Value vs Growth Investing Isn't So Simple

The difference between growth and value stocks isn't black and white.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Warren Buffett likes to say that price is what you pay, value is what you get. But that doesn't mean blindly indexing to value stocks is a path to long-term success.

After all, value stocks have broadly lagged growth stocks for more than a decade and there's no telling when they'll catch back up.

Besides, value is in the eye of the beholder. It's not for nothing that, on average, about 30% of the stocks in the benchmark Russell 1000 Value Index are also found in the Russell 1000 Growth Index.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The remaining 70% are assigned to be either all growth or all value," per FTSE Russell.

Passive investors in a broad market index that tracks the S&P 500 needn't worry about the style differences between value and growth. Such distinctions are of more concern to tacticians and traders.

Nevertheless, there is something unusual about value's long-term slump.

First, a quick recap on value stocks vs growth stocks: Value stocks are equities that are perceived to be trading at a discount based on metrics such as price-to-book ratios, price-to-earnings ratios, dividend payout ratios and the like.

Growth stocks tend to trade at premiums to these metrics, as investors are willing to pony up for accelerating future free cash flows.

It's important to know that classifying stocks as growth or value is not a straightforward matter.

Russell assigns a growth and value weight based on its valuation criteria, which is how so many stocks find themselves represented in both benchmark indexes.

As FTSE Russell notes, what started out as a way for active managers to benchmark their performance based on their investment styles became a tool for professionals to make "unbalanced allocations based on their strategic or tactical views."

In other words, the benchmark growth and value indexes are not pure plays, and haven't been for decades.

"Pre-conceived notions of 'growth' and 'value' aren't always reflected in indexes labeled growth and value," writes Liz Ann Sonders, chief investment strategist at Charles Schwab. "That has been both exacerbated and emphasized in the post-pandemic era, especially for a sector like technology, which is traditionally thought of as dominating the growth sphere but now has a hefty weight in some value indexes."

Is value investing dead?

"Value investing is based on the premise that paying less for a set of future cash flows is associated with a higher expected return," writes the equity investing team at Dimensional Fund Advisors. "That's one of the most fundamental tenets of investing."

Over the long haul, value stocks have indeed outperformed growth stocks in the U.S., often by wide margins.

"Data covering nearly a century backs up the notion that value stocks — those with lower relative prices — have higher expected returns," Dimensional adds. "While disappointing periods emerge from time to time, the principle that lower relative prices lead to higher expected returns remains the same."

Given that mean reversion is a thing in both life and investing, value investors may be forgiven for expecting their stylistic preference to come back vs growth.

But it hasn't happened yet.

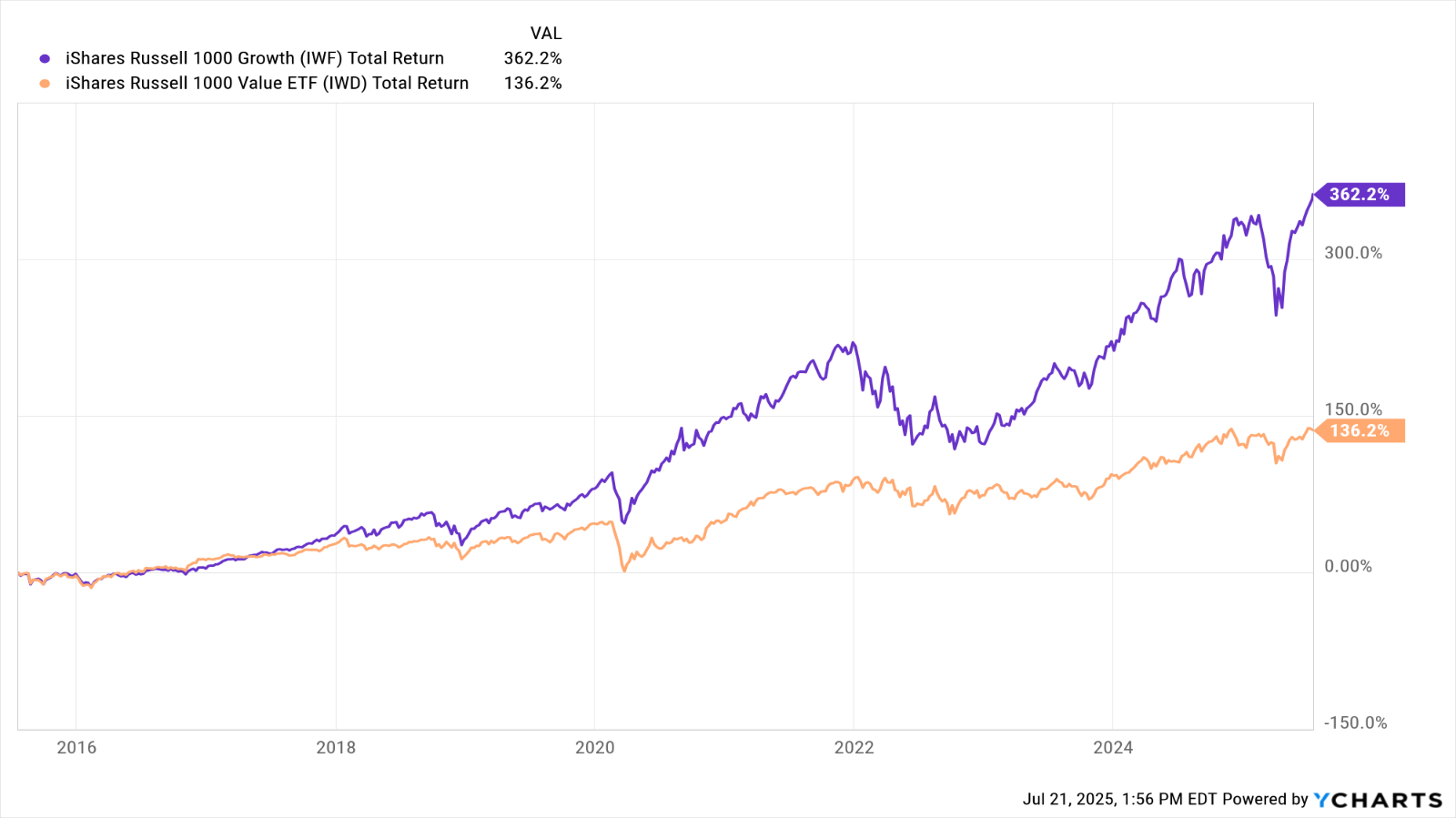

Have a look at the chart below to see the performance of the iShares Russell 1000 Value ETF (IWD) vs the iShares Russell 1000 Growth ETF (IWF) over the past decade to see how far the gap has widened on a total return basis (price change plus dividends).

Using these benchmark ETFs as proxies, we can see that growth returned more than 360% over the past 10 years vs less than 140% for value. That bucks historical trends in a big way. Since 1927, value stocks outperformed growth stocks by 4.4% annually in the U.S.

This doesn't mean value investing is dead. However, it might suggest that value investing via a broad index like the Russell 1000 Value Index isn't the best way to find value stocks. It isn't necessarily a good proxy for retail investors looking for cheap diversification to true value names.

Finding true value stocks is hard – just ask Warren Buffett. That said, value investors do have history on their side.

As Hartford Funds notes, "the performance of growth stocks and value stocks has been cyclical. This cyclical behavior highlights the benefits of having both types of investments in a portfolio."

Getting the balance and timing of such tactical allocations is generally best left to the pros.

Related Content

- What Will the Fed Do at Its Next Meeting?

- If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have Today

- The 10 'Real' Richest Counties in the U.S.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.