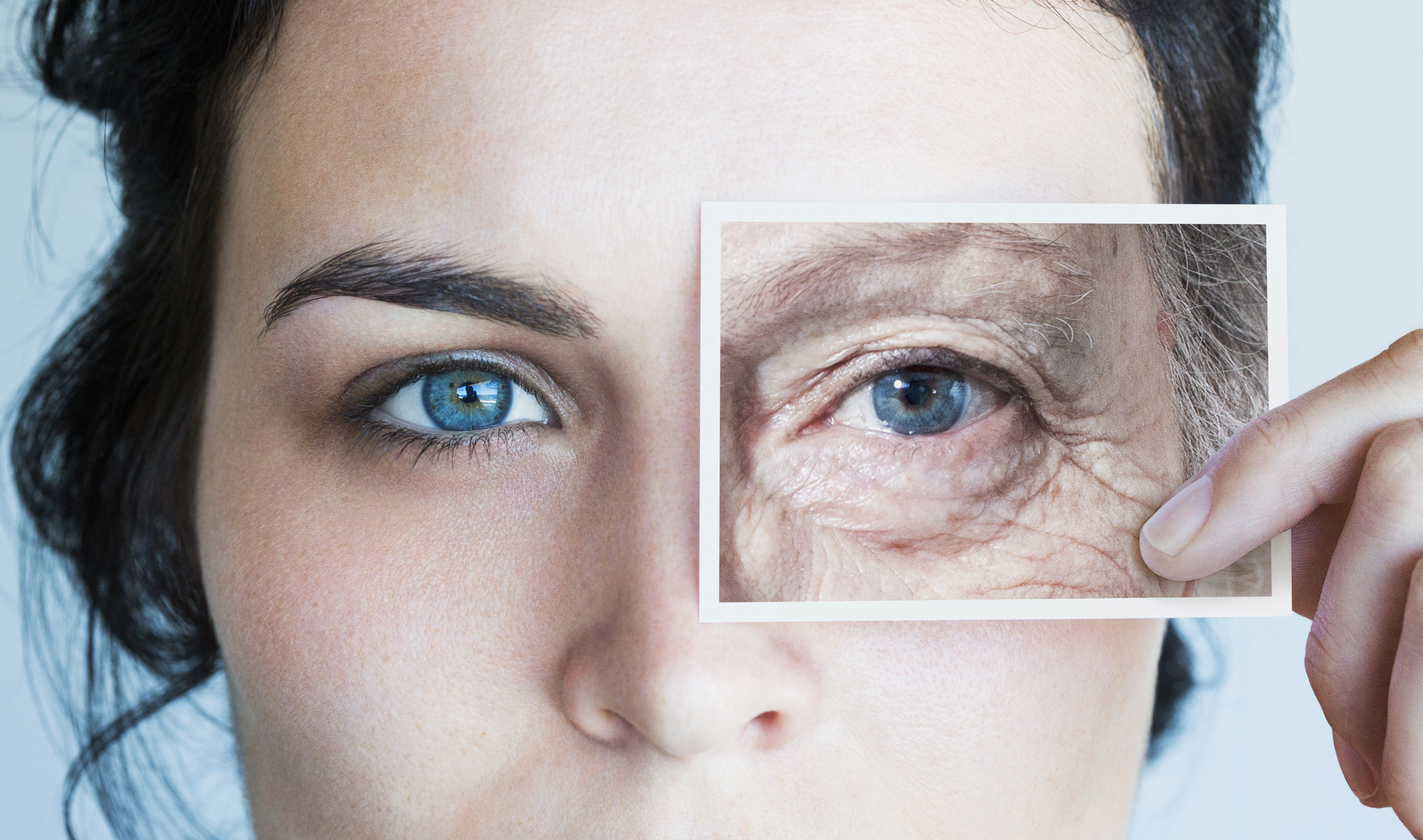

Americans are generally upbeat about their prospects for a secure and comfortable retirement, even after feeling the effects of the coronavirus pandemic and stock market volatility. But preretirees are less confident than those already retired about creating a secure income stream in retirement.

Those are among the conclusions of a new poll conducted by Kiplinger’s Personal Finance, in partnership with the Alliance for Lifetime Income, a trade group that helps educate consumers about how to protect assets in retirement.

The pandemic-induced bear market in February and March dampened the retirement investments of nearly two-thirds of respondents. And a majority (56%) of those polled say they would like more guaranteed income.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Even so, nearly three-fourths of respondents are very or somewhat confident that they can create a secure income stream, or “paycheck,” in retirement. Part of the reason: About half of preretirees and 70% of retirees in our survey receive a pension, although for more than half of them it is a modest monthly income of $2,500 or less. Women, respondents in their fifties and those with net worth of less than $500,000 are somewhat less confident about achieving a secure retirement.

