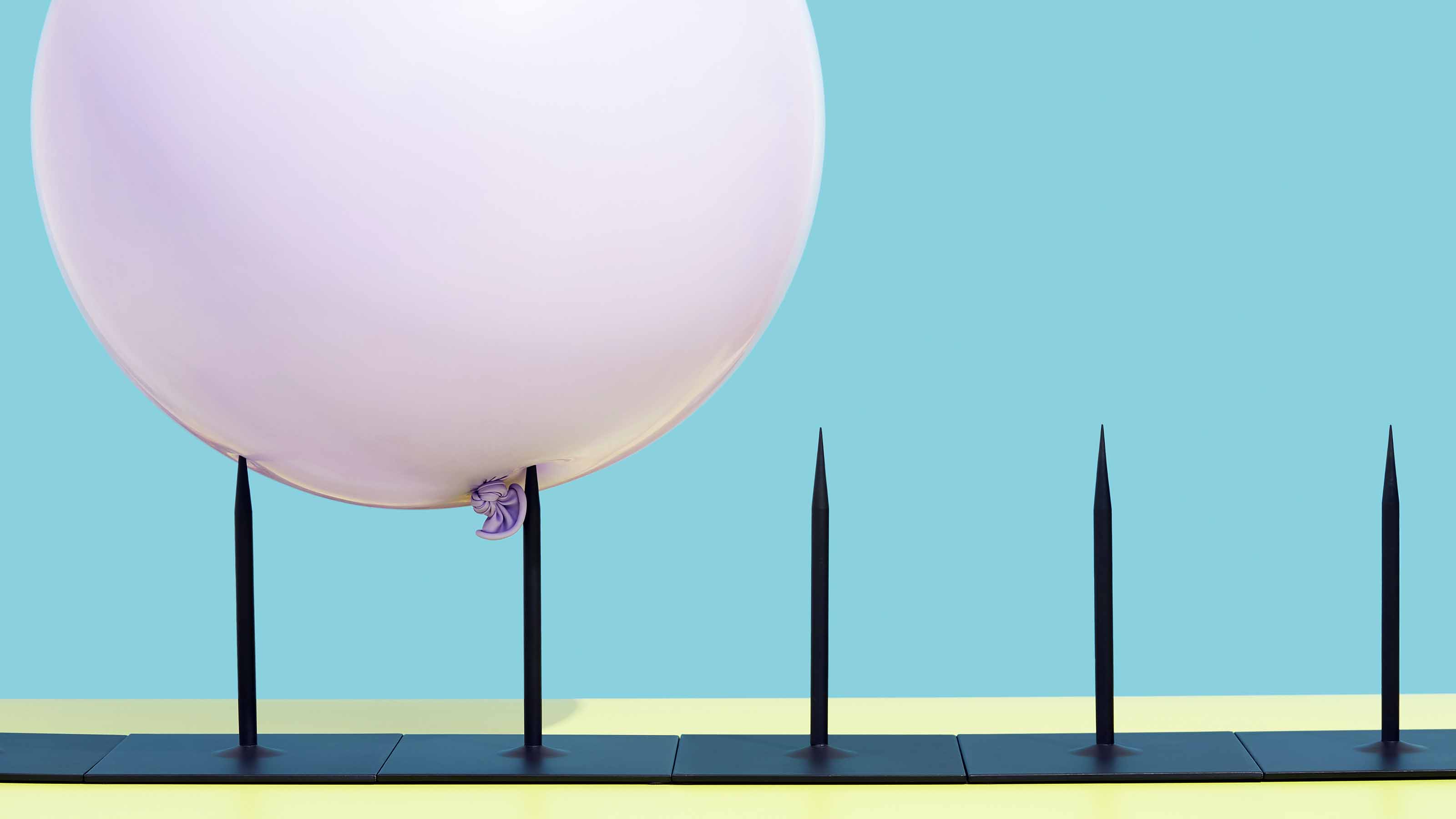

Has Inflation Peaked? Here's What the Experts Are Saying

Inflation decelerated by more than expected in July, but that doesn't mean our era of fast-rising prices – or Fed rate hikes – is over.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

One month does not make a trend, but inflation did indeed moderate in July.

