Stock Market Today: Ukraine Talks Bring Out the Bulls

Even amid skepticism of Russia's announcement that it would pull back military operations around Kyiv, Wall Street took a glimmer of peace hopes at face value.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Fresh signs of at least the potential of a resolution in Eastern Europe whetted risk appetites Tuesday, even as the ominous 2-10 yield curve came even closer to inverting.

During the latest round of talks with Ukraine today, Russian Deputy Defense Minister Alexander Fomin said his country's military would "drastically" remove its military presence from Kyiv. That triggered another day of buying from investors, who weren't deterred by a U.S. official's skeptical comment to news outlets that Russia's moves indicated "a redeployment, not a withdrawal."

Wall Street also wasn't put off by a potential inversion of the two- and 10-year Treasury rates – "potential" being the key word, as various data sources conflicted on whether the two-year's yield merely equaled the 10-year yield or surpassed it.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Even then, Lauren Goodwin, economist and portfolio strategist at New York Life Investments, warns against using a yield inversion as an egg timer.

"While curve inversion has historically been an important market signal of recession risk, it does not tell us much about when recession might likely occur," she says.

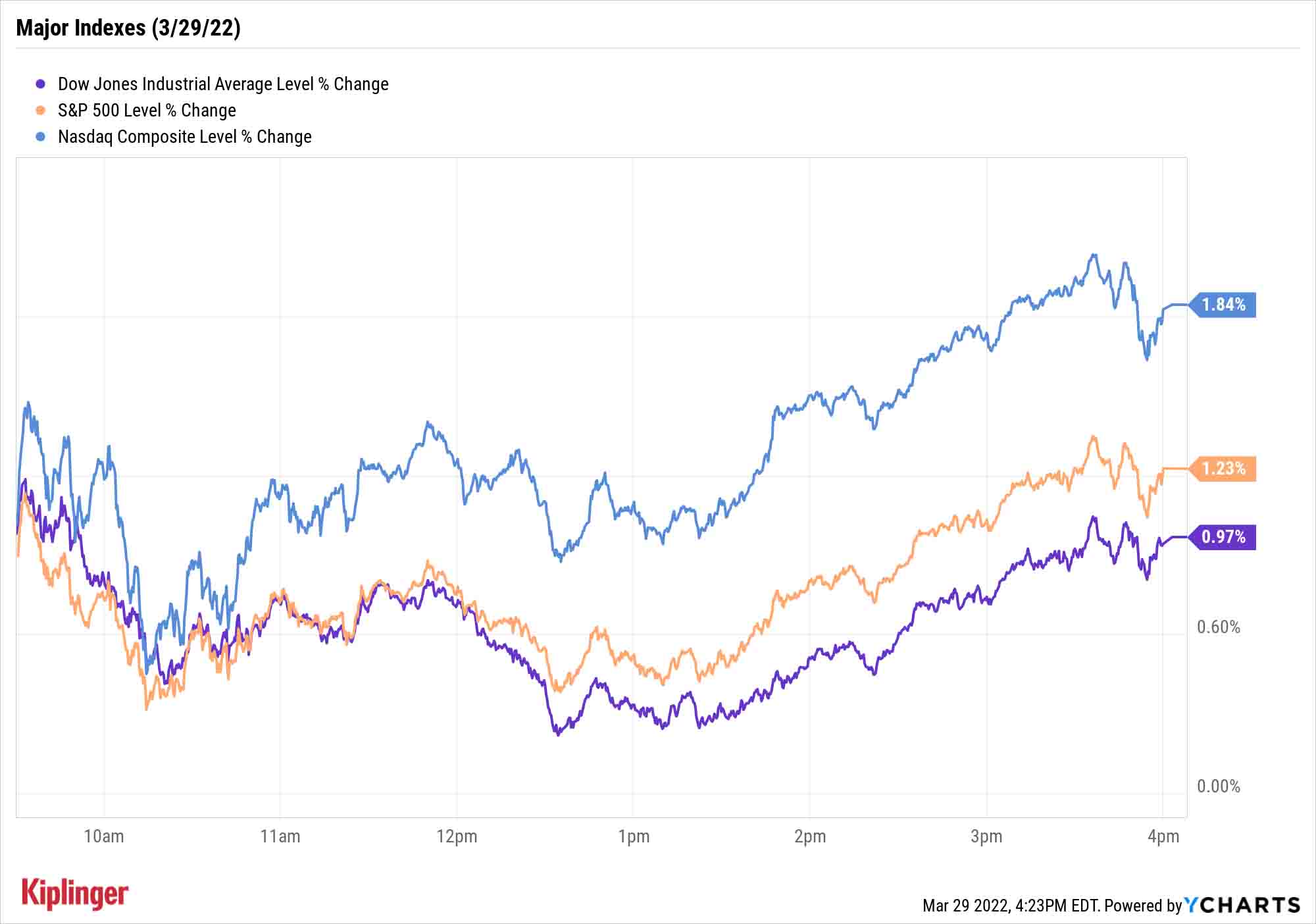

Real estate investment trusts (REITs) including mall operator Simon Property Group (SPG, +4.8%) and Public Storage (PSA, +3.4%) enjoyed the biggest gains Tuesday, with the sector up 2.9% to lead the S&P 500 (+1.2% to 4,631). The Nasdaq Composite had an even better day, up 1.8% to 14,619, while the Dow Jones Industrial Average recorded a 1.0% gain to 35,294.

Other news in the stock market today:

- The small-cap Russell 2000 roared ahead by 2.7% to 2,133.

- U.S. crude oil futures retreated 1.6% to end at $104.24 per barrel.

- Gold futures fell 1.4% to settle at $1,912.20 an ounce.

- Bitcoin slid 0.5% to $47,720.70. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Shares of Robinhood (HOOD) spiked 24.2% after the financial services platform said it extended trading hours for clients. Customers on HOOD's platform will now be able to trade between 7 a.m. through 8 p.m. ET, giving them an additional four hours. This big upside move put a dent in HOOD's year-to-date deficit. Heading into today, shares were down nearly 28% for the year-to-date.

