Red vs Blue: Staying the Financial Course During an Election

History shows economic uncertainty in presidential election years is often unfounded, as the markets perform well, for the most part, no matter who wins.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As we enter another election season, politics will inevitably occupy a prominent place in consumers’ minds. Presidential campaigns offer a wave of new policy promises and agendas that look to address kitchen-table issues like jobs, taxes and health care.

Presidential elections also feel incredibly consequential, as whoever wins control of the White House will be in charge of the policy agenda for the next four years. Consumers naturally speculate about how election outcomes and policy proposals might affect their household budgets and investment portfolios.

But the truth is that the economy and the markets are much more indifferent to presidential election outcomes than many people believe. Despite the uncertainty, history shows us that investors don’t have to worry too much about how an election result will affect their investments — and keeping this top of mind will help them navigate economic waters during 2024.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Investors have been rewarded regardless of who wins the White House

Conventional wisdom suggests one political party is inherently better or worse for investors than another, but historically, stock returns have been strong under both Democratic and Republican presidents. In looking at past returns since 1932, Democratic presidents have seen stocks advance by 8.6% on average, compared to an average of 6.6% under their Republican counterparts.

But these numbers don’t tell the full story. When removing outlier periods from the averages — the boom years under Bill Clinton and the subsequent dot-com bust and global financial crisis under George W. Bush — the difference in returns between parties is practically zero, suggesting investors interpret historical relationships with a healthy skepticism.

