Financial Advice and Retirement Confidence: What's Wealth Got to Do With It?

This retirement researcher notes that retirement confidence increases the most for those with access to advice who have a lower total level of savings.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

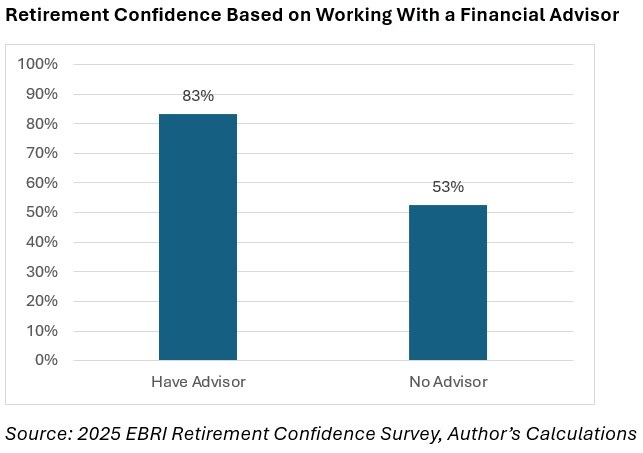

It is widely cited in the media that households that work with a financial advisor tend to have significantly higher levels of retirement confidence (or more generally financial well-being).

For example, leveraging data from the 2025 EBRI Retirement Confidence Survey (RCS), I find that 83% of working respondents who have a financial advisor are somewhat or very confident about their retirement vs only 53% of those who do not.

This statistic masks the fact that households who work with financial advisors tend to have significantly more wealth than those who do not, and that wealth has a significant positive relationship with retirement confidence.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Kiplinger Building Wealth program handpicks financial advisers and business owners from around the world to share retirement, estate planning and tax strategies to preserve and grow your wealth. These experts, who never pay for inclusion on the site, include professional wealth managers, fiduciary financial planners, CPAs and lawyers. Most of them have certifications including CFP®, ChFC®, IAR, AIF®, CDFA® and more, and their stellar records can be checked through the SEC or FINRA.

Therefore, it’s not necessarily clear what the impact of financial advice is on retirement confidence when controlling for things like age and wealth.

I explore this effect in this piece, leveraging data from 2025 EBRI RCS, where I find clear evidence that retirement confidence increases the most for those with access to advice who have a lower total levels of savings (i.e., wealth).

For example, retirement confidence increases by roughly 20 percentage points for working households with less than $100,000 in wealth (controlling for age) among those who use a financial advisor, while there is effectively no change in retirement confidence for households with more than $1 million in savings.

These findings suggest that while increasing access to financial advice would likely benefit all households, those with lower levels of wealth would likely get the greatest benefit in terms of boosting retirement confidence and potentially improving long-term retirement outcomes for Americans.

Retirement confidence

Retirement is perhaps the most complex financial goal most Americans must address. There is a variety of complex decisions that must be made when it comes to preparing for retirement, such as how to invest savings, how much to save, when to retire, etc.

In theory, access to a financial advisor can help households make better retirement decisions and therefore boost retirement confidence.

One of the questions in the 2025 EBRI Retirement Confidence Survey asks: “Overall, how confident are you that you (and your spouse) will have enough money to live comfortably throughout your retirement years?”

There are four possible responses:

- Very confident

- Somewhat confident

- Not too confident

- Not at all confident

I define a respondent as being confident about retirement if she is somewhat or very confident. The analysis only includes workers between the ages of 25 and 65 who know how much they have in savings in investments (not including their primary residence).

Here’s how retirement confidence varies among respondents who note having a financial advisor and those who do not:

We can see that 83% of respondents working with a financial advisor are somewhat or very confident about their retirement vs only 53% of those not working with a financial advisor.

These types of high-level statistics are often cited in the media, intended to imply that working with a financial advisor results in a significant improvement in expected retirement outcomes.

What these statistics ignore, though, is that there are significant differences in the attributes of households that have access to a financial advisor and the extent to which this could be driving these differences.

