Stock Market Today: Stocks Slide Ahead of September Jobs Report

Higher-than-expected initial jobless claims gave stocks an early boost, but they ran out of steam as the day wore on.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

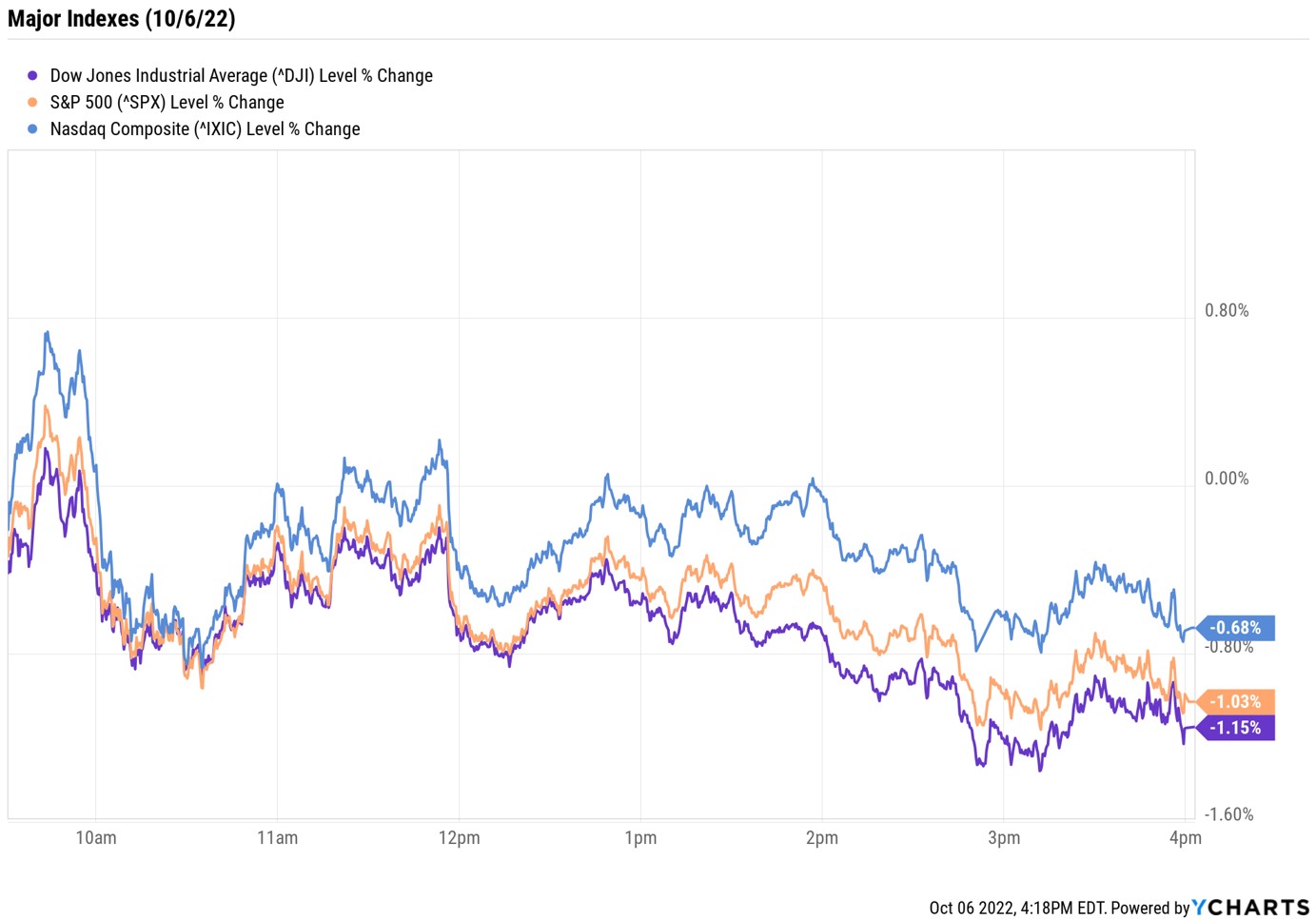

Stocks popped higher out of the gate Thursday after early morning data showed a bigger-than-expected jump in weekly jobless claims. But the gain was short-lived, with markets turning lower after a Federal Reserve official chimed in on rate hikes. Thursday's trading marked the second straight loss in a week that started out with a remarkable 765-point gain for the Dow.

Ahead of the opening bell, the Labor Department said initial unemployment claims were up by 29,000 in the week ended Oct. 1, to 219,000, a five-week high. But the big jobs news comes tomorrow with the release of the nonfarm payrolls report for September. Consensus expectations are for the U.S. to have added 248,000 jobs last month (down from August's 315,000) and the unemployment rate to remain steady at 3.7%.

Tomorrow's jobs report will give the Federal Reserve another clue as to whether or not its aggressive rate-hike campaign is working to slow growth. But ahead of this data point, Minneapolis Fed President Neel Kashkari, who is typically considered one of the more dovish members of the central bank, said at a banking conference today in Minnesota that he is seeing "almost no evidence that underlying inflation is coming down." As such, he is "not comfortable saying we are going to pause [hiking rates]," Kashkari added.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

By the close, the Dow Jones Industrial Average was down 1.2% at 29,926, the S&P 500 Index was off 1.0% at 3,744, and the Nasdaq Composite was 0.7% lower at 11,073.

Other news in the stock market today:

- The small-cap Russell 2000 shed 0.6% to 1,752.

- U.S. crude futures rose 0.8% to $88.45 per barrel, notching their fourth straight win.

- Gold futures were unchanged at $1,720.80 an ounce.

- Bitcoin slipped 0.6% to $20,012.81. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Pinterest (PINS) stock jumped 4.9% after Goldman Sachs analyst Eric Sheridan upgraded the social media stock to Buy from Neutral (the equivalent of Hold). The analyst cited the company's "improved user growth/engagement trends in the short/medium term and the potential for upside to revenue growth trajectory and operating margin estimates as we move into 2023/2024."

- Weed stocks jumped after President Joe Biden pardoned thousands of people convicted at the federal level for marijuana possession, as well as those convicted in the District of Columbia. "Sending people to prison for possessing marijuana has upended too many lives and incarcerated people for conduct that many states no longer prohibit," Biden said in a statement. He also asked the secretary of Health and Human Services and the attorney general to "initiate the administrative process to review expeditiously how marijuana is scheduled under federal law." Canopy Growth (CGC, +22.2%), Curaleaf Holdings (CURLF, +33.1%) and Cresco Labs (CRLBF +24.4%) were among the day's biggest gainers.

AI's Top Stock Picks

This week's price action reminds us that the stock market is still prone to volatile swings. While these wild up-and-down moves aren't for the faint of heart, they can create exciting opportunities for stock pickers.

19 Best Stocks to Buy Now for High Upside Potential

Some of the most skilled stock pickers, like Warren Buffett or billionaires Philippe Laffont and David Tepper, have used the market pullback to go bargain hunting for equities. While not everyone has access to the research and insights these deep-pocketed players do, tactical investors trying to find some of the top stocks to watch do have options. Danelfin, an analytics platform that harnesses the power of big data technology and machine learning, is one of them. This artificial intelligence (AI) system analyzes hundreds of fundamental, technical and sentiment data points per day for 1,000 U.S.-listed shares and 600 European-listed firms, then generates several stock picks that it views as highly likely to outperform the market over the next 30 to 90 sessions.

So, what does Danelfin say investors should be buying now? Read on as we take a look at the platform's latest high-scoring stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.