Stock Market Today: Stocks Drop After Target Earnings, Fed Minutes

The major indexes fell after Target (TGT) reported plunging profits in Q2, and failed to recover after the release of the Fed's July meeting minutes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Stocks took a sharp turn lower in early trading Wednesday, as a major earnings miss from one of the nation's biggest retailers shocked investors.

Ahead of the opening bell, Target (TGT) said its second-quarter earnings plunged 90% year-over-year to 39 cents per share – missing analysts' consensus estimate by a mile – as the company aggressively marked down excess inventory. But, even though CEO Brian Cornell said on the company's earnings call that "the vast majority of the financial impact of these inventory actions is now behind us," TGT stock fell 2.6% today.

Wall Street also got the latest reading on consumer spending this morning, with data from the Commerce Department showing retail sales were flat in July. Excluding gas and auto sales, the metric was up 0.7% month-over-month.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But the main event of the day was the mid-afternoon release of the minutes from the Federal Reserve's July meeting, at which the central bank issued its second straight 75 basis-point rate hike. (A basis point is one-one hundredth of a percentage point.)

"The minutes of the Fed's July policy meeting affirmed that rates haven't stopped rising but that the peak could come sooner than previously thought," says Sal Guatieri, senior economist at BMO Capital Markets. "Citing few signs of lessening in underlying inflation pressures, and noting that strength in the labor market casts doubt on the underlying weakness in the economy (or at least GDP), the minutes confirmed that the only question for September is whether the Fed will scale back to 50 basis points from consecutive 75-basis-point hikes."