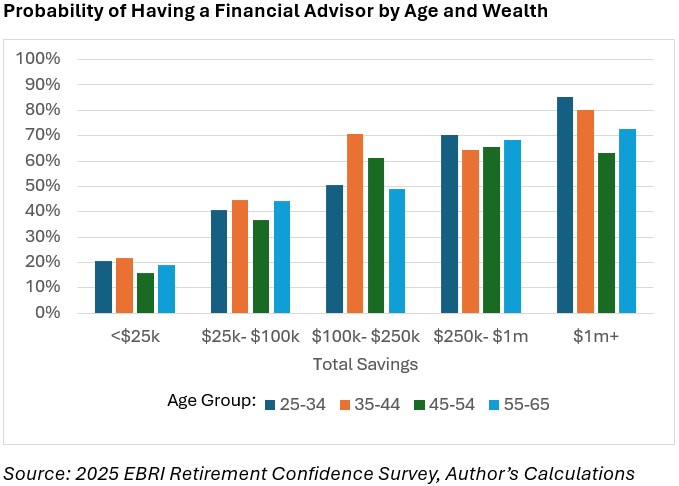

For example, the next chart includes information about the percentage of respondents who note working with some kind of financial advisor by age and total savings:

We can see there are material differences in the probability of working with a financial advisor, especially by wealth level.

For example, the probability of a respondent working with a financial advisor with less than $25,000 in total savings is only about 20%. In contrast, if the respondent has $1 million in savings, the probability is closer to 75%.

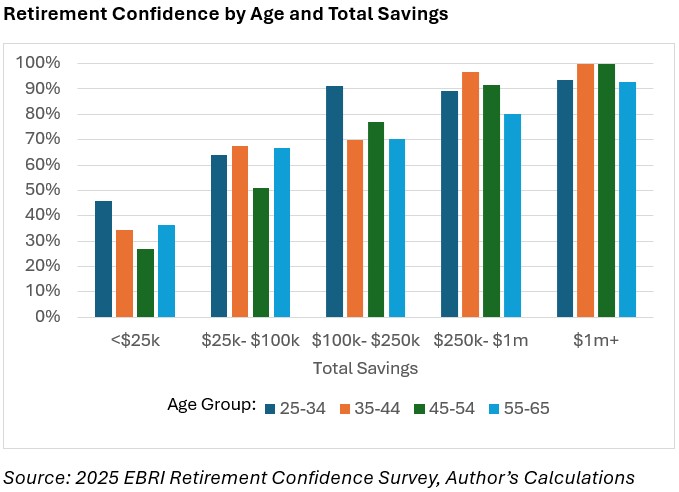

These differences in the likelihood of having an advisor are especially important when considering how retirement confidence is related to age and total savings.

We can see that while only about 30% of respondents with total savings of less than $25,000 are confident about retirement, closer to 95% of respondents with $1 million or more are.

Combined, households with a financial advisor tend to have significantly more savings, which is significantly (positively) related to retirement confidence.

This makes the impact of a financial advisor potentially ambiguous, since it’s clear that controlling for things like age and savings (but savings in particular) is important when attempting to estimate the potential impact of a financial advisor on retirement confidence.

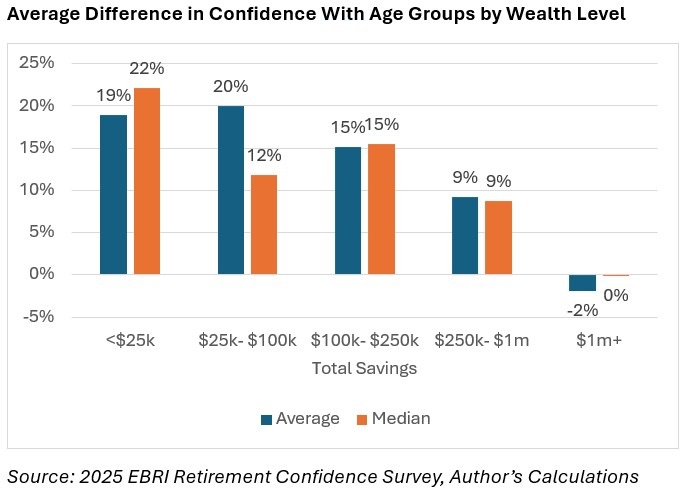

I did this by estimating the retirement confidence levels for the 20 different age and total savings groups considered previously for respondents who note working with a financial advisor and those who do not.

I then subtracted the retirement confidence level among those without a financial advisor from those with an advisor to determine the marginal potential impact and then estimated the average and median for each age group with each total savings level:

The impact of a financial advisor on retirement confidence clearly varies by level of total savings.

For example, respondents with a financial advisor who have less than $25,000 in savings have retirement confidence levels that are about 20 percentage points higher than those without. In contrast, there is virtually no difference among those with $1 million in savings.

