Stock Market Today: Stocks Close Higher After Terrible Tuesday

Energy was the best-performing sector as oil prices bounced, while real estate and materials stocks lagged.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Stocks stabilized Wednesday after Tuesday's hotter-than-expected inflation data sparked Wall Street's worst selloff in over two years.

Inflation remained in focus today with the early morning release of the producer price index (PPI) for August. Similar to yesterday's consumer price index (CPI), the PPI – which measures what suppliers are charging for goods and services – rose at a slower annual clip in August than it did in July. However, on a month-over-month basis, both PPI and core PPI, which excludes energy and food prices, were up from July's figures.

"There is a divergence in headline and core inflation building, where headline is cooling and core is heating up," says Jamie Cox, managing partner at Harris Financial Group. "That's an odd phenomenon and likely influenced by the shift from goods to services post-pandemic. The Fed should proceed with caution and not hit the emergency brake on rate hikes."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While yesterday's selling was broad-based, today's action was more mixed. In terms of sector performance, real estate (-1.2%) and materials (-1.2%) were the biggest laggards, while energy (+2.8%) outperformed as U.S. crude futures rose 1.3% to settle at $88.48 per barrel.

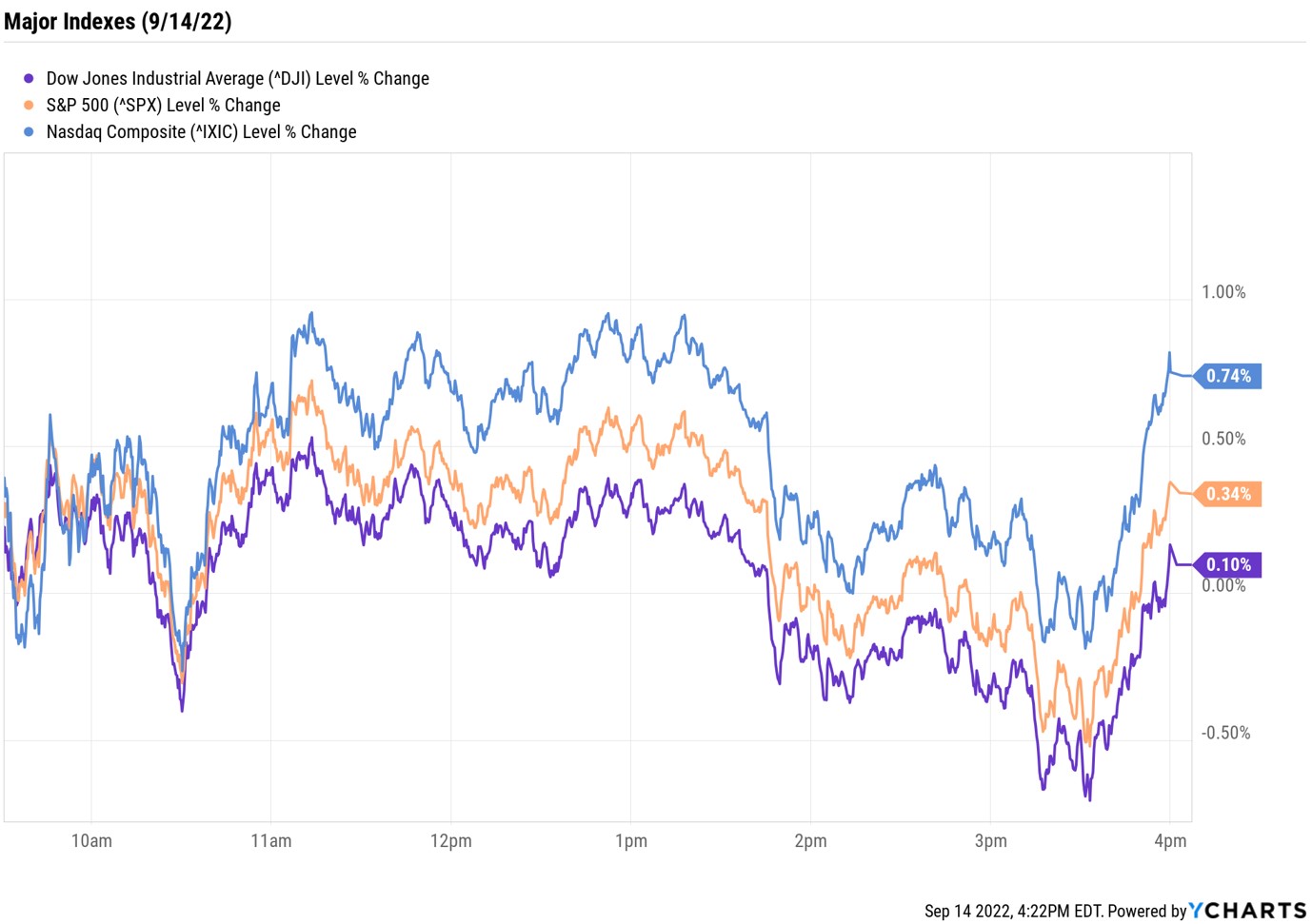

As for the major indexes, the Nasdaq Composite ended up 0.7% at 11,719, while the S&P 500 Index (+0.3% at 3,946) and the Dow Jones Industrial Average (+0.1% at 31,135) also finished with modest gains.

Other news in the stock market today:

- The small-cap Russell 2000 rose 0.4% to 1,838.

- Gold futures fell 0.5% to end at $1,709.10 an ounce.

- Bitcoin shed 1.7% to $19,968.03. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Starbucks (SBUX) jumped 5.5% after the coffee chain raised its long-term growth targets. The company is now projecting annual earnings-per-share growth of 15% to 20% over the next three years, and same-store sales growth of 7% to 9% – up from previous guidance of 11% and 4.5% growth, respectively, at the midpoint. SBUX also said it plans to build around 2,000 new U.S. stores by 2025, bringing its worldwide total to 45,000 locations, and will start buying back its shares in its next fiscal year. "Starbucks has set a high bar for itself and while we believe it is achievable given brand strength and new management capabilities, we believe skepticism persists about the challenges of accelerating growth – in particular at a time of macro uncertainty," says BofA Securities analyst Sara Senatore (Buy).

