I'm an Insurance Pro: Going Without Life Insurance Is Like Driving Without a Seat Belt Because You Don't Plan to Crash

Life insurance is that boring-but-crucial thing you really need to get now so that your family doesn't have to launch a GoFundMe when you're gone. Also, that small policy from work? It's like a snack, not a whole dinner.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If you want to see a group of folks instantly become evasive, ask them two questions at a dinner party: "So who are you voting for?" and "Do you have life insurance?"

One of those questions starts arguments. The other leads to an uncomfortable silence, followed by someone saying, "I mean … I have something through work, so I'm probably fine." (Note: Rarely are they fine.)

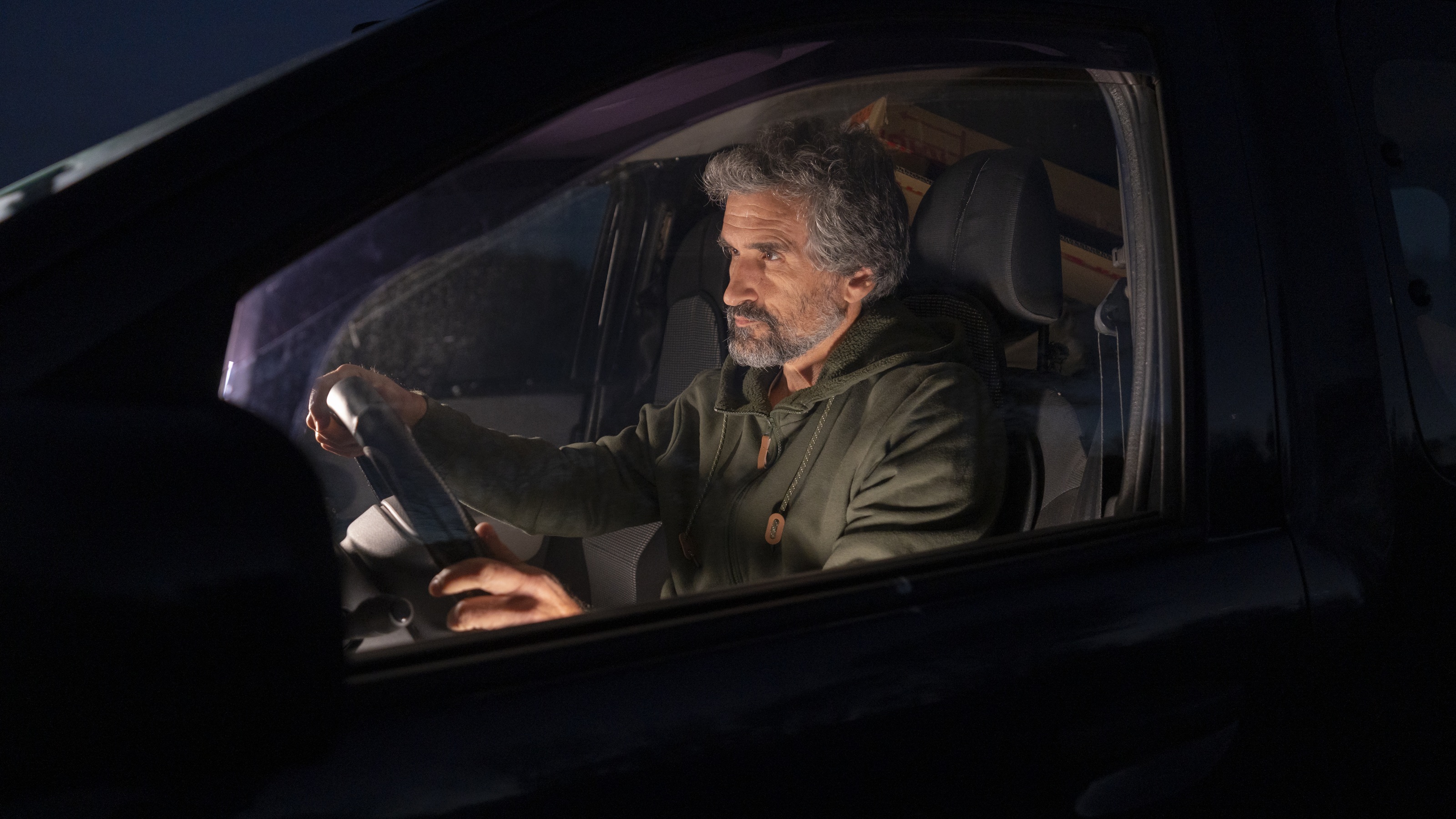

Life insurance is not fun to think about. That's kind of the point. It's financial planning for the scenario where you are not around to do financial planning anymore. But going without it is like driving without a seat belt because you don't plan to crash.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

And not having it can be catastrophic for anyone who relies on you — spouse, kids, aging parents, business partners, boyfriends, girlfriends, pet goldfish.

So let's get this done.

About Adviser Intel

The author of this article is a participant in Kiplinger's Adviser Intel program, a curated network of trusted financial professionals who share expert insights on wealth building and preservation. Contributors, including fiduciary financial planners, wealth managers, CEOs and attorneys, provide actionable advice about retirement planning, estate planning, tax strategies and more. Experts are invited to contribute and do not pay to be included, so you can trust their advice is honest and valuable.

