Stock Market Today: S&P 500 Narrowly Escapes Bear Territory

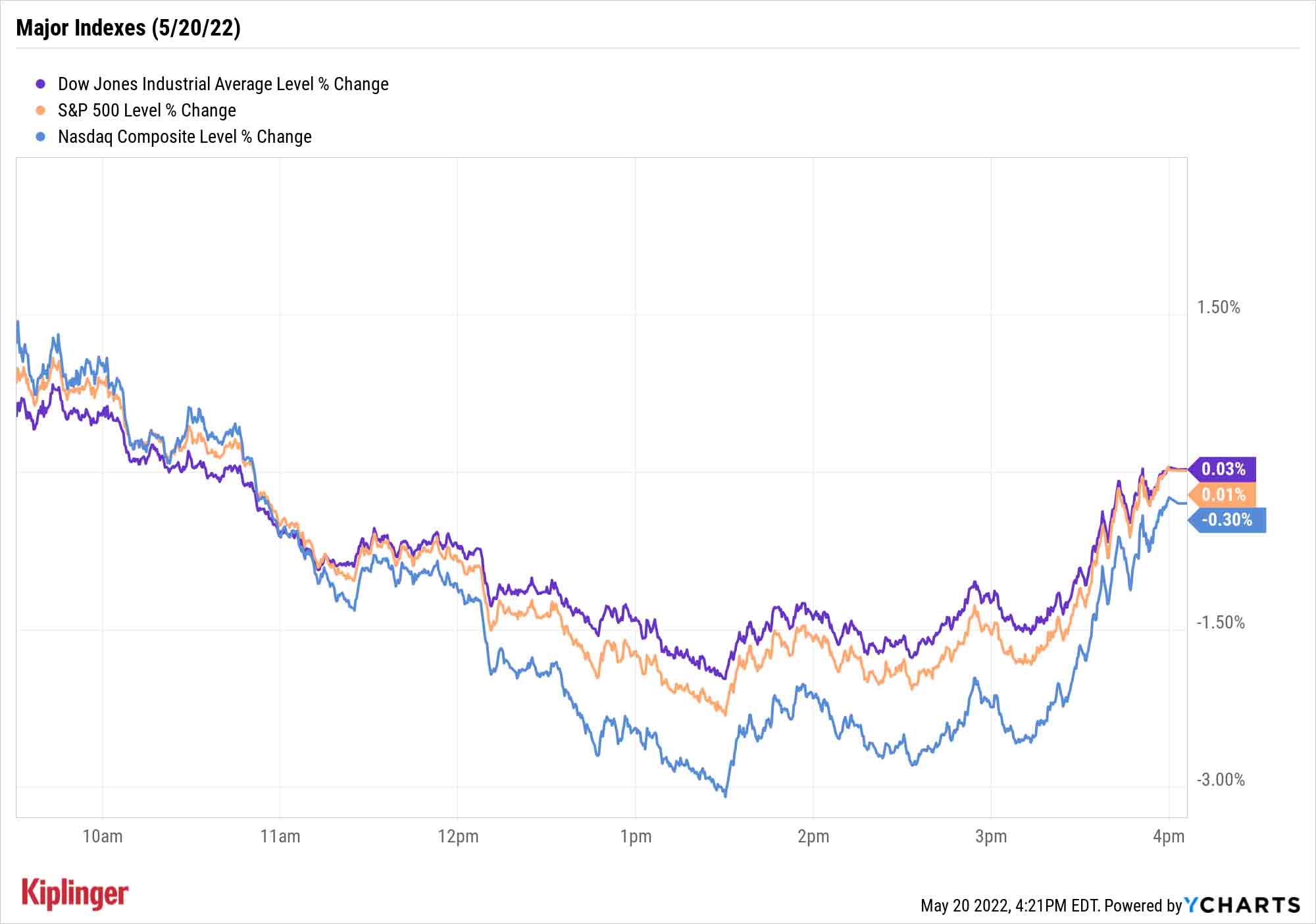

The S&P 500 was on pace Friday to finish more than 20% below its January record highs, but a late recovery kept the bear at bay for at least one more session.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The S&P 500 made its closest brush with a new bear market yet, falling more than 20% from its all-time highs during Friday's intraday action before reversing course and actually finishing with a marginal advance.

Specifically, the 500-company index dropped as low as 3,810 – well below the 3,837 level that would mark a 20% drawdown from its Monday, Jan. 3, record highs and put it in an official bear market – but rebounded late in the session to eke out a gain of less than a point, to 3,901.

