Stock Market Today: Dow Surrenders 809 Points as Q1 Earnings Roll In

The Nasdaq, meanwhile, suffered its biggest one-day percentage loss since September 2020.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

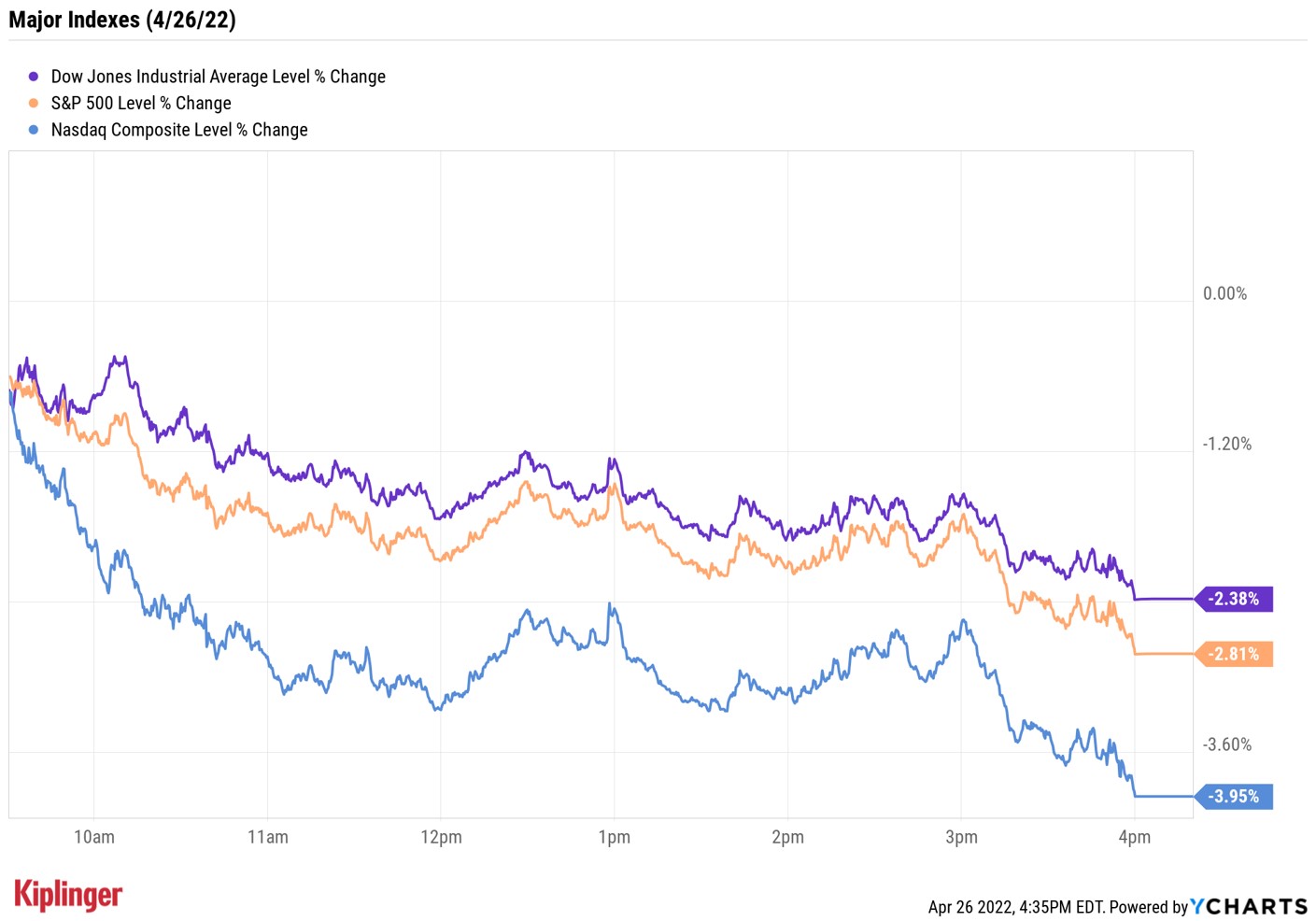

U.S. stocks opened the day in negative territory and losses accelerated as the session wore on.

