Stock Market Today: Tesla, Tech Lift Stocks After Rocky Open

Tesla popped amid a filing suggesting another stock split; gains in mega-cap technology names also helped carry the major indexes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

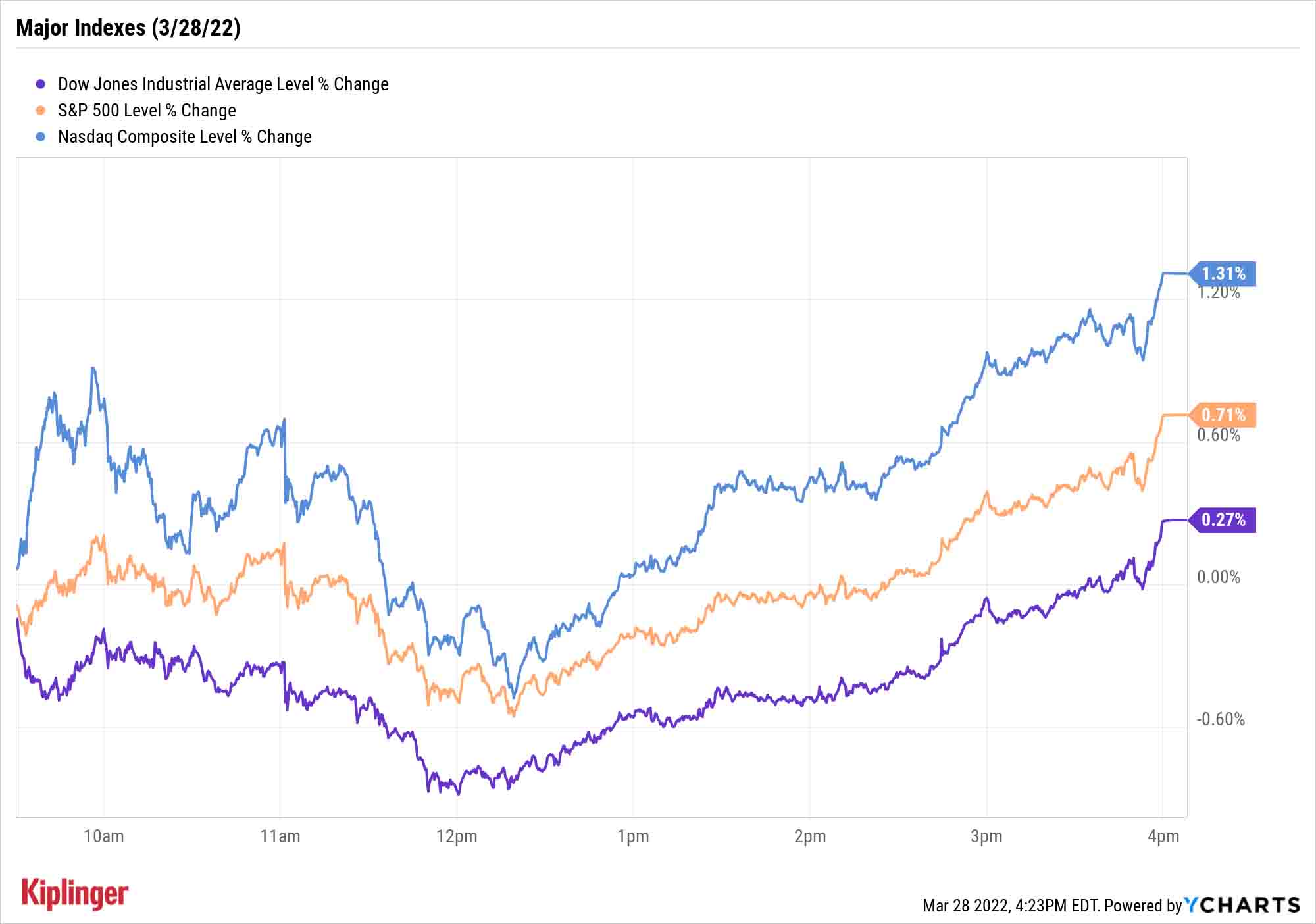

The market got off to a disorganized start to the week, but one that still saw the major indexes finish in positive territory.

Tesla (TSLA, +8.0%) had an outsized say in the market's performance Monday, jumping out of the gate after the company filed for its second stock split since 2020. Technology (+1.2%) also did some of the lifting, with names such as Adobe (ADBE, +4.3%) and Intuit (INTU, +4.6%) propelling the sector.

Financials (-0.3%) balked, however, as U.S. Treasury yield curves continued to flatten.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The five-year vs. 30-year briefly inverted for the first time since 2006, and the two-year vs. 10-year spread was below 10 basis points earlier," says Michael Reinking, senior market strategist for the New York Stock Exchange. (A basis point is one one-hundredth of a percentage point.) A reminder: In the past, an inverted 2-10 yield curve has been a fairly reliable predictor of a coming recession.

And energy (-2.5%) sagged as a worsening COVID outbreak in China exacerbated demand concerns and knocked U.S. crude oil prices 7.0% lower, to $105.96 per barrel.

While stocks largely opened in the red, they recovered in the afternoon to post lumpy gains. The Nasdaq Composite improved by 1.3% to 14,354, the S&P 500 rose a more modest 0.7% to 4,575, and the Dow Jones Industrial Average managed to eke out a 0.3% gain to 34,955.

Other news in the stock market today:

- The small-cap Russell 2000 finished virtually flat at 2,078.

- Gold futures lost 0.7% to settle at $1,939.80 an ounce.

- Bitcoin rocketed 7.9% over the weekend to $47,979.80. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Coinbase Global (COIN) was a big winner today, advancing 7.9%. In addition to rising Bitcoin prices, shares of the cryptocurrency exchange got a lift on news it is in talks to by 2TM – the owner of Brazil's biggest crypto exchange, Mercado Bitcoin. According to reports, sources familiar to the matter say that talks between the two firms started in 2021 and a potential deal could be confirmed by as early as next month.

- Concerns over red-hot inflation prompted RBC analyst Nik Mondi to downgrade Campbell Soup (CPB, -0.9%) to Sector Perform from Outperform, the equivalents of Hold and Buy, respectively. The analyst expects cost pressures to linger into next year and prefers exposure to reopening stocks versus those with a focus on cooking from home.

Make Volatility Work for You

Volatility has been the name of the game for most of 2022, and interest rate drama is another reason it's likely to continue.

"The yield curve is powerful, and – at the very least – is signaling a cooling economy," says Ross Mayfield, investment strategy analyst at research firm Baird. "Volatility should remain heightened and the bar for investing success is raised."

That's anathema to many investors, who have been conditioned to mentally link volatility with danger to the point where low-volatility funds have become a popular hidey-hole.

But for active or tactical investors and traders, volatility can cut both ways – and indeed, rather than trying to fade market turbulence, it can pay to lean into it.

High-volatility stocks very well might be among some of your portfolio's most problematic holdings during a down market, but they're also more likely to be among your top performers whenever the major indexes swing back higher. Today, we've taken a glimpse into the market's recent rockiness and found 20 picks that boast not just high recent volatility, but high quality (as measured by Wall Street's favorable opinions on these stocks).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.