Stock Market Today: Dow Reclaims 34K as Walmart, Home Depot Stocks Soar

Both retailers reported higher-than-expected earnings and revenue in Q2 and reiterated their full-year forecasts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks started Tuesday on shaky ground before muscling higher thanks to a pair of well-received earnings reports from retail giants.

Walmart (WMT) stock jumped 5.1% after the mega-retailer reported higher-than-expected earnings and revenue for its second quarter. The company also reiterated its full-year guidance. This was particularly notable, given that operating income fell in Q2 amid an inventory glut and a shift by consumers toward necessities and away from higher-priced discretionary items.

Home Depot (HD, +4.1%) also beat on the top and bottom lines in its second quarter, and reaffirmed its full-year forecast. While the home improvement retailer said total customer transactions for the three-month period were down 3% year-over-year, the average receipt was up 9.1%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Results from both Walmart and Home Depot suggest the consumer continues to be resilient," says Michael Reinking, senior market strategist at the New York Stock Exchange. "Seemingly, relief at the pump has helped on this front." Reinking adds that in terms of current consumer spending, Walmart highlighted a solid start to back-to-school shopping season, while Home Depot said home improvement spending is still strong despite signs of a weakening housing market. More retailers are scheduled on this week's earnings calendar, with Target (TGT, +4.6%) and Lowe's (LOW, +2.9%) set to report tomorrow.