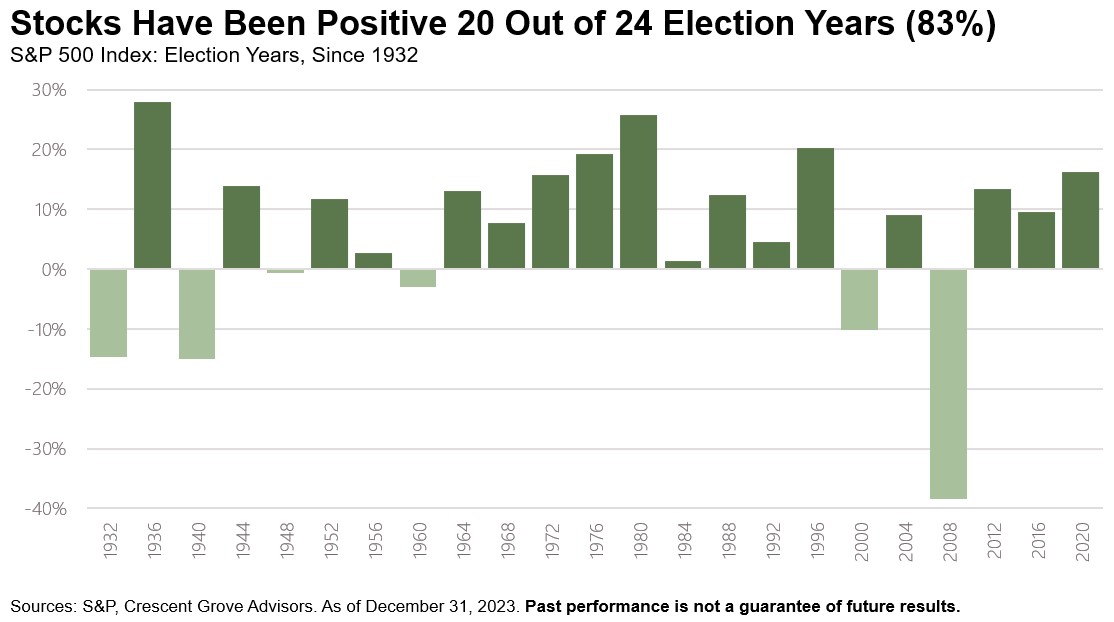

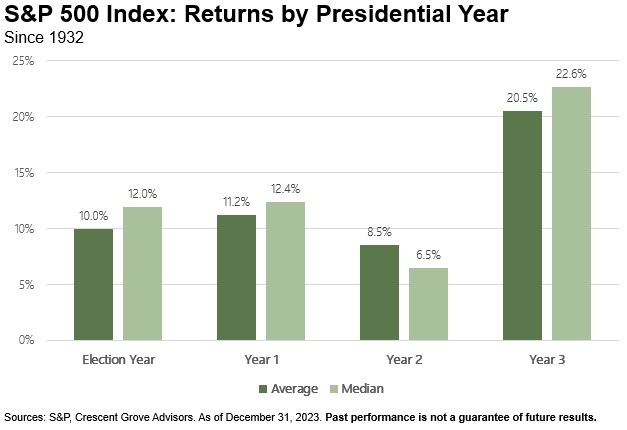

Furthermore, the stock market has typically performed well during presidential election years, in spite of all the uncertainty and media chatter. The S&P 500 has delivered positive annual returns in 20 out of 24 presidential election years from 1932 through 2020. During the 24 presidential election years that occurred in that 88-year period, the S&P 500 delivered an average of 10% annual returns during an election year and on average continued to produce positive returns for each of the three years following an election year.

Markets like checks and balances

Contrary to popular belief, the economy and the stock market actually do better when the White House and Congress are controlled by two different parties. According to S&P data, stocks delivered an average of 12.9% annual returns from 1932 through 2023 when Republicans were in charge of both the White House and Congress, and 9% during that time when Democrats were in power of both branches of government.

However, when there has been a Democratic president and a Republican-controlled Congress from 1932 through 2023, the S&P 500 delivered higher annual returns — of 14%. And stocks have delivered average annual returns of 13.6% when there was a Democratic president and control of the House of Representatives and Senate were split.

In other words, political gridlock can actually be good for investors, because it makes it harder to pass sweeping policy changes that could negatively affect the economy.

In addition, the U.S. economy is big and resilient and is dominated by the private sector, meaning the majority of economic activity is outside the direct control of politicians.

Economic fundamentals are what really matter

While it’s easy to attribute stock price action to one party’s politics, the reality is more nuanced, and market performance is not so easily tied to election cycles or political agendas. Political headlines may drive performance narratives in the near term, but over the long term, returns are driven much more by underlying fundamentals.

The path of monetary policy, the ebb-and-flow of the economy and the strength of corporate earnings are all much more important factors than policy decisions emanating from the White House. Ultimately, it’s the economic backdrop, not the political party in control of the White House, that’s more relevant to understanding why stocks go up or down.

Key takeaways

It's natural to be concerned about elections, but history suggests they have minimal impact on portfolios and markets. In the long run, it’s a fool’s game to try to predict how the U.S. economy and markets will respond to election cycles or political outcomes. Instead, consumers should allow their long-term goals and needs to guide their personal finances and investment portfolios.

One of the big advantages of working with a trusted financial adviser is that they can help Americans keep a cool head among all the media and social media chatter. An adviser can work with an individual or a family to create a budget for meeting expenses and saving money over the long term, and also craft a financial plan to save for college tuition and a financially secure retirement.

After these household budgets and financial plans are created, advisers can serve as behavioral coaches to keep individuals and families focused on their long-term goals and calm them down when they are considering financial decisions based on what they are feeling and hearing in the run-up to Election Day in 2024 or in future presidential election years.

Data isn’t emotional. It doesn’t listen to the TV news or monitor social media. And the data says the American economy and stock market are not drastically affected by the outcome of presidential elections — and, in fact, all that uncertainty can be much ado about nothing.

Related Content

- Four Historical Patterns in the Markets for Investors to Know

- What’s the Difference Between Average and Actual Rate of Return?

- To Make the Case for Equities in the Long Term, Look to the Past

- Expecting a 12% Return on Your Portfolio? That’s Dangerous

- Tax Plans of the 2024 Presidential Candidates

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Bob is a Senior Wealth Advisor with Crescent Grove Advisors | Portfolio Advisory Services. Specifically, Bob focuses on portfolio advisory services for clients with liquid investable assets of $1 million to $10 million. In addition to portfolio management, Bob works to coordinate his clients’ entire financial plan to address tax planning, cash flow, retirement and risk management.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.