- FedEx (FDX) gained 3.7% on news Fred Smith will step down as CEO, effective June 1. Smith has been overseeing the delivery giant since he founded the company in 1973. He will be succeeded by Raj Subramaniam, current president and chief operating officer of FedEx. "We anticipate a seamless transition as FedEx appears to have been grooming Mr. Subramaniam to be the company's next CEO," says Oppenheimer analyst Scott Schneeberger (Perform). "In recent years Mr. Smith appeared to have been ceding an increasing amount of operational and investor-facing responsibility to his top reports, particularly Mr. Subramaniam."

Push Back on Inflation

We'll find out March's jobs tally later this week, but another data point on Wall Street's watch list is the core Personal Consumer Expenditures (PCE) price index.

That report, due out Wednesday, represents the Federal Reserve's favored gauge of inflation – another critical factor in the market's direction from here.

"We believe it is important to point out the historical impact that inflation can have on equity market valuation," says John Lynch, chief investment officer for Comerica Wealth Management. "Specifically, high levels of inflation … have historically pressured the price-to-earnings (P/E) ratio for the S&P 500 Index. Historically, when the CPI approaches 8.0%, the average [trailing 12-month] P/E for the S&P 500 is ~12, which could bring the index to unspeakable levels."

Given that the S&P 500 currently trades at more than 26 times trailing earnings, that would be very bad news, indeed.

You can swat back at inflation via just about any investment type you like. Those looking to make concentrated bets against rising prices can consider these five stocks poised to push higher in an inflationary environment, while those who prefer a diversified approach might instead prefer these five mutual funds.

But some of the most interesting tools in the tool box are inflation-fighting exchange-traded funds (ETFs). Several of these ETFs simply happen to be positioned in areas of the market that do well as prices expand, but in some cases, an inflation-resistant portfolio is the explicit goal.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.