The Rule of Self-Reliance — a Retirement Rule

The rule of self-reliance holds that your well-being in old age is up to you, not your children, because "nothing can bring you peace but yourself."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

“Your mother-in-law is moving in,” my wife said with a smile — a smile I didn’t return.

Then came nervous laughter, followed by a serious conversation. Her mother has been living alone, and with rising prices and shrinking savings, it’s become clear she might soon need more support. Making room for a fifth person in our home is now something we must seriously consider.

Our situation is far from unique. While “boomerang kids” get most of the headlines, many households today are dealing with the opposite trend: Parents moving in with their adult children.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Although estimates vary by definition, research data show that roughly 30% of households are now multigenerational — many formed for financial or caregiving reasons.

Of course, family is family. Many adult children are happy to help, but that support can come at a cost.

Key findings indicate that many members of the so-called “sandwich generation” providing logistical and financial help to their parents often experience significant emotional and financial stress themselves.

It’s why Patrick Huey, owner and principal adviser of Victory Independent Planning, says: “One of the most universal goals I hear from retirees is: ‘I don’t want to end up a burden on my kids.’ ”

Experts say that reality should be a core consideration in retirement planning. One helpful way to frame it: the retirement rule of self-reliance.

When making decisions, from how you spend money to where you live, ask how those choices will impact your ability to remain independent. The goal isn’t just to enjoy retirement, but to reduce the odds your children will have to step in.

Here’s how financial professionals suggest you put the rule into practice.

The rule of self-reliance: Plan for financial flexibility

Maintaining financial self-reliance in retirement depends not only on how much you’ve saved, but how well your savings can stretch over time. Thanks to longer lifespans, today’s retirees face a greater risk of outliving their money, known as longevity risk.

Fewer than one in four retirees are very confident they’ll be able to maintain a comfortable lifestyle throughout retirement, according to the Transamerica Center for Retirement Studies.

How can retirees stay resilient when financial challenges arise?

“Start with a spending plan that can flex as life changes,” Huey says. “I generally advise against overspending early in retirement. Also, use a dynamic withdrawal strategy, like the ‘guardrails’ approach, so you can adjust spending if markets drop or big expenses loom.”

Still, there’s one area in which flexibility can backfire: Financially supporting adult children.

“About half of parents now financially support their adult children, often to the tune of $1,400 a month,” Huey notes. “While generosity feels good, ongoing support can drain your resources and, ironically, increase the chances that you’ll need to lean on your kids later.”

Don't ignore the cost of care

Few things can derail a retirement plan or strain family dynamics as the need for long-term care.

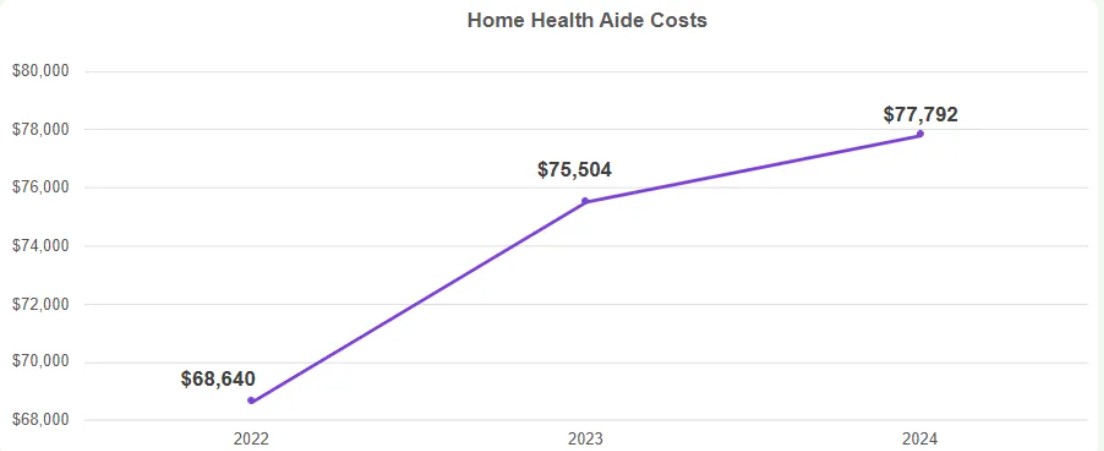

According to the University of Michigan’s 2024 National Poll on Healthy Aging, nearly half of older adults worry about their future care needs, and with good reason. Genworth reports that a home health aide now costs around $77,000 a year, while a private nursing home room can exceed $127,000.

