Top Five Tips From Current Retirees to Future Generations

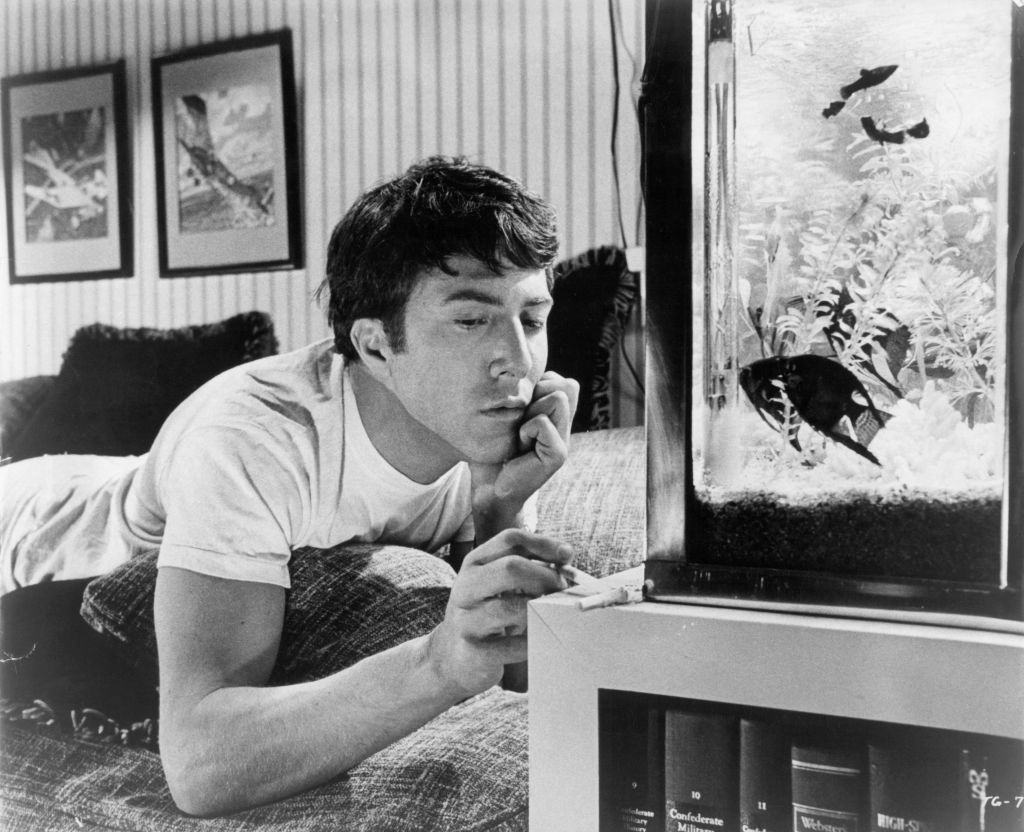

"Plastics" is no longer the wisdom passed down to the young, as in "The Graduate." These days, retirees are giving much better advice.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Just as history repeats itself, or at least rhymes, so future generations can learn a thing or two about retirement planning from their elders. We don't mean the dubious advice given to the listless twenty-something in the 1967 film, The Graduate: "I just want to say one word to you. Just one word.... Plastics!" Today's retirees offer far better counsel for those who are still working, from recent graduates to the oldest Gen Xers.

Some of us are well-suited for thinking ahead and others — not so much. A Nationwide study found that two-thirds of investors surveyed spent no time on retirement planning at all. Failing to prepare for your later years can leave you at risk of running short of funds, especially as Social Security benefits cover only around 40% of pre-retirement income.

The good news is that the right guidance can help future retirees get on the path to financial success. In Fidelity's newly released 2025 State of Retirement Planning report, today's retirees offered five key tips for future generations. Here's what they are.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

1. Start saving as early as possible, even if it's not much

The number one piece of advice, given by 66% of current retirees, was to begin saving as early in life as possible, even if you can save only small amounts at the start. This advice is crucial because the earlier you begin investing, the more compound growth helps your nest egg to grow, and the less you have to actually set aside for the future.

If you start saving at 20 and invest $184 per month, you would become a millionaire by age 67, assuming an 8% average annual return. If you wait a decade until you're 30, that number jumps to $410, while those who begin saving at 40 face a much more daunting challenge of setting aside $954 per month.

