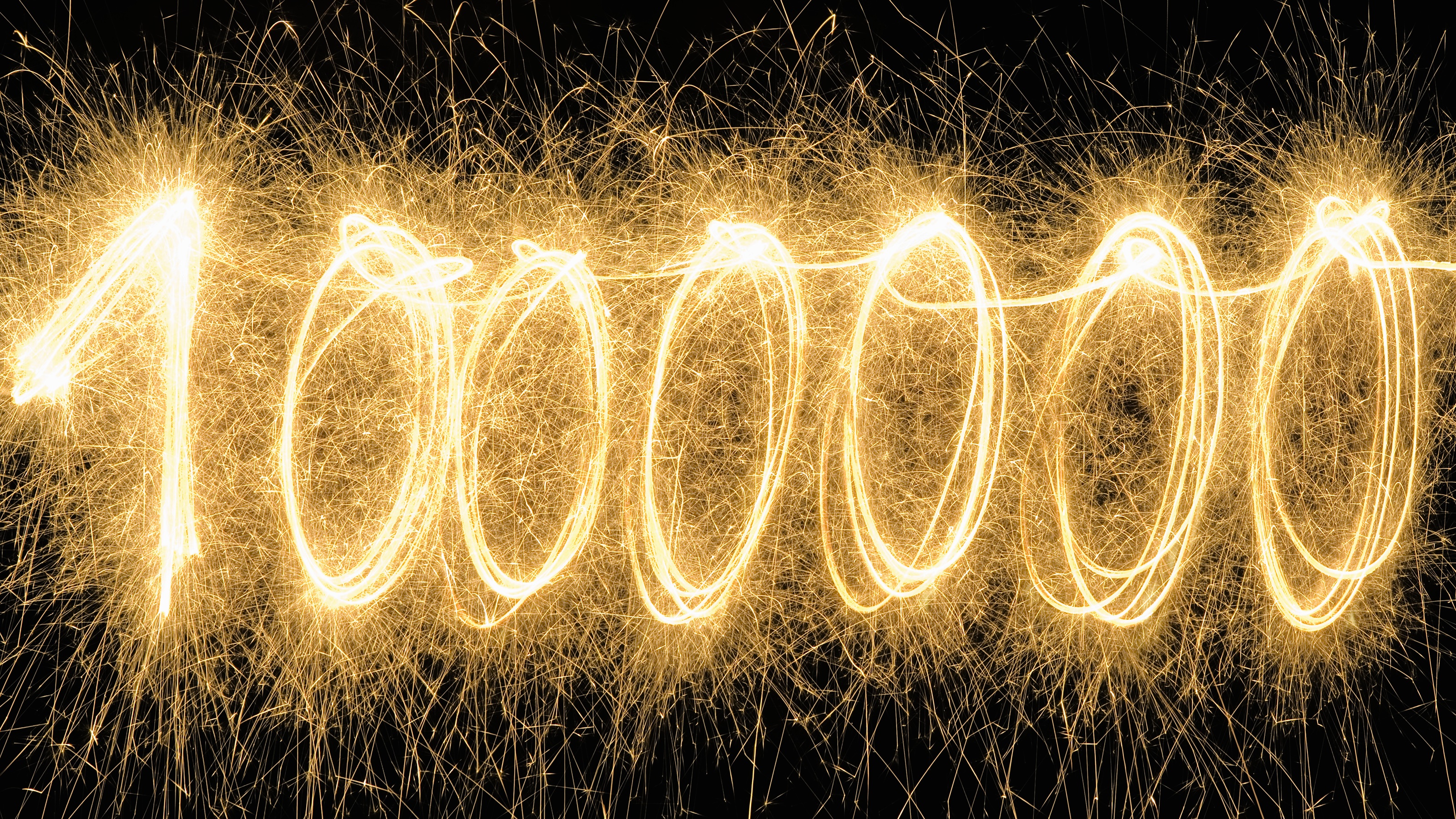

My First $1 Million: Health Care Worker, 48, Sagadahoc County, Maine

"I read a commonsense book by Jack Bogle, and I invested in index funds for 22 years. I can truly say that book changed my life."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome to Kiplinger's My First $1 Million series, in which we hear from people who have made $1 million. They're sharing how they did it and what they're doing with it. This time, we hear from a married 48-year-old health care worker in Sagadahoc County, Maine.

See our earlier profiles, including a writer in New England, a literacy interventionist in Colorado, a semiretired entrepreneur in Nashville and an events industry CEO in Northern New Jersey. (See all of the profiles here.)

Each profile features one person or couple, who will always be completely anonymous to readers, answering questions to help our readers learn from their experience.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

These features are intended to provide a window into how different people build their savings — they're not intended to provide financial advice.

THE BASICS

How did you make your first $1 million?

I migrated to the U.S. in my mid-20s. I was working and always just saved. I parked most of it in cash until I educated myself on investing.

I started by investing in individual stocks, but the daily price gyrations were too much for my appetite. I then read a commonsense book by Jack Bogle, and I invested in index funds for 22 years.

I could truly say that book spoke to me and changed my life. I was able to max out my IRA contributions through work for several years. I always max out my Roth.

I crossed to seven figures last year.

What are you doing with the money?

I withdrew some money from my brokerage to help my nephew pay off student loans and give early inheritance gifts to my niece and nephew. This allowed them to migrate from a Third World country to a First World one.

THE FUN STUFF

Did you do anything to celebrate?

