How Big Will the Fed Rate Hike Be? Wall Street's Top Minds Weigh In

The Fed rate hike announcement is due out Wednesday afternoon, and markets are anticipating another monster increase.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The Federal Reserve's rate-setting committee kicks off its regularly scheduled two-day meeting on Tuesday, and it's all but certain to deliver yet another jumbo interest rate hike.

The great bulk of traders, investors, economists and strategists are forecasting a 75 basis point (bp) increase to the federal funds rate when Chair Jerome Powell and the rest of the Federal Open Market Committee (FOMC) wrap up their latest policy confab on Wednesday. (A basis point equals 0.01%, by the way.) The Fed will release its decision at 2:00 pm Eastern. However, as per usual, market participants are likely to be more keen on what Powell has to say at his post-proclamation press conference scheduled shortly thereafter.

The market has had plenty of time to digest another big rate hike, and it really should come as no surprise. Powell has never been one to mince words, for one thing. Besides, the latest readings on inflation showed that a number of key components of the consumer price index continue to expand at alarming rates.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Inflation, it seems, is by no means under control. The economy, despite feelings to the contrary, remains way too hot.

The question then isn't so much whether the Fed will hike by 75 bp later this week. (Although a not insignificant portion of the bond market is betting on a 100 bp hike.) Rather, the big unknown is where and when does the Fed's current policy of tightening end?