Getting into the habit of investing early also makes it much more likely that you'll stick with the plan. You can then base your budget around investing before taking on additional financial commitments, such as buying a home or having children.

2. Take full advantage of employer-sponsored 401(k)s

Taking advantage of 401(k) plans was another key piece of advice given by 58% of current retirees. Again, this guidance makes good sense as 401(k) contributions come with both tax breaks and, often, employer matching contributions.

If you contribute $1,000 to a 401(k) and are in the 22% tax bracket, the contribution may reduce your take-home pay by as little as $780 after accounting for your tax break. If your employer matches 100% of your contribution, you'd spend $780 to end up with $2,000 invested — an impressive return that no one should be missing out on.

A growing number of 401(k) plans auto-enroll employees. If yours doesn't, sign up as soon as possible. Aim to invest 10% to 15% of your income, even if you must work up to this amount. One good way to do that is to divert your raises to your 401(k) funds as soon as you receive them, so you can boost your retirement savings with money you aren't used to spending.

If your account is auto-enrolled, ensure the withdrawal amount is sufficient. Experts at Harvard Business School warn that contribution amounts often start at a low percentage of your salary. Moreover, if you change jobs frequently, auto-escalation of contributions may happen too slowly.

"Unless the employee actively chooses a different path for their contributions, a fraction of their paycheck goes into their 401k account as retirement savings," John Beshears, the Albert J. Weatherhead Jr. Professor of Business Administration, said in an interview with Harvard.

"That fraction is going to be on a schedule to ratchet up, say, once a year. For the employee who, on a regular basis, leaves their job after one or two years — for them, the escalator doesn't have a chance to fully kick in. Then you have to start at 3 percent again, because you're moving to a new company."

Curious how your 401(k) savings stack up to that of your peers? Check out our article on the average 401(k) balance by age.

3. Pay off high-interest debt before shifting your focus to retirement savings

Debt was a troubling issue for current retirees, with 42% urging today's workers to pay off high-interest loans before they shift their focus to retirement savings.

It's not surprising that retirees urge debt payoff as a top priority, as recent research has shown the amount of non-mortgage debt seniors have is one of the key factors that determine their happiness in retirement.

Unfortunately, Federal Reserve data shows the current group of retirees is both more likely to owe money than older Americans in the past and more likely to owe larger amounts. Those older Americans who are still in debt likely want their younger peers to avoid making the same mistakes.

4. Educate yourself about social security and retirement benefits

Many current retirees — 41% — have urged today's workers to educate themselves on how Social Security and retirement benefits work. It's understandable why this advice is so common, as a study published by the National Bureau of Economic Research revealed that a fifth of older Americans regretted not delaying their Social Security claim.

Unfortunately, despite Social Security being a key source of retirement income, research from the American Society of Pension Professionals and Actuaries revealed that only 8% of adults could correctly identify the factors that determine the amount of Social Security they will receive. As a result, many people claim without the knowledge they need to maximize benefits.

Since a claim at the earliest possible age of 62 could result in a 30% benefits cut compared to claiming at full retirement age, and could reduce the likelihood of maximizing your lifetime benefits, the consequences of claiming at the wrong time can be severe and lifelong. In fact, if you're married and the higher earner, you could even shrink survivor benefits for your spouse.

5. Consult a financial adviser to develop a retirement plan

Finally, 37% of current retirees advise those who are still working to consult with a financial adviser when making retirement plans.

Working with an adviser can help head off many of the issues mentioned above, as they can help create a solid plan for when to claim Social Security and how much to save and invest.

Fortunately, current workers still have time to implement this advice. By saving early and aggressively, focusing on debt repayment, and taking the time to learn the ins and outs of the Social Security system, those who are not yet retired have a golden opportunity to set themselves up for financial security in retirement that far too many people don't enjoy today.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Christy Bieber is an experienced personal finance and legal writer who has been writing since 2008. She has been published by Forbes, CNN, WSJ Buyside, Motley Fool, and many other online sites. She has a JD from UCLA and a degree in English, Media, and Communications from the University of Rochester.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

How Medicare Advantage Costs Taxpayers — and Retirees

How Medicare Advantage Costs Taxpayers — and RetireesWith private insurers set to receive $1.2 trillion in excess payments by 2036, retirees may soon face a reckoning over costs and coverage.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.