Over Half of Americans Stumble Financially After Losing a Loved One. Are You Prepared?

Losing a loved one can be overwhelming, and for many, it also puts an unexpected strain on their finances, a study shows.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Losing a loved one can take a deep emotional and mental toll. Yet, beyond the grief, many are unprepared for the financial strain that follows — from paying for funeral expenses to everyday living costs. The financial fallout can be overwhelming.

A study by the Western and Southern Financial Group shows how prepared (or unprepared) Americans feel about the financial challenges that can come from the loss of a loved one.

- Over half of Americans (51%) experienced financial struggles after losing a loved one.

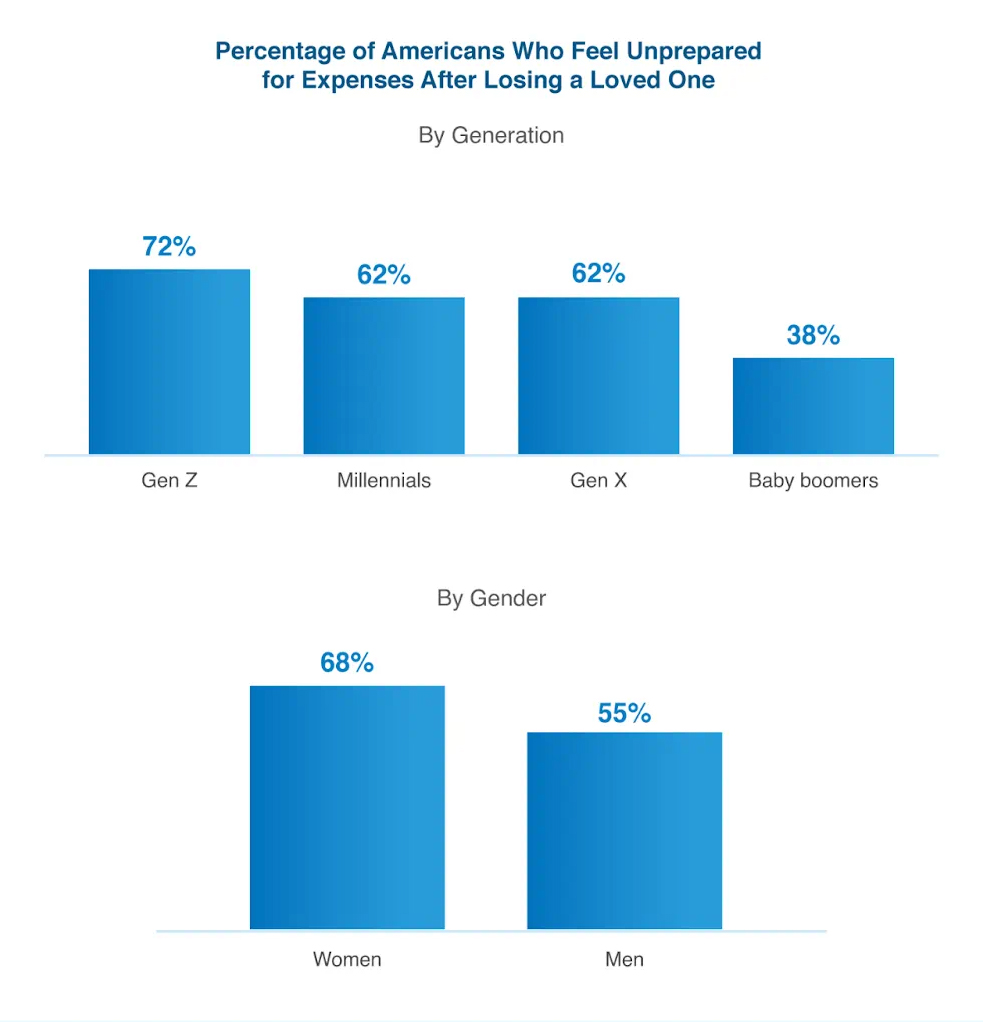

- 62% of Americans don't feel financially prepared to handle expenses that may arise if they lose a loved one, with Gen Z (72%) being the most likely to say so.