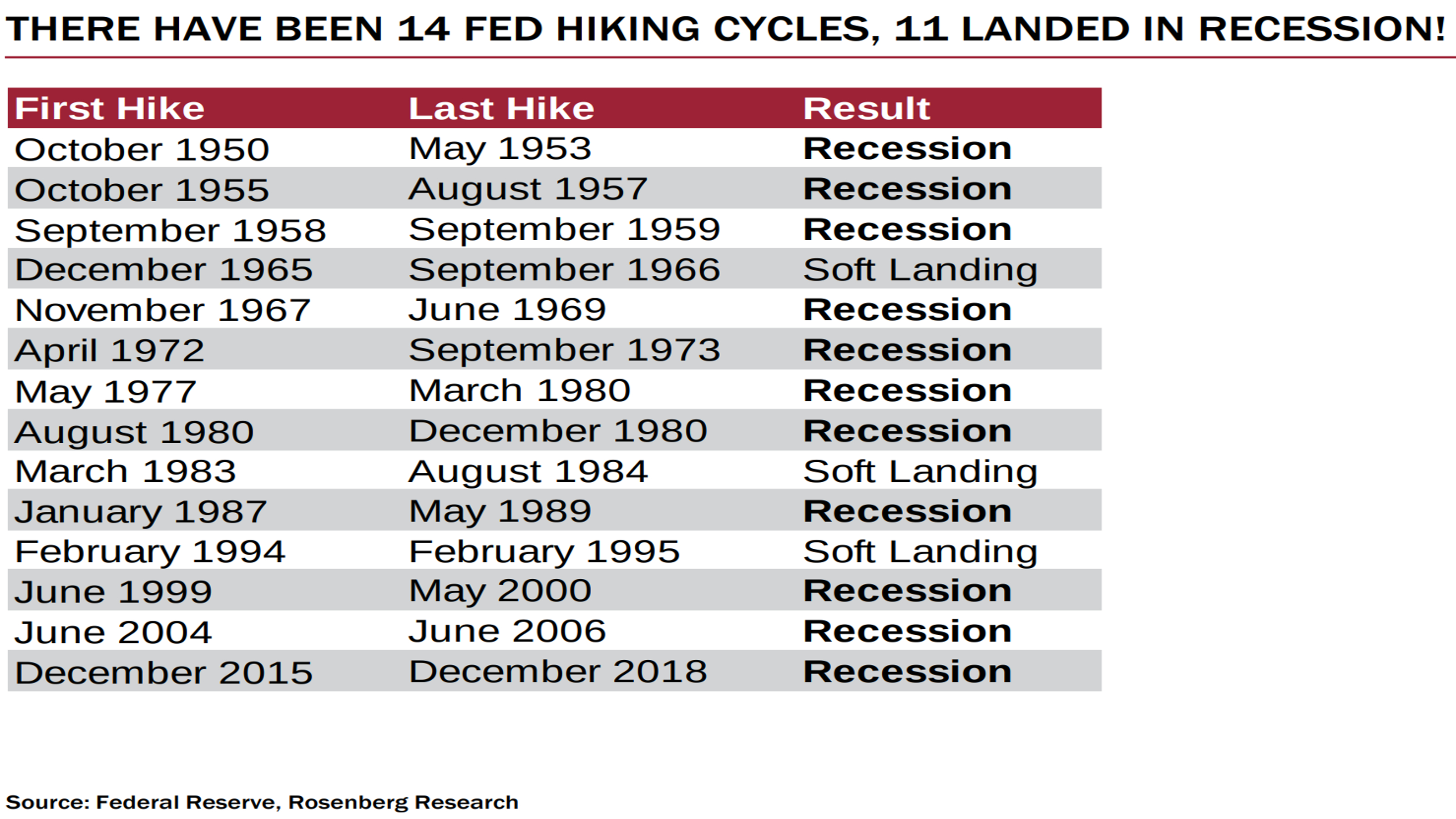

The Fed is striving to pull off everyone's dream scenario of a so-called soft landing. Yet history suggests such feats are exceedingly rare. And so, as we'll see in much of the commentary below, prognosticators are increasingly fearful that the only way to achieve the Fed's 2% inflation target is for the economy to slip into recession.

With the FOMC's Wednesday policy announcement dominating the market's psyche, we figured it was a good time to round up some select analysis from economists, strategists, chief investment officers and the like. Below please find a smattering of what the pros are expecting out of the Fed and the market in the days ahead:

- "Any hopes of a fast retreat in core inflation were quickly dashed with the latest U.S. CPI report. U.S. consumer prices climbed 8.3% year-over-year in August, marking a slight slowdown thanks to a decline in gas prices. Meanwhile, core CPI, which removes volatile food and energy components, doubled market expectations, jumping 0.6% month-to-month, and 6.3% from a year ago. The hotter-than-expected report highlights just how persistent price pressures are, and all but cements another historically large Fed rate hike." – Priscilla Thiagamoorthy, economist at BMO Capital Markets Economic Research

- "We expect the FOMC to deliver a third 75 bp rate hike at its September meeting, taking the funds rate to 3.0% to 3.25%. The bond market is pricing a one-in-four chance of a 100 bp hike. We expect 50 bp hikes in November and December, taking the funds rate to 4.0% to 4.25% at year-end. How high will the funds rate ultimately need to go? Our answer is high enough to generate a tightening in financial conditions that imposes a drag on activity sufficient to maintain a solidly below-potential growth trajectory. We could imagine the hiking cycle extending beyond this year if additional tightening proves necessary to keep growth on a below-potential path." – Jan Hatzius, chief economist, Global Investment Research Division at Goldman Sachs

- "Third time is the charm! We expect the makers of domestic monetary policy will, at the conclusion of their upcoming policy deliberations, again raise the funds rate target band by 75 basis points. This would make the September rate hike the third consecutive super-sized rate hike of this tightening cycle. A 75 basis point hike would lift the upper end of the target range to 3.25%, making this tightening cycle comparable to that executed by Chairman Greenspan in the early 1990's, yet this is not likely to be the last rate increase. We expect the Fed to hike rates until a 4.0% to 4.25% target band is established by year-end or before the end of the first quarter of 2023. After this aggressive tightening, it will be time for the Fed to pause and assess the economic impact of its cumulative policy adjustment. Besides a third large rate hike, we expect policy makers will maintain the current $95 billion per month portfolio reduction target." – Steven Ricchiuto, U.S. chief economist at Mizuho Securities

- "Last week's U.S. CPI report confirmed why we don't see a soft landing for the economy: inflation is proving sticky as we expected, and central banks are following a whatever-it-takes approach to inflation. This suggests they will overreact to upside inflation surprises but not necessarily respond to downside surprises. The upshot? We expect a policy over-tightening that causes recessions. Our whole portfolio approach prompts us to reaffirm our tactical views taking reduced risk. We favor credit given our view that a major default cycle is unlikely, and are underweight developed market equities given the recession hit we see ahead." – Wei Li, global chief investment strategist at BlackRock Investment Institute