Life insurance: The gist

Life insurance isn't a lottery ticket. For the most part, it's not an investment method either. It's a temporary substitute for you — your income, your caregiving, your debt-handling, your "I'll pay for it."

If nobody truly depends on you, then sure, you may not need much beyond coverage for final expenses. But, you know, you could leave a chunk of money to charities.

But if even one person would be scrambling in the event of your passing — emotionally and financially — life insurance is your way of not leaving a financial mess for them to clean up after you exit stage right.

Employer life insurance is like the snack bowl at a party. It's nice that it's there, but it's not a substitute for dinner.

You may ask, Why? Here are three reasons:

1. It's usually not enough.

Many group plans pay one to two times your salary. If you have a mortgage, kids and a spouse who'd need years of income replacement, that math doesn't work. You leave them enough for only a year or two.

2. It's not permanent or portable.

People change jobs. Companies downsize. You retire. Your "coverage" evaporates in each of those scenarios. Sometimes that happens right when you're older, and buying life insurance on your own is more expensive, or maybe you can't even get life insurance because of a health condition.

3. You don't control the details.

The employer chooses the carrier and the rules, and sometimes the beneficiaries default to whatever the HR file says from when you last updated it in 2017. (Yes, I've seen that happen — a payout could go to your ex instead of your current spouse.)

So treat work coverage as a bonus layer, not the foundation.

Who needs life insurance?

Glad you asked. These are the people who need life insurance the most:

1. Parents of minor kids.

If you have kids who are not financially independent, you need life insurance. Full stop. Mic drop.

Even if your spouse works. Even if you don't earn much. Even if you think "they'll be OK if something happens to me."

Raising kids is expensive, and the loss of a parent often leads to a need for childcare, tutoring, therapy, time off work, maybe a move — and a thousand other expenses nobody wants to think about.

2. Anyone with shared debt.

Mortgage. Co-signed student loans. Business loans. You name it. Everyone has debt. Unfortunately, a lot sometimes.

Debt doesn't die with you. It becomes somebody else's problem fast. If you don't want your partner or family to have to sell the house or drain savings to cover your debt, life insurance can help.

3. Business owners and key employees.

If your death would destabilize a business because you're the revenue engine, the operator or the person holding relationships together, you need coverage. I mean, you are irreplaceable at work, aren't you?

If your business plan includes "hope nothing happens to me," that's not a plan. That's a vibe. And not a realistic one.

Temporary/term life insurance vs permanent (or close to it)

This is where people get stuck because the online world has opinions and salespeople. Here's the brief version.

Term life insurance:

- Covers you for a set period (10, 20, 30 years)

- The most affordable way to buy a lot of coverage

- Good for income replacement while kids are growing up, mortgage years, peak earning years.

For most households, term is the right tool. It's like renting coverage for the years when your financial obligations are the highest.

Permanent life insurance (whole life, universal, etc.):

- Covers you for life as long as premiums are paid, subject to terms, etc.

- More expensive because it includes a cash-value component (money for you)

- Best for estate planning, special-needs dependents, business succession, people with permanent obligations or specific tax strategies (aka big shots)

The biggest mistake people make: Ignoring beneficiary updates

Life insurance works only if it pays the right person or people, so here's your year-end or life-event checklist. If you answer yes to any of these questions, you might need to update your beneficiaries.

- Did you get married or divorced?

- Have you added kids to the family (births or adoptions) since the policy was set up?

- Did any beneficiary die, become estranged or turn into your villain origin story?

- Do you want proceeds to be split in a trust instead of outright?

Beneficiary designations override what you have in your will. So if your policy still lists your ex because you never updated it, congratulations: You just bought a very expensive gift for the wrong person.

Health matters, but timing matters more

People put off applying for life insurance because they're worried they won't qualify. And yes, your health can affect price and eligibility.

But here's the part that should motivate you: You are never going to be younger or healthier than you are today. (I saw this quote for the first time the other day, and it really hit home.)

Looking for expert tips to grow and preserve your wealth? Sign up for Adviser Intel, our free, twice-weekly newsletter.

Also, life insurance premiums don't go down over time. They go up. Waiting five years before applying would be like trying to buy concert tickets after the show has already started.

Even if you have a health condition, there often are options. The earlier you explore them, the better your odds of getting what you need.

The blunt truth (with a bit of kindness)

Life insurance is one of those things you buy because you don't want your family's future to depend on GoFundMe and good luck.

It's not about being maudlin. It's about being responsible in the most human way possible by protecting the people you love from financial chaos at the exact moment they least need chaos.

So yes, thinking about, and planning for, your mortality is uncomfortable. Most important things are.

But if you handle it now — while it's boring and hypothetical — you get to spend the rest of your life not thinking about it.

Which, let's be honest, is the real dream here.

Want to learn more about insurance? Visit icgs.org.

Related Content

- Four Common Misconceptions About Life Insurance

- When Is the Perfect Time to Buy Life Insurance?

- How to Shop for Life Insurance in 3 Easy Steps

- Retirement Planning With Life Insurance

- How Much Life Insurance Do You Need?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Karl Susman is a veteran insurance agency principal, nationally engaged insurance expert witness and broadcast host who translates insurance from jargon to judgment. For more than three decades, he's helped consumers, courts and policymakers navigate coverage, claims and compliance. As Principal of Susman Insurance Agency, Karl works directly with households and businesses to compare options and make clear, defensible coverage decisions.