Nothing special, really. Didn't buy anything extravagant. (The day) just went on by like it was an ordinary day that I'll never forget.

What is the best part of making $1 million?

Just a source of personal pride. I was poor growing up, and money has always been a source of stress. Right now, I'm not only able to help myself, but also others.

It's good to know that the little amount of money I gave my relatives changed their lives profoundly.

Did your life change?

Outside of cutting down on work and increasing volunteer hours, not much changed. Like I mentioned earlier, I was able to help out my relatives. Outside of that, I'm still the same old me.

Does anyone know you're a millionaire?

My current partner has an inkling, but she has not seen my spreadsheets. People have different attitudes when it comes to money, so I would probably keep this to myself.

Any plans to retire early?

Fortunately, I like my job, and it's not too physically or emotionally demanding. I did cut down on hours so I can gain some of my time back.

I'm planning to work on a part-time or per-diem basis because I like the structure of having workdays and weekends.

LOOKING BACK

Anything you would do differently?

I probably wouldn't have been too hard on myself with maxing out my contributions. Money issues definitely contributed to the divorce of my first marriage.

At some point, I realized that time is really my currency and not so much the money.

Right now, I only work part time and contribute less to my retirement accounts.

Did you work with a financial adviser?

No. I was able to figure out the accumulating part pretty easily. It might be different when it's time to tap these accounts.

Did anyone help you early on?

Just books and an inherent desire to solve my family's money issues.

LOOKING AHEAD

Plans for your next $1 million?

Nothing, really.

Any advice for others trying to make their first $1 million?

Time is your currency, not money.

Do you have an estate plan?

I have been thinking more and more about this. I want to create an estate to pass on what I was able to accomplish to the next generation. I'm just thinking of the most efficient way to do it.

What do you wish you'd known …

When you first started saving? Compounding interest is your best friend and worst enemy (when it comes to debt).

When you first started investing? That I shouldn't be so hard on myself, and (remember that) everything takes time.

If you have made $1 million or more and would like to be anonymously featured in a future My First $1 Million profile, please fill out and submit this Google Form or send an email to MyFirstMillion@futurenet.com to receive the questions. We welcome all stories that add up to $1 million or more in your accounts, although we will use discretion in which stories we choose to publish, to ensure we share a diversity of experiences. We also might want to verify that you really do have $1 million. Your answers may be edited for clarity.

RELATED CONTENT

- You're 62 Years Old With $1 Million Saved: Can You Retire?

- Want to Earn $1 Million More Over Your Lifetime? Do This

- Do You Have at Least $1 Million in Tax-Deferred Investments?

- Are You Rich? U.S. Net Worth Percentiles Can Provide Answers

- Compare Your Net Worth by Age

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As Contributed Content Editor for the Adviser Intel channel on Kiplinger.com, Joyce edits articles from hundreds of financial experts about retirement planning strategies, including estate planning, taxes, personal finance, investing, charitable giving and more. She has more than 30 years of editing experience in business and features news, including 15 years in the Money section at USA Today.

-

Thinking of Switching Phone Carriers? Do These 8 Things First

Thinking of Switching Phone Carriers? Do These 8 Things FirstSwitching carriers is easier than ever, but overlooking the fine print could cost you. Here’s what to check before you make the move.

-

Samsung Galaxy S26 Ultra: What to Know Before You Upgrade

Samsung Galaxy S26 Ultra: What to Know Before You UpgradeThe Galaxy S26 Ultra brings new features and strong launch deals, but whether it’s worth upgrading depends on what you already own.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

What Is an Assumable Mortgage and Could It Save You Thousands?

What Is an Assumable Mortgage and Could It Save You Thousands?With mortgage rates still elevated, taking over a seller’s existing home loan could lower monthly payments — if the numbers work.

-

Have You Fallen Into the High-Earning Trap? This Is How to Escape

Have You Fallen Into the High-Earning Trap? This Is How to EscapeHigh income is a gift, but it can pull you into higher spending, undisciplined investing and overreliance on future earnings. These actionable steps will help you escape the trap.

-

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial Clarity

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial ClarityThe key is to resist focusing only on the markets. Instead, when making financial decisions, think about your values and what matters the most to you.

-

Where Olympians Store Their Medals is a Great Lesson For Your Valuables and Cash

Where Olympians Store Their Medals is a Great Lesson For Your Valuables and CashWhat you can learn about protecting your cash and values from where Olympians store their medals.

-

An Executive's 'Idiotic' Idea: Skip Safety Class and Commit a Federal Crime

An Executive's 'Idiotic' Idea: Skip Safety Class and Commit a Federal CrimeSeveral medical professionals reached out to say that one of their bosses suggested committing a crime to fulfill OSHA requirements. What's an employee to do?

-

How You Can Use the Financial Resource Built Into Your Home to Help With Your Long-Term Goals

How You Can Use the Financial Resource Built Into Your Home to Help With Your Long-Term GoalsHomeowners are increasingly using their home equity, through products like HELOCs and home equity loans, as a financial resource for managing debt, funding renovations and more.

-

How to Find Free Money for Graduate School as Federal Loans Tighten in 2026

How to Find Free Money for Graduate School as Federal Loans Tighten in 2026Starting July 1, federal borrowing will be capped for new graduate students, making scholarships and other forms of "free money" vital. Here's what to know.

-

My First $1 Million: Retired Senior Policy Analyst, 64, Washington, D.C.

My First $1 Million: Retired Senior Policy Analyst, 64, Washington, D.C.Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.