To Make the Case for Equities in the Long Term, Look to the Past

While cash yields are attractive now, if we look at the performance of equities in the past, we can expect that, going forward, they could be a better bet.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Well, the year 2023 is officially a wrap. Overall market performance was relatively strong, with equities, defined as the total return of the S&P 500, up 26.29% for the year, and bonds, defined as Bloomberg U.S. Aggregate Bond Index, up 5.53%.

The strong performance of equities in 2023 was somewhat unexpected, with many market forecasters predicting lower returns at the beginning of the year, especially with growing concerns of a recession. The stock market return for 2024 is equally uncertain, and many investors may be looking to cash, given attractive yields exceeding 5%; however, it’s important to remember that equities have dramatically outperformed cash historically, especially over longer investment periods, and are expected to do so into the future.

Therefore, the case for equities is as strong today as ever, but it’s important to ensure the risk level of your portfolio is appropriate and to stay invested for the long term!

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A look back in time

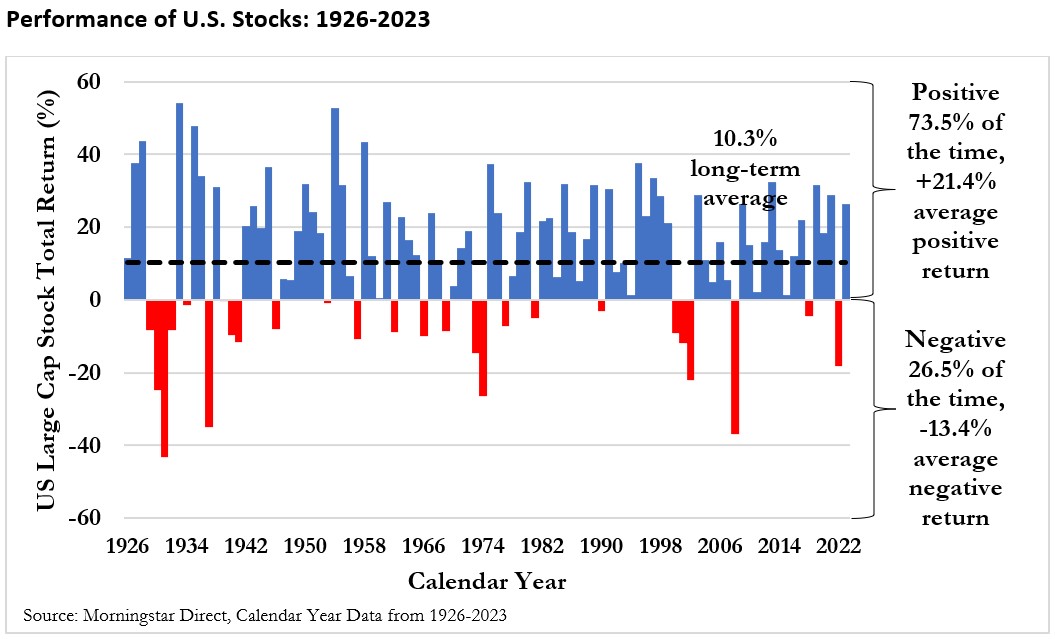

There has always been risk associated with investing in equities, especially over shorter periods, which is why it’s important to take a long-term perspective when it comes to investing. If we look at total returns for U.S. equities from 1926 to 2023, which include the performance benefit of dividends, they’ve been positive for 73.5% of calendar years with an average annual long-term geometric return of 10.35%, as demonstrated in the chart below.

It’s important to note, though, while the total return on stocks has been positive for 73.5% of calendar years, if we look at five-year periods, it’s been positive 87.2% of the time, and if we look at 10-year periods, it’s been positive 95.5% of the time. In other words, being invested for the long term has definitely benefited investors.