- Rail stocks like Union Pacific (UNP, -3.7%) and Norfolk Southern (NSC, -2.2%) were lower today as negotiations between freight railroad unions near a deadline that could lead to a potential strike if all sides do not come to an agreement by the end of the week. Stifel Research analyst Benjamin Nolan sums things up: "Long story short, the 12 rail unions and the U.S. Class 1's and a handful of smaller carriers have been at the negotiation table for the last few years. Both parties have been unable to reach agreements. So, the White House got involved and made non-binding recommendations that nine unions have agreed to, so far. We are now in the final week of negotiations before the Railway Labor Act Collective Bargaining Process runs its course, and on Friday, the parties are free to either strike/lock-out labor." While Nolan thinks a railroad strike is "unlikely," he expects a "last-minute agreeement or immediate congressional intervention."

Weather the Market Storms With the Dividend Kings

This week's inflation updates all but assure another aggressive rate hike from the Federal Reserve at next week's policy meeting. According to CME Group, the probability that the central bank will lift its benchmark rate by 75 basis points has jumped to 74% from 45% one month ago, while the odds of a 100 basis-point rate hike are now at 26% from zero over that same time frame. A basis point is one-one hundredth of a percentage point.

And the Fed is likely to "maintain its hawkish stance until they see a sustained downward trend in inflation," says Eric Sterner, chief investment officer for financial planning firm Apollon Wealth Management. Risky assets will continue to struggle, Sterner believes, which means "investors should maintain a defensive and diversified portfolio to weather this storm."

We often recommend dividend stocks as one area where investors can seek shelter. And where better to find the cream of the crop of income-growing names than with the Dividend Kings – elite members of the Dividend Aristocrats who have a minimum of 50 straight years of dividend hikes under their belts. That makes these consistent dividend growers a bit more trustworthy than your typical income investment – especially in a year full of ups and downs in the market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.