- 39% turned to credit cards or personal loans to cover unexpected expenses after the loss of a loved one. Gen Z (47%) was the most likely to do so.

62% of participants felt ill-equipped to handle the costs that often come after the loss of a loved one, the survey showed. Women (68%) expressed more financial concern than men (55%), highlighting a gender gap in perceived readiness. While over half of the participants said they have struggled financially after losing a family member, 14% described their challenges as significant, while 37% said they were manageable.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The death of a spouse can also result in a considerable decline in average income for the surviving spouse, which is particularly difficult for baby boomers (60%) compared to Gen X (51%), millennials (33%), and Gen Z (39%), per the survey. Affording immediate living expenses posed a challenge, especially for Gen Z (41%) and millennials (34%). Many (26%) also feared falling behind on mortgage or rent payments.

To cover many of the unexpected costs after losing a loved one, many of those surveyed relied on savings or emergency funds, with Gen Z leading at 57%. Credit cards or personal loans were used by 39%, and Gen Z (47%) was again the most likely to rely on this method. Less than half, or 35%, used life insurance payouts and 7% turned to crowdfunding platforms, with the highest participation among Gen Z (11%).

Average cost of a funeral

It's not surprising that many people are caught off-guard when it comes to the financial costs of losing a loved one.

The average cost of a funeral can range from about $6,300 to $8,300, depending on whether it includes burial or cremation services. The median cost for a traditional funeral with viewing and burial is around $8,000, according to the National Funeral Directors Association.

Other costs to consider may include a burial plot, flowers, memorial service, headstone and markers, and the obituary in the newspaper or online. There are also legal matters, including lawyer fees and costs associated with selling off assets and real estate or other property, paying off outdistancing loans or bills, not to mention lost wages.

A few financial steps to follow after the loss of a loved one

If you haven't yet faced the loss of a loved one and the financial challenges that often follow, here are a few steps you can take to help reduce confusion and stress when the time comes.

- Gather all financial documents. This may include estate planning documents, such as a will or trust, tax returns, utility bills, rent or mortgage payments, bank statements, etc.

- Inform agencies providing benefits. The Social Security Administration, Veterans Affairs, and Medicare are only a few of the agencies that will need to be notified. You’ll also want to contact their insurance company if they had a life insurance policy.

- Contact their bank or other financial institution. You’ll likely need a death certificate to access the financial information of your loved one. Also, if there is a transfer-on-death (TOD) order, their assets will be transferred to the designated beneficiary.

- File the will in probate court. After you file the will, the executor of the will can begin distributing the deceased’s assets per their instructions.

- Settle all remaining debt. In many cases, any remaining liabilities, like a mortgage or auto loan, will be payable by the person who inherits them. Credit card balances, student loans, medical loans, and more are typically charged against the deceased's estate.

- Prepare a final tax return. The final tax return should be submitted by the next tax filing deadline. Work with a tax consultant or attorney to ensure the process goes smoothly.