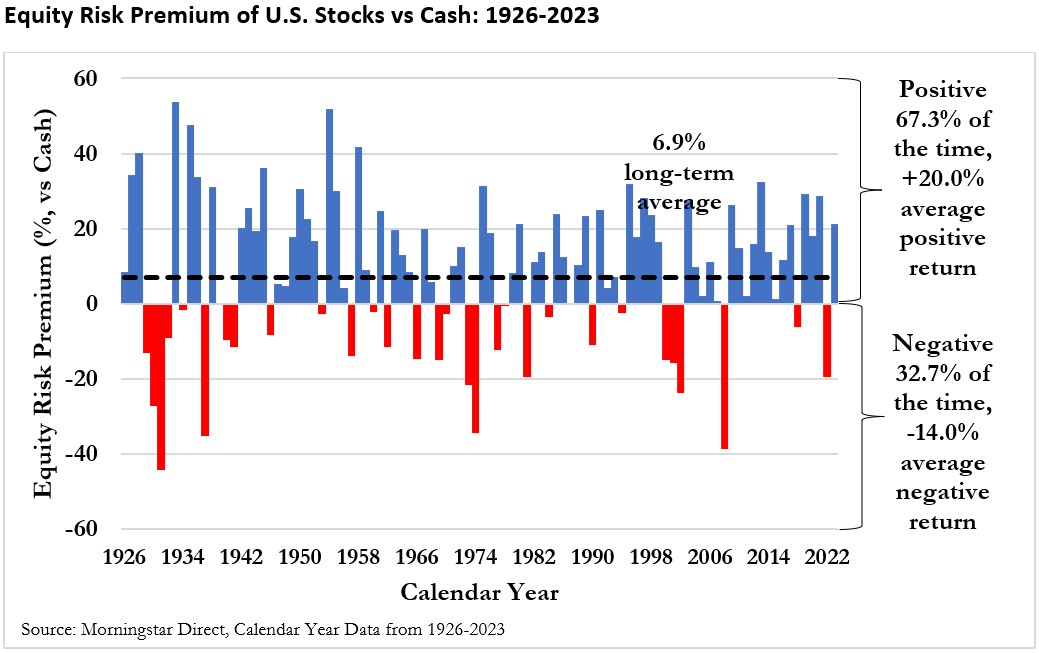

The current high returns on cash, which exceeded 5% at the beginning of the year, may have many investors rethinking their longer-term strategy allocations and possibly underweighting equities in their portfolios. While it’s true that current cash yields are significantly higher than long-term averages, equities have dramatically outperformed cash over the long term. Looking at returns from 1926 to 2023, equities have outperformed by 6.9% per year on average and had a higher return 67.4% of the time, as demonstrated in the chart below.

Clearly, there have been times when cash has outperformed equities, in particular those years when the return on equities was low or negative, but over the long term, equities have dramatically outperformed cash. For example, stocks outperformed cash 76.6% of the time over rolling five-year periods and 85.4% of the time over rolling 10-year periods. Therefore, it’s important to take a long-term perspective when it comes to investing.

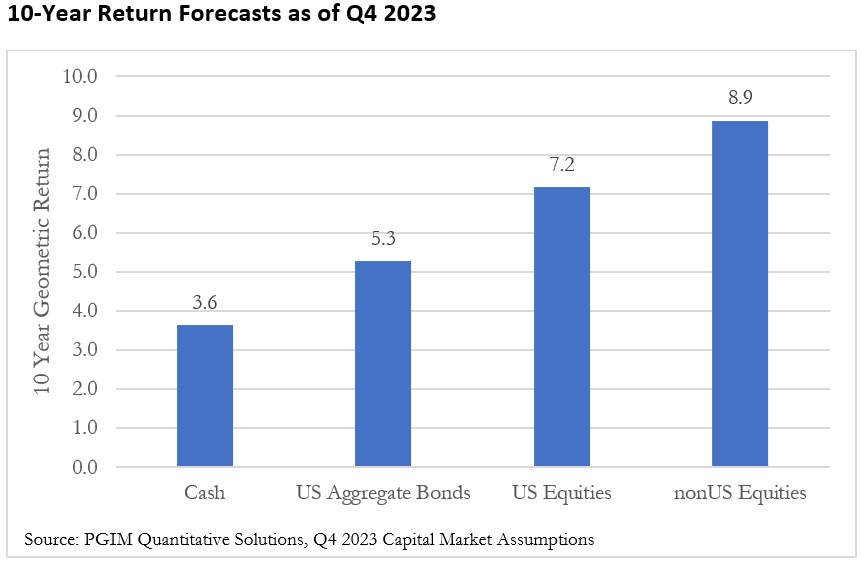

While it obviously is difficult to predict where the market is headed, one of our affiliates, PGIM Quantitative Solutions, does create forward-looking return estimates for the next 10 years. These forecasts can be used to help create expectations for investors around likely future returns. The latest return expectations available, as of Q4 2023, are included below, for a few common asset classes.

Some important things to be aware of with respect to these forecasts. First, there is still the general expectation that stocks will outperform cash and bonds into the future, but at lower levels than have been experienced in the past. Second, the forecasted return for U.S. equities over the next 10 years, at 7.2%, is notably lower than the historical long-term average, at 10.2%. This is more than 3 percentage points lower and important for investors to be aware of when running any kind of financial plan, given the pronounced potential effect.

For example, $1 invested at 7.2% for 10 years would grow to roughly $2 at the end of the period vs $2.66 if invested at 10.2%, which is roughly one-fourth lower.

Going forward

The common expression that past performance is no guarantee of future results is true today more than ever. Since it is impossible to know what’s going to happen in the financial markets, one of the most important things to try to control is investor behavior, by ensuring your portfolio is consistent with your objectives and staying invested for the long term.

Related Content

- Expecting a 12% Return on Your Portfolio? That’s Dangerous

- Your Retirement Readiness Rx: Plan Early and Get Help

- Four Historical Patterns in the Markets for Investors to Know

- Five Common Retirement Mistakes and How to Avoid Them

- What’s the Difference Between Average and Actual Rate of Return?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David Blanchett, PhD, CFA, CFP®, is Managing Director and Head of Retirement Research for PGIM DC Solutions. PGIM is the global investment management business of Prudential Financial, Inc. In this role he develops research and innovative solutions to help improve retirement outcomes for investors with a focus on defined contribution plans. Prior to joining PGIM he was the Head of Retirement Research for Morningstar Investment Management. He is currently an Adjunct Professor of Wealth Management at The American College of Financial Services and Research Fellow for the Alliance for Lifetime Income. David has published over 100 papers in a variety of industry and academic journals that have received awards from the CFP Board, the Financial Analysts Journal, the Journal of Financial Planning, and the International Centre for Pension Management. In 2014 InvestmentNews included him in their inaugural 40 under 40 list as a “visionary” for the financial planning industry, and in 2021 ThinkAdvisor included him in the IA25+. When David isn’t working, he’s probably out for a jog, playing with his four kids, or rooting for the Kentucky Wildcats.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.