Don’t Move to Another State Just to Reduce Your Taxes

If you’re retired or near retirement, maybe a smarter plan for retirement income will allow you to stay put. Yes, your state income tax rate may be higher, but your spendable income will be, too.

We know lots of friends who are considering moving from a high-tax state, such as New York, to a state with low or no state income taxes. They think they will end up with more money, although they are torn because they may also be moving away from family and friends just to escape state taxes.

What I advise them to do is think about spendable income — the amount they’ll have to spend after taxes — and not just low or zero tax rates. If you have more money to spend after paying the tax bill wherever you currently live, you might as well stay where you are, if it’s closer to the grandkids. You may be able to pay for at least one warm-weather winter trip, too.

Design a Smarter Retirement Income Plan

Before making life decisions about moving (or downsizing, purchasing insurance, etc.) retirees ought to know their number for their total starting income, and have a plan for retirement income that includes a projection of income and savings, and all planning assumptions.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The income plan ought to cover:

- Starting income

- Inflation protection

- Beneficiary income protection

- Spousal income (if applicable)

- Plan management (when plan assumptions are not realized)

- Market risk to plan (when markets fluctuate)

- Legacy passed on to beneficiaries or heirs

All these subjects are covered in articles on Kiplinger.com. In one article, How to Generate an Extra $20,000 a Year in Retirement, we examined the income from our favorite investor (a 70-year-old woman with $2 million of savings, of which 50% is in a rollover IRA). We saw a large before-tax income advantage from Income Allocation planning. Even if she invests a portion of that to meet her legacy objective, she still has a $20,000 advantage in spendable annual income.

The question is whether she gives back that advantage in federal and state income taxes in her home state of New York.

Reducing your Combined Federal/State Retirement Tax %

You may have heard that New York is a high-tax state, and that’s true. It ranks No. 5 on Kiplinger’s list of the 10 least tax-friendly states for middle-class families.

Importantly, most states exclude Social Security income from taxation, as well as a portion of IRA distributions and employer pension plans. Together with interest on state and local bonds that is not taxed, a retiree has a head start in reducing state income taxes.

But the question remains how much of that advantage is eaten up in New York state income taxes. The key for our Go2Income planning is that annuity payments are treated the same in both the New York and federal tax returns, meaning the tax benefits carry over. And with some of the adjustments at the state level mentioned above, the favorable tax treatment of annuity payments may be even more valuable.

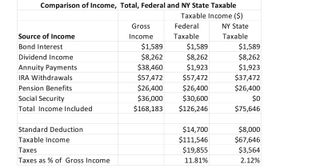

Let me share with you the high-level elements of our 70-year-old investor’s federal and New York state tax filing.

Benefits and Cost from this Planning

For our investor the income taxed by New York would be around $67,500 — or about 40% of her total gross income. As a percentage of total income, the state income tax is a little more than 2%. Even after adding federal taxes, her Retirement Tax Rate is less than 15%. That leaves her a big advantage in spendable income. A traditional plan without annuity payments and with lower income actually pays more in total taxes — with a combined tax rate of over 18%.

So, our plan produces more cash flow from savings, much of it tax-favored, and gives our retiree the freedom to live where she prefers.

And the cost? The primary one is that annuity payments don’t continue at your passing even before the premium has been recovered.

You can elect a beneficiary protection feature that makes sure total annuity payments will equal the premium at a minimum. However, that choice will reduce the level of guaranteed annuity payments and some of the tax benefits. Or you can use the higher annuity payments to purchase some life insurance. And those planning choices aren’t the only options you will have in terms of beneficiary protection.

What if the lure of zero state income taxes is too great? Our retiree could move to Florida, save the $3,500 in New York taxes, adopt a Go2Income plan for her circumstances — and pay for the kids’ trips to visit her.

So be with the kids, live where you want and possibly leave less at your passing if it’s early in retirement. Bottom line: Don’t follow the crowd. Do your own research. And rely on resources at Kiplinger.

At Go2Income, we can provide you with a complimentary personalized plan that delivers both a high starting income and growing lifetime income, as well as long-term savings.

To continue reading this article

please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Why Spotify Stock Is Soaring After Q1 Earnings

Why Spotify Stock Is Soaring After Q1 EarningsSpotify beat expectations for the first quarter and its stock is notably higher following the report. Here's why.

By Joey Solitro Published

-

Is a Phased Retirement Right for You?

Is a Phased Retirement Right for You?Want to keep working, just not as hard? A phased retirement may just be the answer.

By Kimberly Lankford Published

-

Four Tips to Make Your Sales Presentation a Winner

Four Tips to Make Your Sales Presentation a WinnerBeing prepared and not being boring can go a long way toward persuading a potential customer to buy into what you’re offering.

By H. Dennis Beaver, Esq. Published

-

Pros and Cons of Waiting Until 70 to Claim Social Security

Pros and Cons of Waiting Until 70 to Claim Social SecurityWaiting until 70 to file for Social Security benefits comes with a higher check, but there could be financial consequences to consider for you and your family.

By Patrick M. Simasko, J.D. Published

-

Now Could Be Time for Private Investors to Make Their Mark

Now Could Be Time for Private Investors to Make Their MarkThe venture capital crunch may be easing, but it isn't over yet. That means there could be direct investment opportunities for private deal investors.

By Thomas Ruggie, ChFC®, CFP® Published

-

How to Stop Boredom From Ruining Your Happy Retirement

How to Stop Boredom From Ruining Your Happy RetirementRetirees who explore new interests and have an active social life are more likely to find joy — and even greatness — in the newfound freedom of retirement.

By Richard P. Himmer, PhD Published

-

The Life-or-Death Answers We Owe Our Loved Ones

The Life-or-Death Answers We Owe Our Loved OnesHow our life ends isn’t always up to us, but that question too often must be answered by loved ones and health care workers who don’t know what we would want.

By Joel Theisen, RN Published

-

Hot Tips for Home Buyers and Sellers Right Now

Hot Tips for Home Buyers and Sellers Right NowReal estate looks to be especially hopping this spring, thanks to pent-up demand and buyers adjusting to higher mortgage rates. Here’s how you can prepare.

By Pam Krueger Published

-

Is 100 the New 70?

Is 100 the New 70?Eating well, exercising, getting plenty of sleep and managing chronic stress can help make you a SuperAger. Funding that long life requires longevity literacy.

By Phil Wright, Certified Fund Specialist Published

-

Nine Lessons to Be Learned From the Hilton Family Trust Contest

Nine Lessons to Be Learned From the Hilton Family Trust ContestDisclaimers, good communication, post-marital agreements and more could help avoid conflict in a family after the owners of a wealthy estate pass away.

By John M. Goralka Published