Your State (and Trump) Wants to Help You Save for Retirement. Here's How

Maximize your retirement savings by setting up a state-sponsored auto-IRA. And with Trump's newly announced plan, you might even get a match on 401(k) funds in 2027.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Saving for retirement is essential, but it can feel overwhelming; even some higher earners might fall short.

The reality is that those with a workplace 401(k) have a significant advantage in saving. The 57 million employees without a workplace plan not only miss out on employer-matched contributions but also lack an easy account to invest in, where contributions are made by default from paychecks.

Those who have had no workplace plans for most of their working life are typically hit the hardest and struggle the most with financial security in retirement. However, losing access to a 401(k), even for a short time late in life, can have a significant impact during prime saving years.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

This is an issue many older workers face if they're forced out of a secure job too soon, often working part-time or in jobs that offer few benefits and earnings far below their peak. In fact, in both 2024 and 2025, 22% of workers felt they were pushed out of their jobs because of their age.

Whether you're a young worker who doesn't have the kind of job that comes with a 401(k) or an older worker struggling to keep up with savings goals, there's some good news on the horizon. A growing number of states are offering a viable 401(k) alternative, which will come with some additional benefits starting in 2027.

This solution can help if you don't have a 401(k) at work

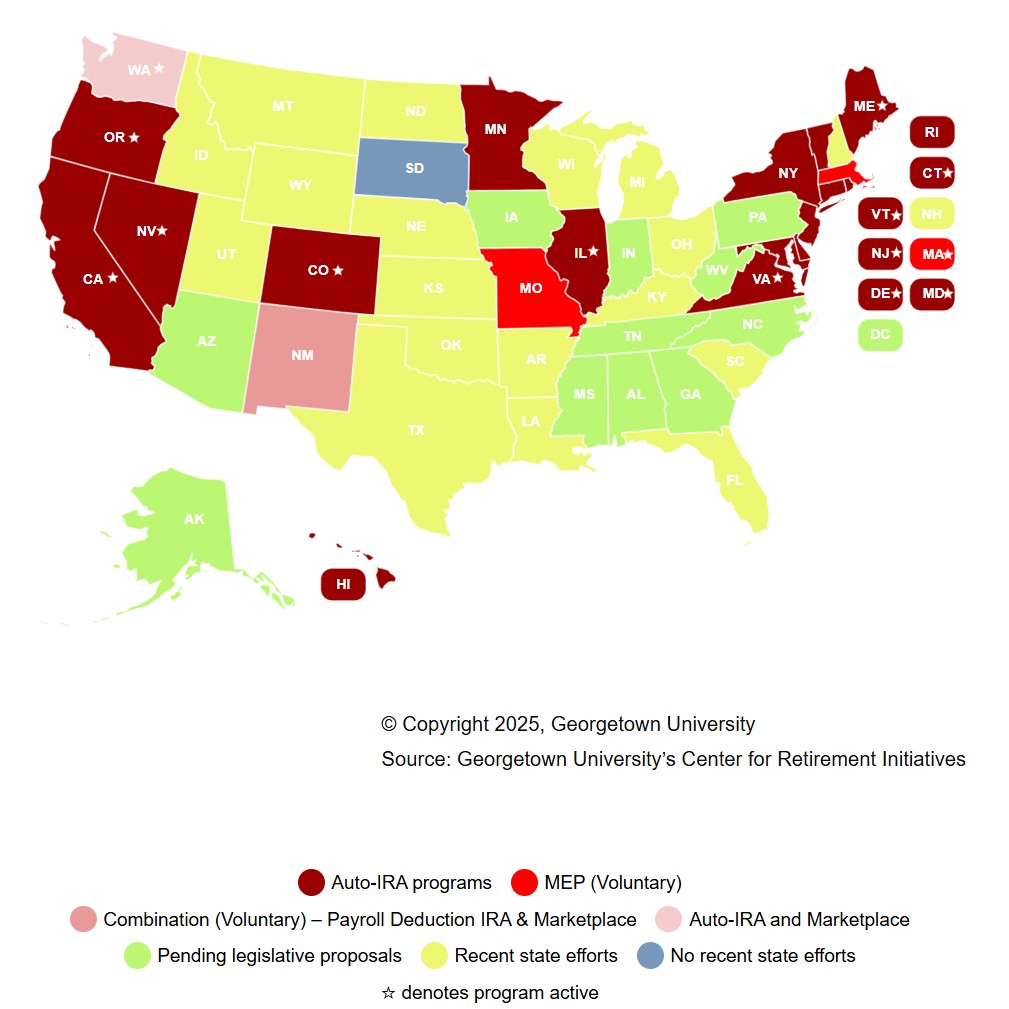

States are often left to pick up the slack when there's a retirement savings gap, as individuals with too little invested turn to social-assistance programs. In an effort to increase retirement savings and reduce reliance on government benefits, 17 states now offer some type of automated individual retirement accounts (auto-IRAs), as of January 2026.

While there's some variation, auto-IRAs generally enroll employees automatically (pdf) in individual retirement accounts managed by state-approved financial services firms, and automated contributions are collected through payroll deductions.

This happens in much the same way many workplace plans auto-enroll new staff members in 401(k)s, and transfer funds automatically into the company's 401(k) plan before paychecks are issued.

Auto-IRAs do allow workers to opt out or change their contribution rates, and employers don't make additional matching contributions as they typically do with 401(k)s. Still, the fact that auto-IRAs make enrollment the default significantly increases the chances of people contributing — and improving their retirement readiness.

Participating states are indicated in dark red below. If your state is a different color, you can read more about its efforts to start an auto-IRA or similar program in a summary developed by the Georgetown University Center for Retirement Initiatives.

South Dakota is the only state not involved in this type of program. If you live in California, you can take advantage of the new "CalSavvy" chat function to help you navigate the CalSavers program.