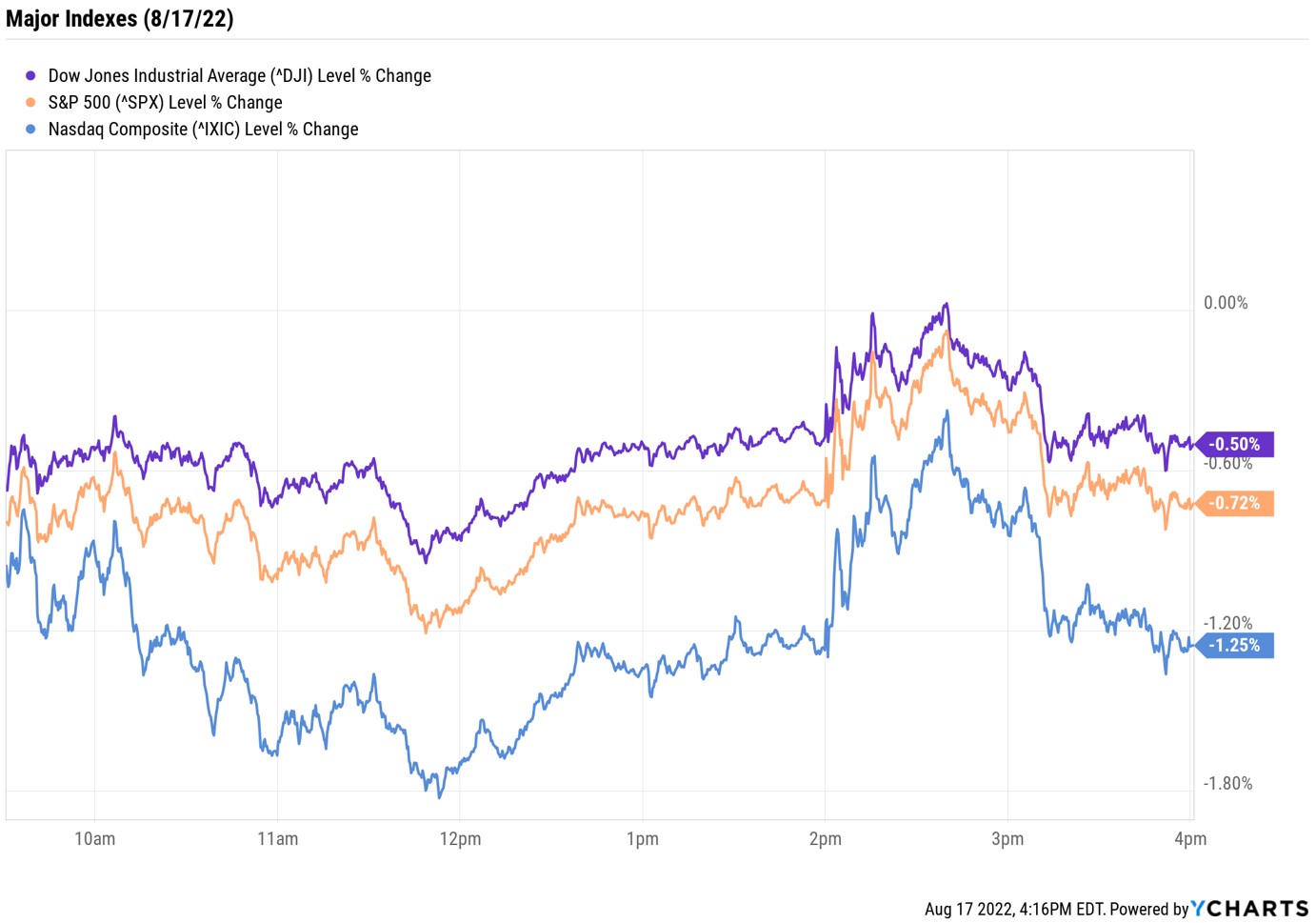

The major market indexes pared a portion of their earlier losses after the release of the minutes, but still ended the day lower. By the close, the Nasdaq Composite was down 1.3% to 12,938 and the S&P 500 Index was off 0.7% to 4,274. The Dow Jones Industrial Average shed 0.5% to 33,980, snapping its five-day winning streak.

Other news in the stock market today:

- The small-cap Russell 2000 shed 1.6% to 1,987.

- U.S. crude futures jumped 1.8% to $88.11 per barrel, ending a three-day losing streak.

- Gold futures closed lower for a third straight day, falling 0.7% to $1,776.70 an ounce.

- Bitcoin fell 2.8% to $23,271.95. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Lowe's (LOW) rose 0.6% after the home improvement retailer reported earnings. In its second quarter, LOW recorded higher-than-expected earnings of $4.67 per share, while revenue of $27.5 billion missed the mark. The company also said that while transaction volume was down 6% quarter-over-quarter, average receipts were up 6.5%, due in part to inflation. "In many ways, the second-quarter print highlights why we prefer LOW to Home Depot (HD): Weaker comparables [same-store sales were down 0.3% year-over-year], but stronger earnings per share growth," says David Wagner, portfolio manager at financial advisory firm Aptus Capital Advisors. "Relative to expectations, while the comp of -0.3% missed consensus of +2.1%, we believe it was largely in line with buy-side expectations. More importantly, we believe the Street was expecting a cut to the EPS guidance, yet strong expense management allowed LOW to raise its EPS guide."

- TJX Companies (TJX, +2.8%) reported second-quarter earnings of 69 cents per share, beating the average analyst estimate for earnings of 67 cents per share. However, revenue of $11.8 billion came in below what Wall Street was expecting, while same-store sales fell a wider-than-anticipated 2%. Still, CFRA Research analyst Zachary Warring maintained a Strong Buy rating on the retail stock. "We continue to see TJX as a top pick in consumer savings plummets, forcing more consumers to return to off-price retailers to search for deals and other retailers look to offload excess inventory for pennies on the dollar," the analyst says.

More Volatility Ahead?

It's been an impressive stretch for the major indexes in the past two months, but market uncertainty still exists. "We believe traders and investors alike should be on guard for more potential volatility ahead," says Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott.

"While this week is relatively quiet on the data front, in the coming weeks, inflation reports and more cues from the Fed will start to trickle in – and these could trigger big moves going forward," he added. Wantrobski anticipates volatility to ramp up in the September-to-October timeframe, and the market to have a few more surprises before year end. However, he encourages longer-term investors to "stay the course," as he sees major upside for the S&P 500 over the next few years.

Investors looking to bulk up their portfolios with companies that have potential for long-term growth might want to take a closer look at metaverse stocks or green energy firms – both expected to be big winners on growing trends. But those wanting to find short-term ballast to counter the choppy seas Wantrobski is warning about might instead consider low-volatility funds. The names featured here offer a variety of strategies aimed to provide stability to a portfolio amid the market's turbulence.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.