Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Homebuying season is here — which means you're not alone if you’re on the hunt for a new home. You and many others are shopping around. But according to a recent study, you’ll need to earn at least six figures to land a typical home in the U.S.

According to a Bankrate study, 30 states and the District of Columbia are more demanding of homebuyers, requiring them to earn nearly $117,000 if they want to buy a home in these areas. This is up 50% from five years ago, when the typical income was almost $78,000.

Prices aren’t the only thing that’s changed. The typical homebuyer today is older, wealthier and less likely to be purchasing their first home.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

According to data from the National Association of Realtors (NAR), first-time buyers now make up just 24% of the market, down from 32% last year — and the lowest share since NAR began tracking the data in 1981.

The median age of first-time buyers rose to 38, while repeat buyers are even older, typically 61 years old, up from 58 the year before. These stats point to just how challenging affordability has become, especially for younger buyers trying to break into the market for the first time.

What’s causing the increase?

Home prices have been climbing for the last five years. Homebuying demand soared when interest rates hit rock bottom during the COVID-19 pandemic in 2020 and 2021, causing prices to skyrocket.

But inventory didn’t keep up with demand. Homes that went on the market sold within a couple of days or weeks — sometimes without home inspections or appraisals — and in some cases, buyers bought homes sight unseen.

Today, inventory still hasn’t kept up with the demand. While there’s an increase in home listings, there are many more prospective homebuyers than home sellers. Because of that, sellers can list their homes for a premium price, knowing there are more people who are looking to buy them, even if homes have stayed on the market longer than a few years ago.

While home prices are going up, mortgage rates are climbing with it. The national average for a 30-year mortgage is 6.90%. In December of 2024, it was 6.87%.In January 2022, it was 3.50%. We may never see the same rock-bottom mortgage rates we did during the early pandemic years, but with the increase in mortgage rates and home prices, it’s getting even more difficult to afford to buy a home.

Home prices are at an all-time high and wages haven’t increased at the same rate. The median sale price of homes sold in January 2025 was $419,200. The federal minimum wage is $7.25 an hour and has not changed since 2009.

Use the tool below, in partnership with Bankrate, to compare offers and rates from different mortgage lenders.

States with the highest and lowest income requirements

How much money you make impacts where you can live. While nationwide market trends can help paint a picture of how the housing market is doing across the country, there are many different housing markets. And in some markets, you’ll need to earn a lot more to afford an average home in those areas.

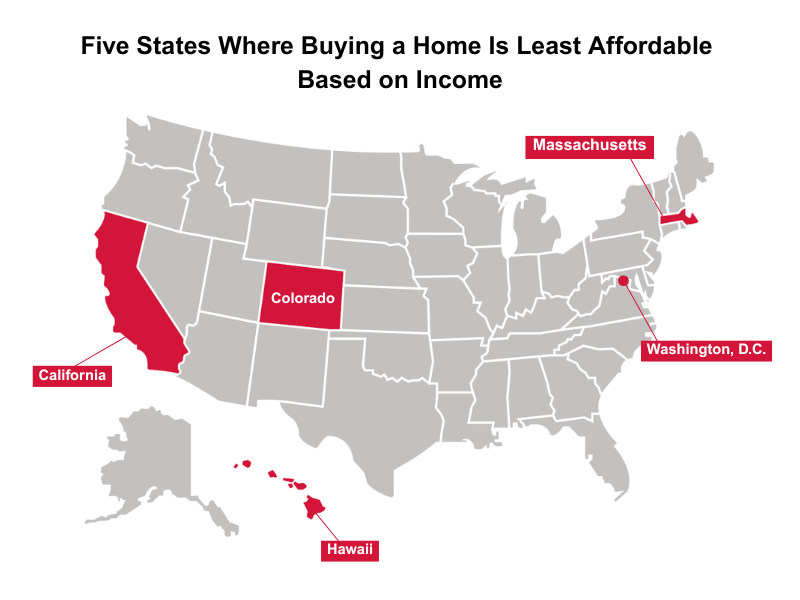

According to the Bankrate study, the states where you need to earn the most are:

- District of Columbia: $240,009

- Hawaii: $235,638

- California: $213,447

- Massachusetts: $174,392

- Colorado: $168,643

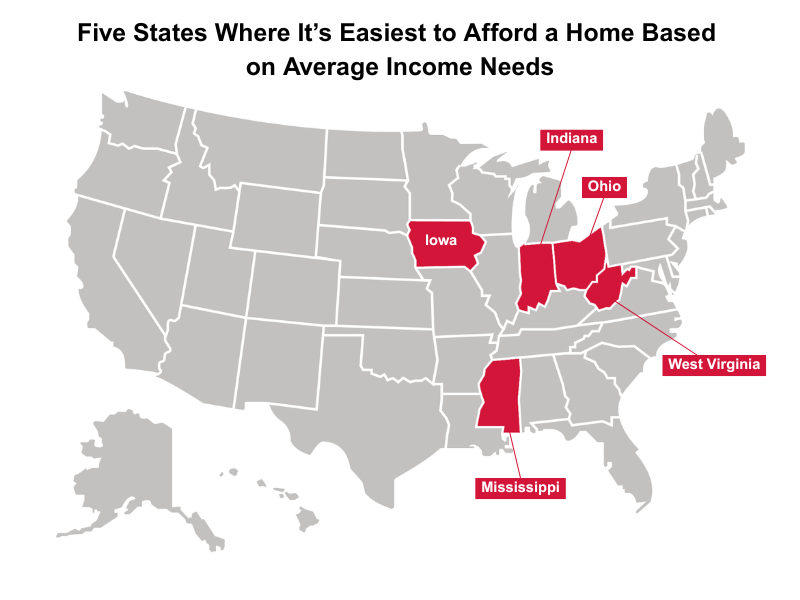

On the other end of the list, the states where you can earn the least are:

- West Virginia: $64,179

- Iowa: $70,437

- Ohio: $71,080

- Mississippi: $72,072

- Indiana: $72,342

Utah saw the biggest increase. In January 2020, the median home sale price was $433,546 (adjusting for inflation). As of January 2025, it’s now $605,400 — an 89.4% jump, or $151,956. Montana saw the second-biggest, at $151,956.

Can you buy a home in 2025?

Even though home inventory is growing ever-so-slightly right now, it’s harder than ever to buy a home in 2025. Home prices may go down in some housing markets while others will see it go up. It depends on the area, the community, the economy and other factors.

Along with your specific homebuying checklist, you’ll also need to consider a few other things.

1. How much home can you afford? Think beyond just the principal and interest when estimating your monthly mortgage payment. You’ll also need to account for property taxes, homeowners insurance, and, in many cases, private mortgage insurance (PMI).

Even with a fixed interest rate, your monthly payment can increase over time due to changes in taxes and insurance costs. That’s why it’s smart to build in a little wiggle room when calculating what you can comfortably afford.

2. Explore what homebuying programs you might qualify for. Whether it’s your first home or your fifth. Many cities, counties and states offer programs that can help with down payments, closing costs, or favorable loan terms.

Every location is different, so take time to research what’s available where you live — or where you plan to move. These programs can vary widely, and a little digging could save you thousands.

3. Shop around for everything. Don’t settle for the first lender you come across. Mortgage rates and loan terms can vary widely, so it pays to compare offers. Start by getting prequalified and then preapproved to show sellers you’re a serious buyer when touring open houses.

And don’t stop at your mortgage. It’s just as important to shop around for homeowners insurance. An insurance agent can help you find the best coverage and rate based on your location, property and specific needs.

The bottom line

Buying a home in 2025 isn’t impossible, but it does require more planning, patience, and persistence than in years past.

Rising prices and higher mortgage rates have made affordability a challenge, but with the right strategy — and a clear understanding of your budget and options — you can still make smart moves in today’s competitive market.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dori is an award-winning journalist with nearly two decades in digital media. Her work has been featured in the New York Times, Wall Street Journal, USA Today, Newsweek, TIME, Yahoo, CNET, and many more.

Dori is the President of Blossomers Media, Inc.

She’s extensively covered college affordability and other personal finance issues, including financial literacy, debt, jobs and careers, investing, fintech, retirement, financial therapy, and similar topics. With a strong journalistic background, she’s also worked in content marketing, SEO, affiliate marketing, content strategy, and other areas.

Dori graduated with a Bachelor’s degree in Multimedia Journalism from Florida Atlantic University. She previously served as the president of the Florida Chapter of the Society of Professional Journalists, where her chapter won the coveted “Chapter of the Year” award for two consecutive years.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?Learn how timing matters when it comes to choosing the right account.

-

The High Cost of Sunshine: How Insurance and Housing Are Reshaping Snowbird Living

The High Cost of Sunshine: How Insurance and Housing Are Reshaping Snowbird LivingThe snowbird lifestyle is changing as insurance and housing costs climb. Here’s how retirees are adapting and where they’re choosing to go.

-

How to Turn Your 401(k) Into A Real Estate Empire — Without Killing Your Retirement

How to Turn Your 401(k) Into A Real Estate Empire — Without Killing Your RetirementTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.He wants a vacation home, but she wants a 529 plan for the kids. Who's right? The experts weigh in.