A federal program that sweetens the pot: Saver's Match

As most state programs lack matching contributions, there's less incentive for worker participation, and workers get less support in saving.

That changes starting in 2027, as the federal Saver’s Match incentive takes effect under SECURE 2.0. In President Trump's February 24, 2026, State of the Union address, Trump announced plans to expand access for workers without employer-sponsored plans, providing them a retirement option similar to the federal Thrift Savings Plan, with the government matching contributions up to $1,000 annually.

White House officials confirmed this aligns with and advances the existing Saver’s Match. Under the program, the federal government will match 50% of contributions to an eligible worker's IRA or workplace plan, up to a maximum of $1,000 for individuals or $2,000 for couples filing jointly on the first $2,000 saved.

The matching funds are available to individuals earning $35,000 or less, or couples with $71,000 or less, with phase-outs beginning at $20,500 for singles or $41,000 for joint filers. These thresholds are indexed for inflation in future years.

During his address, President Trump had this to say about the program:

"Half of all working Americans still do not have access to a retirement plan with matching contributions from an employer. To remedy this gross disparity, I'm announcing that next year, my administration will give these oft-forgotten American workers, great people, the people who built our country, access to the same type of retirement plan offered to every federal worker. We will match your contribution with up to $1,000 each year."

Saver's Match could enhance the retirement savings of millions of low- and moderate-income households, Pew wrote in a report about the new accounts. This greater opportunity for workers to save for retirement would help them secure their futures and also ease burdens on state budgets as lawmakers face the demands of an aging population.

The existence of the match could also prompt people to save more. While 84% of respondents to Pew's survey expressed initial interest in an auto-IRA program even without the matching funds, that number jumped to 94% after hearing about the Saver’s Match.

With explicit support from the Trump administration in the recent State of the Union, the Saver’s Match appears on track for implementation in 2027, rather than facing risks of defunding.

Should you contribute to an auto-IRA?

If your state offers an auto-IRA and you're eligible, contributing to it is a no-brainer.

Even with the Saver’s Match now on track for likely implementation in 2027, IRA accounts offer numerous benefits regardless, including greater flexibility in your investment choices.

Saver's Match FAQs

If you suspect you might qualify for the Saver's Match, though, it's important to make sure you don't lose out. As per the specifics outlined in SECURE 2.0, Section 103, here is what is needed:

- Make eligible contributions in 2027. You must contribute to a qualifying retirement account, such as:

- A workplace plan (e.g., 401(k), 403(b), governmental 457(b), SIMPLE IRA, SEP IRA) via elective deferrals or voluntary contributions.

