Americans to Trump: Help Us Save for Retirement

With a Social Security shortfall looming and many workers struggling to save for retirement, most Americans agree: It's time for the government to step in.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Americans are deep in the throes of a retirement savings crisis. Federal Reserve data from 2022 (the last year for which it’s available) found that the median retirement savings balance among Americans aged 65 to 74 was just $200,000. And a 2024 AARP survey found that 20% of Americans ages 50 and over have no retirement savings whatsoever.

Last year, the National Institute on Retirement Security found that 79% of Americans agree there's a retirement savings crisis. Most Americans also agree that all workers should have a pension for guaranteed retirement income.

However, the Bureau of Labor Statistics estimates that only 15% of private industry workers have a pension through their employers. This places the burden of saving for retirement on individuals and leaves many devoid of the resources they need to invest accordingly.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That doesn’t sit well with the public, according to a recent BlackRock survey. Not only do BlackRock’s findings point to a world of concern among Americans today, but also a lack of government accountability.

What's fueling the retirement savings crisis?

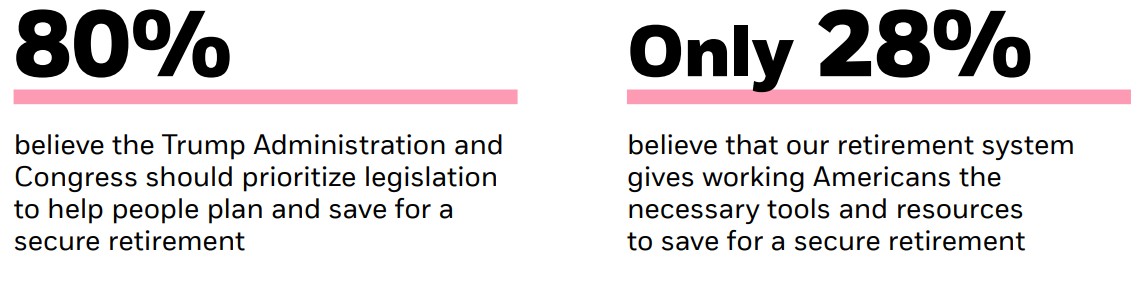

BlackRock surveyed 1,000 registered voters across the U.S. in mid-January about issues related to retirement and financial security. And an overwhelming majority (80%) said they feel that the Trump administration and Congress should prioritize legislation to help working Americans plan and save for a secure retirement.

Worse yet, only 18% of survey respondents are very confident they’ll have enough money to live on during their senior years. And 51% worry more about running out of money than dying.

These fears make even more sense when we dig into Americans’ retirement savings expectations versus their current reality. BlackRock’s respondents said they'll need roughly $2.1 million to retire securely. But 33% have no long-term savings so far, and 69% have socked away less than $150,000 for their senior years.

If Americans were more secure in their day-to-day finances, building their retirement nest eggs wouldn’t be so daunting. But 56% of BlackRock respondents worry about their personal finances at least once a day. And 33% say they would have a difficult time paying an unplanned $500 bill. Logic dictates that if coming up with $500 on the spot is a tough ask, then funding an IRA or 401(k) is pretty much out of the question.

Poor retirement finances literacy

Of course, part of the problem is that many Americans are sorely undereducated about long-term financial planning. As of 2020, roughly 35% of Americans had access to a retirement plan through their jobs, according to the U.S. Census, making employer-sponsored plans almost twice as prevalent as IRAs. But access to an employer plan doesn’t guarantee robust participation, nor does it guarantee that savers know where to put their money within their plan.

It’s common for employer-sponsored 401(k)s to default savers’ contributions to target-date funds. These funds adjust savers’ risk profiles based on how close to or far away from retirement they are. However, target-date funds often come with high fees and invest on the conservative side, leaving savers with less retirement wealth.

There are also inherent limitations with a 401(k) investment strategy, namely because these accounts commonly don’t allow savers to hold individual stocks. Low-cost index funds are a mainstay of 401(k)s, but not every saver knows to use them.

So all told, even when workers contribute to an employer plan, they don’t always get the maximum benefit due to a lack of knowledge, resources and investment choices. That’s why lawmakers can, and should, be doing more to help Americans save for their older age.

How can lawmakers avert the retirement savings crisis?

Effective this year, there's a change to 401(k) plans designed to boost savings among near-retirees — the super catch-up, a provision that allows workers aged 60 to 63 to replace the traditional $7,500 catch-up with a $11,250 contribution. But critics say that between the small incremental difference and the late-in-life opportunity, the super catch-up won’t move the needle all that much.

If lawmakers want to help working Americans save for retirement, they could consider eliminating catch-up contributions altogether and raising contribution limits for workers of all ages in 401(k)s and IRAs. Savers benefit from early-in-life contributions and the compounded returns that ensue. It makes little sense to limit larger contributions to older workers with shorter compounding windows.

Changing 401(k) and IRA contribution rules could also help address Social Security's pending shortfall. Once the program’s trust funds run dry, benefits might have to be cut by more than 20%. That underscores the importance of giving younger workers more leeway with their 401(k) and IRA contributions.

But there’s work to be done beyond increasing 401(k) and IRA contribution limits. Last year, global asset manager Janus Henderson found that almost half of Americans aren't investing their money. For 30%, the reason boils down to a lack of knowledge. Lawmakers could expand rules around 401(k) disclosures, fees and investment choices to give savers more insight and freedom to invest their money in a manner they're comfortable with.

Finally, lawmakers need to acknowledge that saving for retirement is a privilege many low — and even moderate-earners lack. Workers in this situation could benefit from boosted tax credits tied to retirement plan contributions. While some states employ auto IRAs to meet this need, they have low contribution limits and no employer match.

There are numerous options for a retirement savings fix, some more practical than others. Lawmakers must address the retirement crisis plaguing the nation, especially since Social Security cuts are looming.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Maurie Backman is a freelance contributor to Kiplinger. She has over a decade of experience writing about financial topics, including retirement, investing, Social Security, and real estate. She has written for USA Today, U.S. News & World Report, and Bankrate. She studied creative writing and finance at Binghamton University and merged the two disciplines to help empower consumers to make smart financial planning decisions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.