Stock Market Today: Weak Data Weigh on Stocks

A twin bill of bearish reports only added to worries about the wisdom of the Fed hiking rates even as recession remains a possibility.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

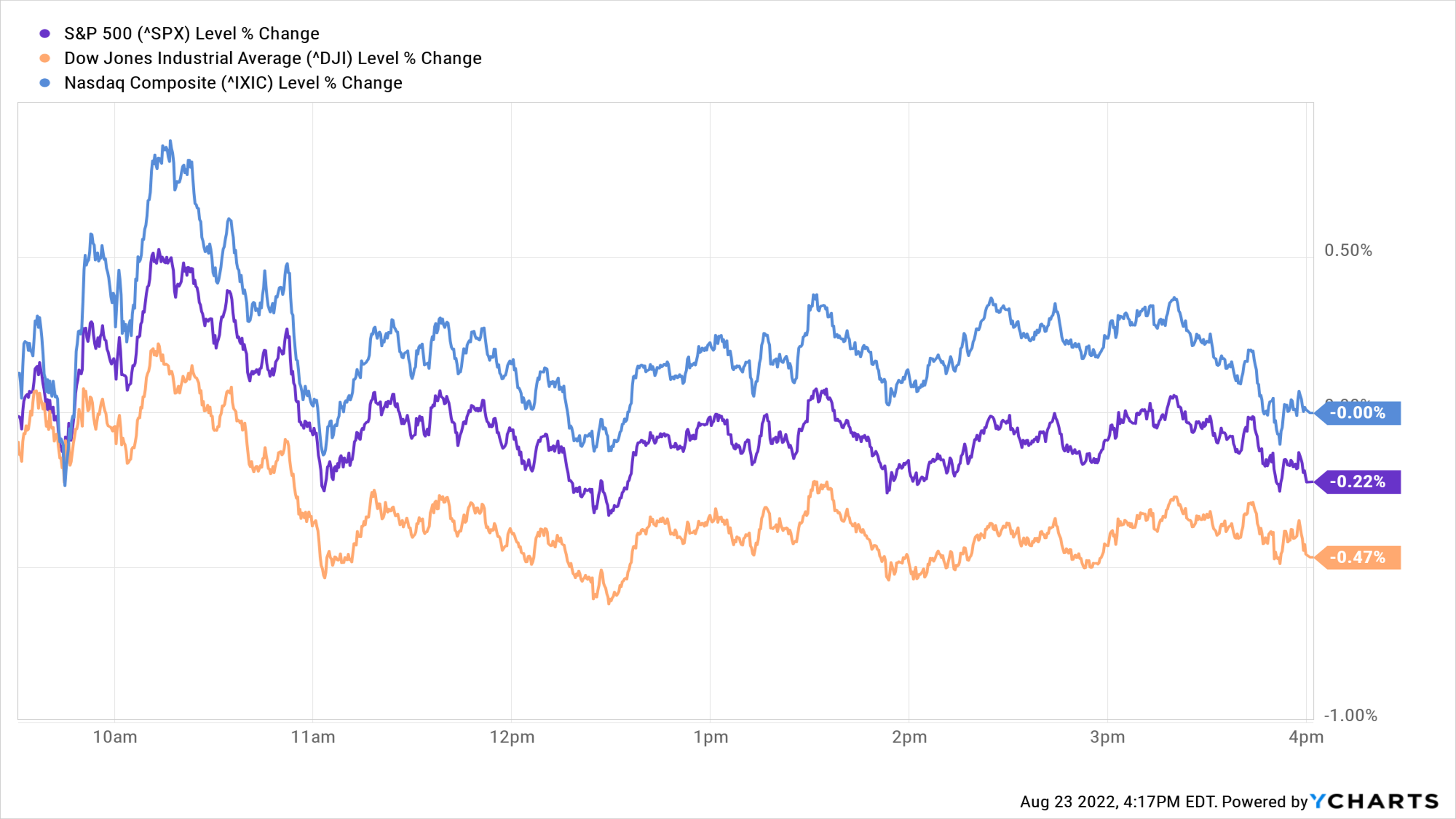

Markets closed mixed Tuesday after a choppy session driven by downbeat economic data and mounting anxiety over the Federal Reserve's determination to stamp out inflation.

On the economic front, a weak reading on new business activity and lower-than-expected new home sales weighed on sentiment even before the opening bell. The S&P Global Flash Composite Purchasing Managers Output Index fell 2.7 points to 45 in August. That's the weakest reading since May 2020, and indicates contraction in demand for both the manufacturing and services sectors of the economy. Meanwhile, the Commerce Department said sales of new single-family homes fell 12.6% to an annualized 511,000 in July, well short of economists' forecasts.

The twin bill of bearish reports only added to market participants' worries about the wisdom of the Fed hiking interest rates even as recession remains a possibility.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Resilience in the U.S. economy is seeping away as consumers are sideswiped by spiraling prices and companies see demand evaporate amid a whirlwind of pressures," writes Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown. "While central bank policymakers will find it hard to ignore the darker clouds gathering over the U.S. economy, for now more rate hikes are likely in a bid to ensure a lid is fixed firmly on inflation."

The blue-chip Dow Jones Industrial Average lost 0.5% to finish at 32,909, while the broader S&P 500 slid 0.2% to 4,128. The tech-heavy Nasdaq Composite, however, was unchanged at 12,381.

Other news in the stock market today:

- The small-cap Russell 2000 added 0.2% to 1,919.

- U.S. crude futures rose 3.6% to $93.62 per barrel.

- Gold futures gained 0.7% to $1,760.60 an ounce.

- Bitcoin increased 2.1% to $21,540 (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

All Eyes on Powell

The market is likely to remain obsessed with the Fed all week, and that means heightened volatility remains the order of the day. The central bank convenes its annual policy symposium in Jackson Hole, Wyo., on Friday. Chairman Jerome Powell is scheduled to speak at 10:00 a.m. Eastern time. And until he does, markets will be on edge about what the Fed chief might signal – even if it turns out to be absolutely nothing new.

"We expect Powell to reiterate the case for slowing the pace of tightening laid out in his July press conference and the July minutes released last week," writes Jan Hatzius, chief economist, Global Investment Research Division at Goldman Sachs. "He is likely to balance that message by stressing that the FOMC remains committed to bringing inflation down and that upcoming policy decisions will depend on incoming data."

Regardless of what transpires in Jackson Hole, the tools at the Fed's disposal are both blunt and slow acting. Although inflation has shown signs of slowing, rising prices remain a serious concern. Investors would do well to check out the best stocks for fighting inflation.

And as for volatility? That sure isn't going away anytime soon. If anything, it could pick up once A-Team traders return to their desks from their August vacations. Investors with frazzled nerves might want to investigate low-volatility exchange-traded funds. Indeed, the best low-vol ETFs might just help them sleep at night despite roller coaster markets.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Relying on Real Estate in Retirement? Avoid These 3 Mistakes

Relying on Real Estate in Retirement? Avoid These 3 MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

These Small Money Habits Really Can Plant Roots

These Small Money Habits Really Can Plant RootsFebruary gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.