The consumer price index rose 8.5% year-over-year – after jumping a scorching 9.1% in June – and was unchanged on a month-to-month basis. Core CPI, which strips out volatile food and energy components, rose 5.9% from a year ago and just 0.3% vs. June.

Both the headline and core inflation readings came in blessedly below forecast. But although the data offer a welcome respite for consumers – not to mention the Federal Reserve's interest-rate setting committee – experts are split on where consumer prices and Fed policy goes from here.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In order to get a sense of what economists and market strategists are thinking about these latest developments, we've excerpted some of their commentary on the July CPI report below:

- "The July CPI report is a welcome relief for the economy. Markets seem to agree, based on the initial positive response of risk assets to the report. The Fed's forecast of a soft landing would be greatly improved if we see continued declines in core goods – particularly durables such as new and used cars and household furnishings –and a further slowdown in shelter inflation. We think this report is consistent with our forecast of a 50-basis-point [a basis point is one-one hundredth of a percentage point] hike in September. This morning's data confirms that we have seen a peak in inflation and endorses our view that peak Fed hawkishness is likely behind us." – Aditya Bhave, U.S. and global economist at BofA Securities

- "Unlike the previous two CPI reports, today's CPI release provides some welcome news for members of the FOMC. That said, monetary policymakers have made clear that they need to see clear evidence of a sustained slowdown in inflation before pivoting on monetary policy. To that end, core CPI is still up 5.9% year-over-year and has grown at a 6.8% annualized pace over the past three months. In our view, it will take several more soft inflation prints before the FOMC begins to feel confident that it is getting price pressures in check. At least a 50-basis-point (bp) rate hike at the September FOMC meeting remains the most likely outcome." – Sarah House, senior economist at Wells Fargo Economics

- "July core CPI rose by 0.31% month-over-month, below expectations and the slowest monthly pace since September. Declines in airfares and used car prices contributed to the slowdown, and we also note a sequentially slower but still elevated pace of shelter inflation. Headline CPI was unchanged, with the year-on-year rate falling 0.6 percentage point to 8.5% on lower gasoline prices." – Jan Hatzius, chief economist, Global Investment Research Division at Goldman Sachs

- "Inflation softened more than expected after months of upside surprises, led primarily by weaker core price pressures. This was driven by deflation in used cars, airline fares, and lodging, while shelter inflation held firm. Although the move is in the right direction, it is too early to say if the trend will be sustained. Today's inflation report increases the probability of a 50bp hike at the September meeting, which remains our baseline. However, a 75bp hike remains on the table, given that the Fed will have several more data points in hand, including new employment and CPI reports, before the decision." – Pooja Sriram, U.S. economist at Barclays Investment Bank

- "While the headline inflation data today moderated a bit on the back of falling gasoline prices, it's still running at a worryingly high rate. Over time, we think the slowdown in economic growth (globally), the continuation of the Federal Reserve's assertive hiking cycle and the possibility of resolution with several persistent supply chain issues should influence broad inflation lower. Still, while Core PCE inflation (the Fed's favored measure) is likely to moderate in the coming months, it will still remain well-above the Fed's 2% inflation target. The persistence of still solid inflation data witnessed today, when combined with last week's strong labor market data, and perhaps especially the still solid wage gains, places Fed policymakers firmly on the path toward continuation of aggressive tightening. Indeed, we believe it's quite likely that the FOMC will raise policy rates another 75 basis points at the September 21 meeting, the third such substantial hike in a row." – Rick Rieder, BlackRock's chief investment officer of Global Fixed Income and head of the BlackRock's Global Allocation Investment Team

- "Markets are enjoying the CPI report suggesting that inflationary pressures are easing, and the trajectory is moving in the right direction. With this CPI print, equity markets, already overbought, can certainly take a sigh of relief, but it still doesn't answer the question as to whether THE 'bottom' is in. Still, the lower than consensus estimate for headline inflation is undeniably good news for markets and consumers alike." – Quincy Krosby, chief global strategist at LPL Financial

