What You Expect in Retirement vs What You Get: Where Reality Can Surprise You

A financial planner explores how your expectations for retirement can greatly differ from reality — and how you can plan for that.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When and how we each eventually retire can have significant implications on our financial situations during retirement.

Here, I’ll review three key gaps that exist when it comes to retirement expectations, primarily leveraging data from EBRI’s 2025 Retirement Confidence Survey (RCS):

- People tend to retire early (about three years, on average)

- Retirement tends to happen more suddenly than expected (more like a waterfall than a glide path)

- The actual odds of working during retirement are a lot lower than expected (75% expect to work, but only about 30% do so)

Collectively, these three gaps can have significant (negative) financial implications on retirement outcomes if they aren’t considered; therefore, it’s important for companies and financial planners to educate workers about these gaps to help them plan accordingly.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Kiplinger Building Wealth program handpicks financial advisers and business owners from around the world to share retirement, estate planning and tax strategies to preserve and grow your wealth. These experts, who never pay for inclusion on the site, include professional wealth managers, fiduciary financial planners, CPAs and lawyers. Most of them have certifications including CFP®, ChFC®, IAR, AIF®, CDFA® and more, and their stellar records can be checked through the SEC or FINRA.

Retiring early is the norm

One of the most important assumptions in a retirement plan is the age of retirement. A few extra years of work can do wonders in terms of closing any kind of savings gaps.

Working longer gives someone an extra year to save, an extra year for those savings to grow, one less year of retirement income to fund and one additional year to delay claiming Social Security. I’ve often described delayed retirement as the “silver bullet” when it comes to improving retirement outcomes.

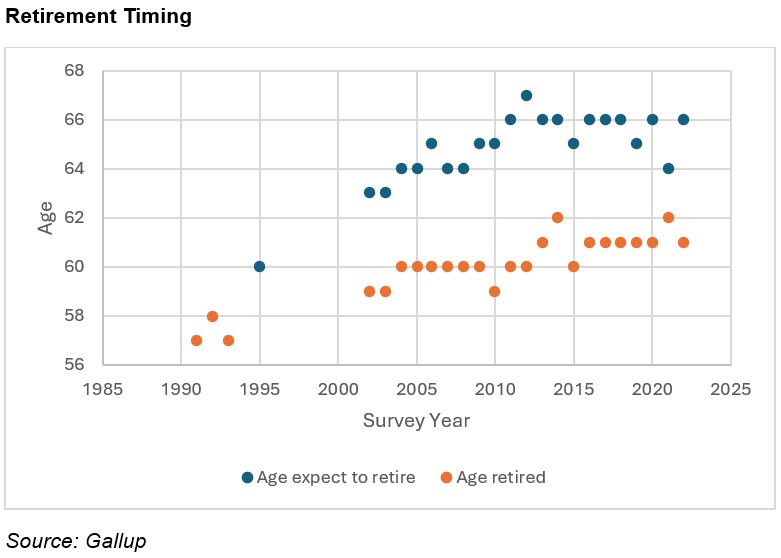

Unfortunately, there has been a relatively persistent gap between actual and expected retirement ages for the past 30-plus years, where people tend to retire earlier than expected (on average).

For example, historically about 50% of retirees retire on time, about 45% retire earlier than expected, and about 5% retire later than expected.

The median expected retirement age is 65, which has drifted slightly upward over time, but the median actual retirement age is closer to 62.

We can see the evolution of actual and expected retirement ages leveraging data from Gallup, an effect that is very consistent with some research I’ve worked on leveraging data from the Health and Retirement Study.

While there was a noticeable bump in retirement timing differences in the latest RCS, where only 40% noted retiring earlier in the 2025 RCS, vs 49% in the 2024 version, it’s too early to say if this is part of a new trend or a relatively temporary effect.

The gap clearly persists, though, where most people retire before they expect to do so (or on time), while relatively few (only 6%) retire later than expected.

It’s important to note that many of the reasons people retire early are not related to choice.

For example, based on the 2025 RCS, while 44% of retirees note retiring early because they could afford to do so, 66% of the reasons cited were out of the respondent’s control (each respondent could select multiple options), such as company downsizing or health issues.

In other words, retiring early for many (or most) of those who have to do so is less of a choice than something that just happens (that can’t easily be prepared for).

Retirement is more like a waterfall than a glide path

Most people expect a smooth transition into retirement.

For example, 50% of workers expect a gradual transition or reduction of hours leading to a full-time stop in retirement (or glide path).

In reality, though, 73% of retirees report a full-time stop, while only 19% report more of a glide path. These findings suggest retirement could be a lot more abrupt than most workers are expecting today.

While part of this effect is likely related to the involuntary situations prompting when people retire (i.e., they retire early), experiencing an abrupt retirement may leave the individual with fewer options should they want (or need) to continue working.

Working in retirement: Not so much a thing

While it’s true that labor force participation rates have been on the rise among older Americans over the last few decades, the actual percentage of working retirees is significantly lower than those who expected to do so.