- An IRA. Keep in mind that traditional IRAs qualify; Roth IRAs generally do not, as the match goes to pre-tax accounts. The match applies to up to $2,000 in your annual contributions (50% match = up to $1,000 max per person, or $2,000 for joint filers if both qualify/contribute).

- Meet basic personal requirements (same as the current Saver’s Credit):

- Be age 18 or older by the end of the tax year.

- Not a full-time student for any part of 5 calendar months in the year.

- You are not claimed as a dependent on someone else’s tax return.

- Not a nonresident alien (with limited exceptions).

- Check your modified adjusted gross income, or MAGI: This is the primary limiter, and thresholds are set for 2027 but will be inflation-adjusted in future years.

- Full 50% match: MAGI up to $20,500 for single filers; $30,750 for heads of household, or $41,000 iif married and filing jointly.

- Partial/phased-out match: Reduces gradually between $20,501–$35,500 (single), $30,751–$53,250 (head of household), or $41,001–$71,000 (joint). There aren't matching amounts above the upper limit. To estimate, use your expected 2027 MAGI, or use the Retirement Clearinghouse Saver’s Match Estimator.

- Make a claim via your tax return (process details still finalizing):

- File your 2027 tax return (in 2028) and indicate your qualifying contributions.

- A new separate IRS form will likely handle the Saver’s Match claim.

- The Treasury will deposit the match directly into your eligible retirement account.

- Your plan or IRA provider must accept these federal deposits. No separate "application" exists now — it's claimed on your taxes after contributing.

Note: This program is still in the implementation phase, with the IRS seeking comments and planning details, such as a new tax form, so official tools or final forms aren't fully rolled out yet. In fact, it's still unclear whether employers would fund the account and how exactly the matching would come into play.

Funding for the Saver’s Match is authorized as mandatory spending under the 2022 SECURE 2.0 Act and requires no new congressional approval for its 2027 rollout. However, expansions announced by Trump may need Congressional approval.

Keep track of your auto-enrollments

Whether you're eligible for a Saver's Match, auto-enrolled in an IRA, or auto-enrolled in a 401(k), you'll always want to keep tabs on your retirement funds.

It's up to you to build a secure retirement, so make sure you have a clear idea of your savings goals and that you're on track to achieve them, so you don't find yourself struggling as a retiree.

Building a dream retirement shouldn’t feel like a second job. Subscribe to our free newsletter, Retirement Tips.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Christy Bieber is an experienced personal finance and legal writer who has been writing since 2008. She has been published by Forbes, CNN, WSJ Buyside, Motley Fool, and many other online sites. She has a JD from UCLA and a degree in English, Media, and Communications from the University of Rochester.

- Kathryn PomroyContributor

- Ellen B. KennedyRetirement Editor, Kiplinger.com

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

How Medicare Advantage Costs Taxpayers — and Retirees

How Medicare Advantage Costs Taxpayers — and RetireesWith private insurers set to receive $1.2 trillion in excess payments by 2036, retirees may soon face a reckoning over costs and coverage.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning Strategy

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning StrategyOnce you're retired, your focus should shift from maximum growth to strategic preservation and purposeful planning to help safeguard your wealth.

-

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just Valuables

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just ValuablesLegacy planning integrates your values and stories with legal and tax strategies to ensure your influence benefits loved ones and good causes after you're gone.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

My Grandkids Want Me to Donate to Their Teams and School Fundraisers. I Adore Them, but I'm on a Budget.

My Grandkids Want Me to Donate to Their Teams and School Fundraisers. I Adore Them, but I'm on a Budget.When your heart says "yes" but your wallet says "no," there is still a way forward. Here's what financial pros say.

-

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'Becoming "work optional" is about control — of your time, your choices and your future. This seven-step guide from a financial planner can help you get there.

-

Quiz: Do You Know How to Maximize Your Social Security Check?

Quiz: Do You Know How to Maximize Your Social Security Check?Quiz Test your knowledge of Social Security delayed retirement credits with our quick quiz.