- "The July CPI report might be the first clear indication that consumers are pushing back against high inflation in response to tighter monetary policy. It's a sign that inflation is close to peaking, though the climb down the mountain will be slow due to rising wages and rents. The report will go some way to offsetting the impact of the strong July jobs report in the Fed's eyes, though policymakers will need to see more convincing evidence that inflation is heading toward the 2% target. The Fed will see one more jobs report and another CPI release before the September 20 to 21 meeting. For now, we lean toward a 50-basis-point (bp) rate hike in the face of weaker economic data and some moderation in consumers' long-run inflation expectations." – Sal Guatieri, senior economist at BMO Capital Markets

- "The decline in Inflation, which peaked a few months ago, is now showing up in the headline data in a meaningful way. The Fed now has plenty of cover to reduce the pace and size of future rate hikes. This is really good news and decreases the odds of stagflations and the need for a big recession to break the back of embedded inflation." – Jamie Cox, managing partner at Harris Financial Group

- "The bond market loves the number, and for a good reason. The inflation rate is still elevated at +8.5% YoY from +9.1% in June; the core inflation rate stayed at +5.9%, but that is still off the +6.5% March peak (and the consensus had been looking at a bump to +6.1%). Many goods items related to the dollar (appliances, apparel) declined, and we saw big relief in the airlines, used vehicles, rental cars, and education/communications. The price softness was breathtakingly broadly based. Excluding shelter, CPI was -0.3%, and this has not happened since May 2020." – David Rosenberg, founder and president of Rosenberg Research

- "Headline CPI decelerated in July as gas prices declined, giving consumers some relief at the pump. Declining retail gas prices will likely give a much-needed boost to consumer confidence. Consumers feel the nagging pressures from rising shelter and food prices. Rising rental costs are especially troublesome. We could see rising rents continue in the near future as would-be home buyers recalibrate amid rising borrowing costs. Transportation costs declined over 2% from a month ago, perhaps a sign of cooling demand for travel. The Fed will have another inflation report before September's FOMC meeting and if August's inflation report is as good as this one, we could expect a 50 basis point hike instead of a more aggressive increase in rates." – Jeffrey Roach, chief economist at LPL Financial

- "If we continue to see declining inflation prints, the Federal Reserve may start to slow the pace of monetary tightening and if the market starts to price in fewer rate hikes, we expect the yield curve to steepen. While the Fed has hiked interest rates by 225 bps already this year, the market is pricing in an additional 117 bps of hikes still to come in 2022." – Nancy Davis, founder of Quadratic Capital Management and portfolio manager of the Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL)

- "July finally saw some good news for consumer prices, and not just with lower gas prices. The big runup in retailers' inventories since late 2021 is translating into more discounting for consumers. With the economy much cooler than in 2021, inventory levels higher, and gas prices down in the first ten days of August, inflation is probably past the peak. However, the U.S. is at risk of another surge in utility prices this coming winter if Europe suffers an energy shortage, which currently seems quite likely – British natural gas futures and German electricity futures are pricing in surges to prices that matched last winter's highs. Another tough winter heating season could hit consumers harder than last year's, since many households have spent down the financial cushions they built up during the pandemic. Inflation is likely to be stuck above 5% through the winter as utility prices stay high and global supplies of petroleum products stay tight." – Bill Adams, chief economist for Comerica Bank

- "The market seems to be taking comfort in the fact that we're seemingly past peak inflation and we should continue to see declines in the second half of the year. It looks like the odds of another 75 basis point hike by the Fed have dipped significantly in the wake of this report and we could only see a 50 basis point hike at the next meeting. If energy prices continue to fall, then I expect that we'll see inflationary data coming down in future months. This dynamic should support risk assets and we will likely see long term interest rates fall as well." – Brian Price, head of investment management for Commonwealth Financial Network

- "As we've said all year, the Fed has its back against the wall and gets let up (on raising interest rates) until inflation starts coming back down. One month doesn't make a trend, but at least headline is coming down and core stopped going up. If we see future months' data showing a decrease in inflation, then it will help markets see the end of the tunnel in terms of rate hikes." – Chris Zaccarelli, chief investment officer at Independent Advisor Alliance

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

Why the Next Fed Chair Decision May Be the Most Consequential in Decades

Why the Next Fed Chair Decision May Be the Most Consequential in DecadesKevin Warsh, Trump's Federal Reserve chair nominee, faces a delicate balancing act, both political and economic.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.