Financial planning for life after loss

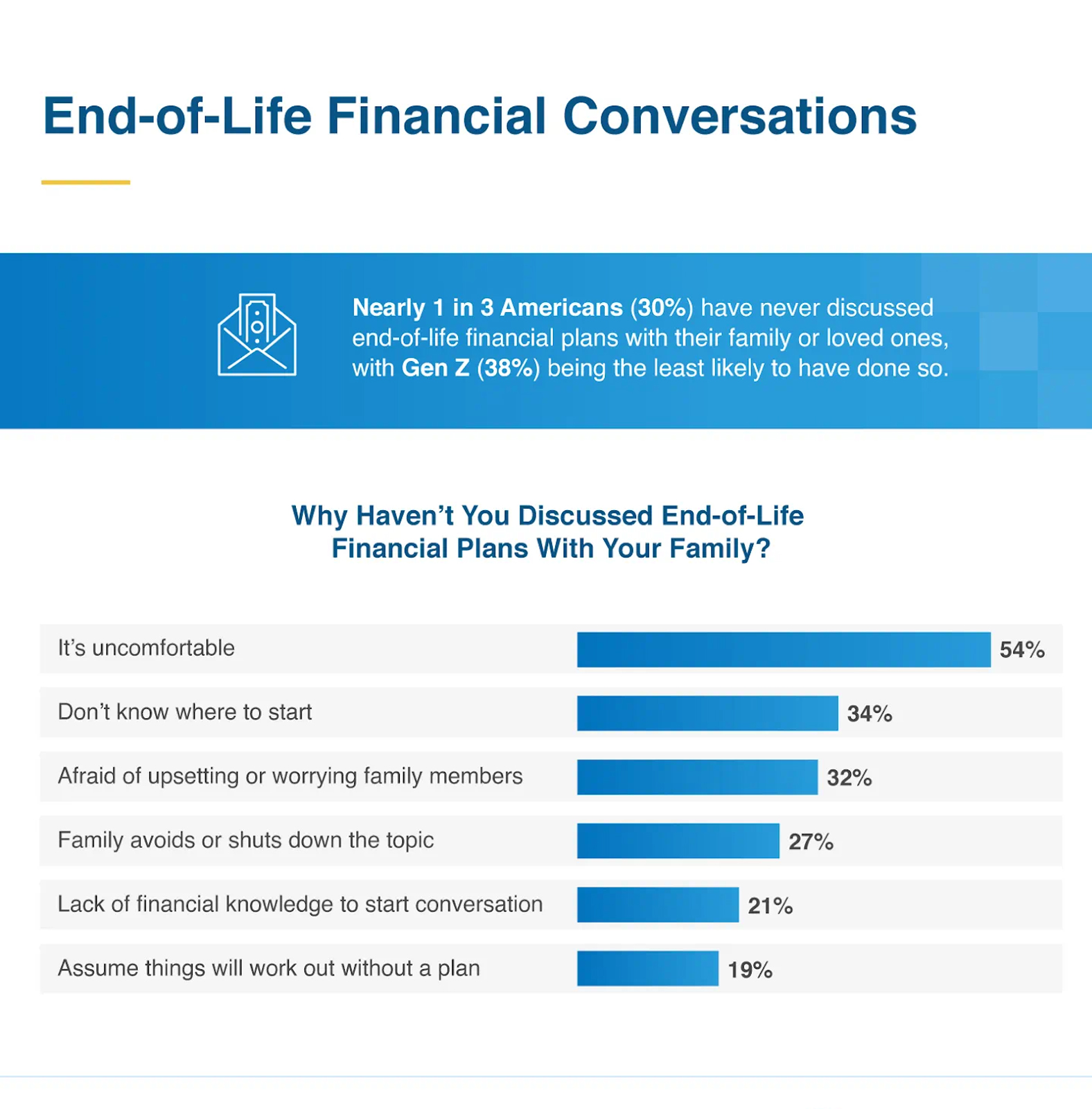

When you lose a loved one, it’s not uncommon to rely on savings, retirement accounts, Social Security, and any life insurance previously purchased to meet your unexpected financial commitments. However, the survey also points out one glaring issue: Nearly 1 in 3 Americans (30%) have never discussed end-of-life financial plans with their family or loved ones. It’s one of the most important conversations we aren’t having. But you can change that.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

For the past 18+ years, Kathryn has highlighted the humanity in personal finance by shaping stories that identify the opportunities and obstacles in managing a person's finances. All the same, she’ll jump on other equally important topics if needed. Kathryn graduated with a degree in Journalism and lives in Duluth, Minnesota. She joined Kiplinger in 2023 as a contributor.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.