Earnings remained in focus, and several of today's reactions were negative. General Electric (GE), for instance, spiraled downward 10.3% after its results. While the industrial conglomerate beat on the top and bottom lines in its first quarter, CEO Lawrence Culp warned the company is "trending toward the low end" of its full-year guidance as it continues "to work through inflation and other evolving pressures."

JetBlue Airways (JBLU), meanwhile, shed 11.4% after the air carrier's plans to reduce capacity growth in the short term offset a narrower-than-expected first-quarter loss. JBLU's post-earnings decline pressured fellow airline stocks, with Alaska Air Group (ALK, -4.6%), Southwest Airlines (LUV, -3.0%) and Delta Air Lines (DAL, -3.2%) all finishing notably lower.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The selling was broad-based, with consumer discretionary (-5.1%) and technology (-3.7%) the two hardest hit sectors. Only energy gained ground, adding 0.1% as U.S. crude futures climbed 3.2% to $101.70 per barrel.

At the close, the Nasdaq Composite was down 4.0% at 12,490 – its worst day since September 2020 – the S&P 500 Index was off 2.8% at 4,175 and the Dow Jones Industrial Average was 2.4% lower at 33,240.

Other news in the stock market today:

- The small-cap Russell 2000 gave back 3.3% to 1,890.

- Gold futures gained 0.4% to settle at $1,904.10 an ounce.

- Bitcoin retreated 5.9% to $37,918.63. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) "Bitcoin was tentatively back above the $40,000 level as Wall Street became more optimistic with the long-term outlook for cryptocurrencies after reports that Fidelity Investments will allow Bitcoin into 401(k)s," says Edward Moya, senior market strategist at currency data provider OANDA. "Bitcoin reversed lower as risk aversion returned to Wall Street; Russia's suspension of gas supplies to Poland sent risky assets, including Bitcoin, sharply lower."

- Sherwin-Williams (SHW) jumped 9.4% after the paints and coatings retailer reported first-quarter adjusted earnings of $1.61 per share and revenue of $5 billion, both figures higher than analysts were expecting. SHW also reaffirmed its full-year guidance for adjusted earnings of $9.25 to $9.65 per share. "Our team delivered results in line with our expectations in an environment characterized by strong demand, ongoing cost inflation and choppy raw material availability that improved meaningfully in the final weeks of the quarter," said John Morikis, CEO of Sherwin-Williams, in the company's earnings release.

- United Parcel Service (UPS) slipped 3.5% after the delivery giant reported earnings. In its first quarter, UPS recorded adjusted earnings of $3.05 per share and revenue of $24.4 billion, higher than consensus estimates. The company also reiterated its full-year guidance, though CEO Carol Tome cautioned that we're not likely to see the same kind of e-commerce growth witnessed during the pandemic going forward. Argus Research analyst John Eade (Buy) said weakness in the stock represents a "buying opportunity," and that the company "remains well positioned to benefit from a number of positive trends."

What Wall Street's Saying About Social Media Stocks

One notable decliner in today's trading: Twitter (TWTR). Shares retreated 3.9% to $49.68– one day after the company's board of directors approved Elon Musk's $44-billion, or $54.20 per-share, buyout of the platform.

News that the Tesla (TSLA) CEO is taking TWTR private has narrowed the field of social media stocks, but analysts are still upbeat about the few remaining primary players.

Case in point: S&P Global Market Intelligence pegs the average analyst price target for Facebook parent Meta Platforms (FB) – which joins Twitter on this week's tech-focused earnings calendar – at $315.51, implying 44% potential upside from current levels.

Today, we take a closer look at the social media stocks to watch post-Twitter and break down why Wall Street's pros are so bullish on the group. Take a look.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.