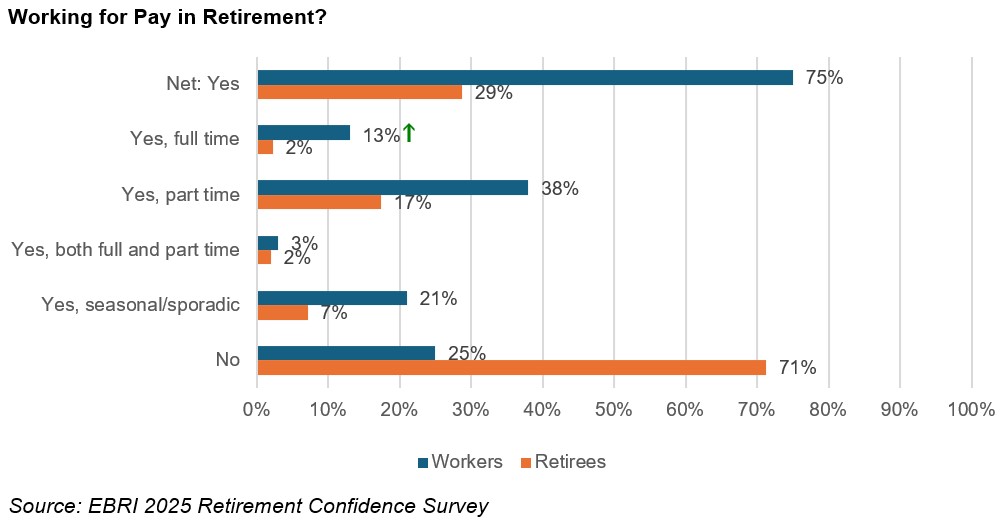

We can see this effect by looking at data from the RCS, which asks current workers if they think they will work for pay after they retire and if they have worked for pay since they retired. The distribution of responses is included below.

We can see that while 75% of workers expect to work for pay in retirement, only about 30% have done so, primarily on a part-time (17%) or a seasonal/sporadic (7%) basis. Only 2% of retirees report working full time in retirement.

Among those who note working for pay, the number one cited reason was wanting to stay active and involved (89% of respondents), followed by enjoying working (88% of respondents).

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth, our free, twice-weekly newsletter.

Only 40% of those working report doing so to make ends meet, although 73% report working for pay to make money to buy extra things.

Helping investors expect the expected

A retirement income plan is only as good as its assumptions. There are notable, persistent gaps that exist between worker expectations and the outcomes experienced by retirees that need to be incorporated into any kind of retirement income projection, especially since most of the gaps could negatively affect the retirement outcome of workers.

Educating workers on these points and helping set reasonable expectations is key.

For example, a client may say they plan on working until age 67, but educating them about the likelihood of early retirement and using age 65 in financial planning is probably a more reasonable assumption.

Additionally, a client may be confident he or she will work in retirement to supplement any kind of savings shortfall, but this is a lot less likely to happen in reality.

Therefore, understanding what’s actually expected in retirement can help clients prepare for what they might not expect.

All investing involves risk. The views expressed herein are those of PGIM investment professionals at the time the comments were made and may not be reflective of their current opinions and are subject to change without notice. Neither the information contained herein nor any opinion expressed shall be construed to constitute an offer to sell or a solicitation to buy any security.

PGIM DC Solutions LLC ("PGIM DC Solutions") is an SEC-registered investment adviser, a Delaware limited liability company, and an indirect wholly-owned subsidiary of PGIM, Inc. ("PGIM"), the principal asset management business of Prudential Financial, Inc. ("PFI") of the United States of America. PGIM DC Solutions is the retirement solutions provider of PGIM and aims to provide innovative defined contribution solutions founded on market leading research and investment capabilities. Registration with the SEC does not imply a certain level of skill or training. PFI of the United States is not affiliated in any manner with Prudential plc incorporated in the United Kingdom or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom. Registration with the SEC does not imply a certain level of skill or training.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is not a recommendation. Clients seeking information regarding their particular investment needs should contact their financial professional.

Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information, nor do we make any express or implied warranties or representations as to the completeness or accuracy. Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated, based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

The foregoing may contain "forward-looking statements" which are based on PGIM DC Solutions’ beliefs, as well as on a number of assumptions concerning future events, based on information currently available to PGIM DC Solutions. Current and prospective readers are cautioned not to put undue reliance on such forward-looking statements, which are not a guarantee of future performance, and are subject to a number of uncertainties and other factors, many of which are outside PGIM DC Solutions’ control, which could cause actual results to differ materially from such statements. PGIM DCS-4448828

Related Content

- Five Things I Wish I’d Known Before I Retired

- The End of Retirement as We Know It

- The Five Stages of Retirement (and How to Skip Three of Them)

- Six Financial Actions to Take the Year Before Retirement

- Retirees’ Anti-Bucket List: 10 Experiences You Don’t Want

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David Blanchett, PhD, CFA, CFP®, is Managing Director and Head of Retirement Research for PGIM DC Solutions. PGIM is the global investment management business of Prudential Financial, Inc. In this role he develops research and innovative solutions to help improve retirement outcomes for investors with a focus on defined contribution plans. Prior to joining PGIM he was the Head of Retirement Research for Morningstar Investment Management. He is currently an Adjunct Professor of Wealth Management at The American College of Financial Services and Research Fellow for the Alliance for Lifetime Income. David has published over 100 papers in a variety of industry and academic journals that have received awards from the CFP Board, the Financial Analysts Journal, the Journal of Financial Planning, and the International Centre for Pension Management. In 2014 InvestmentNews included him in their inaugural 40 under 40 list as a “visionary” for the financial planning industry, and in 2021 ThinkAdvisor included him in the IA25+. When David isn’t working, he’s probably out for a jog, playing with his four kids, or rooting for the Kentucky Wildcats.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.