The Holidays Won’t Be Canceled

Malls will be quieter, but consumers will still go shopping.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

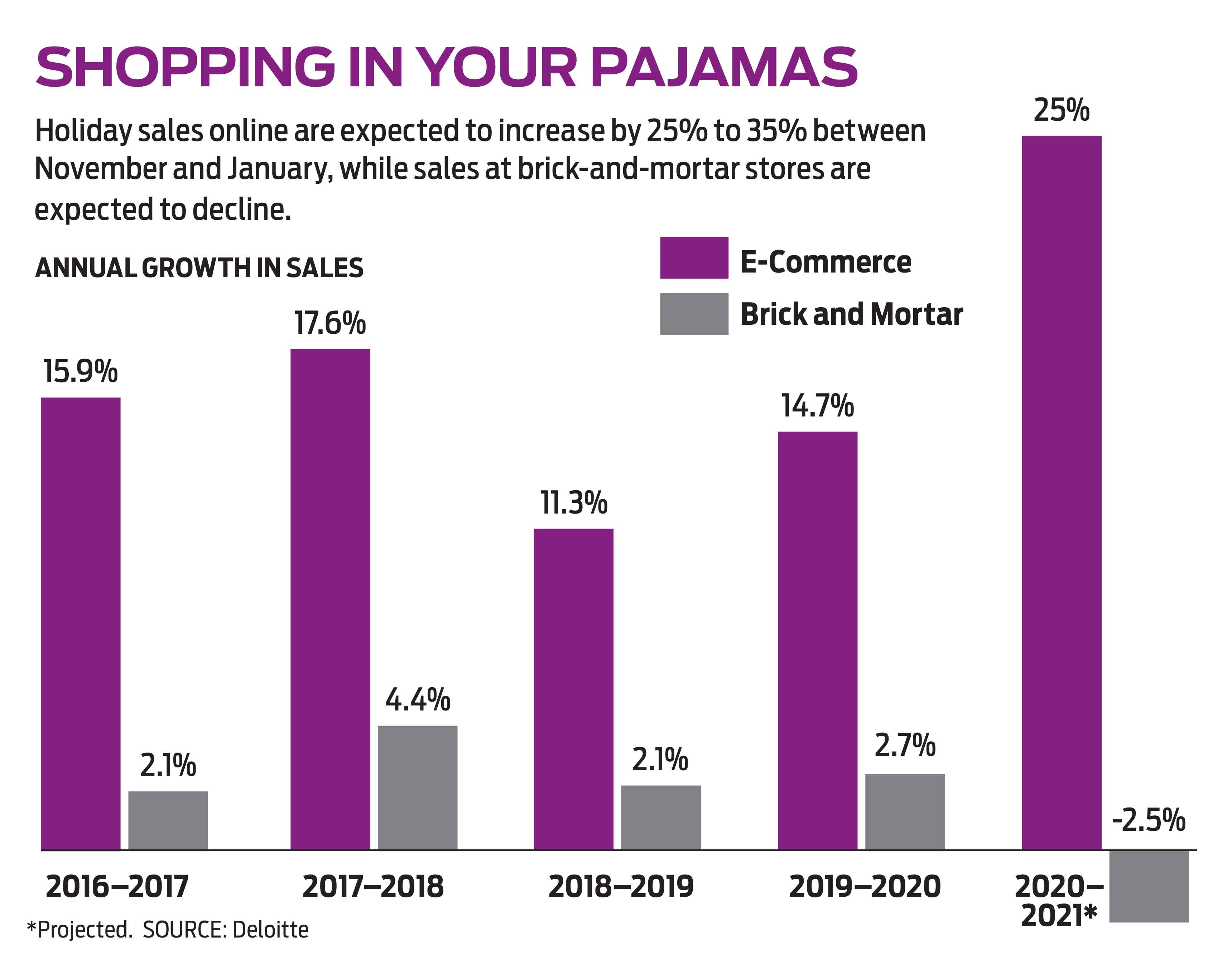

In a year that compelled us to revamp the way we work, where our children go to school and what we do for fun, the 2020 holiday shopping season will look markedly different, too. With a COVID-19 vaccine still months away from broad availability, many people are reluctant to go to stores and malls, so perhaps it’s not surprising that more than two out of three shoppers surveyed by CreditCards.com said they plan to do most of their seasonal shopping online this year. The Kiplinger Letter forecasts that online sales will jump by 28% this year as Americans continue to use their phones and tablets to buy holiday gifts.

But the pandemic isn’t the only factor driving this trend. Nearly 70% of shoppers said that convenience was the main reason they plan to shop online.