These costs aren’t covered by Medicare, leaving many families scrambling to cover the gap.

One survey found that 56% of adults would consider taking a loan from their retirement accounts to provide care for a loved one, while 43% fear caregiving expenses could prevent them from ever retiring.

“Relying on adult kids for caregiving can strain both sides,” says Huey. He recommends exploring long-term care insurance or hybrid life/LTC policies while you’re still relatively young and healthy.

Wait too long, and you might find the premiums too steep or become ineligible altogether. If coverage isn’t an option, earmark specific savings to help self-fund future care.

However, some people might struggle to even imagine themselves in that position.

“Create a financial retirement plan that includes at least one spouse needing long-term care for multiple years,” advises Eric Walters, managing partner and co-founder of Summit Hill Wealth Management. “Doing that helps bring a challenging topic forward so we can discuss and plan for it.”

Rethink where you live

For many working adults, housing is the biggest expense. In retirement? Still housing. But cost isn’t the only factor when choosing where to live in retirement. Can you age safely and comfortably in your current home?

According to AARP, 75% of Americans age 50 and older want to stay in their homes as long as possible. Yet nearly half say they’re unsure if their community will support their needs as they age.

“Evaluate your living space and consider making it age-friendly, or moving to a home with fewer barriers,” Huey says. “Sometimes, relocating closer to health care or community services can keep you independent longer.”

That could mean downsizing, moving to a one-story home or joining a continuing care retirement community (CCRC). Each of these options can help reduce physical and financial burdens later. If you intend to age in place, evaluate whether you need to make modifications well in advance of when you actually need them.

Walters adds that downsizing can lift another major weight: your stuff. “One of the main benefits of moving out of your oversized home is that it forces you to throw away, sell and give away all the things you’ve accumulated but nobody wants.”

The basis of good manners is self-reliance.

Ralph Waldo Emerson

Have the conversations now

Perhaps one of the most impactful ways to preserve independence and prevent family stress is also the simplest, yet most often avoided.

“The first and most overlooked strategy is open communication,” says Annie Garland, CFP® and wealth adviser at Wealth Clarity. “Too often the plan is simply, ‘I’m going to die in this house.’ That mindset can create crisis-driven decisions later. Having honest conversations early allows families to make choices rooted in love, safety and financial reality rather than emotion in the moment.”

Walters recommends preparing and regularly reviewing key estate-planning documents, such as advance directives, powers of attorney and living wills. Just as important: Keep an updated list of accounts, contacts and critical paperwork in a place your future self or loved ones can easily find.

That step alone can help ensure decisions are made according to your wishes and spare your family from having to piece everything together on their own.

Take care of the one thing you can’t outlive — your health

Ultimately, self-reliance in retirement rests just as much on your physical and mental well-being as it does on your finances.

Plenty of research shows daily habits such as staying active, eating well and keeping strong social connections can go a long way toward preserving independence and, in turn, easing the burden on your loved ones.

As Garland puts it: “The two best gifts aging parents can give their children are financial stability and physical vitality. Both require a lifetime of small, consistent choices.”

Most retirees want to enjoy life on their own terms while honoring the values that helped shape their families. Following the retirement rule of self-reliance means doing what you can today to stay independent longer and safeguard peace of mind for everyone involved.

Ralph Waldo Emerson, who quite literally wrote the book on self-reliance, said it best: “Nothing can bring you peace but yourself. Nothing can bring you peace but the triumph of principles.”

Read More Retirement Rules

- The '120 Minus You Rule' of Retirement

- The Retirement Rule of $1 More

- The 'First Year of Retirement' Rule

- The Y Rule of Retirement: Why Men Need to Plan Differently

- The Rule of 240 Paychecks in Retirement

- The 'Die With Zero' Rule of Retirement

- The '8-Year Rule of Social Security' — A Retirement Rule

- The Kevin Bacon Rule of Retirement

- The Rule of Retirement Inversion

- The Rule of 1,000 Hours in Retirement

- The 'Second Law' of Retirement Rules

- The Rule of Four Futures

- The Rule of $1,000: Is This Retirement Rule Right for You?

- The Rule of 55: One Way to Fund Early Retirement

- The 80% Rule of Retirement: Should This Rule be Retired?

- The 4% Rule for Retirement Withdrawals Gets a Closer Look

- The Rule of 25 for Retirement Planning: How Much Do You Need to Save?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.