Wedbush: Apple Stock Is a Buy Ahead of iPhone 13 Launch

Wedbush's Daniel Ives is predicting a "normal" launch of the iPhone 13. And for AAPL stock, normal is ideal.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Apple (AAPL, $151.12) fanboys and AAPL stock bulls alike are amped for the coming launch of the iPhone 13. And Wedbush Securities says their enthusiasm is very much warranted.

Analyst Daniel Ives writes that recent supply-chain checks suggest a "normal" launch for the latest iteration of Apple's wildly popular smartphone, which he expects to drop in the third week of September.

That doesn't sound like good news for AAPL. But between the global shortage of semiconductors and spread of COVID-19 Delta variant overseas, "normal," in this case, is extremely good news.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Ives' Read on the iPhone

"Asia supply chain builds for iPhone 13 are currently still in the approximately 90 million unit range compared to our initial iPhone 12 reads at 80 million units (pre-COVID), and represent an approximately 10%-plus increase year-over-year out of the gates," Ives writes in a Tuesday note to clients.

Although the iPhone 13 build number "will clearly move around" over the coming months because of the global chip shortage, the analyst believes the data "speaks to an increased confidence with Apple CEO Tim Cook & Co. that this 5G-driven product cycle will extend well into 2022, and should also benefit from a post-vaccine consumer 'reopening environment.'"

Fanboys will be happy to hear that Ives has increased confidence that the iPhone 13 will offer an "eye-popping" one-terabyte storage option. That's double the maximum storage capacity available in any previous iPhone model.

What It Means for Apple Stock

Apple bulls, meanwhile, should be pleased to know that the iPhone 13 remains the potential catalyst AAPL stock could probably use at this point.

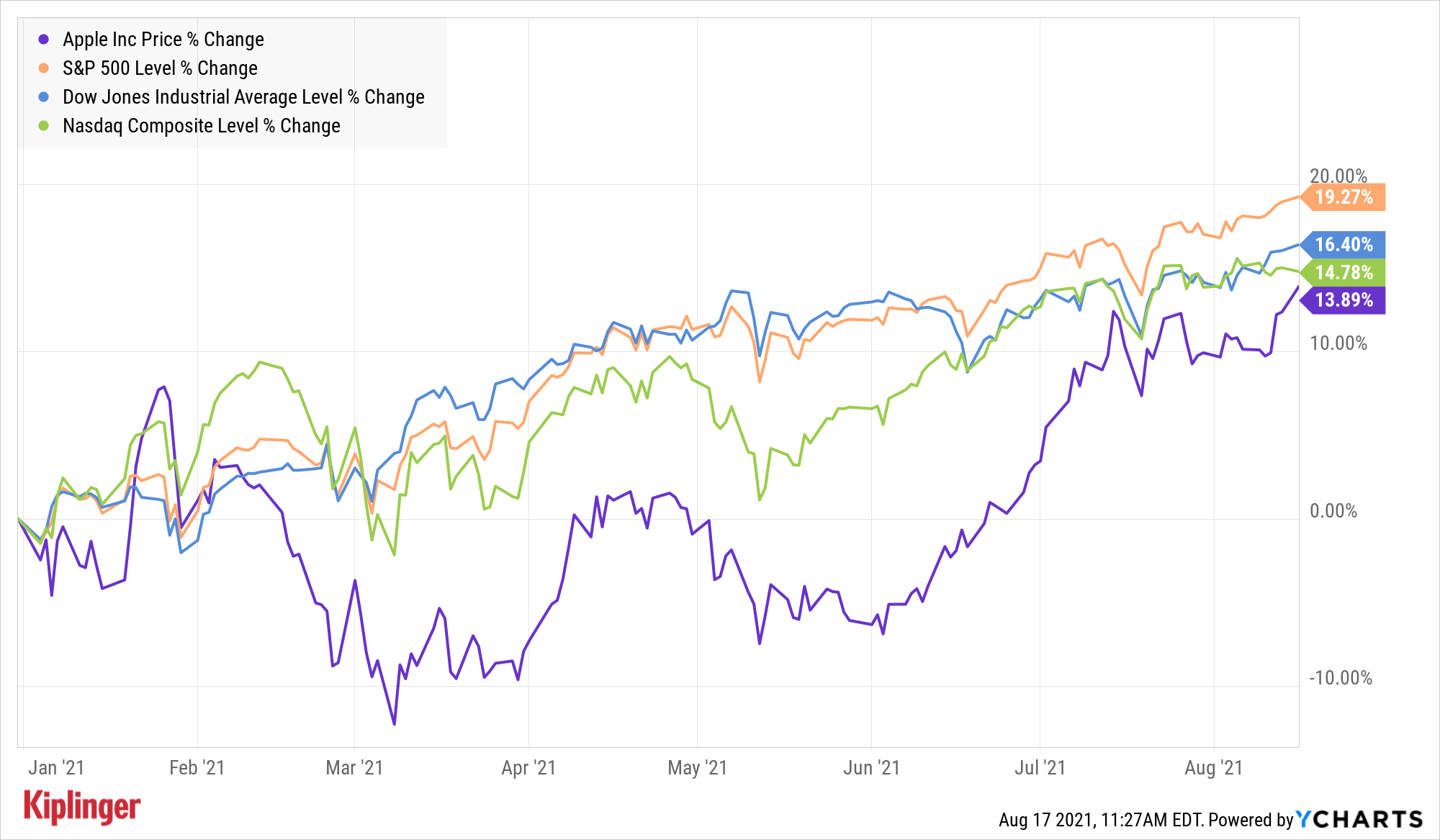

Shares in Apple were up 13.9% for the year-to-date through Aug. 16, lagging the Nasdaq (14.8%), Dow Jones Industrial Average (16.4%) and S&P 500 (19.3%) over that span.

Although investors would surely like to see the world's largest publicly listed company beat the major benchmarks by year-end, let's remember: AAPL stock is nothing if not a long-term holding.

Just ask Warren Buffett, chairman and CEO of Berkshire Hathaway (BRK.B), and arguably the greatest long-term investor of all time. AAPL is by far Buffett's favorite stock, accounting for a whopping 41.5% of Berkshire Hathaway's total portfolio value as of June 30.

Wall Street is firmly in the buy-and-hold camp as well. Of the 42 analysts issuing opinions on AAPL stock tracked by S&P Global Market Intelligence, 25 rate it at Strong Buy, seven say Buy, seven call it a Hold, one has it at Sell and two say Strong Sell. Their consensus recommendation comes to Buy, with high conviction, per S&P GMI.

The Street's average target price of $163.29, however, gives Apple stock implied upside of just 8% over the next year or so.

The bulls, naturally, expect much more from shares. As for Wedbush's Ives, he maintained his Outperform (Buy) rating, calling Apple "a top tech name to own." Meanwhile, the analyst's $185 price target gives AAPL implied upside of about 22% over the next 12 months.

"Our favorite large-cap tech name to play the 5G transformational cycle is Apple," writes Ives, "with the one-two punch of its massive services business and iPhone product cycle translating into a $3 trillion market cap for Cupertino in the next six to 12 months."

Apple's market cap was roughly $2.5 trillion as of Aug. 16.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.