Note that I wouldn’t take this to suggest financial advisors don’t or can’t benefit wealthier households, but rather that the impact is likely to be greater for those households with less wealth (i.e., those households that need more help).

While a variety of factors could be driving these differences, I believe the differences are related to how a financial advisor can help people make better decisions to improve their overall financial well-being or retirement preparedness.

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth, our free, twice-weekly newsletter.

For example, a financial advisor can help people save more for retirement and make better choices about debt, etc., which can have a meaningful long-term impact on financial well-being that may not be evident from things like total savings today.

This is also not intended to suggest financial advisors cannot benefit wealthier households, rather than the relative benefit is likely to be greater among those with lower levels of wealth.

Increasing access to financial advice: The key to better retirement outcomes?

The results of this analysis imply that the potential benefits of financial advice are not likely to be the same across all households, whereby households with lower levels of savings (or wealth) would likely benefit the most.

Unfortunately, these are the households that are also the least likely to have access to a financial advisor.

Therefore, focusing on avenues to increase access to financial advice among households with lower savings is likely to be especially important to improving retirement outcomes.

I think this is where employers can offer a variety of solutions that could be priced more attractively than what might exist in a more retail setting. These could span from more digital-focused tools (e.g., retirement managed accounts) to something much more holistic (e.g., access to financial advisors).

Regardless of how we increase access to advice to American households, doing so is likely going to be a key aspect of increasing retirement outcomes for all.

All investing involves risk. The views expressed herein are those of PGIM investment professionals at the time the comments were made and may not be reflective of their current opinions and are subject to change without notice. Neither the information contained herein nor any opinion expressed shall be construed to constitute an offer to sell or a solicitation to buy any security.

PGIM DC Solutions LLC ("PGIM DC Solutions") is an SEC-registered investment adviser, a Delaware limited liability company, and an indirect wholly-owned subsidiary of PGIM, Inc. ("PGIM"), the principal asset management business of Prudential Financial, Inc. ("PFI") of the United States of America. PGIM DC Solutions is the retirement solutions provider of PGIM and aims to provide innovative defined contribution solutions founded on market leading research and investment capabilities. Registration with the SEC does not imply a certain level of skill or training. PFI of the United States is not affiliated in any manner with Prudential plc incorporated in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom. Registration with the SEC does not imply a certain level of skill or training.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is not a recommendation. Clients seeking information regarding their particular investment needs should contact their financial professional.

Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information, nor do we make any express or implied warranties or representations as to the completeness or accuracy. Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated, based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

The foregoing may contain "forward-looking statements" which are based on PGIM DC Solutions’ beliefs, as well as on a number of assumptions concerning future events, based on information currently available to PGIM DC Solutions. Current and prospective readers are cautioned not to put undue reliance on such forward-looking statements, which are not a guarantee of future performance, and are subject to a number of uncertainties and other factors, many of which are outside PGIM DC Solutions’ control, which could cause actual results to differ materially from such statements.

No representation or warranty is made as to future performance or such forward-looking statements. PGIM DCS-4624864

Related Content

- Now's a Great Time to Become a Financial Adviser: Here's Why

- How Savvy Is Your Financial Adviser? Three Ways to Find Out

- Three Ways Fiduciary Financial Planners Put You First

- What You Expect in Retirement vs What You Get: Where Reality Can Surprise You

- Expecting a 12% Return on Your Portfolio? That’s Dangerous

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David Blanchett, PhD, CFA, CFP®, is Managing Director and Head of Retirement Research for PGIM DC Solutions. PGIM is the global investment management business of Prudential Financial, Inc. In this role he develops research and innovative solutions to help improve retirement outcomes for investors with a focus on defined contribution plans. Prior to joining PGIM he was the Head of Retirement Research for Morningstar Investment Management. He is currently an Adjunct Professor of Wealth Management at The American College of Financial Services and Research Fellow for the Alliance for Lifetime Income. David has published over 100 papers in a variety of industry and academic journals that have received awards from the CFP Board, the Financial Analysts Journal, the Journal of Financial Planning, and the International Centre for Pension Management. In 2014 InvestmentNews included him in their inaugural 40 under 40 list as a “visionary” for the financial planning industry, and in 2021 ThinkAdvisor included him in the IA25+. When David isn’t working, he’s probably out for a jog, playing with his four kids, or rooting for the Kentucky Wildcats.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.