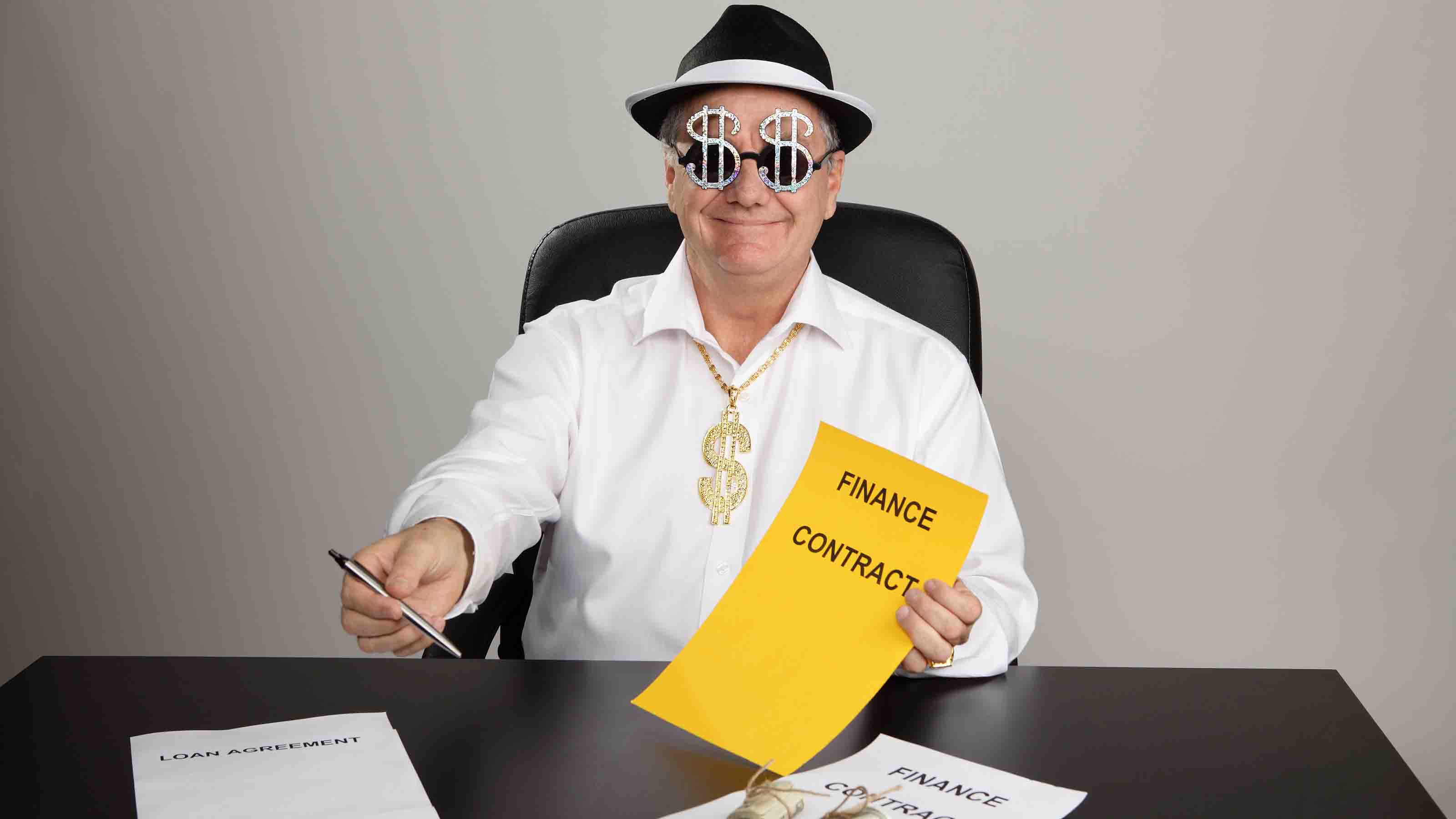

Fighting Senior Fraud Before it Happens

New law enlists retail workers in fight against scamming retirees.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Tucked into the 2022 omnibus appropriations bill that President Biden signed into law earlier this year is a little-known measure that aims to tackle the financial exploitation of seniors. The Fraud and Scam Prevention Act promises a new level of prevention and response to this exploitation by recruiting a new army to fight it: the clerks and shopkeepers that seniors interact with as they go about their daily business.