But the surge in online shopping may have been affected by the pandemic, which compelled consumers who were sheltering at home to buy everything from groceries to lawn mowers online. “During the lockdown, people got used to purchasing things in ways they might not have done before,” says Stacy Berek, managing director of GfK, a consumer products consultant. Older Americans who didn’t shop much online in the past have become more comfortable buying over the internet now, she adds, and that trend will likely continue even after the pandemic is over.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The economic downturn will dampen spending, as many families have been hit by furloughs, unemployment and high medical costs. But Deloitte predicts that holiday spending will still rise by 1% to 1.5%. Consumers who haven’t been spending much money lately on travel, dining out, gym memberships and other services because of the pandemic have more to spend on physical merchandise, provided they have been able to hold on to their jobs, according to The Kiplinger Letter. Guilt will be a powerful motivator, too, says Marshal Cohen, chief industry adviser, retail, for market research firm NPD Group. For example, toy sales will be strong, he says, because “Mom and Dad feel really bad that their kids had to endure this terrible year.”

Deals, deals, deals. With the coronavirus still a threat, even the most die-hard bargain shoppers may be disinclined to storm their favorite retailers in search of Black Friday discounts. Many big stores, including Walmart, Target and Best Buy, have announced that they’ll be closed on Thanksgiving Day. But you’ll be able to find plenty of deals without leaving the safety and comfort of your home. And you won’t have to do all of your shopping at once, either, because for many retailers, every day will be Black Friday. For example, Home Depot says it will offer its Black Friday discounts throughout the holiday season.

Shoppers who procrastinate could face shortages of popular items, along with shipping delays. UPS says items sent via ground delivery should be shipped by December 16 to arrive in time for Christmas. The deadline for packages sent via ground delivery through FedEx and the U.S. Postal Service is December 15.

One way to avoid shipping delays (not to mention unappreciated presents) is to give gift cards, which can be delivered electronically. But be careful. In recent months, several major retailers, including Lord & Taylor, Pier 1 and Modell’s Sporting Goods, have filed for bankruptcy, and more retailers are likely to disappear if the economic downturn stretches into 2021. When a retailer files for bankruptcy, gift card holders often have only a few weeks to redeem their cards before they become worthless. Gift cards for local businesses could also lose their value if the retailer fails, says Ted Rossman, industry analyst for CreditCards.com. Although a check or general-purpose gift card is less personal, it’s a safer choice, he says.

How to pay. The CreditCards.com survey found that debit cards were the most popular form of payment for holiday shopping this year. Forty-six percent of those surveyed said they planned to pay with debit cards, while 39% said they planned to use credit cards.

That may reflect consumers’ reluctance to run up debt at a time of economic uncertainty, Rossman says. But when you forgo credit cards, you give up numerous benefits, including the ability to dispute the charge if an item is damaged or stolen. In addition, many credit cards offer rewards that can save you money.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Block joined Kiplinger in June 2012 from USA Today, where she was a reporter and personal finance columnist for more than 15 years. Prior to that, she worked for the Akron Beacon-Journal and Dow Jones Newswires. In 1993, she was a Knight-Bagehot fellow in economics and business journalism at the Columbia University Graduate School of Journalism. She has a BA in communications from Bethany College in Bethany, W.Va.

-

Will You Get a Trump Tariff Refund in 2026? What to Know Now

Will You Get a Trump Tariff Refund in 2026? What to Know NowTax Law The Supreme Court's tariff ruling has many wondering about refund rights and how tariff refunds would work.

-

2026 Tax Refund Delays: 5 States Where Your Money Is Stuck

2026 Tax Refund Delays: 5 States Where Your Money Is StuckState Tax From New York to Oregon, your state income tax refund could be delayed for weeks. Here's what to know.

-

Paper Tax Filers Face Long Wait as IRS Digitization Effort Stalls

Paper Tax Filers Face Long Wait as IRS Digitization Effort StallsTax Filing Last April, the IRS launched its Zero Paper Initiative to speed up paper tax return processing. The project isn’t going well.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

The Current I-Bond Rate Is Mildly Attractive. Here's Why.

The Current I-Bond Rate Is Mildly Attractive. Here's Why.Investing for Income The current I-bond rate is active until April 2026 and presents an attractive value, if not as attractive as in the recent past.

-

What Are I-Bonds? Inflation Made Them Popular. What Now?

What Are I-Bonds? Inflation Made Them Popular. What Now?savings bonds Inflation has made Series I savings bonds, known as I-bonds, enormously popular with risk-averse investors. How do they work?

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.