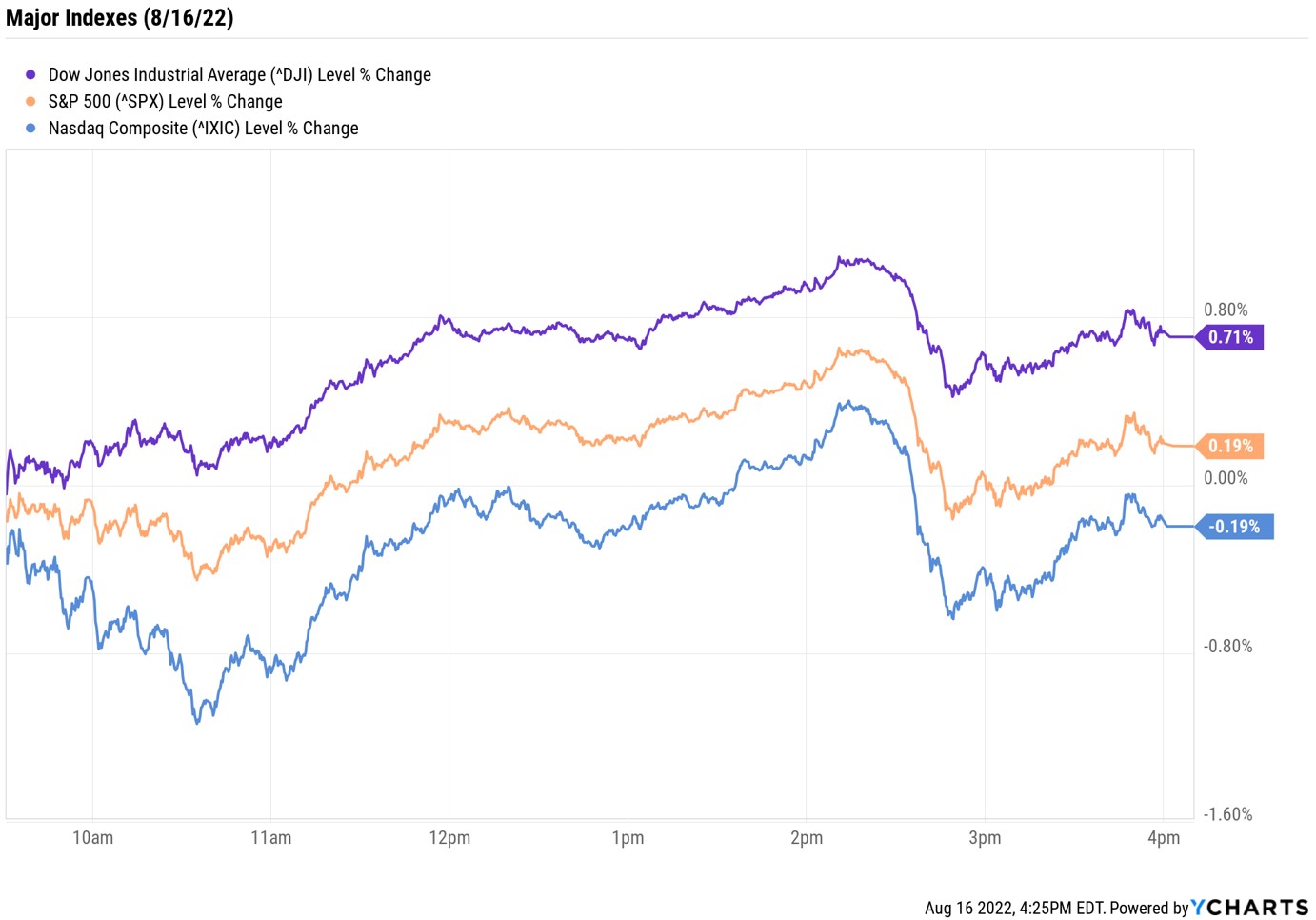

The blue-chip earnings pushed the Dow Jones Industrial Average higher for a fifth straight day, rising 0.7% to 34,151 – its first close above 34,000 since early May. The S&P 500 Index also closed higher, up 0.2% at 4,305, while the Nasdaq Composite (-0.2% at 13,102) erased an early afternoon lead to end with a modest loss.

Other news in the stock market today:

- The small-cap Russell 2000 ended with a marginal loss at 2,020.

- U.S. crude futures fell 2.4% to $87.26 per barrel, their lowest close since January. "Crude prices are declining over fears China's growth could slow much more and on improving odds that the Iranian crude could flood the market as negotiators near a potential revival of the Iran nuclear deal," says Edward Moya, senior market strategist at currency data provider OANDA.

- Gold futures closed lower for a second straight day, shedding 0.5% to $1,789.70 an ounce.

- Bitcoin slipped 0.2% to $23,933.97. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Bed Bath & Beyond (BBBY) continued to climb, this time boosted by news RC Ventures, the venture capital firm owned by GameStop (GME) Chairman Ryan Cohen, bought 1.6 million out-of-the-money BBBY calls with strike prices between $60 and $80 (meaning the stock is expected to rally past these levels). At one point today, the meme stock was up more than 75% before ending the day with a 29.1% gain at $20.65.

- Snowflake (SNOW) gave back 1.8% after UBS Global Research analyst Karl Keirstead downgraded the cloud-based data platform to Neutral from Buy. The analyst says the stock's nearly 50% rally off its June lows has created a "less-favorable set-up given the macro headwinds, more checks citing a desire to trim discretionary data analytics spend and Snowflake’s customer profile, which (like AWS) includes a number of emerging tech/internet firms and pandemic beneficiaries that may be moderating spending growth."

Buffett's Q2 Buys and Sells

Warren Buffett spent most of Q2 adding to existing stakes in some of his favorite stocks. That's according to a Monday evening regulatory filing from Berkshire Hathaway (BRK.B), Buffett's holding company.

According to the Form 13F that was filed with the Securities and Exchange Commission (SEC) yesterday, Warren Buffett and his team continued to buy in the second quarter as the broader stock market sold off (the S&P 500 fell 16.5% in Q2).

Among the most notable positions added to in the Berkshire Hathaway equity portfolio were the purchase of another 3.9 million shares of Apple (AAPL) – the largest position by a mile. Buffett also increased his stake in another Dow Jones stock and aggressively purchased shares of Occidental Petroleum (OXY), leading some to speculate if the Oracle of Omaha is just going to buy the oil and gas firm outright. Read on as we take a closer look at all of Buffett & Co.'s buys and sells in the second quarter of 2022.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.