Stock Market Today: Stocks End Mixed Ahead of Jobs Day

A solid earnings report for MercadoLibre (MELI) kept the Nasdaq above water on Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It was a choppy day of trading on Thursday as investors looked ahead to the market's next big catalyst: the July jobs report, which will be released tomorrow morning.

"The labor market is an extremely critical input in the debate around inflation and how many Fed rate hikes are needed to 'whip it' that has been driving markets," says Brent Schutte, chief investment officer at Northwestern Mutual Wealth Management Company.

In tomorrow's report, "investors will be looking for evidence that the pace of job gains is slowing to a more sustainable pace and/or that more Americans are returning to the labor market," he says. Schutte adds that wage data is another important metric to watch, particularly to see if average hourly earnings start to moderate – something that is needed in order for inflation to push lower.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Today's weekly jobless claims data gave us a glimpse into the state of the labor market, with initial unemployment claims climbing by 6,000 to 260,000 in the final week of July.

"With the jobs report coming tomorrow, today's slight uptick in jobless claims isn't likely to be a major market nor Fed mover," says Mike Loewengart, managing director of investment strategy at E*Trade. "Remember that while jobless claims have been slowly rising, the labor market remains robust."

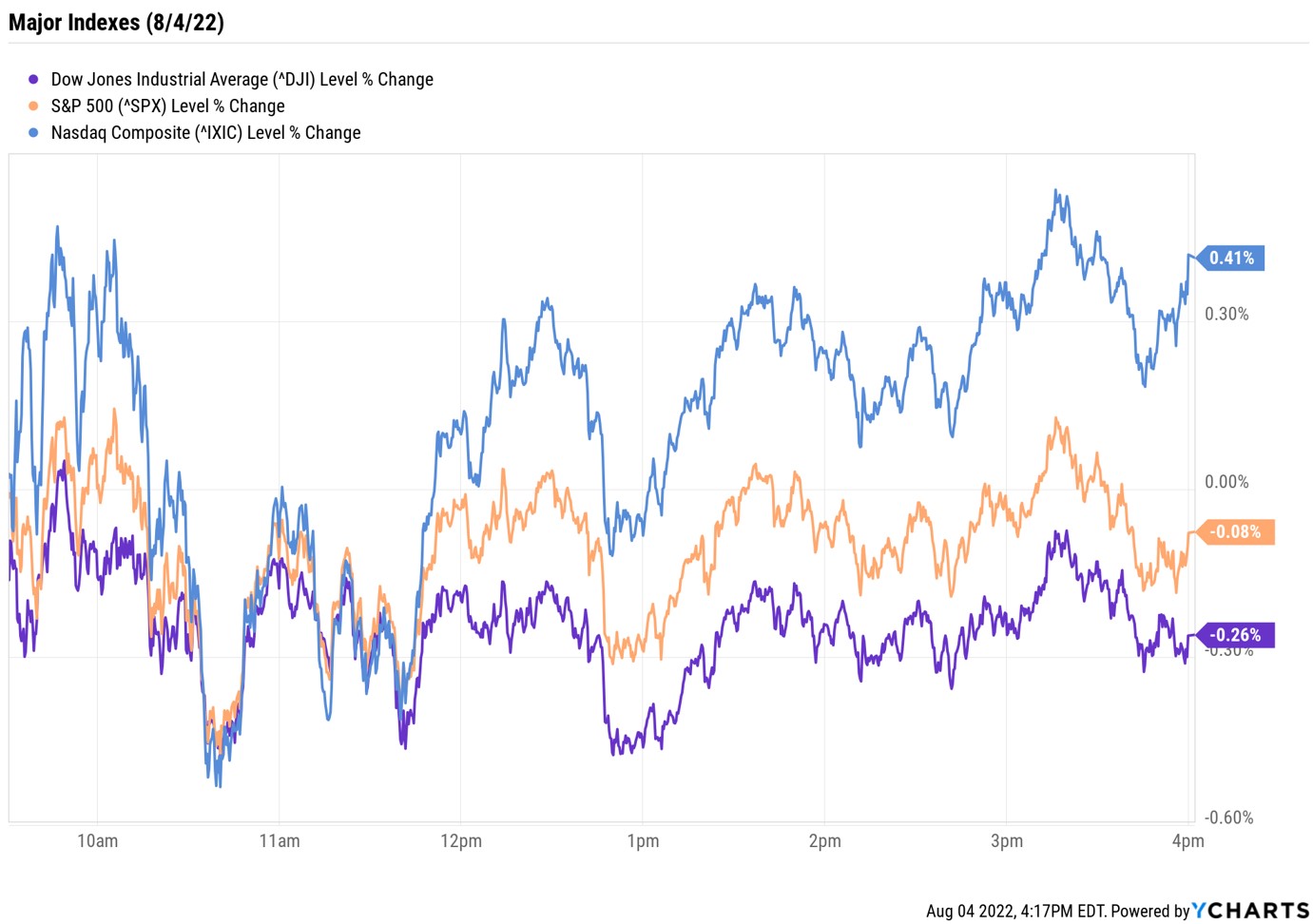

The market certainly didn't have much of a reaction to today's numbers. The Nasdaq Composite rose a modest 0.4% to 12,720, as shares of Latin American e-commerce concern MercadoLibre (MELI, +16.2%) soared on a solid Q2 earnings report. The S&P 500 Index slipped 0.1% to 4,151, and the Dow Jones Industrial Average shed 0.3% to 32,726, as Walmart (WMT) fell 3.7% on news the mega-retailer is cutting 200 corporate positions.

Other news in the stock market today:

- The small-cap Russell 2000 gave back 0.2% to end at 1,906.

- U.S. crude futures slumped 2.3% to $88.54 per barrel, their lowest settlement since Feb. 2.

- Gold futures rose 1.7% to finish at $1,806.90 an ounce.