The legislation even creates a new task force, the Senior Scam Prevention Advisory Group, with representatives from government agencies, consumer advocates and industry organizations. Cynics might be inclined to roll their eyes at the formation of another watchdog, but some experts say this group has the potential to kick things up a notch. The group has been given the job of developing a training program, one that teaches retailers, financial institutions and wire-transfer services to recognize scams and stop senior fraud before it happens. As part of its duties, the group “would also be required to evaluate the success of the educational materials and programs they implement instead of using methods that have proven to be ineffective,” says Erin Witte, director of consumer protection at the Consumer Federation of America.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In the past, educational and prevention efforts have been directed mainly at seniors and bank tellers, but Witte thinks this focus on also training industry stakeholders can fortify the front lines in a growing battle. “These companies are often in a position to help prevent consumers from losing their money to a scam,” she says. “A retail cashier may be able to alert customers to a potential fraud before they purchase several hundred dollars in gift cards, a very common scam tactic.”

Gift Card Purchases a Red Flag For Fraud

Consumers who buy a lot of gift cards at once, often with a high-dollar value, are a red flag to store clerks or managers who know that the cards are often a scammer’s preferred method of payment and the buyer merely the latest victim. That intervention, though, currently only happens about 25% of the time, according to an April report by AARP. But it’s a crucial moment because AARP also finds that more than half the time a third-party intervenes in an attempted financial exploitation, the potential victims avoid losing money.

At the same time, the act also creates a new Senior Fraud Advisory Office within the Federal Trade Commission’s Bureau of Consumer Protection. This office also aims to “reform the FTC complaint system to drive better participation and enhance fraud surveillance through better coordination with law enforcement agencies,” says Dawit Kahsai, senior legislative representative at AARP.

For instance, the office has orders to actively monitor the latest fraud schemes and use that information for targeted outreach not only to seniors but their families and caregivers, too. A dedicated website of identified scams and resources is also part of the plan.

An AARP poll conducted earlier this year suggests getting the word out may be meaningful. Eight in 10 (82%) U.S. adults age 50 and older say they are talking to their elderly relatives about scams, with family caregivers even slightly more likely to report doing so (85%).

Still, thwarting the $5.89 billion in consumer fraud losses reported to the FTC last year (up 70% from a year ago) is a massive undertaking. Although alerting people can reduce the risk of financial harm, some older adults never receive these warnings and succumb to the pressure of bad actors.

In a recent case prosecuted by the U.S. Attorney’s Office for the Northern District of Georgia, for example, an accountant at an Atlanta-based wealth management firm pleaded guilty to federal charges of embezzling $800,000 from an elderly client with dementia that the accountant befriended over the course of 10 years.

Telling co-workers that the client was like “a grandmother to her,” court documents show that beginning in 2010, the accountant stole the victim’s annuity payments, wrote more than 200 fraudulent checks, and withdrew cash or diverted payments from the woman’s bank accounts. She’s also accused of impersonating the woman in phone conversations with financial institutions as well as using the victim’s name and Social Security number to open a separate account to conceal the alleged fraud.

The firm learned of the fraud in mid-March 2021, immediately fired the accountant and reported the crime to law enforcement. But the damage was done.

Finding new ways to prevent cases like this one is a big focus of the legislation, and it’s why Witte is hopeful that the new measures will have an impact. “Prevention is critical to protecting consumers,” she says, “because once the scammer has stolen the money it’s very difficult to get back.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Scam Report: FTC Says Older Adults Targeted

Scam Report: FTC Says Older Adults TargetedThe Federal Trade Commission says more money is being taken from older adults by scams involving social media, cryptocurrency and texts.

-

Text Scams: How to Avoid (and Report) Them

Text Scams: How to Avoid (and Report) ThemSpam texts are surpassing robocalls as the preferred choice of scammers. Here’s how to avoid being a victim.

-

Retirees, Protect Yourself From Thieves Online

Retirees, Protect Yourself From Thieves OnlineScams Scams targeting the elderly are frequent. Here are some expert ways to build your protection from scammers.

-

Don't Be Fooled: 5 Steps to Help Avoid Financial Scams

Don't Be Fooled: 5 Steps to Help Avoid Financial ScamsScams Some savvy stay-safe tips to help protect yourself and watch out for family members at the same time.

-

Thwarting the Robocaller Invasion

Thwarting the Robocaller InvasionScams Consumers have an array of weapons at their disposal in the fight to help keep those infuriating interruptions at bay.

-

10 Scams That Will Ruin Your Retirement

10 Scams That Will Ruin Your RetirementScams