- "Until recently, a 75 bp hike was the presumed move, but following last week's CPI report, the market has started to speculate that the Fed could even consider a larger, 100 bp. hike. Even if the Fed raises by 75 bp, that hike would bring the federal funds rate up to 3.0% to 3.25%, which has not been seen since 2008. One of the key points from its announcement will be how the Fed proceeds for the rest of the year. Markets are now pricing in the likelihood that the federal funds rate will reach over 4% by the end of the year. This would mean several more large hikes are on the way." – Kevin Simpson, co-founder and chief investment officer at Capital Wealth Planning

- "We had a sneaking suspicion last week that U.S. equity markets were pressing into oversold territory. Though trading will likely be tricky ahead of the FOMC decision this coming Wednesday (9/21), we believe there is enough bandwidth to warrant further upside in stocks over the short-run. Overall, our work continues to point to a basing/bottoming effort in stocks taking place, which implies that we are likely to see continued skirmishes back-n-forth between the bulls and bears in sessions ahead. With the FOMC on Wednesday, plus several other central banks discussing monetary and rate policies this week, we anticipate another heavy 'macro' influence over the stock markets, with investors myopically focused on inflation and Treasury yields." – Dan Wantrobski, technical strategist and associate director of research at Janney

- "The FOMC on Wednesday is widely expected to announce a third straight 75 bp rate hike, lifting the target range to 3.0% to 3.25%, while indicating more tough medicine is on the way. The interest rate projections are ripe for upgrading, while GDP growth estimates will be pared. The unemployment rate could be bumped higher, indicating more 'pain' is needed to wrestle inflation to the ground. It is unclear which direction the inflation forecasts will take … but a material upgrade would send a hawkish signal. In his press conference, Chair Powell will likely affirm that the Fed needs to act 'forthrightly' and 'strongly' to tackle inflation and that a restrictive policy stance will need to be in place for 'some time.' Wednesday's move should take policy rates into modestly restrictive territory, so it will be noteworthy if the Chair signals a somewhat nimbler approach to tightening going forward. Also of note will be whether he still thinks the Fed can engineer a soft landing, despite the need for higher interest rates." – Sal Guatieri, senior economist at BMO Capital Markets

- "We expect the Fed to raise its policy rate by 75 bp in September to 3.0% to 3.25% and project the target range for the federal funds rate to reach 3.75% to 4.0% by year-end. This would be 50 bp higher than in June. We also look for the median member to project one additional 25 bp hike in 2023, bringing the new terminal rate to 4.0% to 4.25%. In the updated FOMC statement, we think the Fed will likely be clear that monetary policy will be moving into restrictive territory. In addition, we think the Fed will want to send the signal that a restrictive policy stance will be needed 'for some time' in order to guard against market expectations of a quick pivot to rate cuts once inflation has begun to move lower. We look for the September statement to say 'further increases in the target range will be appropriate,' as opposed to 'ongoing increases' as was the case in July. In addition, we think the statement could then add, 'the committee believes restoring price stability will likely require a restrictive policy stance for some time.' We expect the main message from the updated projections to be that risks of a hard landing are rising. – U.S. Economist Michael Gapen, Rates Strategist Mark Cabana and FX Strategist John Shin, Global Rates and Currencies Research at BofA Securities

- As noted above, soft landings are rare. David Rosenberg, founder and president of Rosenberg Research, makes sure to remind everyone of that from time to time. In an on-brand move that was succinct, if rather depressing, the not-quite permabear of a strategist published the following graphic on Monday:

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you might be wasting your money. Here's what you need to know.

-

The November CPI Report Is Out. Here's What It Means for Rising Prices

The November CPI Report Is Out. Here's What It Means for Rising PricesThe November CPI report came in lighter than expected, but the delayed data give an incomplete picture of inflation, say economists.

-

The Delayed September CPI Report is Out. Here's What it Signals for the Fed.

The Delayed September CPI Report is Out. Here's What it Signals for the Fed.The September CPI report showed that inflation remains tame – and all but confirms another rate cut from the Fed.

-

Banks Are Sounding the Alarm About Stablecoins

Banks Are Sounding the Alarm About StablecoinsThe Kiplinger Letter The banking industry says stablecoins could have a negative impact on lending.

-

What Will the Fed Do at Its Next Meeting?

What Will the Fed Do at Its Next Meeting?The Federal Reserve is expected to keep rates unchanged at the next Fed meeting.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.