- Bitcoin fell 4.3% to $22,455.60. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- The Bank of England (BOE) this morning raised its interest rates by 50 basis points (a basis point is one-one hundredth of a percetage point), the biggest increase since 1995. However, the central bank's "commentary was more concerning with expectations for a 'long recession,' and expectations for inflation to climb much higher before it begins to pull back," says Quincy Krosby, chief global strategist for independent broker-dealer LPL Financial. "The market is now expecting a series of rate hikes as the BOE launches an aggressive campaign to curtail an entrenched inflationary backdrop. Moreover, the BOE move in rates, coupled with its downcast commentary, comes amid a political vacuum."

- Coinbase Global (COIN) jumped 10.0% after the cryptocurrency exchange said it is partnering with BlackRock (BLK, +0.8%) to make bitcoin available to the asset manager's institutional investors. "This is much needed positive news for crypto traders and should provide some optimism for the longer-term health of the cryptoverse," says Edward Moya, senior market strategist at currency data provider OANDA.

- Crocs (CROX) plunged 10.7% after the plastic shoemaker reported earnings. In its second quarter, CROX brought in adjusted earnings of $3.24 per share on revenue of $964.6 million, more than analysts were expecting. However, the company lowered its full-year sales forecast. Still, CFRA Research analyst Zachary Warring maintained a Strong Buy rating on CROX. "We see tons of upside in CROX and expect strong cash flow from both brands allowing them to pay down debt significantly," the analyst says.

Fidelity's Best Actively Managed Funds

2022 has been a stock picker's market. But researching individual stocks that may or may not outperform the broader market isn't for the faint of heart – and sometimes it's just easier to leave the driving to the pros.

Enter Fidelity, which is one of the premier low-cost mutual fund providers around whose portfolio managers celebrate the art of stock picking. Indeed, each spring, they hold friendly competitions to see who can come up with the best investment ideas.

Thankfully for investors, there's no shortage of Fidelity funds to choose from. In fact, often the hardest part in choosing a mutual fund is sifting through the onslaught of options available to find one that works best for your personal investing goals. Here, we've compiled five of the best actively managed Fidelity funds that cover a variety of strategies – any one of which should serve you well for the remainder of 2022 and beyond.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.