Among the stocks weighing on the market Friday was Tesla (TSLA, -6.4%), which sank to its lowest level since August 2021 following a Business Insider report claiming that CEO Elon Musk's privately held SpaceX "paid a flight attendant $250,000 to settle a sexual misconduct claim against Musk in 2018." Musk decried the article as "political," but it nonetheless acted as the cap on a difficult week for Tesla, which was just kicked out of the S&P 500's ESG index and is facing COVID lockdown headaches at its operations in China.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Meanwhile, Deere (DE, -14.1%) was clobbered despite topping both sales and earnings forecasts and raising its full-year profit outlook. The major criticism of its report? The farm-equipment manufacturer's sales outlook relies on having a strong second half of 2022, which isn't a certainty.

The Dow, like the S&P 500, closed with a marginal gain to 31,261. The Nasdaq declined 0.3% to 11,354 but finished well off its intraday lows.

Dan Wantrobski – the technical strategist and associate director of research at Janney Montgomery Scott who said earlier this week that he was "encouraged" by Wednesday's washout – notes that while this drawdown might have lower to go, longer-term investors can begin sharpening their knives.

"At 3,800, we do believe that the S&P 500 resides in a price range (3,600-4,000) that can lead to some attractive returns over the coming years," he says." He's not calling a bottom for short-term traders, but "investors who hold a long-term view can start to deploy sideline cash in small increments and build long positions for the intermediate- to longer-term timeframe."

Other news in the stock market today:

- The small-cap Russell 2000 declined 0.2% to 1,773.

- U.S. crude oil futures gained 0.4% to settle at $110.28 per barrel.

- Gold futures ended the day unchanged at $1,842.10 an ounce.

- Bitcoin put together a small afternoon relief rally but still finished down $29,265.24. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Deckers Outdoor (DECK) jumped 12.6% after the maker of Ugg boots reported earnings. For its fiscal fourth quarter, DECK reported earnings of $2.51 per share on $736.0 million, up 113% and 31.2%, respectively, year-over-year. Both figures easily surpassed analysts' expectations, as well. "The company was able to offset supply chain disruptions by leveraging SG&A [selling, general and administrative expenses] in the quarter," says CFRA Research analyst Zachary Warring, who upgraded the retail stock to Buy from Hold. "The company continues to repurchase shares aggressively while maintaining a debt free balance sheet. We see this as an attractive entry point for shares as the company continues to execute and grow its HOKA brand well over 25% annually."

- Ross Stores (ROST) followed in the footsteps of fellow retailers Walmart (WMT) and Target (TGT), plunging in the wake of its quarterly results. Shares spiraled 22.5% after the off-price apparel and home fashions retailer reported lower-than-expected earnings and revenue in its first quarter (97 cents per share actual vs. $1.00 per share est.; $4.3 billion actual vs. $4.5 billion est.), while same-store sales slumped 7% over the three-month period. However, the "big news from ROST's first-quarter earnings report was the company lowered its fiscal 2022 earnings per share guidance to $4.34-4.58 vs. $4.71-$5.12 prior and the Street's $5.01 view," says UBS Global Research analyst Jay Sole (Neutral). "The midpoint of the new range is 8% below ROST's full-year 2021 earnings per share and 3% below its full-year 2019 result." Sole adds that he does not believe today's pullback represents a buying opportunity, and that more guidedowns could be in store as inflation negatively impacts lower-income consumer demand. Quarterly results from retailers will continue to be in focus next week, with Best Buy (BBY) and Dollar General (DG) among the many names on the earnings calendar.

Make Your Portfolio Pay You Every Month

Regular readers of Closing Bell will note that this week, we've been pounding the table about the role dividends can play in helping investors absorb volatile downturns like the one we've suffered in 2022.

We're not alone. Several strategists suggest loading up on dividend stocks in the current environment, including Gargi Chaudhuri, head of iShares investment strategy. "We see dividend stocks as an alternative source of quality, offering outperformance over the broad market, attractive yield for income, and diversified exposure to sectors benefiting from the current macro regime of high inflation and slowing growth," she says.

Most of our recommendations across the week have focused on dividend growth – namely, the S&P 500 Dividend Aristocrats, as well as their counterparts in Canada and Europe. That said, investors more interested in high current yield might find that the Aristocrats are a bit stingy. The ProShares S&P 500 Dividend Aristocrats (NOBL) exchange-traded fund, for instance, yields just 2% at current prices.

Those looking to load their cart with juicier yields might be better off eyeballing a different cohort: monthly dividend payers. Most U.S. dividend stocks tend to pay on a quarterly basis, but there are a select group of equities and funds that conveniently pay you just as frequently as you receive your bills – that is, once each month. Many of these monthly payers also tend to come from special classes, such as real estate investment trusts (REITs) and business development companies (BDCs) that pay much higher dividends than your average blue-chip stock.

Read on as we review a dozen of these generous monthly dividend names.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.