What Is a Margin Call?

Margin calls can be painful for investors trading with borrowed cash. Here, we answer the question "what is a margin call?" and explain why they happen.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Margin Call is a movie that chronicles the early stages of the 2008 financial crisis, where an investment bank faces collapse after taking on debts too large to handle – and has to make some tough choices under pressure to avoid going bankrupt altogether.

While individual investors may not have as many zeros in their account as the fictitious firm in this film, they too can be subject to a margin call – with potential consequences just as serious.

So what exactly is a margin call, and why do they happen?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What is a margin call and how does it work?

Trading with borrowed cash can create a margin call. The practice, known as margin trading, involves putting up a modest amount of cash to invest with significantly larger buying power. Or more simply, margin traders borrow money from their brokers. The money they provide up front as well as the underlying investments they buy with borrowed cash are the collateral for that loan.

This investing practice can be quite complex. But without getting into details, let's just say margin trading is always costly because of the interest rates on these loans. It is also often very risky.

A margin call is an event that happens to margin traders where their broker demands more money. This occurs because a margin trader's account is facing significant losses, and the broker fears they won't get repaid on their loan.

Think of it this way: If you invest $10,000 of your own money and lose $7,500… it's very embarrassing, but it's your choice whether to stay the course. And if your personal budget doesn't add up after the losses, it's unfortunate, but ultimately it's your call as to which bills get paid first.

If you had invested $5,000 of your own money and another $5,000 you borrowed from your bank … well, it's not just your money that's gone with that $7,500 loss. The bank is going to want its money back, but your investment portfolio that's now valued at $2,500 doesn't cover the tab – and paying your broker becomes a top priority.

When do margin calls happen?

That previous scenario is actually unlikely to happen, in fact, because your brokerage will demand money before losses ever get that bad. This is because trading platforms have sophisticated systems that measure risk and predict when you're in danger of suffering a big loss. As a result, your broker will almost always demand more money sooner rather than later.

They also demand a minimum amount of investor equity in a portfolio – that is, your own personal skin in the game and not just their loan. Equity percentages vary, but are generally at least 30%.

Let's do some math to show an example of how this would work.

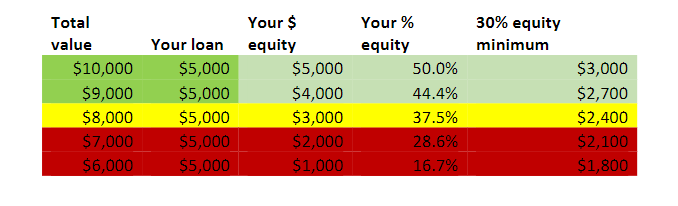

You put up $5,000 of your own money and borrow $5,000 from your broker to make a $10,000 investment. Your investor equity stake is 50% of the $10,000 value.

Now let's say that investment falls to $8,000 in value. The loan is still $5,000, so the losses are not shared equally. Rather, your investor equity takes the hit first and so you only have a $3,000 direct stake – or 37.5% of $8,000.

At this point, your broker may politely warn you are at risk and suggest you deposit more cash. After all, things can change on Wall Street and you're still above their 30% equity threshold.

Unfortunately, things get even worse and the value of your investment keeps drifting lower toward $7,000. Minus their loan, your personal stake would be a mere $2,000 or about 28.5%.

Now things are serious. Since 30% of $7,000 is $2,100, you'll have to put an extra $100 in your account immediately to meet that minimum.

That might not sound terrible. But what if you pony up $100 and the investment keeps falling to $6,000? Well, 30% of $6,000 is $1,800. So you're still behind, and have to come up with even more cash.

If you don't have it, you'll be forced to sell some or all of your portfolio to make up the difference.

Fundamentally, margin calls happen because of this lack of investor equity in a portfolio. So before you engage in any margin trading, have a full understanding of your broker's structure – including the specifics of margin calls, minimum equity requirements and other fine print.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jeff Reeves writes about equity markets and exchange-traded funds for Kiplinger. A veteran journalist with extensive capital markets experience, Jeff has written about Wall Street and investing since 2008. His work has appeared in numerous respected finance outlets, including CNBC, the Fox Business Network, the Wall Street Journal digital network, USA Today and CNN Money.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.