We’ve included highlights from the poll here (figures are medians unless otherwise indicated).

What sources of retirement income (beyond Social Security) do you expect to receive?*

- Withdrawals from a retirement savings plan: 66%

- Pension from my employer: 50%

- Interest income from CDs and savings accounts: 39%

- Income from bonds, dividend-paying stocks or REITs: 33%

- Annuity income: 21%

- Rental income from real estate: 11%

- Income from a trust: 5%

- Other: 6%

- None: 3%

How confident are you that you have or will have enough income to live comfortably in retirement?**

- Very confident: 25%

- Somewhat confident: 48%

- Neither confident nor unconfident: 17%

- Somewhat unconfident: 8%

- Very unconfident: 3%

Do you have a plan for how you will draw down your retirement savings?

- I don’t plan to touch my principal. My living expenses will be covered by Social Security, investment income, a pension or annuity: 28%

- I plan to withdraw an amount each year that will rise or fall depending on returns: 18%

- I plan to use a rule of thumb, such as the 4% rule, as a guide: 15%

- I’m leaving it up to my financial adviser: 12%

- I plan to pay my bills from my savings, just as I do now: 11%

- No, and that worries me: 9%

- No, but I will go back to work if my money runs low: 5%

- Other: 2%

Do you work with a professional financial adviser for your retirement savings and investments?

- Yes: 50%

- No 50%

Would you be willing to put a portion of your retirement savings into an annuity that would guarantee a monthly income for the rest of your life?**

- Not sure: 35%

- No, I would not consider this: 26%

- Yes, in the future: 23%

- Yes, I have already done so: 17%

Which of the following are you very or somewhat worried about during retirement?*

- Not being able to afford long-term care if I or my spouse needs it: 65%

- Running out of money when I’m older: 58%

- Not being able to afford quality health care: 55%

- Being too cautious financially and not enjoying retirement: 53%

- Not having enough money to live comfortably: 53%

- Not being able to travel as much as I want: 45%

- Not getting a regular paycheck: 39%

- Not being able to find new activities to fill my time: 29%

- Leaving a job that I enjoy: 28%

- Having to rely on my adult children for financial support: 23%

Percentage of respondents who took (or plan to take) Social Security before full retirement age

- 31%

Why did you claim Social Security benefits early?*

- I was concerned about future benefit cuts: 24%

- I needed more income: 15%

- To maximize benefits with my spouse: 15%

- I wanted to invest my benefits: 12%

- Longevity doesn’t run in my family: 11%

- I wanted to delay tapping my portfolio: 11%

- Health issues made it impossible for me to continue working: 8%

- Other: 24%

Nearly 30% of those in our survey who have an employer retirement savings plan have the option to invest a portion of their savings in an annuity. Have you done so?

- Yes: 66%

- No: 34%

Methodology

We surveyed a national sampling of 840 Americans between the ages of 50 and 75, equally divided between men and women, who had a net worth of at least $100,000. The poll was conducted by Brown Oak Audience Insights from June 11 to June 13, 2020 and has a 3.4% margin of error.

*Respondents were asked to choose all applicable options.

**Percentages do not add up to 100% due to rounding.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

10 Retirement Tax Plan Moves to Make Before December 31

10 Retirement Tax Plan Moves to Make Before December 31Retirement Taxes Proactively reviewing your health coverage, RMDs and IRAs can lower retirement taxes in 2025 and 2026. Here’s how.

-

The Rubber Duck Rule of Retirement Tax Planning

The Rubber Duck Rule of Retirement Tax PlanningRetirement Taxes How can you identify gaps and hidden assumptions in your tax plan for retirement? The solution may be stranger than you think.

-

COVID Aged Your Brain Faster, Even if You Didn't Get Sick

COVID Aged Your Brain Faster, Even if You Didn't Get SickWhether you contracted COVID or not, your brain took a hit. Here's what that means for your health and what you can do about it.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

QCD Limit, Rules and How to Lower Your 2026 Taxable Income

QCD Limit, Rules and How to Lower Your 2026 Taxable IncomeTax Breaks A QCD can reduce your tax bill in retirement while meeting charitable giving goals. Here’s how.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Estate Planning Checklist: 13 Smart Moves

Estate Planning Checklist: 13 Smart Movesretirement Follow this estate planning checklist for you (and your heirs) to hold on to more of your hard-earned money.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.